Market Size

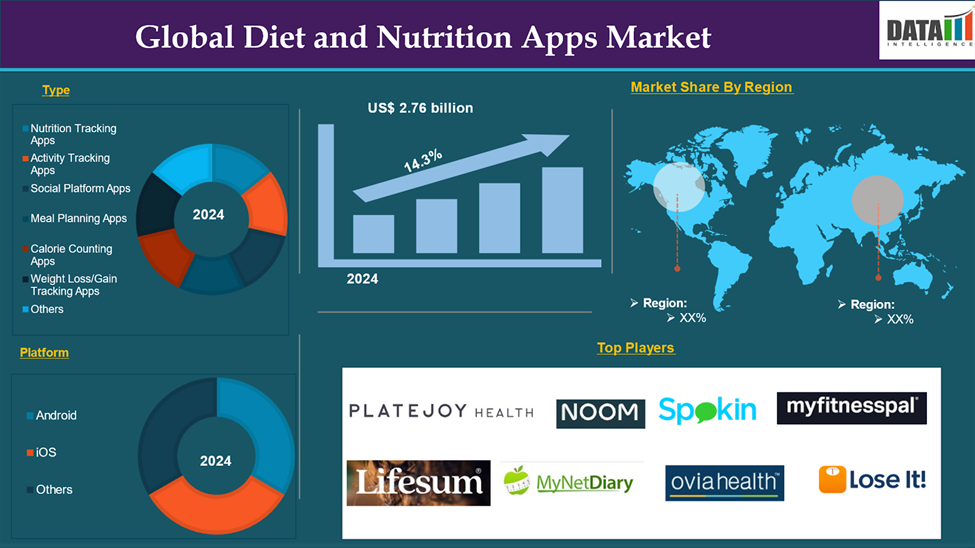

The Global Diet and Nutrition Apps Market reached US$ 2.76 billion in 2024 and is expected to reach US$ 9.58 billion by 2033, growing at a CAGR of 14.3 % during the forecast period 2025-2033.

The global diet and nutrition apps market consists of mobile applications designed to help users manage their dietary habits and track their nutritional intake. These apps provide a variety of features such as calorie counting, meal planning, exercise tracking, and personalized nutrition advice. As awareness around health and wellness increases, the market has experienced significant growth, with more people turning to digital solutions to manage their diet, set fitness goals, and enhance their overall well-being.

The demand for personalized health management is a key driver in the growth of the diet and nutrition apps market, fueled by a growing interest in fitness, weight loss, and disease prevention. Many of these apps utilize advanced technologies like artificial intelligence and machine learning to deliver tailored recommendations based on users’ health data. As the market continues to evolve, innovations that improve user experience and provide more precise insights into nutrition and wellness are emerging. With mobile technology becoming an integral part of daily life, the diet and nutrition apps market is poised for further expansion, with new apps constantly being developed to meet the diverse needs of consumers worldwide. These factors have driven the global diet and nutrition apps market expansion.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

Growing Health Consciousness

Growing health consciousness is a major driver of the global diet and nutrition apps market. As people become more aware of the importance of maintaining a healthy lifestyle, the demand for tools to help track and optimize their diets has increased. This shift, fueled by greater access to health information and a focus on preventing lifestyle diseases, has expanded the market for these apps. Consumers are now more focused on tracking their food intake, understanding nutritional needs, and making informed decisions about their diets.

This growing awareness of health is also driving interest in fitness, weight management, and disease prevention. As a result, people are turning to technology for personalized support, with diet and nutrition apps offering tailored insights and real-time tracking to help users stay on course with their health goals. Demand for specialized apps catering to specific diets, like vegan, gluten-free, and keto, has grown significantly. This trend is expected to continue, further fueling the growth of the global diet and nutrition apps market.

Additionally, key players in the industry have innovative product launches that would drive this global diet and nutrition app market growth. For instance, in October 2023, MyFitnessPal introduced new updates and features for users of Google's Wear OS to make tracking and logging their diet and exercise easier and more streamlined. With these updates, users can now monitor their dietary intake, including tracking calories and nutrients, directly on their Wear OS smartwatches. This makes it more convenient to log food and exercise data without needing to pull out a phone, as the smartwatch offers a more hands-on, accessible way to track health metrics on the go. All these factors demand the global diet and nutrition apps market.

Moreover, the rising demand for integration with corporate wellness programs contributes to the global diet and nutrition apps market expansion.

Privacy and Data Security Concerns

Privacy and data security concerns are significant challenges in the global diet and nutrition apps market. Users often share sensitive health information, such as dietary habits and medical conditions, raising concerns about the security of this data. Data breaches or unauthorized access can undermine trust, limiting the widespread adoption of these apps. The fear of misuse or mishandling of personal information creates a barrier for users who may hesitate to provide essential details for personalized nutrition guidance.

Studies show that 60% of adults are worried about companies tracking their health data, and in 2021, data breaches in the healthcare sector affected over 45 million people. This highlights the vulnerabilities in these systems and the need for stronger security measures. To address these concerns, app developers must implement robust data protection strategies, such as encryption, secure data storage, and clear privacy policies. Ensuring compliance with data protection laws and obtaining user consent for data collection are critical steps to building trust and encouraging app adoption. Thus, the above factors could be limiting the global diet and nutrition apps market's potential growth.

Market Segment Analysis

The global diet and nutrition apps market is segmented based on type, service, platform, devices, age, end-user, and region.

Platform:

The iOS segment is expected to dominate the global diet and nutrition apps market share

The iOS segment holds a major portion of the global diet and nutrition apps market share and is expected to continue to hold a significant portion of the global diet and nutrition apps market share during the forecast period. The iOS segment plays a key role in the global diet and nutrition apps market, driven by the large user base of iPhones and iPads. iOS users have access to a wide variety of health and fitness apps, many of which are integrated with Apple's ecosystem, such as the Apple Health app and fitness trackers. This integration provides a seamless user experience and encourages more engagement with diet and nutrition tracking.

Apple's emphasis on privacy and security makes iOS an appealing platform for users concerned about the safety of their health data. Additionally, iOS devices offer high-quality displays and advanced technology, enabling more accurate and visually engaging tracking of nutrition and wellness data. As a result, the demand for diet and nutrition apps on iOS is expected to grow, driven by its strong user base and privacy features.

Additionally, key players in the industry investments and innovative product launches that would drive this segment growth in the global diet and nutrition apps market. For instance, in March 2023, the personalized nutrition startup Zoe raised an additional $2.5 million as part of a Series B extension round, bringing their total funding in this round to $38 million. This funding will help Zoe continue developing and expanding its platform, which focuses on providing tailored nutrition advice based on individual biology, helping people make more personalized and effective food choices.

Also, in September 2024, InsideTracker launched a new feature called Nutrition DeepDive, a food and supplement tracker that provides highly personalized nutritional insights by analyzing data from multiple sources, including blood tests, DNA, and fitness tracker data. These factors have solidified the segment's position in the global diet and nutrition apps market.

Market Geographical Share

North America is expected to hold a significant position in the global diet and nutrition apps market share

North America holds a substantial position in the global diet and nutrition apps market and is expected to hold most of the market share. This growth is driven by several key factors, including demographic changes, technological advancements, and rising health awareness.

One significant driver is the aging population in North America. In 2022, 58 million individuals in the U.S. were aged 65 and above, and this figure is expected to grow to 22% of the population by 2040, creating a greater demand for health management solutions.

Smartphone penetration also plays a crucial role, as the widespread adoption of smartphones makes diet and nutrition apps more accessible. Affordable and integrated into daily life, smartphones allow users easy access to health information and services. Growing health consciousness among consumers is another key factor, with more people seeking tools to monitor their nutrition and make healthier lifestyle choices.

Additionally, in this region a major of key players' presence, well-advanced healthcare infrastructures, and innovative launches would drive this global diet and nutrition apps market growth. For instance, in July 2024, in the U.S. Cleveland Clinic and FitNow teamed up to launch an innovative diet app, aiming to help users adopt healthier eating habits and manage their nutrition more effectively.

This app combines Cleveland Clinic's expertise in medical and health sciences with FitNow's experience in fitness and wellness technology. The goal is to provide users with a tool that not only helps them track their food intake but also offers personalized recommendations based on their specific health needs, goals, and preferences. Thus, the above factors are consolidating the region's position as a dominant force in the global diet and nutrition apps market.

Asia Pacific is growing at the fastest pace in the global diet and nutrition apps market share

Asia Pacific holds the fastest pace in the global diet and nutrition apps market and is expected to hold most of the market share. The Asia-Pacific diet and nutrition apps market is experiencing rapid growth, fueled by several key factors. One of the main drivers is the rising smartphone penetration across the region. As smartphones become more affordable and integrated into everyday life, they offer easy access to diet and nutrition apps, allowing users to track and manage their health and nutrition more efficiently.

Furthermore, there is a growing health awareness among consumers, leading to increased demand for apps that support healthier lifestyle choices, including food tracking, weight management, and overall wellness. The rapid urbanization and expanding middle class in Asia-Pacific further contribute to this trend, driving higher food expenditures and a need for innovative solutions in the food and wellness industries. These demographic shifts present significant opportunities for diet and nutrition apps to meet the evolving demands of consumers in the region.

Additionally, in this region, key players' innovative launches would drive this global diet and nutrition apps market growth. For instance, in February 2024, NutriAIDE is a new mobile app launched to help users make healthier and more sustainable nutrition choices. The app was introduced by R. Hemalatha, the Director of the ICMR-National Institute of Nutrition, and Markus Keck, Chair of Urban Climate Resilience at Augsburg University in Germany. Where it was unveiled in front of scientists involved in the transformation of urban food environments.

Also, in April 2024, Britannia NutriChoice, a popular brand in India known for its range of healthy snacks, launched a new health monitoring app called NutriPlus. The app was introduced to coincide with World Health Day, emphasizing the importance of maintaining good health. Thus, the above factors are consolidating the region's position as the fastest-growing force in the global diet and nutrition apps market.

Major Global Players

The major global players in the diet and nutrition apps market include Lifesum AB, MyNetDiary Inc., PlateJoy LLC, Noom, Inc., SPOKIN, INC., Ovia Health, MyFitnessPal, Inc., FitNow, Inc., Cronometer, YAZIO., Fatsecret., and WW International, Inc. among others.

Key Developments

- In February 2025, Alma launched the first AI-powered nutrition companion app, designed to make healthy eating simple, personalized, and effortless for users. The app leverages artificial intelligence (AI) to provide tailored nutrition guidance, helping users make healthier food choices based on their individual preferences, goals, and needs.

- In September 2024, the nutrition tracking service "Vivoo," which originated in the U.S., has officially expanded to Japan. Vivoo provides users with an easy way to monitor and analyze their nutritional data, empowering them to make informed choices about their diet and lifestyle. The service is tailored to promote healthy living by delivering personalized insights based on individual health information.

| Metrics | Details | |

| CAGR | 14.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Nutrition Tracking Apps, Activity Tracking Apps, Social Platform Apps, Meal Planning Apps, Calorie Counting Apps, Weight Loss/Gain Tracking Apps, Others |

| Service | Paid, Free | |

| Platform | Android, Ios, Others | |

| Device | Smartphones, Tablets, Wearable Devices | |

| Age | Adults, Teenagers, Senior Citizens | |

| End-User | Hospitals, Fitness Centers, Homecare Settings, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-world Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global diet and nutrition apps market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2025

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.