Bakery Processing Equipment Market Size

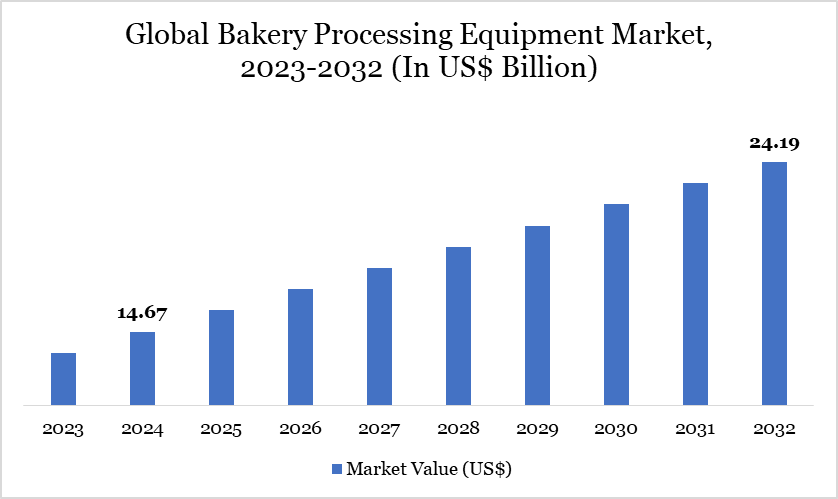

Bakery Processing Equipment Market reached US$ 14.67 billion in 2024 and is expected to reach US$ 24.19 billion by 2032, growing with a CAGR of 6.45% during the forecast period 2025-2032.

The global bakery processing equipment market is experiencing steady growth, driven by increasing demand for baked goods such as bread, cakes, and pastries across both developed and emerging markets. Rising urbanization, changing consumer lifestyles, and the popularity of ready-to-eat and convenience foods are fueling this demand. Technological advancements in automation and energy-efficient equipment are encouraging bakeries to upgrade their production lines.

Additionally, the growth of artisanal and gluten-free bakery trends is prompting diversification in equipment types. Asia-Pacific is emerging as the fastest-growing region, led by expanding middle-class populations and growing foodservice sectors.

Bakery Processing Equipment Market Trend

Automation and smart technology integration are transforming bakery processing equipment by enhancing precision, consistency, and efficiency. Advanced systems use AI, IoT, and robotics to monitor and control baking processes in real time, reducing human error and labor costs. This trend allows bakeries to scale production while maintaining quality and adapting quickly to changing demands.

Companies drive the bakery processing equipment market by continuously innovating with advanced technologies like automation and AI to meet evolving consumer demands. For instance, in May 2025, Andrew Mafu Machinery launched a fully automated bread production line designed to modernize industrial baking. The system combines high-precision automation with traditional bread-making, producing up to 10,000 loaves per hour. The line is customizable to accommodate different recipes, loaf sizes, and regional preferences.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details |

| By Equipment Type | Mixers, Ovens & Proofers, Slicers & Dividers, Sheeters & Molders, Depositors & Pan Greasers, Others |

| By Mode of Operation | Semi-Automatic, Automatic |

| By Function | Mixing, Extrusion, Baking, Enrobing, Molding, Cooling, Other |

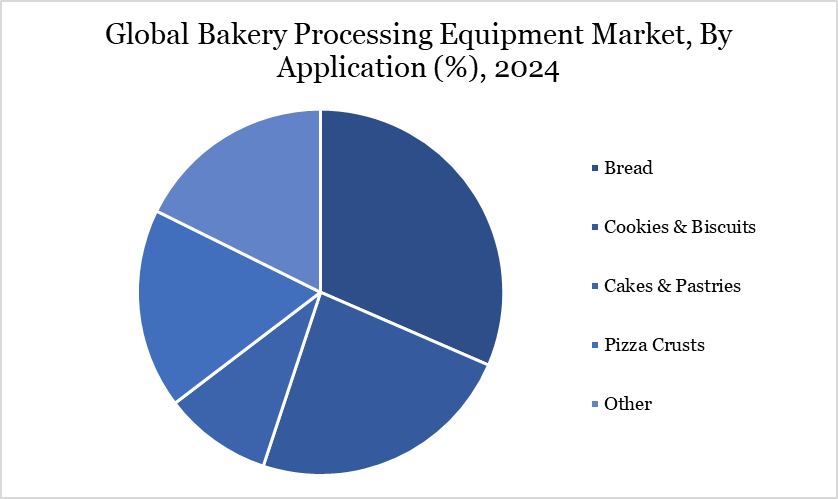

| By Application | Bread, Cookies & Biscuits, Cakes & Pastries, Pizza Crusts, Other |

| By End-User | Retail Bakeries, Hotels & Restaurants, Foodservice Providers, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Bakery Processing Equipment Market Dynamics

Growing Consumer Demand for Bakery Products

The growing consumer demand for bakery products is a primary driver of the bakery processing equipment market. According to the USDA, in 2024, US baked goods exports reached a total value of US$4.35 billion, reflecting strong global demand for American bakery products. The total export volume amounted to 1.47 million metric tons, underscoring the country's significant role in the international baked goods market. This surge in demand, fueled by urbanization, rising disposable incomes, and changing dietary habits, necessitates high-capacity and efficient processing equipment.

Consumers also seek product variety and consistent quality, prompting bakeries to invest in advanced machinery. The increasing preference for packaged and convenience bakery items further accelerates equipment adoption. As the consumption of bread, cakes, pastries, and snacks continues to rise globally, manufacturers are compelled to expand and modernize their production capabilities.

High Initial Capital Investment

High initial capital investment is a significant restraint in the bakery processing equipment market as it limits the ability of small and medium-sized enterprises to adopt advanced machinery. Modern equipment such as automated mixers, ovens, and conveyors requires substantial upfront costs, which many businesses, especially in emerging economies, find difficult to afford. For instance, according to the American Bakers Association, cookie and cracker manufacturers spend almost US$ 800 million on energy each year in the US.

This financial barrier delays modernization and automation, affecting production efficiency and scalability. The return on investment can also be slow, discouraging firms from making large capital commitments. Moreover, securing financing for such purchases can be challenging due to limited credit options or high interest rates. As a result, many bakeries continue to rely on manual or semi-automatic processes. This slows down overall market growth and adoption of innovative processing technologies.

Bakery Processing Equipment Market Segment Analysis

The global bakery processing equipment market is segmented based on equipment type, mode of operation, function, application, end-user and region.

Bread Dominates Global Bakery Processing Equipment Market Due to High Daily Consumption and Demand for Automation

Bread holds a significant share in the global bakery processing equipment market due to its status as a staple food consumed worldwide. The consistent demand for various types of bread, including white, whole wheat, and artisanal varieties, drives the need for advanced processing machinery. Rapid urbanization and changing lifestyles have boosted the popularity of packaged and ready-to-eat bread products.

Automated equipment enhances production efficiency, consistency, and hygiene, meeting both mass-market and specialty bread needs. Innovations in equipment for dough mixing, proofing, baking, and slicing cater specifically to bread production. In December 2023, Hobart, a leading commercial food equipment manufacturer, launched its new HSL130 spiral mixer with a 130-pound capacity. Designed for smaller bakery operations and specialty pizza shops, the mixer gently incorporates ingredients ideal for artisan breads and Neapolitan pizza dough. This new model expands Hobart’s HSL spiral mixer range, offering consistent, high-quality dough mixing for smaller batch needs.

Bakery Processing Equipment Market Geographical Share

Europe Leads the Global Bakery Processing Equipment Market Due to High Consumption, Technological Innovation, and Demand for Artisanal Baked Goods

Europe’s diverse consumer preferences and increasing demand for artisanal and specialty baked goods are significantly contributing to the growth of the bakery. For instance, Tate & Lyle’s consumer insights report reveals that nearly 45% of young people in Europe buy bakery products daily, viewing them as an important part of their diet. Similarly, according to the European Commission, the average annual consumption of bread and bakery products in Europe is about 57 kg per person. While most EU countries see consumption around 50 kg per capita, Germany and Austria lead with approximately 80 kg annually. This rising demand encourages bakeries to invest in advanced, automated equipment to boost output and maintain consistency.

Additionally, the presence of key players offering customized and sustainable solutions strengthens Europe’s market position. Growing awareness of food safety and hygiene standards also propels equipment modernization. The region’s focus on research and development ensures continuous improvements in bakery machinery. Overall, Europe’s combination of tradition, innovation, and robust industrial ecosystem makes it a dominant player in the bakery processing equipment market.

Sustainability Analysis

The global bakery processing equipment market is undergoing a significant technological transformation driven by automation, sustainability, and customization. The integration of AI and IoT facilitates real-time monitoring, predictive maintenance, and process optimization, enhancing efficiency and reducing waste. Smart ovens and energy-efficient systems, including hybrid gas-electric and hydrogen-fueled models, are being adopted to lower carbon footprints and operational costs.

Companies are investing heavily in research to develop energy-efficient, automated, and multi-functional equipment tailored to evolving consumer trends. For instance, on August 13, 2024, Bühler India introduced two new SmartLine solutions, DirectBake Smart and RotaMold Smart, targeting the growing biscuit and cracker market. The DirectBake Smart is a versatile Direct Gas Fired oven, while the RotaMold Smart is a rotary molder designed for producing diverse shapes and intricate designs. Both systems integrate Bühler’s advanced technology to enhance efficiency, reliability, and product variety for biscuit manufacturers.

Bakery Processing Equipment Market Major Players

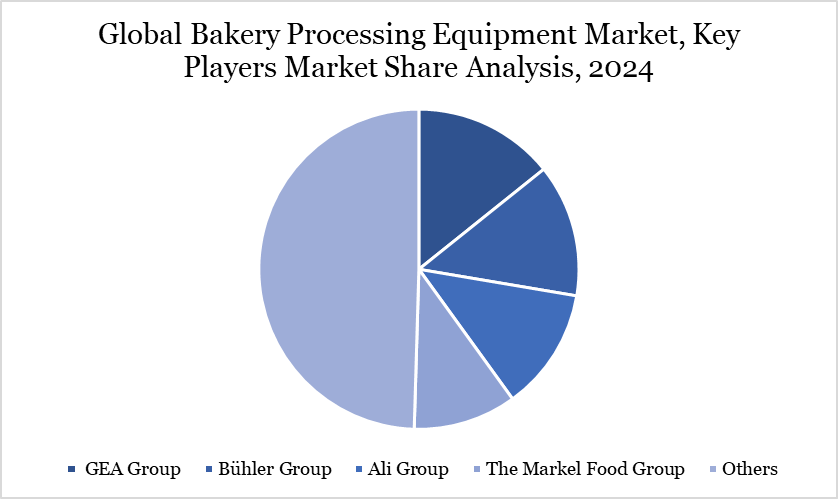

The major global players in the market include GEA Group, Bühler Group, Ali Group, The Markel Food Group, Heat and Control, Inc., The Middleby Corporation, MECATHERM SAS, Koenig Maschinen GmbH, JBT Marel Corporation, ARKA Machineries and others.

Key Developments

In March 2025, Unox launched the new SPEED Compact ECO oven, designed specifically for the quick service industry. This rapid, compact oven optimizes space and simplifies use while ensuring excellent ROI. Ideal for fast preparation of snacks, ready meals, and frozen pastries, it can cook items like waffles in 30 seconds and sandwiches in 75 seconds, delivering consistent, high-quality results.

In October 2022, in a collaboration, LBX Food Robotics and celebrity chef Buddy ‘Cake Boss’ Valastro launched customized Bake Xpress hot food kiosks in Las Vegas. These robotic bakeries, located at the LINQ Hotel + Experience alongside The Boss Cafe, operate 24/7, baking signature bakery-style pizzas inspired by East Coast neighborhood delis. The kiosks debuted in August and have quickly become popular among hotel and casino guests.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies