Automated Hematology Analyzer Market Size and Trends

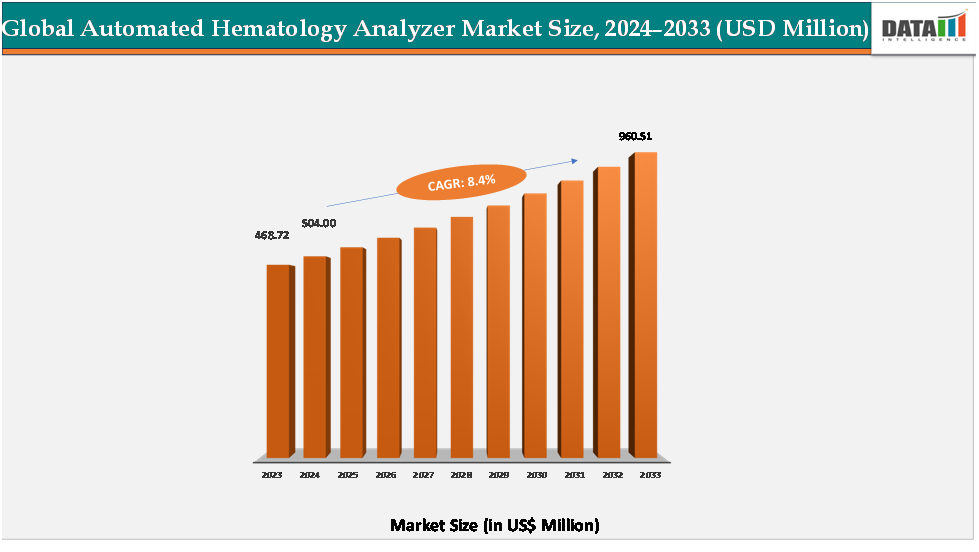

The global automated hematology Analyzer Market reached US$ 468.72 million in 2023, with a rise to US$ 504.00 million in 2024, and is expected to reach US$ 960.51 million by 2033, growing at a CAGR of 8.4%during the forecast period 2025–2033.

The Automated Hematology Analyzer market is experiencing robust growth, driven by the rising demand for accurate, efficient, and high-throughput diagnostic solutions that are essential for managing a wide range of blood disorders and routine health assessments. These analyzers deliver rapid, reliable, and multi-parameter results, enabling hospitals, laboratories, and diagnostic centers to improve clinical decision-making and reduce turnaround times.

Continuous technological advancements, including AI integration, advanced cell differentiation, and compact system designs, are enhancing diagnostic precision and workflow efficiency, while the growing focus on preventive healthcare, increasing test volumes from chronic and infectious diseases, and the expansion of healthcare infrastructure in emerging economies are further fueling adoption. Moreover, the integration of hematology analyzers into digital healthcare ecosystems and their expanding role in point-of-care and decentralized diagnostics are creating new growth opportunities, firmly positioning them as a cornerstone of modern clinical diagnostics and long-term market expansion.

Key Market highlights

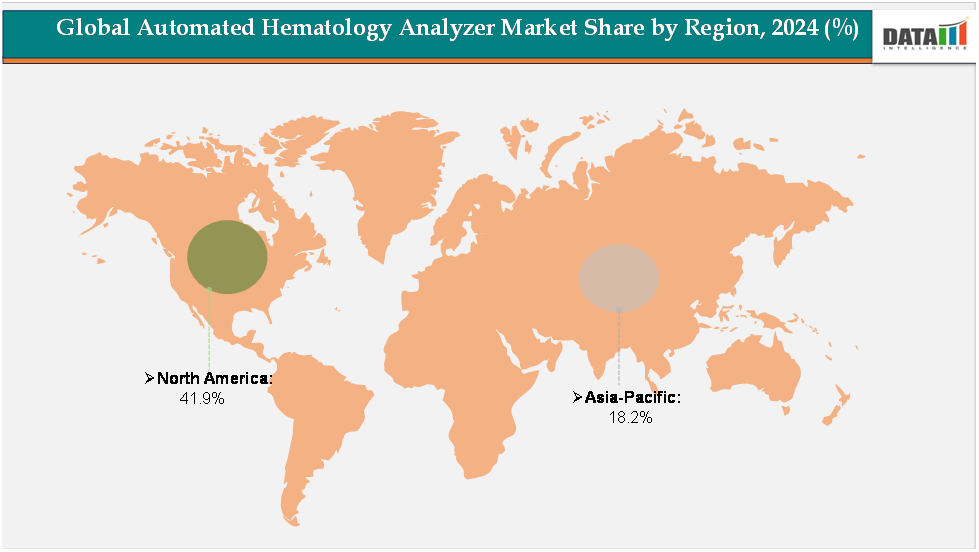

- North America leads the automated hematology analyzer market, accounting for approximately 41.9% of global revenue, supported by its high diagnostic testing volumes and strong presence of leading hematology device manufacturers.

- Asia-Pacific is the fastest-growing regional market, holding about 18.2% of the share, driven by expanding healthcare access, rising prevalence of chronic and infectious diseases, and increasing investments in laboratory automation across countries such as China, India, Japan, and South Korea.

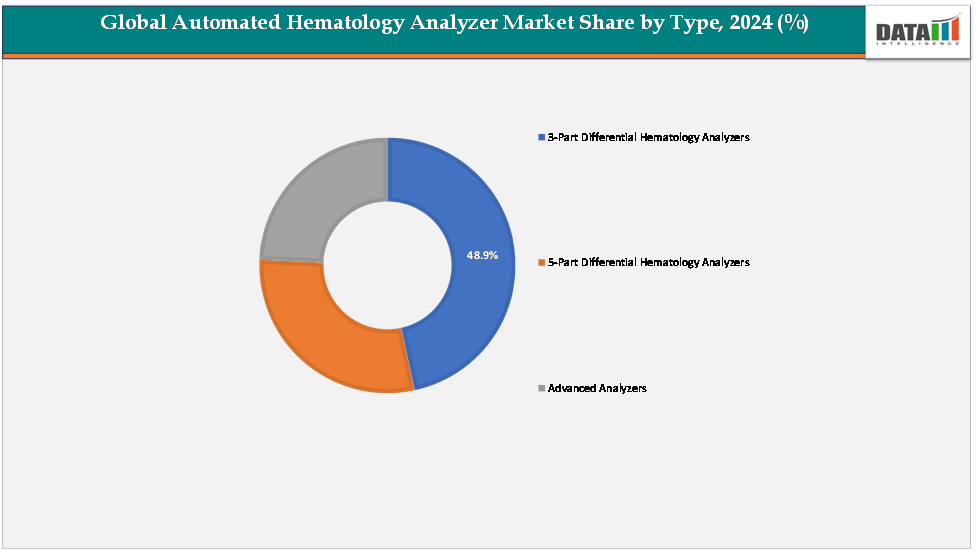

- 3-Part Differential Hematology Analyzers remain the dominant product segment, contributing around 48.9% of global revenue. Their widespread adoption in small to mid-sized laboratories and diagnostic centers, owing to cost-effectiveness, ease of operation, and suitability for routine testing, underscores their critical role in fueling market growth.

Market Size & Forecast

- 2024 Market Size: US$504.00 million

- 2033 Projected Market Size: US$960.51 million

- CAGR (2025–2033): 8.4%

- North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Source : DataM Intelligence Email : [email protected]

Drivers & Restraints

Driver: Rising Prevalence of Blood-Related Disorders

The rising global burden of blood-related disorders is one of the most significant drivers of the Automated Hematology Analyzer market. Conditions such as anemia, leukemia, lymphoma, hemophilia, and various infectious diseases that affect blood parameters continue to increase in prevalence across both developed and developing regions. For instance, the World Health Organization (WHO) estimates that anemia alone impacts more than 1.6 billion people worldwide, while hematological malignancies such as leukemia and lymphoma are among the most commonly diagnosed cancers requiring frequent monitoring. Automated hematology analyzers are critical tools in this context, as they enable clinicians to perform comprehensive blood analysis with speed, accuracy, and efficiency. By delivering multi-parameter results in a short time frame, these systems facilitate early diagnosis, disease monitoring, and treatment management. The growing emphasis on preventive health checkups and routine blood testing, coupled with the surge in chronic and infectious diseases, is expected to further accelerate demand, making blood-related disorders a central growth driver for the global market.

Restraint: High Capital and Maintenance Costs

The market faces a major restraint in the form of high acquisition and maintenance costs. Advanced analyzers, particularly those with 5-part or more sophisticated differential capabilities, require substantial initial investment, making them less accessible to smaller laboratories, primary care facilities, and healthcare providers in low- and middle-income countries.

For more details on this report, Request for Sample

Segmentation Analysis

The global automated hematology analyzer market is segmented by type, application, and end-user, and region.

Product Type:

The 3-part differential hematology analyzer segment is estimated to have 48.9% of the automated hematology analyzer market share.

The 3-part differential hematology analyzer segment currently represents the dominant share of the global market, accounting for approximately 48.9% of revenue. These analyzers are particularly well-suited for routine diagnostic applications, offering cost-effective solutions for small to mid-sized laboratories, community clinics, and diagnostic centers. Their relatively simple design, lower upfront cost, and ease of operation make them highly attractive in emerging economies, where healthcare providers often balance cost considerations with the need for reliable diagnostic solutions.

3-part analyzers provide adequate diagnostic capability for most routine hematology tests, ensuring strong utilization across primary healthcare networks. Their continued popularity is also driven by the widespread need for routine blood counts in preventive health checkups, pre-operative screenings, and basic disease monitoring. As a result, 3-part differential analyzers are expected to retain their dominant market position in terms of volume over the forecast period.

The 5-part differential hematology analyzers segment is estimated to have 32.8% of the automated hematology analyzer market share.

5-part differential hematology analyzers are emerging as the fastest-growing product segment, driven by increasing demand for precision diagnostics and advanced clinical applications. These analyzers provide detailed leukocyte differentiation, which is critical for identifying complex hematological conditions, oncology cases, and immune-related disorders. As the incidence of cancers such as leukemia and lymphoma continues to rise globally, the need for advanced diagnostic technologies has become more pronounced. Furthermore, high-volume laboratories, research institutions, and tertiary care hospitals are increasingly investing in 5-part systems due to their superior diagnostic accuracy, ability to handle large test volumes, and compatibility with laboratory automation.

While their higher cost limits adoption in smaller facilities, rapid technological advancements and declining price points are expected to accelerate penetration. The push toward personalized medicine and the integration of advanced hematology diagnostics into precision healthcare strategies further reinforce the growth trajectory of this segment, making it the fastest-growing category within the market.

Geographical Analysis

The North America Automated hematology analyzer market was valued at 41.9%market share in 2024

North America continues to dominate the global Automated Hematology Analyzer market, accounting for approximately 41.9% of overall revenue. The region’s leadership is driven by its advanced healthcare infrastructure, high adoption of innovative diagnostic technologies, and strong presence of leading device manufacturers. The United States, in particular, has one of the highest diagnostic testing volumes in the world, supported by robust reimbursement frameworks, a well-established network of clinical laboratories, and an aging population with a high prevalence of chronic and hematological disorders. Strategic collaborations between academic institutions, research organizations, and industry players further fuel innovation and clinical adoption.

Additionally, the increasing integration of hematology analyzers with digital health platforms and laboratory information systems enhances workflow efficiency and strengthens their role within the region’s healthcare ecosystem. These factors collectively position North America as the leading market and a hub for innovation in automated hematology diagnostics.

The Europe Automated Hematology Analyzer market was valued at 20.9% market share in 2024

Europe represents a significant share of the Automated Hematology Analyzer market, supported by growing healthcare expenditure, favorable government initiatives, and widespread adoption of laboratory automation across key countries such as Germany, the UK, France, and Italy. The region also benefits from a strong focus on preventive healthcare and early disease detection programs, which drive demand for routine hematology testing. Moreover, the high prevalence of blood cancers, an aging population, and an established clinical laboratory network contribute to steady growth.

Europe remains a key regional market with stable growth prospects and ongoing investment in healthcare modernization.

The Asia-Pacific Automated Hematology Analyzer market was valued at 18.2% market share in 2024

Asia-Pacific is projected to be the fastest-growing region in the automated hematology analyzer market, accounting for approximately 18.2% of the global share. The region’s rapid growth is fueled by rising healthcare access, increasing investments in laboratory infrastructure, and a surging prevalence of both chronic and infectious diseases. Countries such as China and India, with their large populations and growing healthcare needs, are driving high demand for cost-effective hematology testing solutions. Additionally, Japan and South Korea are contributing significantly through advanced technological adoption and healthcare innovations.

The rising emphasis on preventive health screenings, combined with the growing affordability of diagnostic technologies, is accelerating adoption across both urban and rural settings. As healthcare infrastructure continues to modernize and patient awareness increases, the Asia-Pacific region is set to remain the fastest-growing market for automated hematology analyzers in the coming years.

Competitive Landscape

The major players in the automated hematology analyzer market include Beckman Coulter, Inc., Accurex, Sysmex, Shenzhen Mindray Bio-Medical Electronics Co., Ltd, Abbott, HORIBA Group, Biobase Biodusty(Shandong), Co., Ltd., Erba Group, Labtron Equipment Ltd., Trivitron Healthcare, among others.

Key Developments:

- In March 2025, Sysmex America, Inc. expanded its 3-part differential automated hematology analyzer line with the XQ-320. Designed for physician office laboratories, stat labs, and any setting requiring rapid diagnostic results, the XQ-320 is the first 3-part differential analyzer to feature the BeyondCareQuality Monitor, ensuring reliable and accurate CBC testing.

- In January 2024, HORIBA Medical introduced the HELO 2.0, a high-throughput automated hematology platform that is CE-IVDR approved, with US FDA approval pending. Building on the success of the original HELO, this next-generation system was developed in collaboration with customers to enhance performance and meet the comprehensive needs of high-throughput, fully automated hematology testing

Market Scope

| Metrics | Details | |

| CAGR | 8.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US $Mn) | |

| Segments Covered | Type | 3-Part Differential Hematology Analyzers, 5-Part Differential Hematology Analyzers, Advanced Analyzers |

| Application | Diagnostic Testing, Blood Screening, Treatment Monitoring, Research and Development, Others | |

| End-User | Hospitals, Clinical Laboratories Academic and Research Institutes Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global automated hematology analyzer market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here