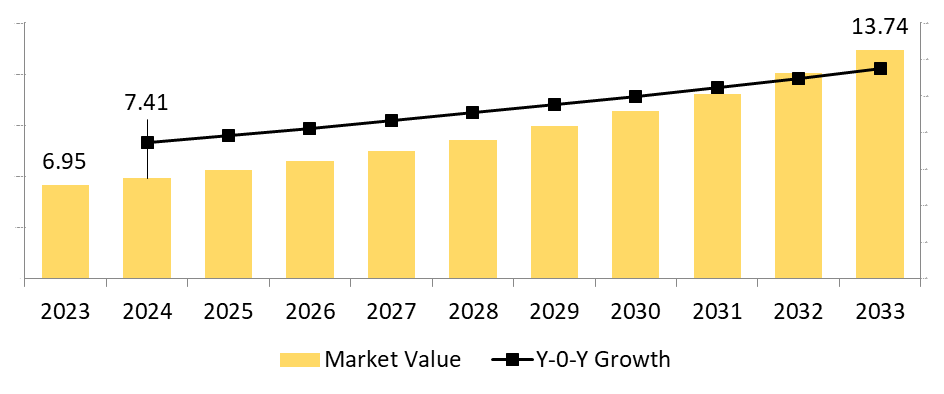

Hematology Market Size and Growth

The global hematology market is projected to grow from US$ 7.41 billion in 2024 to US$ 13.74 billion by 2033, registering a CAGR of 7.1% during the forecast period. The growth of the hematology market is primarily driven by the increasing prevalence of these disorders and the demand for advanced diagnostic instruments, reagents, and consumables. Pharmaceutical companies are also investing in R&D to improve disease detection and patient outcomes.

Technological advancements are transforming the hematology market, focusing on AI-based analyzers, digital pathology, and point-of-care testing. Automation in laboratories reduces diagnostic errors, improving efficiency. Molecular diagnostics and companion diagnostics strengthen personalized medicine approaches.

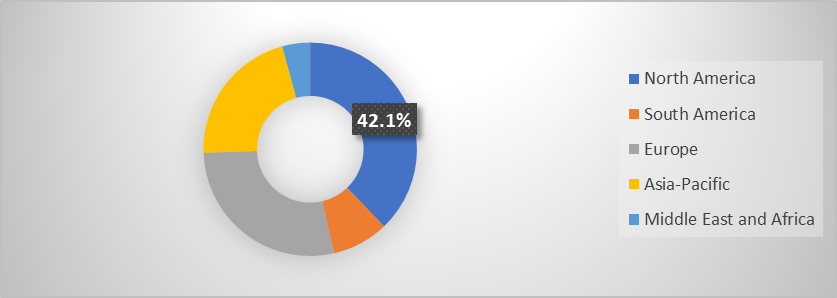

North America is predicted to dominate the hematology market due to robust healthcare infrastructure, increased diagnostic awareness, and supportive reimbursement policies. However, the Asia-Pacific region is expected to experience the fastest growth, driven by rising healthcare expenditure, a growing patient population, and the adoption of innovative instruments in countries like China and India.

Hematology Market Size, 2024–2033 (USD Billion)

Key Highlights from the Report

North America leads the hematology market, holding 42.1% share in 2024, driven by strong healthcare systems, major pharmaceutical players like Abbott and Roche, and active clinical research backed by FDA approvals.

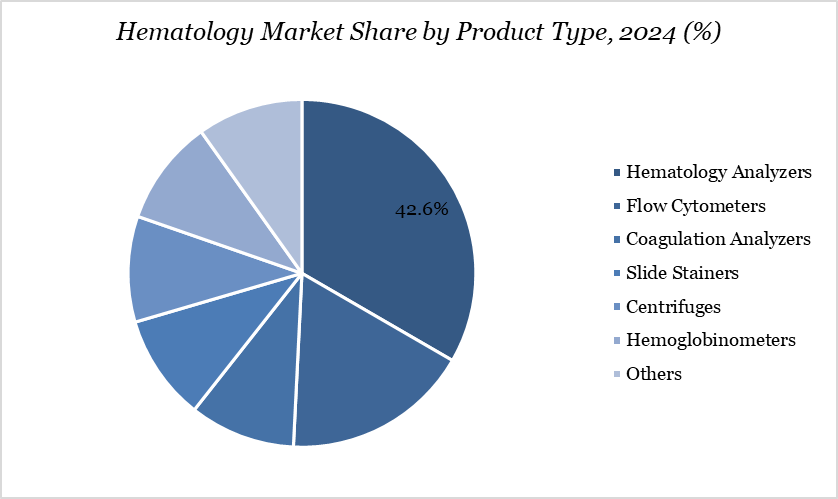

Hematology Analyzers expected to be the leading product type, capturing 42.6% share in 2024, supported by product launches, collaborations, and partnerships that strengthen its dominance.

For more details on this report – Request for Sample

Market Dynamics

Drivers - Rising Prevalence of Blood Disorders

The hematology market is growing due to the increasing prevalence of blood disorders like anemia, hemophilia, thalassemia, leukemia, and lymphoma. This is driven by aging populations, genetic factors, and lifestyle issues. Advanced diagnostic solutions like automated analyzers and molecular diagnostics are needed for early detection and monitoring. The need for long-term management and treatment of chronic hematologic conditions is also driving innovation in therapeutic approaches like targeted drugs and cell-based therapies.

For instance, Anemia affects 24.3% of the global population, affecting 1.92 billion individuals in 2021. Iron deficiency anemia affects 30%, particularly women and children. White blood cell cancers like leukemia, lymphoma, and myeloma contribute significantly to the hematologic disease burden. In the U.S., 187,740 new cases of WBC cancers are expected in 2024, accounting for 9.4% of all new cancer diagnoses.

Restraints: High Cost of Advanced Hematology Systems

The high cost of advanced hematology systems, such as the Sysmex XE-2100, is a significant obstacle to market access and adoption in 2024. These systems can cost around $107,000 per unit, with entry-level models starting at $5,000-15,000, mid-range systems between $15,000- $50,000, and sophisticated instruments exceeding $120,000. In India, advanced analyser prices typically range from ₹2 lakh to ₹18 lakh, depending on brand and feature set. These costs, compounded by recurring expenses like service contracts, reagents, and maintenance, hinder deployment and slow market expansion, especially in resource-constrained settings.

Market Opportunities: Growing Demand for Personalized Medicine & Molecular Hematology

The demand for personalized medicine and molecular hematology is increasing due to advancements in molecular diagnostics, next-generation sequencing, and genomic profiling. These technologies enable clinicians to identify genetic mutations and biomarkers associated with blood cancers, hemoglobinopathies, and other hematologic disorders, enabling targeted therapies like monoclonal antibodies, CAR-T cell therapies, and gene therapies. This shift in healthcare systems is influencing therapy decisions, driving demand for advanced molecular testing platforms and encouraging pharmaceutical companies to align drug development with biomarker-driven clinical pathways.

Market Segmentation Analysis

By Product Type - Hematology Analyzers Segment is expected to leads the market

Hematology analyzers remains the dominant segment in the Hematology market, accounting for nearly 37.6% share in 2024. The hematology analyzers segment is gaining popularity due to the demand for automated diagnostic solutions for rapid, accurate, and high-throughput blood testing. The increasing prevalence of blood cancers, anemia, and infectious diseases is driving the adoption of multi-parameter analyzers. Advancements in AI-based algorithms, digital imaging, and automation are enhancing diagnostic accuracy and reducing manual errors. Point-of-care testing and modernization programs are also driving the adoption of advanced hematology analyzers.

For instance, in June 2025, Sysmex Corporation has received FDA clearance for its XR-Series Automated Hematology Analyzer, marking a significant milestone in the company's preparations for its early market launch in the United States.

By Reagent Type – Coagulation Reagents is expected to lead the market with strong growth potential

The coagulation reagents segment is projected to register the fastest growth, with a CAGR of 4.5% from 2024 to 2033. The coagulation reagents segment is growing due to the rise in bleeding disorders, thrombotic conditions, and anticoagulant therapy use in cardiovascular patients. These reagents are crucial for routine screening, monitoring therapy, and diagnostic assays. The demand for reliable and sensitive reagents is fueled by personalized therapy monitoring and surgical procedures. Innovation in reagent formulations, offering stability, accuracy, and compatibility with automated analyzers, supports this segment's growth in the hematology market.

Market Regional Insights

Hematology Market Share by Region, 2024 (%)

North America Hematology Market Trends

North America's hematology market is expanding due to high prevalence of hematologic disorders and early disease detection awareness. The region's healthcare infrastructure, automated hematology analyzers, and advanced molecular diagnostic platforms are contributing to growth. Supportive reimbursement policies and significant research investments are accelerating innovation in diagnostics and therapeutics. The rapid adoption of precision medicine, companion diagnostics, and novel therapies like CAR-T cells strengthens the region's market leadership.

For instance, in May 2025, Thermo Fisher Scientific has launched the Invitrogen Attune Xenith Flow Cytometer, enabling immunology and immuno-oncology researchers to automate workflows and obtain detailed insights from critical cellular samples. This solution, leveraging Thermo Fisher's core acoustic focusing technology, offers improved time to results and greater flexibility for researchers to tackle a broader range of applications with greater sensitivity.

Asia-Pacific Hematology Market Trends

The Asia-Pacific region is experiencing rapid market expansion due to its large patient population, increasing prevalence of genetic blood disorders, and rising healthcare expenditure. Countries like China and India are investing in diagnostic infrastructure, modernizing laboratories, and promoting affordable testing. The adoption of advanced hematology analyzers, demand for point-of-care testing in rural areas, and a surge in clinical trials and medical tourism are driving innovation and accessibility, making the region the fastest-growing global hematology market.

For instance, in January 2025, Erba Transasia Group, India's top In-vitro Diagnostic (IVD) company, introduced its advanced Haematology analyzer, Erba H7100, at a Clinical Symposium in Kochi, highlighting the need for high-end analyzers to address current challenges faced by clinical laboratories.

Market Companies:

The following are the major companies operating in the hematology market. These players hold a significant share and play an important role in shaping market growth and trends.

The hematology market is dominated by leading diagnostic companies like Sysmex Corporation, Beckman Coulter, Abbott Laboratories, Siemens Healthineers, Mindray, Boule Diagnostics, Diagnostica Stago, Roche Diagnostics, HORIBA Group, and Erba Group. These companies offer hematology analyzers, coagulation systems, reagents, and consumables for high-throughput laboratories and point-of-care settings. They invest in automation, AI-based hematology systems, and molecular diagnostics, enhancing efficiency and accuracy in disease detection.

Key Developments

In September 2024, Zoetis Inc. introduced new hematology analyzer Vetscan OptiCell, an AI-powered diagnostic tool for advanced Complete Blood Count (CBC) analysis. The product offers significant time, cost, and space savings for veterinary care teams, improving patient outcomes and enhancing clinic workflow efficiency.

In June 2024, HORIBA, a global leader in analytical and measurement technology, has introduced new compact hematology instruments with erythrocyte sedimentation rate (ESR) on board. The Yumizen H550E, H500E CT, and H500E OT which currently offer combined testing for CBC/DIFF with ESR results from whole blood in 60 seconds, adding a comprehensive profile for inflammatory disease assessment.

Suggestions for Related Report

For more medical devices-related reports, please click here