Overview

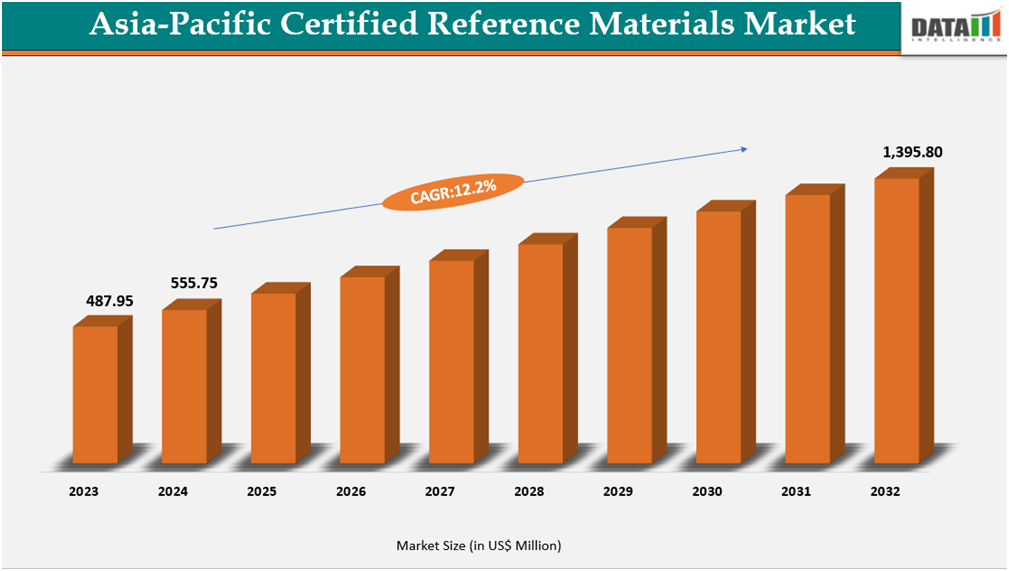

The Asia-Pacific certified reference materials market was US$555.75 million in 2024 and is expected to reach US$1,395.80million in 2032, growing at a CAGR of 12.2% during the forecast period (2025-2032).

Asia-Pacific Certified Reference Materials (CRM) market is witnessing accelerated growth, driven by expanding regulatory oversight, the maturation of metrology infrastructure and increasing demand for traceability across analytical laboratories. As economies across the region industrialize and diversify, the need for reliable calibration standards and analytical benchmarks has become central to quality assurance in pharmaceuticals, food safety, environmental monitoring, clinical diagnostics and industrial chemistry. Countries like China, Japan, South Korea, India and Australia have significantly increased their domestic CRM production capacity, while Southeast Asian nations are enhancing their reliance on accredited reference materials through international collaboration.

Asia-Pacific CRM market continues to mature as regional regulatory and accrediting infrastructures improve. In 2024, Asia-Pacific-affiliated accreditation bodies accredited over 75,000 laboratories for reference materials (ISO 17034), calibration, testing and more. This shows a significant increase in regional capacity for high-quality CRM development and certification. This institutional strengthening promotes better consistency in CRM quality, hence facilitating cross-border acceptance under both the Asia-Pacific and ILAC mutual recognition agreements. Industry collaboration is gaining traction. For example, major metrology institutions in China, Korea and Japan (KRISS, NIM and AIST) founded the Asian Collaboration on Reference Materials to share experience and harmonize CRM standards. Such activities are increasing demand for CRM in Asia-Pacific.

Industry Trends and Strategic Insights

- Government labsdominate theend-user segment in the market, capturing the largest revenue share of 29.01% in 2024.

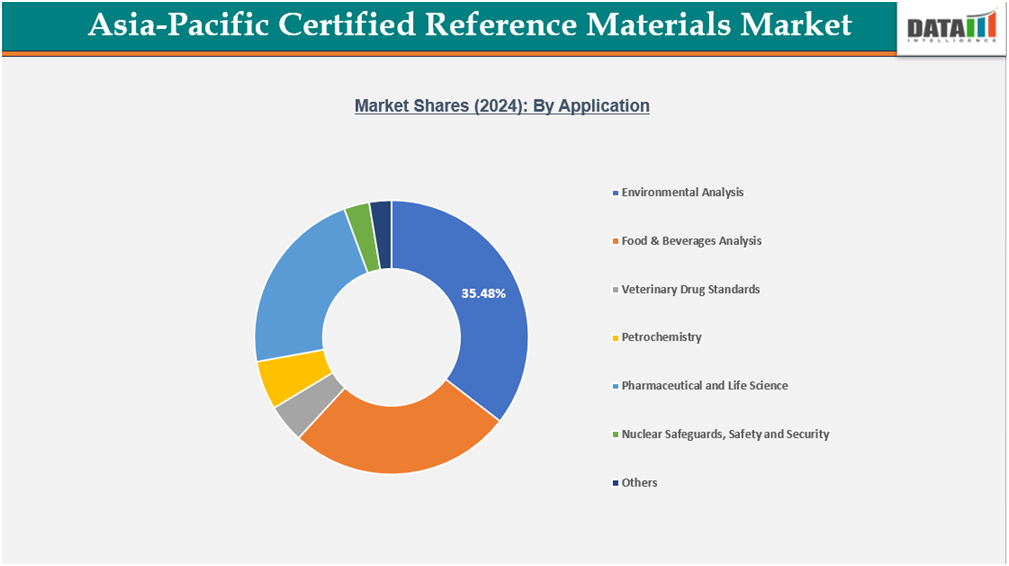

- By application, environmental analysis experiences the largest market, registering a significant 35.48% in 2024.

Market Size and Future Outlook

- 2024 Market Size:US$555.75 Million

- 2032 Projected Market Size: US$1,395.80 Million

- CAGR (2025-2032):12.2%

- Largest Market: China

Fastest Market: India

source: DataM Intelligence Email: [email protected]

Market Scope

| Metrics | Details |

| By Type | Organic, Inorganic |

| By Application | Environmental Analysis, Food & Beverages Analysis, Veterinary Drug Standards, Petrochemistry, Pharmaceutical and Life Science, Nuclear Safeguards, Safety and Security, Others |

| By End-User | Government Labs, Private Laboratories, QC Labs of Food Companies, Universities and Scientific Research Centre, Mass Spectrometer Manufacturing Companies, Others |

| By Country | China, Japan, South Korea, India, SEA Countries and Rest of Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Strengthening Regulatory Frameworks and Compliance Culture Across Asia-Pacific

The Certified Reference Materials (CRM) market is being driven by Asia-Pacific's quickly changing regulatory framework, which places a greater premium on accuracy, traceability and quality assurance across testing laboratories. Over the last decade, countries including China, India, Japan, South Korea and ASEAN members have steadily aligned their national quality infrastructure with global standards like ISO 17025 and ISO 17034, which govern laboratory competence and reference material manufacture, respectively. Beyond pharmaceuticals and food safety, the criteria now cover environmental monitoring, industrial product quality, forensic science and medical diagnostics. As a result, there is an increased demand for verified CRMs for calibration, quality control and inter-laboratory comparisons.

The development of approved testing facilities in the region exemplifies this regulatory transition. For example, India's NABL (National Accreditation Board for Testing and Calibration Laboratories) and China's CNAS (China National Accreditation Service) have expanded ISO-compliant lab certifications in the environmental, metallurgical and clinical sectors.In 2024 alone, NABL saw a rise of accredited facilities, many of which require certified reference materials to provide accurate and reproducible findings. In response, metrology organizations such as NIM (China) and NPLI (India) have expanded their CRM portfolios and inter-laboratory comparison programs. As a result, the area environment becomes increasingly dependent on locally produced, internationally recognized reference sources.

Improving Analytic Chemistry Applications in Forensic Science, Clinical Analysis, Environmental Analysis and Materials Analysis

Asia-Pacific is rapidly developing its analytical chemistry skills in a wide range of fields, including forensic science, clinical diagnostics, environmental monitoring and advanced materials research. This advancement is playing a critical role in increasing demand for certified reference materials.

National forensic agencies and crime labs in nations such as India, China and Singapore are strengthening their capacity to meet international standards for toxicology, narcotics, explosives and DNA testing.

High-precision CRMs are critical for assuring the accuracy, reproducibility and legal defensibility of analytical findings. Forensic labs are increasingly requiring multi-analyte CRMs for complicated matrices, which drives demand for both stock and unique reference materials.

As chronic diseases and personalized treatment become more prevalent, countries such as Japan, South Korea and Australia are investing in biomarker-based clinical diagnostics. The demand for traceable, ISO-compliant reference materials, such as those for vitamins, hormones and therapeutic medication monitoring is increasing in hospital labs, academic research facilities and in vitro diagnostic manufacturers. CRMs are especially important for inter-laboratory calibration and assay validation in clinical studies.

Segmentation Analysis

The Asia-Pacific certified reference materials market is segmented based on type, application, end-user and country.

Driving Environmental Precision — Asia-Pacific Leads the Way with Certified Reference Materials for a Cleaner Future

Effective environmental monitoring across the Asia-Pacific region is becoming increasingly dependent on the availability and use of Certified Reference Materials (CRMs), particularly for complex analyses involving pollutants. The demand for CRMs in these applications is rising sharply, not just due to industrial activity but primarily because of government-enforced testing protocols, national metrology frameworks and participation in global environmental treaties.

One of the strongest examples of regional coordination is the Asian Collaboration on Reference Materials (ACRM), which includes the Korea Research Institute of Standards and Science (KRISS), the National Institute of Metrology in China (NIM) and Japan’s National Institute of Advanced Industrial Science and Technology (AIST). These national metrology institutes are directly involved in developing CRMs for environmental applications, indicating that governments are proactively investing in reliable standards.

In China, this demand is institutionalized through the National Sharing Platform for Reference Materials, which is supported by the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ). The platform currently hosts more than 7,600 reference material categories and includes over 30,000 metadata entries, many of which relate directly to environmental matrices such as river sediment, agricultural runoff and industrial effluent. The platform supports national regulations on soil contamination, drinking water safety and food adulteration, all of which require traceable CRMs for verification and validation.

Powering Cleaner Energy Transitions — Asia-Pacific Fuels Precision with Certified Reference Materials for Petrochemistry

The rising adoption of fuel blending mandates, stricter emissions controls and an accelerated pivot toward cleaner energy across Asia-Pacific are all contributing to an unmistakable surge in demand for Certified Reference Materials (CRMs) in petrochemistry. Countries across the region are facing the dual challenge of ensuring both fossil fuel quality and renewable fuel integrity. In this context, CRMs for gasoline, diesel, petroleum products and biofuels have become critical to calibration, traceability and regulatory testing in labs and refineries.

India is increasing efforts to develop domestic CRM infrastructure tailored to petrochemical applications. Bharat Petroleum Corporation Limited (BPCL), a public sector entity under the Ministry of Petroleum and Natural Gas, has established the nation’s first ISO 17034:2016-accredited Reference Material Producer (RMP) laboratory in Sewree, Mumbai. This lab, also accredited to ISO 17025 for testing, produces CRMs for diesel, aviation turbine fuel, lubricants, sulfur content, flash point, kinematic viscosity and density.

Malaysia is also expanding its biofuel blending program, which is deepening the need for quality-assured fuel testing. The government’s B10 biodiesel mandate is in place for the transport sector in many regions and expansion toward B20 blending is under consideration. The B20 (B20 biofuel program) is fully implemented, domestic biodiesel production reached 1.8 million metric tons in 2024, up from approximately 1.1 million tons consumed in 2023, along with nearly 300,000 tons in exports. Increased blending percentages necessitate tighter quality checks, especially regarding fuel stability, moisture content and glyceride levels, all parameters requiring calibration and validation through certified biofuel CRMs.

Tariff And Regulatory Landscape

Asia-Pacific CRM market is diverse and often fragmented tariff and regulatory landscape. CRMs are generally classified under the Harmonized System (HS) Code 3822.00, which covers diagnostic or laboratory reagents, including those on a backing. However, due to the lack of a dedicated sub-classification for CRMs in many countries, they are often grouped with general laboratory chemicals, leading to inconsistencies in tariff application.

For instance, China typically levies import duties ranging from 0% to 6% depending on the CRM type and its end-use, while India applies customs duties in the range of 5%–10%, with an added Goods and Services Tax (GST) of up to 18%, which significantly increases the landed cost of imported CRMs.

In contrast, technologically advanced nations such as Japan and South Korea maintain lower tariff barriers, with some CRM categories even benefiting from duty exemptions, particularly those used in pharmaceutical, environmental or food safety applications. Meanwhile, Southeast Asian countries like Vietnam, Thailand and Indonesia impose moderate tariffs but are highly import-dependent due to limited domestic CRM production capabilities.

India has a more complex framework, where regulatory bodies such as the Central Pollution Control Board (CPCB), Food Safety and Standards Authority of India (FSSAI) and Central Drugs Standard Control Organization (CDSCO) require CRMs to be traceable to SI units or internationally accepted standards for use in testing applications. Countries like Singapore and Australia often follow European Union or US regulatory benchmarks, mandating traceability to international agencies like NIST or JRC, which imposes higher compliance costs and sometimes delays product registration for overseas suppliers.

SUSTAINABILITY ANALYSIS

The Certified Reference Materials market in Asia-Pacific is gradually integrating sustainability practices, owing to rising environmental consciousness among regulatory bodies, laboratories and CRM producers. The adoption of green chemical concepts, eco-friendly packaging and the reduction of toxic reagents in CRM production is gaining ground, particularly in developed economies such as Japan, South Korea and Singapore. Several producers are pursuing ISO 14001 certification and lifecycle assessments (LCAs) to line with global environmental standards and demonstrate their commitment to responsible material stewardship.

However, sustainability adoption remains inconsistent throughout the region. While high-income countries invest in cleaner industrial technology and automated manufacturing to reduce waste and solvent use, many emerging economies continue to rely on traditional infrastructure. Furthermore, a huge number of CRMs, particularly for trace metals, organic compounds and high-purity standards, are imported from the EU and North America, resulting in a significant carbon footprint from long-distance cold-chain logistics and packaging waste. This presents both an environmental and economic sustainability concern, perhaps pressuring Asia-Pacific countries to localize CRM manufacture in the future.

Competitive Landscape

The Asia Pacific Certified Reference Materials (CRM) market is characterized by a dynamic and rapidly evolving competitive landscape, featuring a fierce battle for dominance between entrenched global giants and a burgeoning wave of agile local and regional manufacturers. The market is currently fragmented, with multinational players like Merck KGaA, LGC Group, and Waters Corporation holding significant influence due to their global reputation and extensive portfolios.

However, their position is increasingly challenged by strong National Metrology Institutes (NMIs) such as the National Institute of Metrology (NIM) in China and the National Institute of Advanced Industrial Science and Technology (AIST) in Japan, alongside a growing number of specialized local producers capitalizing on domestic regulatory shifts and cost-sensitive demand, creating a fertile ground for strategic alliances, joint ventures, and acquisitions.

Key Developments

- In June 2022, AnalytiChem Holding GmbH acquired Chem Service, Inc., a manufacturer of high-purity analytical standards and certified reference materials. Founded in 1962 and located in West Chester, PA, Chem Service is accredited to ISO 17034, ISO/IEC 17025 and ISO 9001 for the production and distribution of organic neat and synthetic reference materials. This acquisition significantly enhances AnalytiChem’s portfolio of neat CRMs and pesticide standards, enabling broader market reach through its existing global customer network.

Why Choose This Asia Pacific Certified Reference Materials Market Report

For investors, corporate strategists, policymakers, and laboratory directors, navigating the high-growth yet complex Asia Pacific Reference Materials market requires localized, forward-looking intelligence. This comprehensive report serves as an indispensable strategic tool, offering:

- Granular Market Intelligence: Detailed assessment of market size, explosive growth trajectories, and a segment-by-segment analysis through 2032. This provides a complete view of the opportunity landscape, highlighting the rapid adoption of CRMs in quality control, the demand for matrix-matched materials, and the disparities in technological maturity between developed and emerging APAC economies.

- Regulatory Intelligence: In-depth, country-specific analysis of the evolving regulatory frameworks that are primary drivers of CRM demand. This includes insights into pharmacopoeias (Chinese, Japanese, Indian), food safety standards (China GB, FSSAI in India), environmental protection laws, and industrial quality policies that are increasingly mandating the use of accredited CRMs for compliance and trade.

- Competitive Benchmarking: Thorough evaluation of the strategies, market positioning, and technical capabilities of leading multinational corporations, powerful APAC NMIs, and rising regional specialists. This enables informed partner selection, competitive strategy formulation, and identification of acquisition targets in a rapidly consolidating market.

- Investment and Opportunity Mapping: Identification of high-growth applications and untapped demand pockets across key sectors such as pharmaceutical and biotech quality control, clinical diagnostics, food safety & authenticity testing, environmental monitoring, and the region's dominant electronics and advanced manufacturing industries.

- Supply Chain and Market Access Analysis: Critical analysis of the regional value chain, from raw material sourcing and production to certification, distribution, and after-sales support. This includes insights into navigating import/export logistics, regulatory hurdles, cultural nuances in B2B engagement, and establishing a resilient supply chain within the region.

- Expert, Forward-Looking Insights: Strategic recommendations and insights derived from regional industry specialists with deep expertise in APAC market dynamics, analytical science, and quality infrastructure, designed to inform high-stakes investment, market entry, localization, and partnership decisions.