Asia-Pacific Cooling as a Service Market Overview

Asia-Pacific Cooling as a Service market was approximately US$ 2,532.48 million in 2024 and is expected to reach US$ 5,640.36 million in 2032 growing at a CAGR of about 10.6% during the forecast period (2025-2032).

Asia-Pacific is experiencing an unprecedented thermal crisis, driven by rapid urbanization, rising disposable incomes and escalating climate impacts.

Cooling demand is no longer a luxury but a critical necessity for economic productivity, data infrastructure, healthcare and comfort. This surging demand presents a formidable dual challenge: the immense capital expenditure (CapEx) required for modern cooling systems and the severe operational expenditure (OpEx) and environmental cost of their energy consumption.

In a climate of economic uncertainty and high borrowing costs, CaaS liberates corporate and municipal balance sheets by eliminating large upfront investments. This converts cooling from a capital-intensive asset into a transparent, scalable operational expense. With energy prices exhibiting volatility and corporate Net-Zero commitments becoming ubiquitous, the efficiency gains delivered by expert-managed, state-of-the-art cooling systems are a primary driver. CaaS providers are intrinsically motivated to deploy the most efficient technologies to maximize their own margins, directly aligning their profitability with customer sustainability goals.

Governments across Asia-Pacific, notably in Singapore, Japan and Australia, are implementing stringent carbon emission regulations and building efficiency standards. CaaS offers a turnkey solution for compliance, reducing the administrative and technical burden on end-users. The proliferation of IoT sensors, cloud-based analytics and AI-driven predictive maintenance enables the CaaS model to function at scale. Service providers now remotely monitor system health, optimize performance in real-time and pre-empt failures, guaranteeing unprecedented levels of uptime and efficiency.

Market Size and Future Outlook

- 2024 Market Size: US$ 2,532.48 million

- 2032 Projected Market Size: US$ 5,640.36 million

- CAGR (2025–2032): 10.6%

- Dominating Market: China

- Fastest Growing Market: India

Market Scope

| Metrics | Details |

| By Technology | Air cooling, Liquid cooling, Chilled water systems, Evaporative Cooling, Others |

| By Service | Installation, Maintenance, Monitoring, Support |

| By Application | Comfort Cooling, District/Community Cooling, Mission-Critical Cooling, Peak Shaving/Temporary Cooling, Process Cooling |

| By End-User | Residential, Commercial, Industrial |

| By Country | China, India, Japan, Australia, Indonesia, Philippines, Singapore, Malaysia, Vietnam, and the Rest of Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Growing Demand for Energy-Efficient and Low-CAPEX Cooling Solutions

Rising electricity costs, stricter environmental restrictions and heightened awareness of sustainability are all driving a rapid increase in demand for energy-efficient cooling systems in Asia-Pacific.

Many commercial and industrial buildings, such as office complexes, shopping malls and data centers, are looking for solutions to cut operating costs while maintaining peak cooling performance. Cooling-as-a-Service (CaaS) offers a realistic alternative by allowing consumers to pay for cooling as a service rather than investing in expensive equipment, resulting in significant upfront capital expenditure (CAPEX) savings and reduced maintenance requirements.

Countries like India, China and Singapore are seeing rapid urbanization and industry, which is directly boosting cooling demands. For example, Singapore's Ministry of Sustainability and the Environment has made energy-efficient building cooling a national priority, resulting in increased use of outsourced cooling services.

Similarly, India's growing number of high-rise commercial buildings and data center expansions is driving a demand for dependable, low-cost cooling systems that can scale with infrastructure growth. These geographical dynamics make Asia-Pacific an appealing market for CaaS suppliers looking for quick deployment options.

Several real-world projects describe the effectiveness of this driver. Johnson Controls, for example, has earned multi-year CaaS contracts in Singapore, notably for the Raffles City Singapore and Plaza Singapura complexes and is deploying energy-efficient centralized cooling systems to cut electricity usage and carbon emissions.

Asia-Pacific Cooling as a Service Market, Segmentation Analysis

The global Asia-Pacific cooling as a service market are segmented based on technology, service, application, end-user and country.

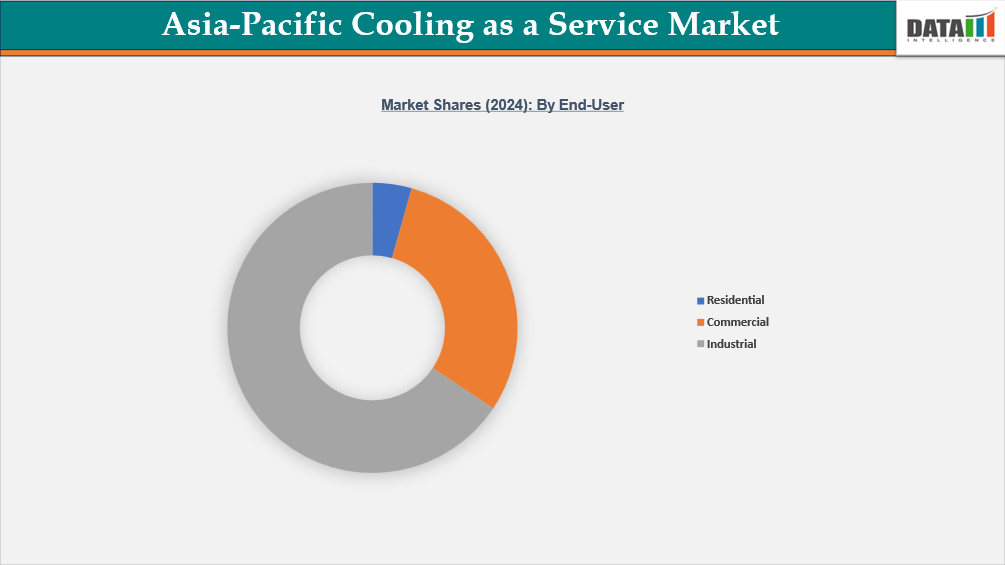

Industrial Segment Leads the Market

The industrial segment in the Asia-Pacific cooling as a service market was valued at US$1,661.94 million in 2024 and is expected to reach US$3,591.47 million by 2032, growing with a CAGR of 10.2% between 2025 and 2032.

Industries across the region require robust and efficient cooling systems to support manufacturing, processing and heavy-duty operations. Cooling is essential not only for equipment protection but also for maintaining product quality, worker safety and regulatory compliance.

Asia-Pacific is home to some of the world’s largest industrial economies, including China, India, Japan and South Korea. The countries host extensive operations in sectors such as steel, cement, chemicals, pharmaceuticals, electronics, IT & Telecommunications and food processing. Each of these industries has unique thermal management needs that are increasingly being met through service-based cooling models.

Cooling as a Service allows industrial operators to access high-performance systems without the burden of capital expenditure. Under this model, service providers design, install, operate and maintain the cooling infrastructure. Customers pay based on consumption or performance, which helps align costs with output and reduces financial risk.

Data centers are a rapidly growing subsegment within industrial cooling demand. With the expansion of cloud computing, artificial intelligence and digital services, data centers across Asia-Pacific are scaling up their operations. Cooling accounts for a significant share of total energy use in these facilities, often exceeding 30 percent. Service-based cooling models are being adopted to ensure uptime, optimize energy use and meet sustainability targets.

Digitalization is enhancing the value proposition of Cooling as a Service in industrial settings. Cloud-based analytics, machine learning and smart controls are being used to optimize cooling loads and detect faults. These features improve system efficiency and reduce downtime, which is critical in high-throughput environments such as data centers and manufacturing plants.

Commercial End-User Segment Gains Traction

The commercial segment in the Asia-Pacific cooling as a service market was valued at US$760.04 million in 2024 and is expected to reach US$1,764.11 million by 2032, growing with a CAGR of 11.2% between 2025 and 2032.

As urban centers expand and commercial real estate grows, the demand for efficient and scalable cooling solutions is increasing. Office buildings, shopping malls, hotels, airports and mixed-use developments all require reliable cooling to maintain occupant comfort and operational continuity.

Cooling as a Service offers commercial property owners a way to access high-performance cooling systems without the burden of capital investment. Under this model, service providers design, install, operate and maintain the cooling infrastructure, while customers pay based on consumption or performance. This approach aligns with the financial and operational priorities of commercial real estate developers and facility managers.

In Singapore, district cooling systems serve major commercial zones such as Marina Bay and Changi Business Park. The centralized model reduces equipment redundancy and frees up valuable floor space in commercial buildings.

China’s commercial sector is adopting service-based cooling in new urban developments and business parks. In cities like Shanghai and Shenzhen, commercial towers are being integrated into district energy networks that include chilled water distribution. These systems are often bundled with smart building technologies that monitor energy use and optimize cooling loads in real time.

India’s commercial real estate market is one of the fastest growing in Asia. With rising demand for Grade A office space and retail complexes, developers are seeking energy-efficient cooling solutions that meet green building standards. Cooling as a Service is being adopted in business districts and IT parks, particularly in cities like Bengaluru, Hyderabad and Pune. These systems help reduce peak demand charges and improve building performance ratings.

Asia-Pacific Cooling as a Service Market, Geographical Penetration

DOMINATING MARKET:

China Leads the Global Market Due to the Rapid Urbanization, Industrial Growth

China cooling as a service market was valued at US$ 879.53 million in 2024 and is estimated to reach US$ 1,690.62 million by 2032, growing at a CAGR of 8.6% during the forecast period from 2025-2032.

China’s demand for Cooling-as-a-Service (CaaS) is gaining strong momentum as rapid urbanization, industrial growth and rising temperatures drive up energy use in cooling systems. The country’s cooling demand has surged significantly over the past decade, with the number of installed air-conditioning units rising from about 531 million in 2015 to nearly 862 million in 2023. This sharp growth has made cooling one of the primary contributors to peak electricity demand, especially during extreme summers when national grid loads exceed 1.5 billion kW. Such high consumption levels have prompted both government and private sectors to explore smarter, more energy-efficient solutions.

Under the CaaS model, building owners or operators do not need to invest in costly cooling infrastructure. Instead, specialized service providers finance, design, install, operate and maintain the cooling systems while clients pay only for the cooling they consume. This approach ensures predictable costs, professional maintenance and significant energy savings. As China transitions toward a service-oriented economy with strong digitalization and environmental goals, CaaS aligns perfectly with its long-term sustainability and climate commitments. The model also supports the integration of renewable power, energy storage and artificial intelligence (AI) for load optimization, ensuring energy-efficient operations and reduced dependence on fossil fuels. According to data from China’s Ministry of Ecology and Environment, energy-efficient cooling solutions could collectively cut carbon emissions by more than 200 million tons annually by 2030 if widely adopted, demonstrating the scale of potential impact.

FASTEST GROWING MARKET:

India is the Fastest-Growing Country Driven by Climate Change, Urbanization and Energy Consumption

India cooling as a service market was valued at US$ 323.14 million in 2024 and is estimated to reach US$ 1,003.62 million by 2032, growing at a CAGR of 15.3% during the forecast period from 2025-2032. India’s demand for Cooling-as-a-Service (CaaS) is growing rapidly as climate change, urbanization and energy consumption drive an urgent need for sustainable temperature control solutions. With average temperatures in Indian cities rising by nearly 1.5°C over the past five decades and the urban heat island effect adding 2–3°C in metropolitan zones, cooling has become a basic necessity rather than a luxury.

As the country’s middle class expands and urban infrastructure scales up, the overall cooling demand is expected to triple by 2030. However, conventional air-conditioning systems involve heavy capital costs, long payback periods and high maintenance, making them inefficient for modern sustainability-driven infrastructure. The CaaS model eliminates these barriers by allowing businesses to pay only for the cooling they use, while the service provider designs, owns and operates the system, enabling cost predictability, lower carbon emissions and improved energy efficiency.

India’s government has identified sustainable cooling as a national priority through the India Cooling Action Plan (ICAP), which aims to cut cooling energy demand by 25–30% by 2038. This aligns with the broader national decarbonization target of achieving net-zero emissions by 2070. Cooling-as-a-Service plays a key role in this transition, as it offers an accessible, performance-based model that reduces electricity consumption by up to 40% compared to conventional systems. According to the Bureau of Energy Efficiency, electricity use from cooling is expected to rise by 300% by 2037–38 if left unchecked. The adoption of service-based cooling can ease the pressure on India’s grid, which already faces summer peak loads exceeding 250 GW, by integrating smart controls, renewable energy and predictive data analytics.

Sustainability and ESG Analysis

The Asia-Pacific Cooling as a Service (CaaS) market represents a transformative approach to addressing one of the region's most pressing sustainability challenges. Traditional cooling systems account for approximately 20% of total electricity consumption in buildings across Asia-Pacific, with this figure reaching as high as 60% in tropical countries like Singapore and Malaysia.

The CaaS model fundamentally alters this paradigm by shifting from capital-intensive ownership models to performance-based service agreements where providers maintain financial incentives to optimize energy efficiency continuously. This alignment of economic and environmental interests creates a powerful mechanism for carbon reduction.

CaaS providers typically deploy state-of-the-art equipment with coefficients of performance (COP) 30-50% higher than conventional systems, integrate advanced building management systems with AI-powered predictive analytics and implement real-time monitoring to identify inefficiencies immediately.

Furthermore, the service model encourages the adoption of low-global warming potential (GWP) refrigerants such as R-32, R-454B and natural refrigerants like ammonia and CO2, moving away from high-GWP hydrofluorocarbons (HFCs) that contribute significantly to climate change.

The economic structure of CaaS where providers bear operational costs creates natural incentives for preventive maintenance, optimal system sizing and equipment upgrades, all of which contribute to reduced energy consumption.

Competitive Landscape

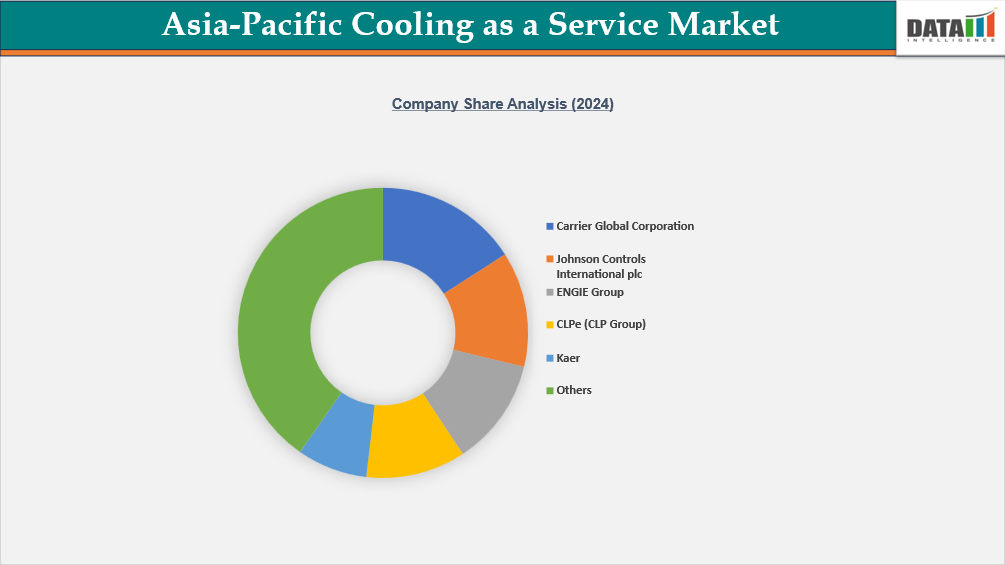

- The Asia-Pacific Cooling as a Service (CaaS) market features a fragmented but competitive landscape, with the "Others" category holding the largest share, indicating a significant presence of numerous local and specialized players.

- Carrier holds a leading position, indicating strong brand recognition and technological leverage from its traditional HVAC roots. It is closely rivaled by global building management giant Johnson Controls and energy-focused player ENGIE Group, forming a powerful top trio. CLP Group, through CLPe, leverages its regional energy utility footprint for a distinct advantage. Singapore-based Kaer, as a pure-play specialist, demonstrates significant regional influence despite its smaller size.

- However, the substantial "Others" category highlights a long tail of competitors, confirming the market's emerging nature with room for consolidation and niche players to coexist alongside the established industrial and energy giants.

Key Developments

- In August 2025, Tata Power Trading Company Ltd (TPTCL) commences Cooling as a service (CaaS) business with a pipeline of 2 lakh+ tons of refrigeration and 25 new projects acquired worth US$ 0.64 million for HVAC optimization.

- In July 2025, AESL partnered with the Maharashtra government's Mahatma Phule Renewable Energy and Infrastructure Technology (MAHAPREIT) to develop district cooling systems in the Mumbai Metropolitan Region and other areas under MAHAPREIT's jurisdiction.

Investment & Funding Landscape

In April 2025, PATRIZIA and Mitsui announced an investment commitment of up to USD 350 million through their APAC Sustainable Infrastructure Fund (A-SIF) to expand Kaer’s Cooling-as-a-Service (CaaS) operations across Asia. This investment aims to accelerate sustainable cooling solutions in key markets such as Singapore, Malaysia, India, Indonesia, Thailand, and Vietnam. The funding will support infrastructure upgrades, digital energy management, and localized service models to reduce carbon emissions in commercial and industrial sectors. This partnership highlights the growing importance of energy-efficient cooling systems amid rising regional demand for sustainable urban infrastructure. It also reinforces Asia’s leadership in advancing low-carbon technologies under the CaaS model.

| Company | Investment/Funding | Year | Details | |

| PATRIZIA & Mitsui | Up to US$ 350 million commitment | 2025 | Via APAC Sustainable Infrastructure Fund (A-SIF) to scale Kaer’s CaaS business across Asia including Singapore, Malaysia, India, Indonesia, Thailand & Vietnam. | |

What Sets This Asia-Pacific Cooling as a Service Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by technology, stage, distribution channel and category segments (sleep disorders, jet lag, shift-work). Scenario forecasts with country-level splits and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect Asia-Pacific cooling as a service commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Country-by-country market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across country markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.