Global Aluminum Casting Market Size

The global aluminum casting market reached US$ 79.07 billion in 2023, rising to US$ 83.50 billion in 2024, and is expected to reach US$ 126.22 billion by 2032, growing at a CAGR of 5.3% from 2025 to 2032.

This growth is driven by the rising demand for lightweight, durable, and corrosion-resistant components across automotive, aerospace, and construction sectors, which improves fuel efficiency and performance. Strong industrial expansion, government regulations on emissions, and technological innovations in die casting, sand casting, and investment casting are making production more efficient, driving the market toward sustainable, cost-effective, and high-quality aluminum solutions globally.

Aluminum Casting Market Industry Trends and Strategic Insights

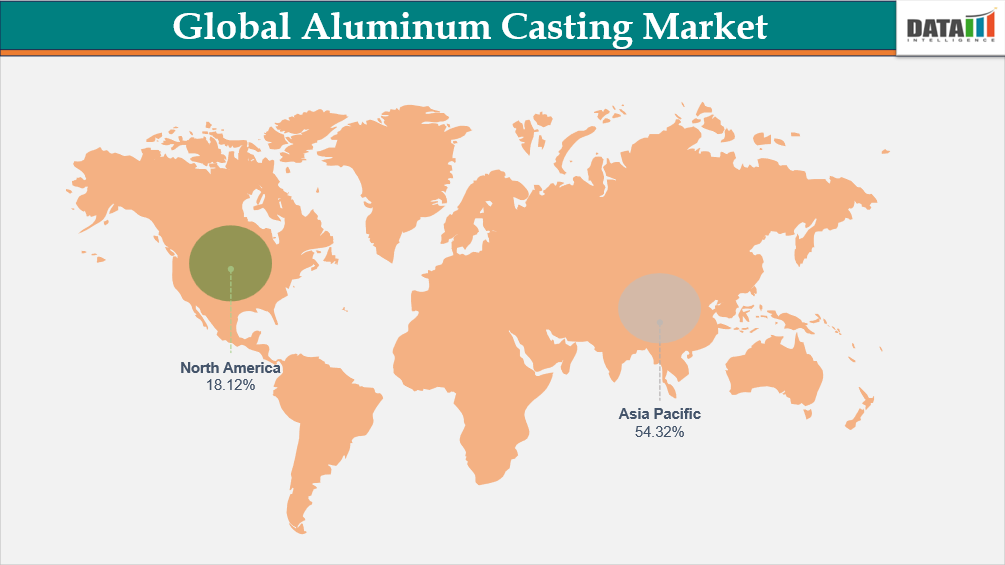

- The Asia-Pacific region leads the global aluminum casting market, capturing the largest revenue share of 54.32% in 2024.

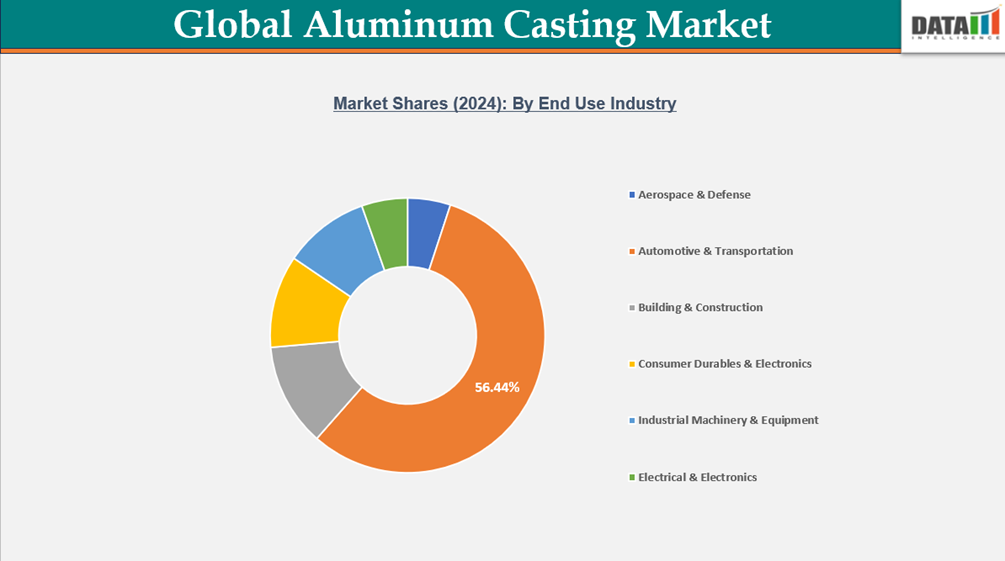

- By end use industry, automotive & transportation leads the global aluminum casting market, capturing the largest revenue share of 56.44% in 2024.

Global Aluminum Casting Market Size and Future Outlook

- 2024 Market Size: US$ 83.50 billion

- 2032 Projected Market Size: US$ 126.22 billion

- CAGR (2025–2032): 5.3%

- Largest Market: Asia-Pacific

- Fastest Growing Market: North America

Market Scope

| Metrics | Details |

| By Casting Type | Die Casting (High Pressure, Low Pressure), Permanent Mold Casting, Sand Casting, Investment Casting, Other Casting Types |

| By Alloy Type | Aluminum-Silicon (Si) Alloys, Aluminum-Magnesium (Mg) Alloys, Aluminum-Copper (Cu) Alloys |

| By Application | Engine & Transmission Components, Structural Components, Body Assemblies & Panels, Electrical Components, Pumps & Valves |

| By End Use Industry | Aerospace & Defense, Automotive & Transportation, Building & Construction, Consumer Durables & Electronics, Industrial Machinery & Equipment, Electrical & Electronics |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Automotive light weighting imperatives significantly accelerate global adoption of advanced aluminum casting solutions

The global automotive industry is undergoing a structural transformation driven by stringent emission regulations, rising fuel efficiency requirements, and increasing consumer demand for high-performance vehicles. Within this context, lightweighting has emerged as a critical design and manufacturing priority. Automakers are aggressively pursuing strategies to reduce vehicle weight without compromising safety, durability, or performance. Aluminum casting is at the forefront of this shift, offering a combination of lightweight properties, corrosion resistance, and high strength-to-weight ratios that outperform traditional steel components in many applications.

Aluminum castings are increasingly being utilized in engine blocks, transmission housings, suspension systems, and structural components, replacing heavier metals to improve fuel economy and lower carbon emissions. The transition to electric vehicles (EVs) further amplifies this trend. EV manufacturers prioritize lightweight materials to offset battery weight and extend driving range. As global EV production scales rapidly, demand for precision aluminum cast components is expected to accelerate significantly.

Segmentation Analysis

The global aluminum casting market is segmented based on casting type, alloy type, application end use industry and region.

Expanding Aerospace Sector Demands High-Strength, Durable Aluminum Cast Components

The aerospace industry is undergoing a period of accelerated expansion, fueled by rising global air travel, increased defense spending, and sustained demand for lightweight, fuel-efficient aircraft. Within this context, aluminum casting has emerged as a critical enabler, offering high-strength, durable, and lightweight components essential for performance, safety, and compliance with stringent regulatory standards. Airlines and defense organizations are prioritizing materials that reduce overall aircraft weight while maintaining structural integrity, thereby driving demand for advanced aluminum alloys in casting applications.

Aluminum castings are widely used in aerospace structures, including engine housings, gearbox casings, landing gear components, and intricate airframe parts. Their combination of corrosion resistance, superior strength-to-weight ratio, and design flexibility makes them highly suitable for the operational stresses and complex geometries characteristic of aerospace systems. Furthermore, innovations in precision casting technologies, such as vacuum die casting and investment casting, are enhancing product reliability, dimensional accuracy, and fatigue resistance, aligning with the industry’s stringent performance benchmarks.

High energy consumption increases production costs, limiting aluminum casting competitiveness

Aluminum casting processes, including high-pressure die casting, sand casting, and investment casting, are inherently energy-intensive due to the requirement for melting aluminum alloys at extremely high temperatures and maintaining precise thermal control during solidification. This reliance on electricity, natural gas, or other energy sources contributes substantially to production costs, affecting the overall competitiveness of aluminum cast products in price-sensitive industries such as automotive, construction, and industrial machinery.

Rising global energy prices exacerbate this challenge, particularly in regions with less efficient power infrastructure or higher electricity tariffs. For instance, manufacturers in North America and Europe are facing increasing operational expenses due to both energy costs and stringent environmental regulations, which require the adoption of cleaner but often more energy-intensive processes. High energy consumption also results in larger carbon footprints, which can influence procurement decisions as industrial buyers increasingly prioritize sustainability and low-emission materials.

Geographical Penetration

Asia-Pacific Leads the Aluminum Casting Market Driven by Industrial Growth and Infrastructure

The Asia-Pacific region dominates the global aluminum casting market, fueled by rapid industrialization, urbanization, and infrastructure development in countries such as China, India, and Japan. Rising demand from the automotive, aerospace, construction, and industrial machinery sectors is driving adoption of advanced aluminum casting solutions, including high-precision engine components, structural automotive parts, and complex aerospace castings.

Government initiatives promoting large-scale industrial and infrastructure projects, such as smart factories, highway expansion, metro networks, and energy-efficient industrial zones, are accelerating adoption of aluminum cast components. Innovations in casting technologies, energy-efficient melting systems, and high-performance alloys are enhancing product quality, operational efficiency, and reliability. Combined with competitive manufacturing capabilities, skilled labor, and abundant raw material resources, the Asia-Pacific region is expected to maintain its leading position in the global aluminum casting market.

India Aluminum Casting Market Outlook

India’s aluminum casting market is experiencing robust growth, driven by infrastructure expansion, industrial modernization, and rising automotive production. Government programs, including investments in highways, metro systems, and smart industrial zones, are boosting demand for high-quality aluminum castings. Domestic innovation in precision casting technologies, alloy development, and automated manufacturing further supports market expansion. With steady economic growth and rapid industrialization, India’s aluminum casting market outlook remains highly promising.

China Aluminum Casting Market Trends

China continues to be a global leader in aluminum casting production and technology adoption, investing heavily in industrial automation, high-precision casting systems, and advanced alloy solutions. Strong domestic demand from automotive, aerospace, and construction sectors drives market growth. Ongoing government-led infrastructure initiatives, technological advancements, and sustainability programs are accelerating deployment of efficient, high-quality aluminum cast components, ensuring China remains a key contributor to the Asia-Pacific and global market expansion.

North America Leading the Charge in Aluminum casting market Adoption

North America is emerging as one of the fastest-growing regions in the aluminum casting market, driven by rising demand in industrial recycling, construction, and steel manufacturing sectors. The region benefits from advanced industrial infrastructure, strong R&D capabilities, and strategic investments in automated scrap handling and high-capacity magnetic systems. The push toward operational efficiency, safety, and sustainable material reuse is accelerating adoption across multiple industrial segments. As governments, recyclers, and private manufacturers invest in modern scrap handling solutions, North America is solidifying its position as a global hub for innovation and market growth.

US Aluminum Casting Market Insights

In the United States, the market continues to grow steadily, supported by high industrial demand, extensive recycling operations, and strong construction activity. Rising focus on automation, operational safety, and efficient material recovery is driving adoption, while advances in magnetic suction technology and automated lifting systems are enhancing performance and reliability. With robust domestic manufacturing capabilities, supportive regulations, and increasing industrial investments, the US market is well-positioned to maintain growth while promoting sustainable and efficient scrap handling practices.

Canada Aluminum Casting Market Industry Growth

Canada’s market is experiencing steady expansion, driven by industrial growth, recycling infrastructure, and rising demand from construction and steel sectors. The country leverages advanced manufacturing, supportive policies, and innovative solutions to expand alloy types of high-capacity magnetic suction machines. Companies are investing in durable, energy-efficient systems and automated handling solutions, boosting operational efficiency and reliability. Continued adoption of advanced scrap handling technologies reflects Canada’s commitment to sustainable industrial practices, optimized material reuse, and long-term market growth, making it a key contributor to the broader North American aluminum casting market.

Sustainability Analysis

The global aluminum casting market is increasingly embracing sustainability, driven by growing demand for energy-efficient, eco-friendly, and low-emission industrial operations. Manufacturers are investing heavily in automated melting and casting systems, advanced mold technologies, and high-performance alloy solutions to optimize production efficiency, reduce material waste, and minimize environmental impact.

Sustainable practices, including responsible sourcing of raw materials, adherence to environmental regulations, and compliance with workplace safety standards, are becoming standard across the aluminum casting sector. Innovations in energy-efficient furnaces, low-carbon melting techniques, and precision casting technologies contribute to reduced energy consumption and lower operational emissions.

Competitive Landscape

- The global aluminum casting market is moderately consolidated, with key players focusing on technological advancements, strategic partnerships, and capacity expansions to strengthen their market presence.

- Major companies such as Ryobi Limited, Alcoa Corporation, Dynacast International, Gibbs Die Casting, and Martinrea International dominate through integrated manufacturing capabilities and global supply networks. These players emphasize lightweighting solutions to cater to the growing demand from automotive, aerospace, and industrial sectors.

- Strategic mergers and acquisitions, such as Nemak’s collaborations with OEMs for advanced die-casting technologies, enhance competitive positioning. Regional players in Asia-Pacific, particularly in China and India, are expanding rapidly due to lower production costs and rising domestic demand. Continuous innovation in high-pressure die casting, sand casting, and investment casting processes, coupled with the adoption of recycled aluminum, further intensifies competition.

Key Developments

- January 2025 – Alcoa Corporation expanded its aluminum casting capacity in the United States by commissioning a new low-emission furnace, enhancing output efficiency and sustainability.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, you gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2025

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

Emerging Companies