Active Pharmaceutical Ingredients Market Size

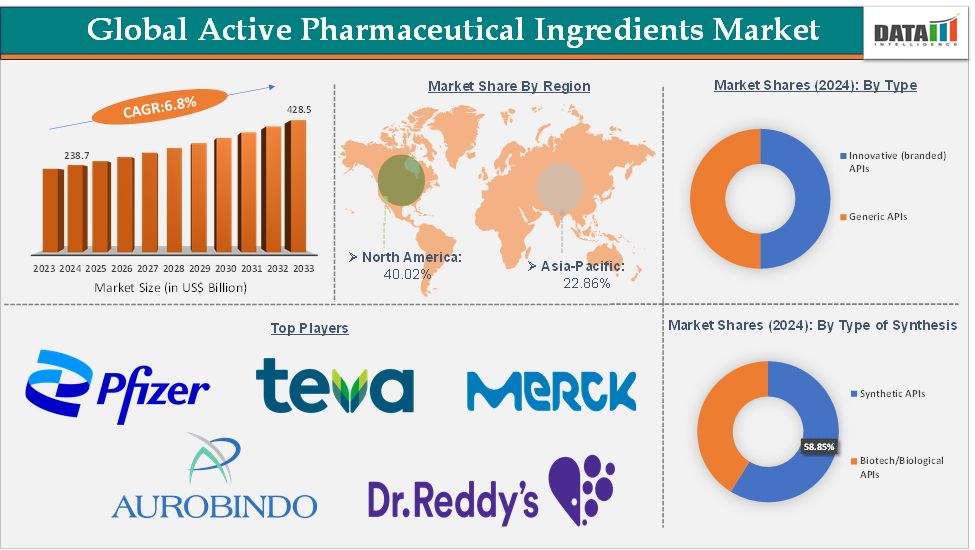

The global active pharmaceutical ingredients market size reached US$ 238.7 Billion in 2024 from US$ 224.7 Billion in 2023 and is expected to reach US$ 428.5 Billion by 2033, growing at a CAGR of 6.8% during the forecast period 2025-2033.

Market Overview

The global Active Pharmaceutical Ingredients (API) market forms the backbone of pharmaceutical manufacturing, supplying the biologically active components used in both branded and generic drugs. The market is fueled by rising prevalence of chronic diseases, aging populations, and expanding access to healthcare worldwide. Synthetic APIs currently dominate production due to established chemical synthesis capabilities, while biotech APIs are the fastest-growing segment, driven by surging demand for biologics, biosimilars, and advanced therapies. North America leads in value share through strong R&D pipelines and advanced regulatory frameworks, whereas Asia-Pacific is emerging as the largest manufacturing hub for cost advantages, scale, and policy support, particularly in India and China.

Executive Summary

Market Dynamics

Drivers:

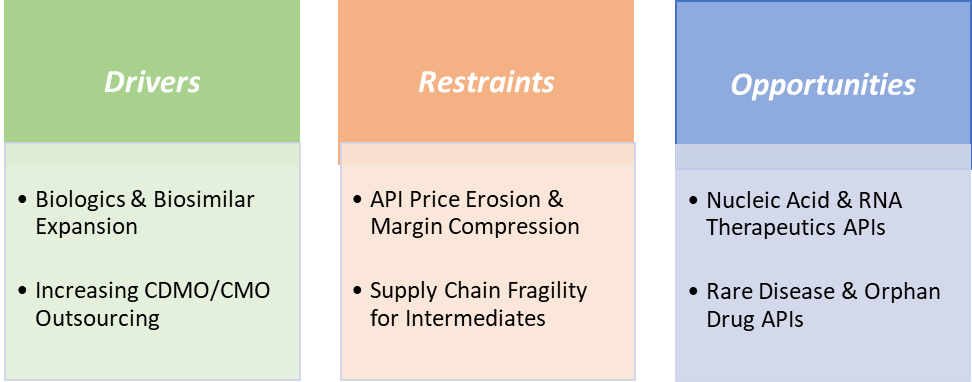

Biologics & biosimilar expansion is significantly driving the active pharmaceutical ingredients market growth

The biologics and biosimilar expansion are becoming one of the most powerful growth engines for the Active Pharmaceutical Ingredients (API) market because it is reshaping both the type and value of APIs demanded globally. Biologics, such as monoclonal antibodies, recombinant proteins, vaccines, and cell- or gene-based therapies are among the fastest-growing segments in pharmaceuticals, accounting for a large share of late-stage pipelines. Every biologic requires a complex, high-value API, often produced through cell culture, fermentation, or advanced purification processes.

As blockbuster biologics like Humira, Avastin, and Herceptin lose patent protection, the biosimilar market is accelerating, creating fresh API manufacturing demand from new entrants. Furthermore, the shift toward niche biologics such as antibody–drug conjugates (ADCs), fusion proteins, and therapeutic peptides has created opportunities for API makers with hybrid chemical–biological capabilities. Countries like India have emerged as major hub for biosimilar API production, partnering with multinational pharma firms to scale capacity. This expansion is not just about higher volumes, it’s also about higher margins, as biologic APIs can be worth hundreds of times more per kilogram than small molecules, significantly lifting overall API market.

Restraints:

API price erosion & margin compression is hampering the growth of the active pharmaceutical ingredients market

API price erosion and margin compression are significant restraints on the Active Pharmaceutical Ingredients (API) market, particularly in mature and highly competitive therapeutic areas. In segments like antibiotics, analgesics, and common cardiovascular drugs, oversupply mainly from large-scale producers in India and China has led to aggressive price competition, often pushing selling prices close to or even below production costs.

Moreover, regulatory compliance costs, environmental control investments, and quality audits add to operational expenses, further tightening margins. For smaller manufacturers, sustaining profitability under these conditions can be challenging, forcing some to exit unprofitable product lines entirely. The effect is especially pronounced in commoditized APIs, where differentiation is minimal, and buyers view suppliers as interchangeable. As a result, companies face reduced incentives to invest in capacity upgrades or innovation in these categories, ultimately slowing overall API market growth and potentially leading to supply instability when prices fall too low to sustain operations.

For more details on this report – Request for Sample

Segmentation Analysis

The global active pharmaceutical ingredients market is segmented based on type, type of synthesis, application, end-user, and region.

The synthetic APIs segment from the type of synthesis is dominating the active pharmaceutical ingredients market with a 58.85% share in 2024

The synthetic APIs segment continues to dominate the Active Pharmaceutical Ingredients (API) market due to its wide applicability, established manufacturing processes, and cost efficiency. Synthetic APIs are chemically synthesized through well-defined organic reactions, making them suitable for a broad range of therapeutic areas such as cardiovascular, central nervous system, anti-infective, and metabolic disorders. Unlike biologic APIs, which require complex biotechnological production, synthetic APIs benefit from decades of process optimization, extensive supplier networks, and scalable batch manufacturing.

For instance, blockbuster small-molecule drugs like atorvastatin (Lipitor) and sofosbuvir (Sovaldi) rely on synthetic APIs produced at large commercial scales. The lower production costs, higher stability, and longer shelf life of synthetic APIs make them the preferred choice for generic manufacturers, especially in emerging markets where affordability is a key factor. Additionally, advances in continuous flow chemistry and green synthesis have improved yields, reduced waste, and lowered production costs, reinforcing the competitive edge of synthetic APIs.

Geographical Share Analysis

North America is expected to dominate the global active pharmaceutical ingredients market with a 40.02% in 2024

North America remains the dominant region in the Active Pharmaceutical Ingredients (API) market due to its strong pharmaceutical manufacturing base, advanced R&D infrastructure, and high regulatory standards. The United States, in particular, is home to many of the world’s largest pharmaceutical companies such as Pfizer, Merck, and other major companies which either produce APIs in-house or contract them from specialized suppliers. The region benefits from a robust demand for both branded and generic drugs, fueled by a large aging population and a high prevalence of chronic diseases like cancer, diabetes, and cardiovascular disorders.

North America is also a leader in high-value API segments such as biologics, high-potency APIs (HPAPIs), and innovative oncology drugs, supported by cutting-edge manufacturing technologies and strong intellectual property protections. The presence of stringent FDA regulations ensures high-quality manufacturing standards, which enhances the global competitiveness of North American API exports. This combination of innovation leadership, high-value product focus, and government-backed supply chain security keeps the region at the forefront of the global API market.

Competitive Landscape

Top companies in the active pharmaceutical ingredients market include Pfizer Inc., Teva Pharmaceuticals USA, Inc., Merck KGaA, AbbVie Inc., Aurobindo Pharma Limited, Dr. Reddy’s Laboratories Ltd., Lupin, Sun Pharmaceutical Industries Ltd., Divi's Laboratories Limited, and Cipla, among others.

Report Scope

Metrics | Details | |

CAGR | 6.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Innovative (branded) APIs and Generic APIs |

Type of Synthesis | Synthetic APIs and Biotech/Biological APIs | |

Application | Oncology, Cardiovascular Diseases, Neurology & Psychiatry Disorders, Endocrinology / Metabolic Disorders, Respiratory Diseases, Gastrointestinal Diseases, Musculoskeletal Disorders and Infectious Diseases, and Others | |

End-User | Pharmaceutical & Biotech Companies, CDMOs/CMOs and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global active pharmaceutical ingredients market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures, and 167 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here