Global Diabetes Therapeutics Market: Industry Outlook

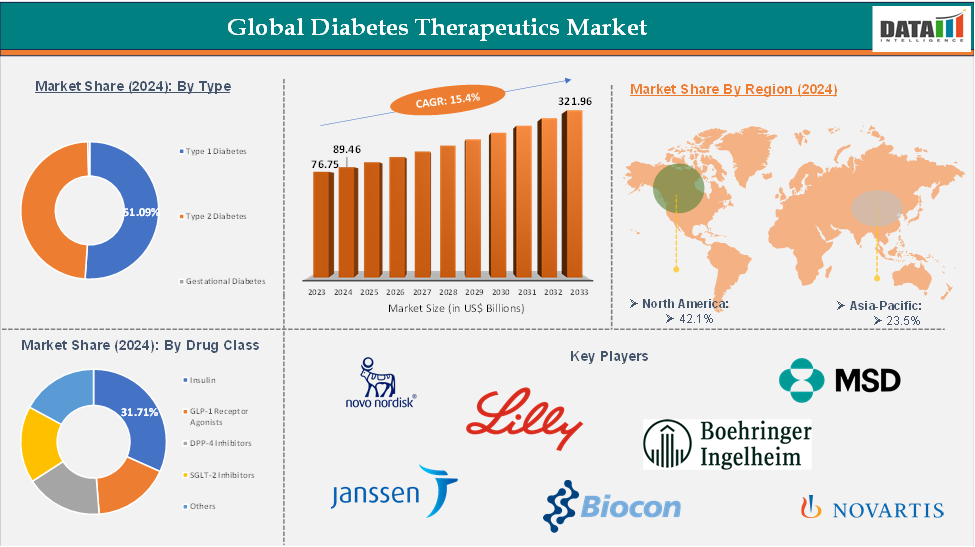

The global diabetes therapeutics market reached US$ 76.75 Billion in 2023, with a rise of US$ 89.46 Billion in 2024 and is expected to reach US$ 321.96 Billion by 2033, growing at a CAGR of 15.4% during the forecast period 2025-2033.

The global diabetes therapeutics market is experiencing rapid transformation due to demographic, lifestyle, technological, and regulatory factors. With diabetes becoming a pervasive and costly chronic disease, the need for effective, safe, and accessible therapeutic options is increasing. Traditional therapies like insulin and metformin are being replaced by newer drug classes, such as GLP-1 receptor agonists, SGLT-2 inhibitors, DPP-4 inhibitors, and dual and triple agonists. These newer classes offer benefits such as weight loss and cardiovascular protection, making them increasingly preferred by healthcare providers and patients.

Major players in the market, including Novo Nordisk, Eli Lilly, Sanofi, Merck & Co., AstraZeneca, and Boehringer Ingelheim, are investing heavily in R&D, launching novel drugs, expanding their geographic reach, and forming strategic partnerships. The rise of biosimilar insulins and oral versions of injectable drugs has opened new avenues for patient-centric care and cost-effective therapy.

The market is also witnessing a paradigm shift toward personalized medicine, digital therapeutics, and integrated care models. The use of connected insulin pens, continuous glucose monitoring systems, mobile health applications, and AI-powered analytics is enhancing treatment adherence, patient engagement, and real-time disease management. North America currently dominates the market due to high healthcare spending, strong reimbursement structures, and advanced clinical infrastructure.

Global Diabetes Therapeutics Market: Executive Summary

Global Diabetes Therapeutics Market Dynamics: Drivers & Restraints

Driver: Rising prevalence of diabetes

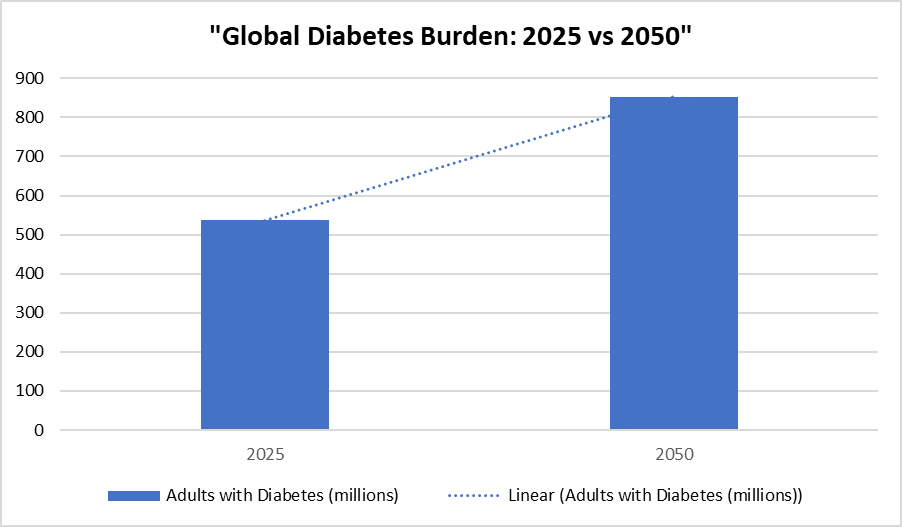

The global diabetes epidemic is a significant factor in the growth and evolution of the diabetes therapeutics market. With sedentary lifestyles and a shift towards high-calorie, processed foods, the incidence of type 2 diabetes has increased globally. Factors like aging populations, urbanization, genetic predisposition, and obesity rates have exacerbated the situation, leading to a sharp increase in new diabetes diagnoses annually.

This growing patient pool has led to a demand for effective treatment solutions, from basic oral antidiabetic drugs to advanced injectable therapies and combination regimens. Healthcare systems worldwide are under pressure to manage long-term complications associated with uncontrolled diabetes, including cardiovascular disease, kidney failure, and neuropathy. Pharmaceutical companies are developing innovative therapies to control blood glucose levels and address associated comorbidities.

For instance, according to the International Diabetes Federation, by 2050, approximately 853 million adults will have diabetes, a 46% increase from the current 1 in 8 population. Over 90% of these individuals have type 2 diabetes, influenced by socio-economic, demographic, environmental, and genetic factors. Key contributors include urbanization, an aging population, decreased physical activity, and rising obesity rates.

Driver: Growing geriatric population

The global diabetes therapeutics market is growing due to the growing geriatric population, who face increased risk of chronic conditions like type 2 diabetes due to factors like reduced insulin sensitivity, impaired glucose tolerance, and age-related metabolic changes. Older adults also face multiple health challenges, such as cardiovascular disease, kidney dysfunction, and cognitive decline, making diabetes management more complex. This demographic shift has led to a demand for user-friendly, effective, and safer treatments. Pharmaceutical companies are developing long-acting formulations, fixed-dose combinations, and therapies with lower hypoglycemia risk, particularly for older individuals with frailty or cognitive impairment. Healthcare systems are also prioritizing preventive care, early diagnosis, and chronic disease management, further expanding the diabetes therapeutics market. The growing number of elderly patients globally influences innovation, regulatory focus, and delivery models in the diabetes care landscape.

Restraint: High initial and maintenance costs

The high cost of diabetes treatments, particularly advanced therapies like GLP-1 receptor agonists and insulin analogs, is a significant barrier in the global diabetes therapeutics market, especially for patients in low- and middle-income countries. This financial burden can lead to delayed or inconsistent treatment, poor health outcomes, and increased healthcare expenditures due to preventable complications. High R&D costs and regulatory hurdles also contribute to increased prices and affordability. Despite efforts by governments and global health organizations to improve access through subsidies, biosimilars, and insurance schemes, cost remains a persistent issue, necessitating broader reforms and pricing innovations to ensure equitable access to essential diabetes care.

For instance, the total estimated cost of diagnosed diabetes in the U.S. in 2022 is $412.9 billion, including $306.6 billion in direct medical costs and $106.3 billion in indirect costs attributable to diabetes.

Opportunity: Growth in point-of-care and portable testing solutions

Digital health solutions are revolutionizing diabetes treatment, offering improved disease management, patient engagement, and healthcare delivery efficiency. Technologies like continuous glucose monitors, smart insulin pens, mobile health apps, telemedicine platforms, and AI-driven decision support tools enable real-time tracking of blood glucose levels, personalized treatment adjustments, medication reminders, dietary tracking, and direct communication between patients and healthcare providers.

These tools empower individuals to take more control over their health, facilitate early intervention, and improve clinical outcomes. Healthcare systems and insurers are recognizing the value of digital therapeutics in reducing hospitalizations and long-term complications, prompting broader integration of these tools into standard care protocols. Mobile-based platforms are particularly valuable in underserved and remote areas. As digital literacy rises and technology becomes more affordable, digital health solutions are expected to become a cornerstone of diabetes care, complementing pharmacological interventions and reshaping therapeutic strategies.

For more details on this report, Request for Sample

Global Diabetes Therapeutics Market Segment Analysis

The global diabetes therapeutics market is segmented based on type, drug class, route of administration, distribution channel, and region.

Drug Class:

The insulin from the drug class is expected to hold 69.06% of the diabetes therapeutics market

The insulin segment is a crucial part of the global diabetes therapeutics market, driven by factors such as rising diabetes prevalence, technological advancements, user-friendly delivery systems, personalized medicine, real-time glucose management, biosimilar insulins, government policies, public health initiatives, and expanding healthcare infrastructure. Rapid-acting, long-acting, and ultra-long-acting insulins have improved glycemic control, reduced hypoglycemia risk, and enhanced patient adherence.

User-friendly delivery systems like insulin pens, pumps, and smart connected devices have made insulin therapy more convenient and precise. The integration of continuous glucose monitoring systems and smart insulin delivery has expanded the insulin segment. Supportive government policies, public health initiatives, and expanding healthcare infrastructure in emerging economies further accelerate the growth of the insulin segment.

For instance, Vertex Pharmaceuticals is aiming to submit its zimislecel cell therapy for type 1 diabetes in 2026, which has shown promising results in enabling patients to produce insulin, eliminating the need for additional therapy in most participants in a key clinical trial.

Moreover, in December 2024, Cipla received approval from the Central Drugs Standard Control Organization (CDSCO) to market and distribute Afrezza, an inhalable insulin, in India. Originally developed by MannKind Corporation, Afrezza provides a needle-free insulin delivery option for adults with both type 1 and type 2 diabetes. The therapy starts acting within approximately 12 minutes, closely replicating the body’s natural insulin response after meals.

Global Diabetes Therapeutics Market - Geographical Analysis

North America is the global diabetes therapeutics market is expected to grow to 37.66 billion in 2024

North America, particularly the US, leads the global diabetes therapeutics market due to advanced healthcare infrastructure, high disease prevalence, and strong research and development capabilities. The region's large and growing diabetic population, fueled by sedentary lifestyles, obesity, and aging demographics, supports access to advanced therapies like next-generation insulin analogs, GLP-1 receptor agonists, and digital diabetes care tools. Major pharmaceutical and biotechnology companies, ongoing clinical research, and FDA regulatory approvals accelerate innovation and product availability. Increased consumer awareness, high healthcare spending per capita, and a focus on integrated care and preventive health contribute to the region's market dominance.

For instance, in March 2025, Vertex Pharmaceuticals (Nasdaq: VRTX) announced key progress in its type 1 diabetes (T1D) program. The company has completed both enrollment and dosing for Parts A and B of its Phase 1/2 study of VX-264, an investigational therapy that combines fully differentiated pancreatic islet cells with a proprietary immunoprotective device. In Part B, participants received the full therapeutic dose, and Vertex has conducted the planned Day 90 analysis, marking a significant milestone in the development of this innovative cell-based treatment for T1D.

Asia-Pacific is the global diabetes therapeutics market is expected to grow with 21.06 Billion in 2024

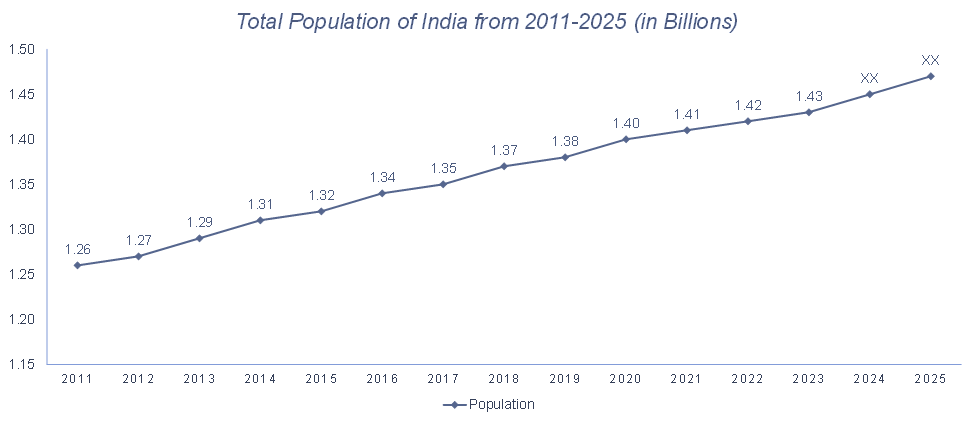

The Asia-Pacific region is experiencing the fastest growth in diabetes therapeutics due to demographic, economic, and epidemiological factors. Rapid urbanization, changing dietary habits, and reduced physical activity have led to a rise in type 2 diabetes cases, especially in countries like India and China. Governments are prioritizing diabetes care through public health campaigns, screening programs, and subsidies.

Moreover, rising healthcare awareness, expanded access to medical services, and improvements in healthcare infrastructure support the adoption of modern therapeutics. Investment by pharmaceutical companies and the availability of cost-effective biosimilars and generics further enhance treatment accessibility and affordability. The region also benefits from a growing middle-class population and digital health innovations.

Global Diabetes Therapeutics Market – Major Players

The major players in the diabetes therapeutics market include Novo Nordisk, Eli Lilly and Company, Merck & Co., Inc. (MSD), Boehringer Ingelheim, Johnson & Johnson (via Janssen), Novartis AG, Biocon Limited, and Innogen Biopharmaceuticals, among others.

Global Diabetes Therapeutics Market – Key Developments

In June 2025, US pharmaceutical major Eli Lilly announced its blockbuster diabetes drug Mounjaro in KwikPen, a single-patient-use prefilled pen designed for once-weekly administration in the Indian market, offering a convenient treatment option for adults with type 2 diabetes.

Global Diabetes Therapeutics Market Report Highlights

Metrics | Details | |

CAGR | 15.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Type | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes |

Drug Class | Insulin, GLP‑1 Receptor Agonists , DPP‑4 Inhibitors, SGLT‑2 Inhibitors, Others | |

| Route of Administration | Injectable, Oral |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

DMI estimates that the worldwide diabetes therapeutics market is expanding rapidly due to an increasing number of type 2 diabetes patients, an aging population, and new treatment advancements. New medication types, such as GLP-1 and SGLT-2 inhibitors, as well as biosimilars, are transforming diabetes treatment. Companies should focus on developing medicines that aid in blood sugar control, weight loss, and heart health. Needle-free and cell-based medicines, such as Afrezza and Zimislecel, demonstrate that patients prefer more accessible and individualized therapy. While North America leads in terms of robust research and advanced healthcare systems, Asia-Pacific is expanding rapidly because to its vast population and inexpensive biosimilar choices. Smart insulin pens, continuous glucose monitoring, and smartphone applications are helping people better control their condition. To thrive, businesses must focus on merging medications with smart devices and collaborate closely with regulators and insurance companies to improve patient access and outcomes.

The global diabetes therapeutics market report delivers a detailed analysis with 86 key tables, more than 87 visually impactful figures, and 205 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here