Overview

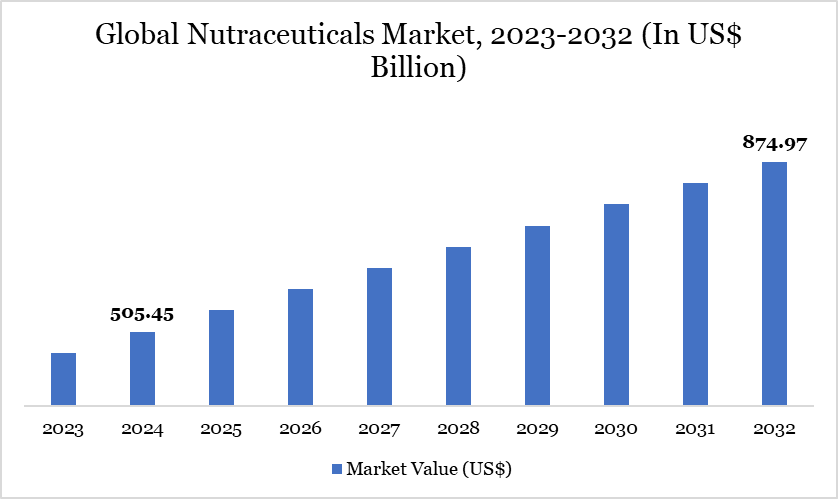

Global nutraceuticals market reached US$ 505.45 billion in 2024 and is expected to reach US$ 874.97 billion by 2032, growing with a CAGR of 7.10% during the forecast period 2025-2032.

Increasing consumer awareness about the benefits of a healthy lifestyle has led to greater demand for health supplements, particularly among aging populations who prioritize wellness. The rising incidence of lifestyle-related chronic diseases has also emphasized the need for preventive care through dietary choices. Additionally, the growth of e-commerce has made nutraceuticals more accessible to consumers, facilitating their purchase.

The market is poised for further expansion, with trends such as personalized nutrition based on individual genetic and lifestyle factors, a heightened focus on sustainability and ongoing innovation in product development. For instance, in July 2024, Renewtra launched as a new brand in India’s nutraceutical industry, aiming to revolutionize the market with its clinically proven, transparent-label products.

Nutraceuticals Market Trend

Personalized nutrition is rapidly emerging as a transformative trend in the nutraceuticals market, driven by advancements in technology, increasing health awareness, and consumer demand for individualized wellness solutions. Nutraceutical companies are increasingly incorporating personalized nutrition into their offerings.

In October 2025, Oriflame Spain launched a new personalized nutrition supplement solution under its Wellosophy brand, becoming the first Oriflame market to offer tailored dietary support. Building on the success of its popular Wellness Pack for men and women, the new offering provides bespoke supplement plans based on individual nutritional needs. This initiative aims to enhance customer health and engagement through a more customized approach to wellness.

Market Scope

Metrics | Details |

By Product | Functional Food, Functional Beverages, Dietary Supplements, Others |

By Ingredient | Herbals, Proteins & Peptides, Vitamins & Minerals, Prebiotics and Probiotics, Others |

By Form | Capsules & Tablets, Powder, Liquid, Others |

By Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Drug Stores/Pharmacies, E-Commerce, Other |

By Application | Digestive health, Immune Health, Sports Nutrition, Heart Health, Bone & Joint Health, Cognitive Health & Mental Wellness, Weight Management, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Rise of Chronic Diseases

The frightening rise in obesity, diabetes and cardiovascular diseases (CVDs) is significantly driving the global nutraceutical market. With over 1 billion people affected by obesity and 537 million adults living with diabetes, the urgency for effective management solutions has never been clearer. Consumers are increasingly seeking nutraceutical products derived from food sources with health benefits that can help prevent or manage these chronic conditions.

The shift towards preventive health measures reflects a growing awareness of the critical link between diet and disease, prompting individuals to explore natural options that enhance well-being. Moreover, the rising health consciousness among consumers, fueled by concerns over chronic disease prevalence, is propelling the nutraceutical market forward.

Innovative Regulatory Approvals And Enhanced Formulations

The global nutraceutical market is driven by innovative regulatory approvals and enhanced formulations. In November 2022, Geno's launch of Avela natural (R)-1,3-Butanediol provides a sugar-free ingredient that elevates beta-hydroxybutyrate levels, enhancing mental clarity and athletic performance without requiring restrictive diets. Derived from plant sugars through sustainable fermentation, Avela aligns with the increasing consumer demand for natural products.

Additionally, regulatory approvals, such as the European Commission’s endorsement of Carbopol Polymers in October 2023, enable the creation of innovative, easier-to-swallow formulations. Together, these advancements cater to diverse consumer needs and preferences, driving the evolution of functional foods and positioning the nutraceutical market for sustained growth.

Diverse Regulatory Frameworks

The global nutraceuticals market faces significant restraints due to diverse regulatory frameworks. Each country has its classification criteria, considering different product perceptions from one region to another. This inconsistency complicates compliance, forcing companies to allocate time and resources to navigate various regulations. Additionally, strict marketing guidelines in some areas limit the health claims that can be made, hindering companies' ability to attract consumers.

Segment Analysis

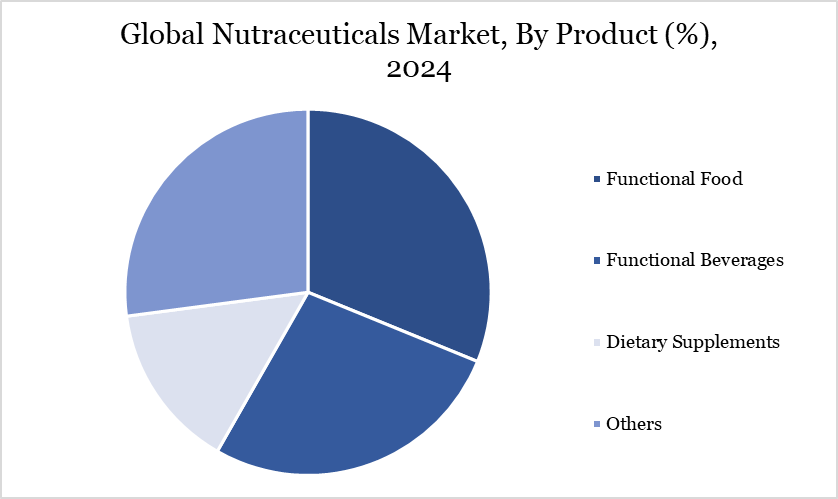

Functional Food Commands a Significant Share in the Global Nutraceutical Market as Companies Innovate with Health-Focused, Clean-Label Offerings

Functional food holds a significant share in the global nutraceutical market due to rising consumer demand for health-enhancing products that go beyond basic nutrition. With growing awareness around preventive healthcare, consumers are increasingly turning to foods fortified with vitamins, minerals, probiotics, and other bioactive compounds. This shift is especially strong among aging populations and health-conscious millennials. Companies are responding by expanding their functional food portfolios, introducing innovations such as plant-based protein snacks, fortified cereals, and probiotic dairy products. Major food and beverage firms are investing in R&D and acquiring niche health brands to stay competitive.

In May 2023, Kirin Holdings and Kellogg Japan collaborated to launch All-Bran Immune Care, a new functional food product aimed at supporting immune system health. This marks a strategic expansion of Kellogg’s All-Bran portfolio, tapping into the growing demand for immune-boosting and gut-health-focused products. The product carries a double health claim, combining L. lactis strain Plasma, a postbiotic known for supporting immune function, with fermented dietary fibre arabinoxylan derived from wheat bran, which promotes intestinal health and regularity.

Geographical Penetration

Rising Health Consciousness Among North American Population

North America dominates the global nutraceuticals market. A high level of consumer awareness regarding wellness strongly supports North America's leadership in the worldwide market. The 2023 CRN Consumer Survey on Dietary Supplements reveals that 74% of US adults take dietary supplements, with 55% classified as regular users. This significant adoption enhances the vital role that supplements play in the daily health routines of Americans.

The widespread usage reflects a robust commitment to preventive health measures and a growing recognition of the benefits of nutraceuticals, driver market dominance, bolstered by effective education initiatives, a diverse range of product offerings health and a supportive regulatory environment. As reliance on dietary supplements continues to rise, it aligns with the broader movement towards holistic health, further solidifying their essential place in everyday life.

AI Impact Analysis

AI is profoundly transforming the nutraceutical market by enabling advanced data analytics for personalized nutrition and targeted supplement formulation. Machine learning models help identify emerging health trends and consumer preferences, accelerating product development cycles. AI-driven automation enhances manufacturing efficiency, ensuring higher quality and consistency in nutraceutical products. Predictive analytics optimize supply chain management, reducing waste and improving delivery times. Natural language processing supports improved customer engagement through chatbots and tailored marketing.

Additionally, AI-driven personalized nutrition is gaining momentum by enabling consumers to receive customized dietary recommendations based on genetic, lifestyle, and health data. In February 2025, Nutrify Today, a leader in AI-powered nutraceutical innovation, launched Dealsphere — a transformative platform aimed at revolutionizing the discovery, licensing, and commercialization of science-backed nutrition products.

Competitive Landscape

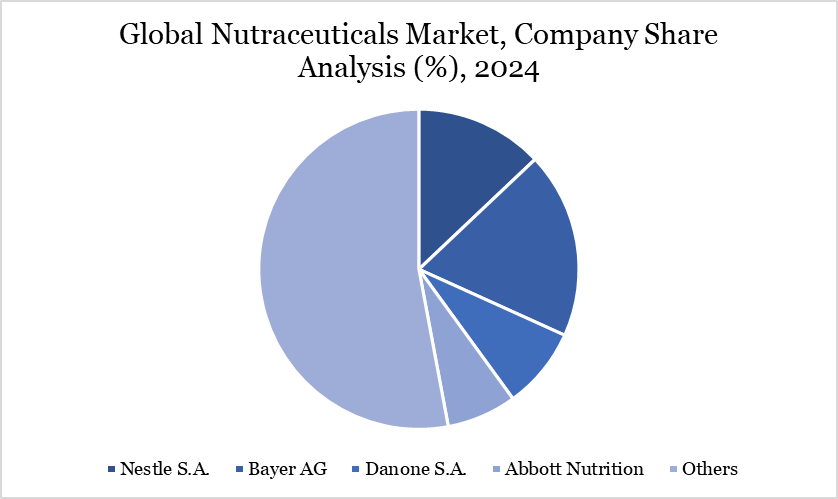

The major global players in the market include Danone S.A., Glanbia plc, Nestle S.A., Bayer AG, Abbott Nutrition, GNC Holdings, LLC, Garden of Life, NOW Foods, Kellanova and Parry Nutraceuticals Limited.

Key Developments

In September 2024, Floré launched a probiotic line for neurodiversity, including pathways support and mood support, formulated for individuals with autism spectrum disorder (ASD). Developed in collaboration with Arizona State University, these products were based on a clinical study that showed significant improvements in gastrointestinal discomfort and cognitive abilities among ASD participants after three months of treatment.

In June 2024, Steadfast Nutrition launched three new supplements: Whey Protein, LIV Raw and a vegetarian Multivitamin mega pack with 180 tablets. These products cater to the protein and nutrient needs of health-conscious individuals and athletes. The launch took place at the International Health Sports and Fitness Festival (IHFF), Asia’s largest health and fitness event.

In June 2024, RSSL introduced a new dietary supplement testing service to support clients in R&D, manufacturing and supply chain functions. This service ensures reliable turnaround and quality results, offering analyses such as nutrition testing, novel ingredient evaluation and regulatory support to meet clients' needs efficiently.

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies