US CAR-T Cell Therapy Market Size & Industry Outlook

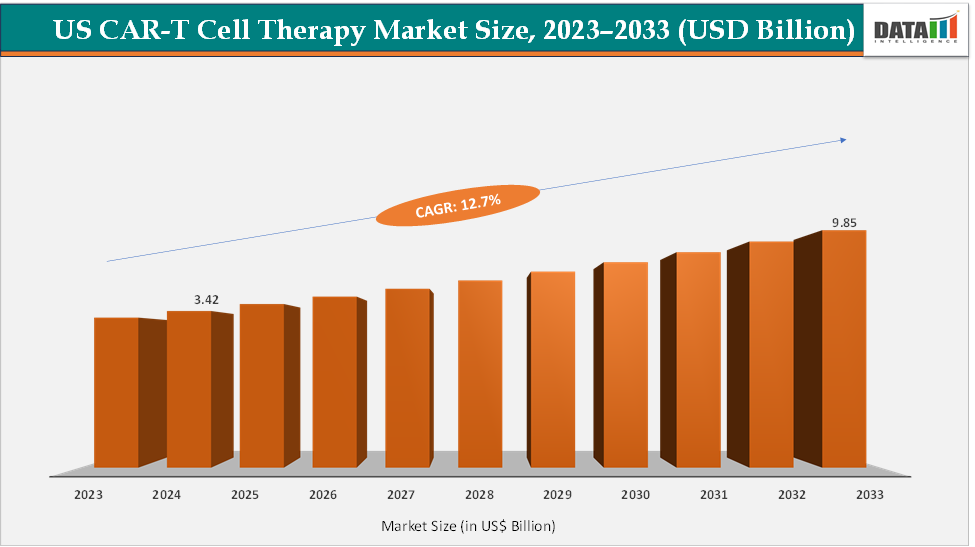

The US CAR-T cell therapy market size reached US$ 3.42 billion in 2024 from US$ 3.07 billion in 2023 and is expected to reach US$ 9.85 billion by 2033, growing at a CAGR of 12.7% during the forecast period 2025-2033. According to the National Institutes of Health, as of December 2024, the US Food and Drug Administration (FDA) approved six CAR T-cell therapies, with ten CAR T-cell therapies commercially available globally, which target the CD19 and B-cell maturation antigen (BCMA) molecules and with approved indications that include B-cell acute lymphoblastic leukemia (ALL), large B-cell lymphoma (LBCL), follicular lymphoma, mantle cell lymphoma, chronic lymphocytic leukemia (CLL), and multiple myeloma.

This growing number of FDA-approved CAR-T cell therapies in the US, targeting key antigens like CD19 and BCMA, is a major driver of market expansion. These approvals validate the clinical efficacy of CAR-T treatments and broaden their use across multiple hematologic cancers such as ALL, LBCL, CLL, and multiple myeloma.

Tisagenlecleucel (Kymriah), axicabtagene ciloleucel (Yescarta), brexucabtagene autoleucel (Tecartus), and lisocabtagene maraleucel (Breyanzi) are cellular drugs, engineered to recognize the B-cell antigen, CD19, and they treat specific B-cell non-Hodgkin lymphomas, B-cell acute lymphoblastic leukemia (ALL), and chronic lymphocytic leukemia (CLL). Idecabtagene violence (Abecma) and ciltacabtagene autoleucel (cita-cel or Carvykti) target the plasma cell-associated protein B-cell maturation antigen (BCMA) and are used to treat multiple myeloma. Tisagenlecleucel (Kymriah), the first commercially available cellular immunotherapy, was FDA-approved in 2017 for children and young adults 25 years and younger with B-cell ALL. This regulatory momentum not only strengthens investor confidence but also accelerates research, manufacturing scale-up, and adoption in advanced cancer care.

Key Market Highlights

- Based on target antigen, the CD19 segment led the market with the largest revenue share of 61.87% in 2024.

- The major market players in the US CAR-T cell therapy market are Novartis AG, Gilead Sciences, Inc., Bristol Myers Squibb company, Johnson & Johnson, and Autolus, Inc., among others

Market Dynamics

Drivers: Expansion of FDA approvals and indications is significantly driving the US CAR-T cell therapy market growth

The steady expansion of FDA approvals and indications has been a primary engine of US CAR-T market growth because each new approval both validates the technology clinically and meaningfully enlarges the addressable patient pool. Early landmark approvals such as Kymriah (tisagenlecleucel) for pediatric/young-adult B-cell ALL in August 2017, and Yescarta (axicabtagene ciloleucel) for relapsed/refractory large B-cell lymphoma in October 2017, proved CAR-T’s clinical utility and paved the way for broader reimbursement and center certification.

Continuous FDA support, along with recent FDA approvals is further accelerating the market growth by offering various products into the market for various indications with proven clinical trials. For instance, in December 2024, the U.S. Food and Drug Administration (FDA) approved obecabtagene autoleucel (Aucatzyl) for the treatment of relapsed/refractory acute lymphocytic leukemia (ALL).

Similarly, in March 2024, Bristol Myers Squibb announced the U.S. Food and Drug Administration (FDA) granted accelerated approval of Breyanzi (lisocabtagene maraleucel; liso-cel), a CD19-directed chimeric antigen receptor (CAR) T cell therapy, for the treatment of adult patients with relapsed or refractory chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL) who have received at least two prior lines of therapy, including a Bruton tyrosine kinase (BTK) inhibitor and a B-cell lymphoma 2 (BCL-2) inhibitor.

Restraints: High cost of therapy and limited reimbursement coverage are hampering the growth of the market

The high cost of CAR-T cell therapies and limited reimbursement coverage remain major obstacles to the widespread growth of the U.S. market. Currently, FDA-approved CD19-targeted therapies such as Kymriah (Novartis) and Yescarta (Gilead/Kite) are priced around $373,000–$475,000 per infusion, while BCMA-targeted options like Abecma and Carvykti for multiple myeloma exceed $450,000–$465,000 per treatment, excluding additional hospitalization and management costs, which can raise total expenses to over $1 million per patient.

These high upfront costs strain healthcare budgets and restrict access, especially outside major cancer centers. Furthermore, reimbursement complexities with differing coverage policies among Medicare, Medicaid, and private insurers often delay or deny patient access. Although outcome-based payment models are emerging, the lack of standardized reimbursement frameworks limits patient volume and slows adoption. Consequently, despite CAR-T’s transformative efficacy, the economic burden continues to act as a significant restraint on market expansion and equitable access in the U.S.

For more details on this report, see Request for Sample

CAR-T Cell Therapy Market, Segmentation Analysis

The US CAR-T cell therapy market is segmented based on therapy type, target antigen, and application.

Target Antigen: The CD19 segment is dominating and the fastest-growing in the US CAR-T cell therapy market, with a 61.87% share in 2024

The CD19 segment holds a dominant position in the U.S. CAR-T cell therapy market due to its early commercialization, broad therapeutic reach, and continued expansion across multiple hematologic malignancies. CD19, a protein expressed on the surface of most B-cell malignancies, became the first and most extensively validated target in CAR-T therapy. The US FDA’s first-ever CAR-T approval, Kymriah (tisagenlecleucel) by Novartis in August 2017, targeted CD19 for pediatric and young adult patients with relapsed or refractory B-cell acute lymphoblastic leukemia (ALL), establishing the foundation for the entire CAR-T industry.

Shortly after, Yescarta (axicabtagene ciloleucel) from Kite Pharma/Gilead was approved in October 2017 for relapsed or refractory large B-cell lymphoma (LBCL), marking the entry of CD19 CAR-T into adult lymphoma treatment. These pioneering therapies not only demonstrated unprecedented response rates in heavily pretreated patients but also catalyzed massive clinical and commercial investments in CAR-T development.

Over time, additional CD19-targeted therapies reinforced this dominance. For instance, in November 2024, the U.S. Food and Drug Administration (FDA) approved obecabtagene autoleucel (Aucatzyl), a CD19-directed CAR T-cell immunotherapy developed by Autolus Inc., for adults with relapsed or refractory B-cell precursor acute lymphoblastic leukemia (ALL).

Competitive Landscape

Top companies in the CAR-T cell therapy market include Novartis AG, Gilead Sciences, Inc., Bristol Myers Squibb company, Johnson & Johnson, and Autolus, Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 12.7% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Therapy Type | Allogeneic CAR-T Cell Therapy and Autologous CAR-T Cell Therapy |

| Target Antigen | CD19, BCMA (B-cell maturation antigen), CD20, CD22, CD30, CD33, and Others | |

| Application | Acute Lymphoblastic Leukemia (ALL), Non-Hodgkin Lymphoma, Chronic Lymphocytic Leukemia (CLL), Multiple Myeloma (MM), Follicular Lymphoma, and Others | |

The US CAR-T cell therapy market report delivers a detailed analysis with 24 key tables, more than 27 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here