US Biosimilars Market Size

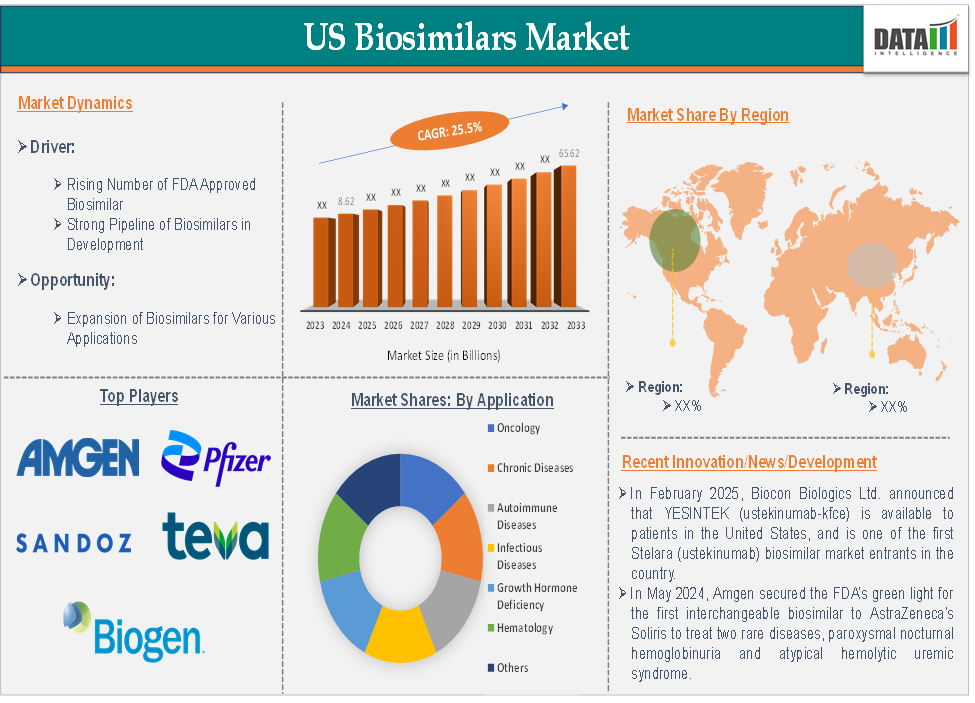

The US biosimilars market size reached US$ 8.62 billion in 2024 and is expected to reach US$ 65.62 billion by 2033, growing at a CAGR of 25.5% during the forecast period 2025-2033.

Biosimilars are biologic medical products that are highly similar to an already approved reference biologic, meaning they have the same mechanism of action, route of administration, dosage form and strength, but they may differ slightly in terms of structural components due to the complex nature of biologics. These products are designed to be as effective as their reference products but are typically offered at a lower cost, providing greater accessibility to patients.

Executive Summary

For more details on this report – Request for Sample

Market Dynamics: Drivers & Restraints

The rising number FDA approved biosimilars significantly driving the US biosimilars market growth

The FDA's regulatory framework for biosimilars, especially the Biologics Price Competition and Innovation Act (BPCIA) of 2009, created a clear pathway for the approval of biosimilars. This has encouraged manufacturers to invest in the development of biosimilars, leading to a rising number of FDA-approved products in the U.S. The FDA's approval of more biosimilars is giving patients more treatment choices while simultaneously driving down costs. For instance, there have been 71 biosimilars approved by the U.S. Food and Drug Administration (FDA). The most recent biosimilar approval was Omlyclo (omalizumab-igec) on March 7, 2025.

List of recently FDA approved biosimilar products:

| Biosimilar Name | Approval Date | Reference Product |

| Omlyclo (omalizumab-igec) | March 2025 | Xolair (omalizumab) |

| Osenvelt (denosumab-bmwo) | February 2025 | Prolia (denosumab) |

| Stoboclo (denosumab-bmwo) | February 2025 | Prolia (denosumab) |

| Merilog (insulin aspart-szjj) | February 2025 | Novolog (insulin aspart) |

| Ospomyvtm and Xbryktm (denosumab-dssb) | February 2025 | Prolia and Xgeva (denosumab) |

| Avtozma (tocilizumab-anoh) | January 2025 | Actemra (tocilizumab) |

| Steqeyma (Ustekinumab-stba) | December 2024 | Stelara (ustekinumab) |

| Yesintek (ustekinumab-kfce) | November 2024 | Stelara (ustekinumab) |

| Imuldosa (ustekinumab-srlf) | October 2024 | Stelara (ustekinumab) |

| Otulfi (ustekinumab-aauz) | September 2024 | Stelara (ustekinumab) |

| Pavblu (aflibercept-ayyh) | August 2024 | Eylea (aflibercept) |

| Enzeevu (aflibercept-abzv) | August 2024 | Eylea (aflibercept) |

| Epysqli (eculizumab-aagh) | July 2024 | Soliris (eculizumab) |

| Ahzantive (aflibercept-mrbb) | June 2024 | Eylea (aflibercept) |

| Nypozi (filgrastim-txid) | June 2024 | Neupogen (filgrastim) |

| Pyzchiva (ustekinumab-ttwe) | June 2024 | Stelara (ustekinumab) |

With increased competition, more treatment options across various therapeutic areas and the ability to offer affordable alternatives to costly reference biologics, biosimilars are gaining acceptance among both patients and healthcare providers. As more biosimilars are approved, the market is expected to continue expanding, ultimately reducing healthcare costs and providing patients with better access to life-saving biologic therapies.

Lack of physician and patient awareness hampering the US market growth

Despite growing evidence supporting the safety and efficacy of biosimilars, physician and patient awareness remains a significant barrier. Some physicians are hesitant to prescribe biosimilars due to concerns over clinical efficacy, immunogenicity and the potential for patient safety issues.

Additionally, patients often prefer to stay on the reference biologic because of brand loyalty or because they perceive it as a safer and more established treatment option. For instance, biosimilars for cancer treatments like trastuzumab or rituximab face challenges in being adopted by oncologists who may prefer the reference drugs due to their established track record.

Market Segment Analysis

The US biosimilars market is segmented based on product type and application.

Application:

The oncology segment is expected to dominate the US biosimilars market with the highest market share

The U.S. FDA has approved a growing number of oncology biosimilars, which has significantly expanded the availability of these cost-saving treatments in the cancer care market. These biosimilars provide options for patients with cancers such as breast cancer, lung cancer, colorectal cancer and lymphoma. For instance, in September 2024, Accord BioPharma, Inc. announced that the U.S. Food and Drug Administration (FDA) approved a 420mg strength of HERCESSI (trastuzumab-strf), a biosimilar to Herceptin® (trastuzumab), to treat HER2-overexpressing breast and gastric or gastroesophageal junction adenocarcinoma.

List of biosimilars approved by US Food and Drug Administration for cancer treatment:

| Biologic Medicine | Biosimilars |

| bevacizumab (Avastin) |

|

| rituximab (Rituxan) |

|

| trastuzumab (Herceptin) |

|

| filgrastim (Neupogen) |

|

| pegfilgrastim (Neulasta) |

|

| epoetin alfa (Epogen or Procrit) |

|

| denosumab (Xgeva) |

|

US Biosimilar Companies

Top U.S. biosimilar companies includes Amgen Inc., Pfizer Inc., Sandoz Group AG, Teva Pharmaceuticals USA, Inc., Biogen, Biocon Biologics Inc., Boehringer Ingelheim International GmbH, Samsung Biologics, Dr. Reddy’s Laboratories Ltd., Fresenius Kabi USA, LLC and among others.

Market Scope

| Metrics | Details | |

| CAGR | 25.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Monoclonal Antibodies, Recombinant Human Growth Hormone (rhGH), Insulin, Anti-coagulants, Erythropoietin, Granulocyte Colony Stimulating Factor, Follitropin, Interferons and Others |

| Application | Oncology, Chronic Diseases, Autoimmune Diseases, Infectious Diseases, Growth Hormone Deficiency, Hematology and Others | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The US biosimilars market report delivers a detailed analysis with 36 key tables, more than 31 visually impactful figures and 198 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.