Biosimilars and Biologics Market Size

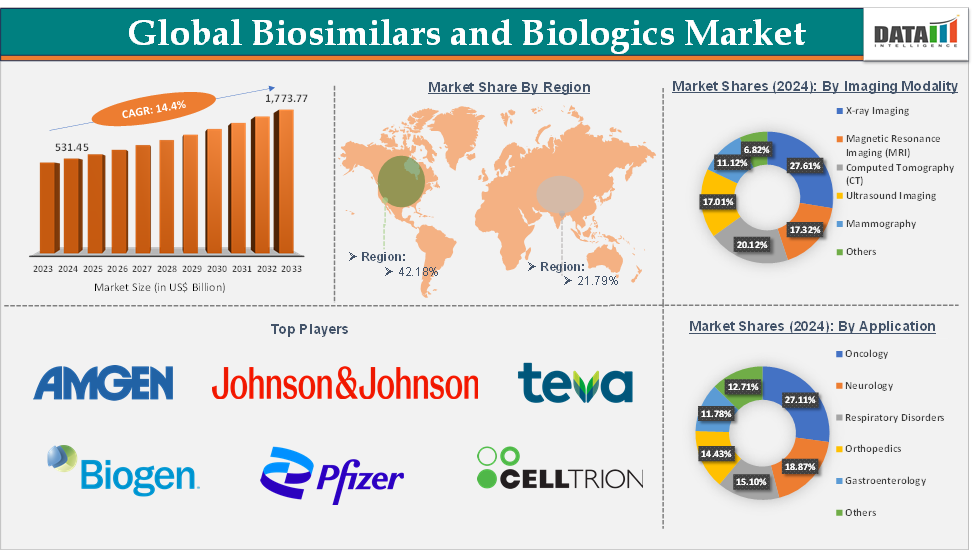

Biosimilars and Biologics Market size reached US$ 531.45 Billion in 2024 and is expected to reach US$ 1,773.77 Billion by 2033, growing at a CAGR of 14.4% during the forecast period 2025-2033.

The global demand for biosimilars and biologics is robust. It continues to grow, driven by the increasing prevalence of chronic diseases, aging populations, technological advancements, and efforts to make healthcare more affordable. For instance, by the end of 2024, the FDA approved a total of 71 biosimilars, including six follow-on biologicals that did not undergo the BLA 351K process for use in the US. These novel product launches are boosting the market growth by offering a huge number of biosimilars.

List of recently FDA-approved biosimilar products:

| Biosimilar Name | Approval Date | Reference Product |

| Jobevne (bevacizumab-nwgd) | April 2025 | Avastin (bevacizumab) |

| Omlyclo (omalizumab-igec) | March 2025 | Xolair (omalizumab) |

| Osenvelt (denosumab-bmwo) | February 2025 | Prolia (denosumab) |

| Stoboclo (denosumab-bmwo) | February 2025 | Prolia (denosumab) |

| Merilog (insulin aspart-szjj) | February 2025 | Novolog (insulin aspart) |

| Ospomyvtm and Xbryktm (denosumab-dssb) | February 2025 | Prolia and Xgeva (denosumab) |

| Avtozma (tocilizumab-anoh) | January 2025 | Actemra (tocilizumab) |

| Steqeyma (Ustekinumab-stba) | December 2024 | Stelara (ustekinumab) |

| Yesintek (ustekinumab-kfce) | November 2024 | Stelara (ustekinumab) |

| Imuldosa (ustekinumab-srlf) | October 2024 | Stelara (ustekinumab) |

| Otulfi (ustekinumab-aauz) | September 2024 | Stelara (ustekinumab) |

| Pavblu (aflibercept-ayyh) | August 2024 | Eylea (aflibercept) |

| Enzeevu (aflibercept-abzv) | August 2024 | Eylea (aflibercept) |

| Epysqli (eculizumab-aagh) | July 2024 | Soliris (eculizumab) |

| Ahzantive (aflibercept-mrbb) | June 2024 | Eylea (aflibercept) |

| Nypozi (filgrastim-txid) | June 2024 | Neupogen (filgrastim) |

| Pyzchiva (ustekinumab-ttwe) | June 2024 | Stelara (ustekinumab) |

Executive Summary

For more details on this report – Request for Sample

Biosimilars and Biologics Market Dynamics: Drivers & Restraints

Rising aging populations and chronic disease burden are significantly driving the biosimilars and biologics market growth

As populations age, the prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders increases. These conditions often require long-term, specialized treatments, and biosimilars and biologics offer targeted and effective therapies for many of these diseases. The high efficacy of biologics and biosimilars in treating complex chronic conditions creates strong demand as the global elderly population grows.

For instance, according to the World Health Organization, by 2030, 1 in 6 people in the world will be aged 60 years or over. At this time, the share of the population aged 60 years and over will increase from 1 billion in 2020 to 1.4 billion. By 2050, the world’s population of people aged 60 years and older will double (2.1 billion). The number of persons aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million. This aging population drives up the demand for biologics as a primary treatment option, expanding the market size. At the same time, this demographic’s high treatment needs exert financial pressure on healthcare systems, leading to an increased emphasis on cost-saving alternatives, such as biosimilars, once the original biologics’ patents expire.

Regulatory challenges are hampering the market growth

Regulatory challenges pose significant barriers to the growth of the biosimilars and biologics markets. These challenges stem from complex approval processes, differing regulations across regions, and stringent requirements that can delay market entry and increase costs. Unlike generics, biosimilars are required to undergo rigorous clinical testing to demonstrate safety, efficacy, and biosimilarity to their reference biologics.

Regulatory bodies like the FDA and EMA demand comprehensive evidence, including analytical, animal, and clinical data, to ensure biosimilars are comparable to original biologics. This approval process can be lengthy and costly, often requiring several years to complete.

In the United States, the FDA’s Biologics Price Competition and Innovation Act (BPCIA) provides a pathway for biosimilar approval, but the process remains time-consuming and expensive. For instance, Sandoz’s Zarxio (filgrastim-sndz) took about four years from initial development to FDA approval as the first U.S.-approved biosimilar. These extended timelines can delay market entry, limit the availability of biosimilars, and discourage investment in biosimilar development due to high upfront costs.

Biosimilars and Biologics Market, Segment Analysis

The global biosimilars and biologics market is segmented based on type, application, and region.

Application:

The oncology segment is expected to hold 31.27% of the market share in 2024 in the biosimilars and biologics market

Biosimilars in oncology have gained acceptance because they undergo rigorous clinical trials to demonstrate equivalence to their reference biologics. Over time, physicians and patients have become more comfortable with biosimilars in oncology due to clinical evidence and supportive real-world data. Their integration into oncology treatment regimens has helped build confidence in their use, which, in turn, supports further growth.

Cancer biologics are often prohibitively expensive, posing a financial challenge for healthcare systems and patients. Biosimilars offer similar efficacy and safety at a fraction of the cost, allowing for more sustainable oncology care and expanding access to advanced cancer treatments. For instance, in July 2024, Zydus Lifesciences Ltd cleared that the Mexican regulatory authority has granted marketing approval for Mamitra, a Trastuzumab biosimilar used to treat various types of cancer.

List of biosimilars approved for cancer treatment:

| Biologic Medicine | Biosimilars |

| bevacizumab (Avastin) |

|

| rituximab (Rituxan) |

|

| trastuzumab (Herceptin) |

|

| filgrastim (Neupogen) |

|

| pegfilgrastim (Neulasta) |

|

| epoetin alfa (Epogen or Procrit) |

|

| denosumab (Xgeva) |

|

Biosimilars and Biologics Market Geographical Analysis

North America is expected to dominate the global biosimilars and biologics market with a 42.18% share in 2024

North America, especially the United States and Canada, has huge aging populations, leading to a higher prevalence of diseases such as cancer, cardiovascular conditions, and autoimmune diseases, all of which require biologics and biosimilars. This drives both the demand for biologics and the need for affordable alternatives like biosimilars.

For instance, according to the Population Reference Bureau, the number of Americans ages 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050 (a 47% increase). Additionally, according to the CDC, an estimated 129 million people in the US have at least 1 major chronic disease. The National Health Council indicates that autoimmune diseases affect approximately 50 million Americans. The increasing availability of biosimilars for various chronic diseases expands patient access and improves treatment outcomes, further driving the market growth in the region.

The U.S. Food and Drug Administration (FDA) has established a clear and streamlined regulatory pathway for the approval of biosimilars. This includes the Biologics Price Competition and Innovation Act (BPCIA), which facilitates the approval of biosimilars and helps shorten the timeline for market entry. For instance, in April 2025, Biocon Biologics Ltd announced that the U.S. Food and Drug Administration (U.S. FDA) approved Jobevne (bevacizumab-nwgd), a biosimilar of Bevacizumab for intravenous use. JOBEVNE, a recombinant humanized monoclonal antibody used to treat several different types of cancer, is a biosimilar to the reference product Avastin (bevacizumab). These FDA approvals are accelerating the North America market growth.

Biosimilars and Biologics Market Competitive Landscape

Top companies in the biosimilars and biologics market include Amgen Inc., Johnson & Johnson, Biogen Inc., Teva Pharmaceutical Industries Limited, Biocon Biologics Inc., Pfizer Inc., Celltrion, Inc., Samsung Bioepis, AbbVie Inc., Boehringer Ingelheim International GmbH, and among others. The emerging players in the market include Eli Lilly and Company, Sanofi S.A., Fresenius Kabi AG, Coherus BioSciences Inc., Alvotech S.A., Polpharma Biologics S.A., Formycon AG, and Hexal AG, among others.

Industry Trends

- In March 2025, Fresenius announced that the Biologics License Application (BLA) for the denosumab biosimilars Conexxence (denosumab-bnht) and Bomyntra (denosumab-bnht) of its operating company, Fresenius Kabi, had been approved by the U.S. Food and Drug Administration (FDA). These denosumab biosimilars are approved for all indications of the reference products: Prolia (denosumab) and Xgeva (denosumab), respectively.

- In March 2025, Celltrion announced the U.S. Food and Drug Administration (FDA) approved OMLYCLO (omalizumab-igec) as the first and only biosimilar designated as interchangeable with XOLAIR (omalizumab) for the treatment of moderate to severe persistent asthma, chronic rhinosinusitis with nasal polyps (CRSwNP), Immunoglobulin E (IgE)-mediated food allergy, and chronic spontaneous urticaria (CSU).

- In March 2025, Celltrion announced that the U.S. Food and Drug Administration (FDA) approved STOBOCLO (CT-P41, denosumab-bmwo) and OSENVELT (CT-P41, denosumab-bmwo), biosimilars referencing PROLIA (denosumab) and XGEVA (denosumab), respectively, for all indications of reference products.

- In February 2025, Samsung Bioepis Co., Ltd. announced that the U.S. Food and Drug Administration (FDA) approved the Biologics License Application (BLA) for OSPOMYV (denosumab-dssb; SB16; 60 mg pre-filled syringe) and XBRYK (denosumab-dssb; SB16; 120 mg vial), biosimilars referencing Prolia and Xgeva, respectively.

Market Scope

| Metrics | Details | |

| CAGR | 14.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Biologics And Biosimilars |

| Application | Oncology, Autoimmune Diseases, Chronic Diseases, Infectious Diseases, Neurology, Ophthalmology, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global biosimilars and biologics market report delivers a detailed analysis with 54 key tables, more than 45 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.