Global Unmanned Aerial Vehicle Market: Industry Outlook

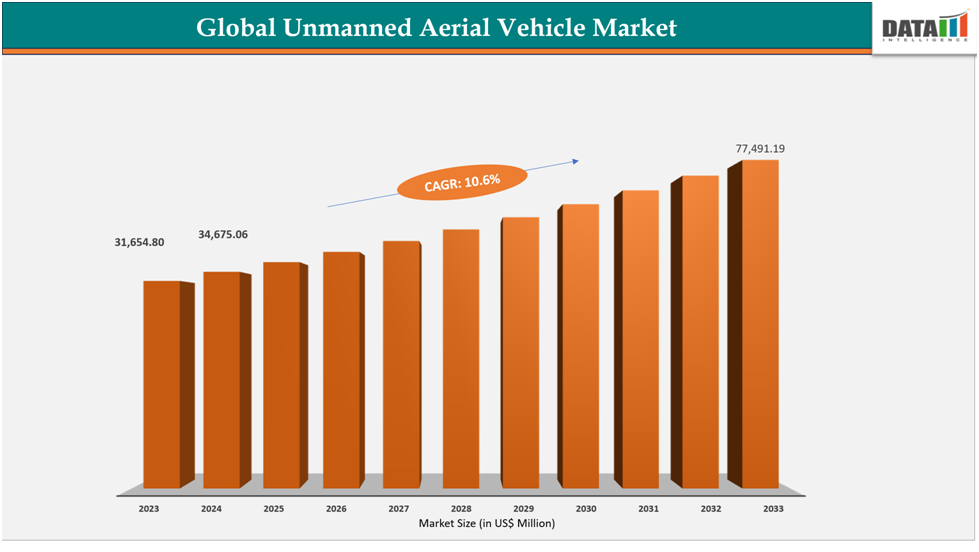

The global unmanned aerial Vehicle Market reached US$31,654.80 million in 2023, with a rise to US$34,675.06million in 2024, and is expected to reach US$77,491.19 million by 2033, growing at a CAGR of 10.69% during the forecast period 2025–2033.

This growth is being driven by increasing applications in defense, surveillance, logistics, and agriculture, as UAVs provide cost-effective, efficient, and versatile solutions compared to traditional methods. The rapid adoption of drones for both commercial and military purposes highlights their growing importance in modern technology ecosystems.

According to the Federal Aviation Administration (FAA), the US has 872,248 registered UAVs, with 338,614 used commercially, signaling a major shift from military applications to commercial services such as delivery, crop monitoring, and infrastructure inspection. This highlights how drones are becoming vital tools in everyday economic activities.

Similarly, in India, the Directorate General of Civil Aviation (DGCA) reported 29,501 registered drones as of January 29, with the national capital leading at 4,882 registrations, followed by Tamil Nadu and Maharashtra. These figures showcase how emerging economies are also accelerating drone adoption, supported by favorable regulations and government initiatives. With such global momentum, the UAV market is growing proving its crucial role in transforming industries worldwide.

Key Market Trends & Insights

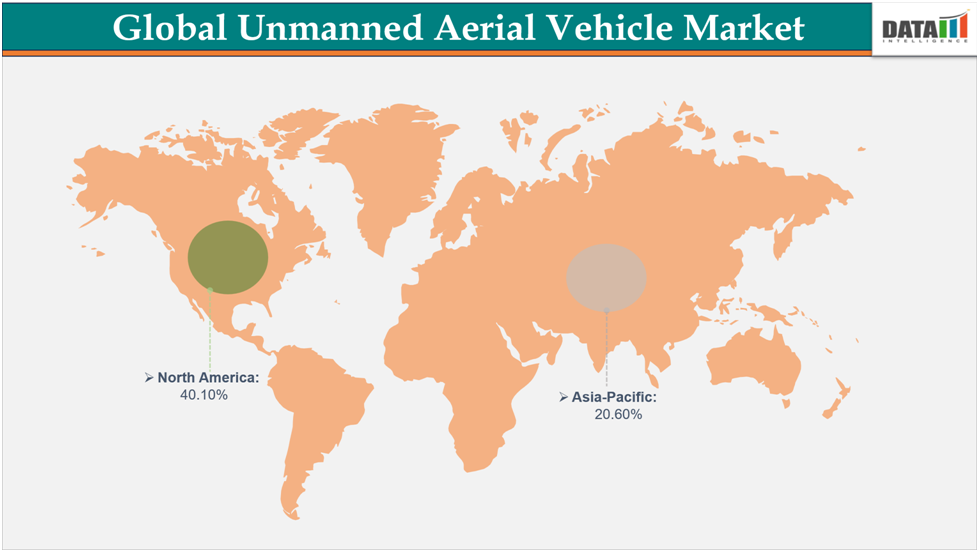

North America currently dominates the global UAV market, holding about 40.10% share. This leadership is driven by strong defense investments, rapid adoption of drones in commercial sectors like logistics and agriculture, and supportive regulatory frameworks.

Asia-Pacific is recognized as the fastest-growing region in the global UAV market, supported by high CAGRs. The growth is fueled by rising defense budgets, increasing adoption in agriculture and logistics, and government initiatives promoting drone technology across countries like China, India, and Japan.

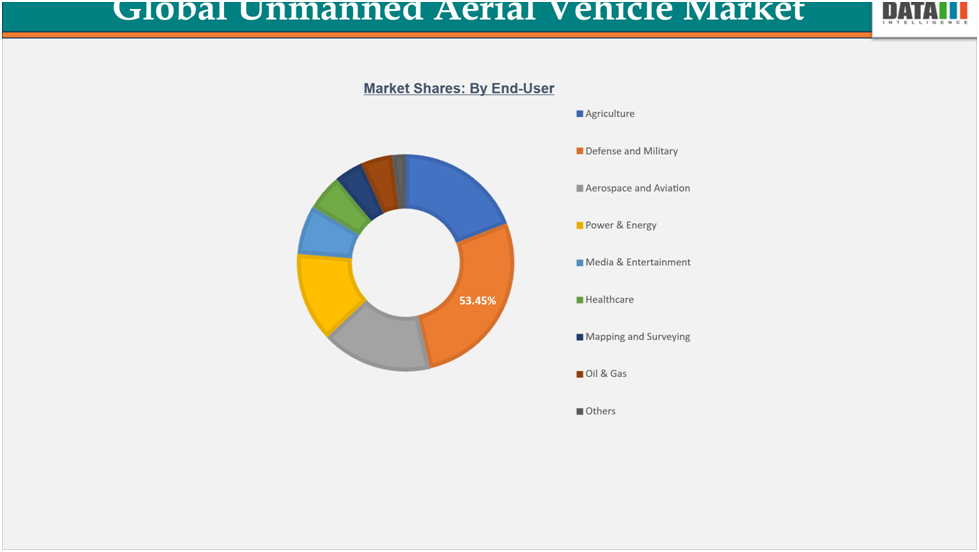

The Defense and Military segment remains the largest contributor to the global UAV market, accounting for 53.45% of total revenue share. Its dominance is driven by widespread use in surveillance, reconnaissance, combat operations, and border security across major economies.

Market Size & Forecast

2024 Market Size: US$34,675.06Million

2033 Projected Market Size: US$77,491.19Million

CAGR (2025–2033): 10.6%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Drivers & Restraints

Driver: Rising Defense & Military Applications

The defense and military sector remains the primary growth engine for the global UAV market, driven by the increasing need for surveillance, reconnaissance, intelligence gathering, and combat operations. In February 2025, the US Department of Defense announced it is redirecting approximately US$50 billion from legacy programs to new priorities, including drones and counter-drone systems. This move highlights the strategic importance of UAVs in future conflicts alongside missiles, missile defenses, and secure communications.

Investment and funding trends further underscore this growth. In March 2025, the US Army requested over US$500 million for counter-UAS programs in its 2025 budget, supporting systems like LIDS (Low, Slow, Small UAS Integrated Defeat System) and directed energy weapons. Globally, France allocated €500 million (US$ 584.26 million) in its 2024 military budget for drone development, focusing on low-cost UAVs, loitering munitions, and next-generation autonomous systems for surveillance, early warning, and potential strike capabilities. These initiatives demonstrate strong government support and strategic prioritization of UAVs in defense planning.

The rising emphasis on military UAVs has also attracted substantial investor interest, with defense-oriented drone technologies gaining momentum. This increased funding supports production expansion, research, and technological innovation in next-generation UAVs. With global military drone spending projected to grow significantly, these trends ensure that UAVs remain critical assets for modern warfare, driving demand, innovation, and sustained growth in the global market.

Restraint: Privacy and Security Concerns

Privacy and security concerns are major restraints for the unmanned aerial vehicle (UAV) market. The increasing use of drones for surveillance, data collection, and delivery raises fears about unauthorized monitoring and data breaches. Individuals and organizations worry that UAVs can capture sensitive information without consent, leading to potential misuse. This has prompted governments to impose strict regulations on drone operations, including flight zones, no-fly areas, and data handling protocols.

Additionally, UAVs are vulnerable to hacking, signal interference, and cyberattacks, which can compromise operational safety. Security threats include drones being used for smuggling, terrorism, or industrial espionage, further limiting their acceptance. Companies are often cautious about adopting UAV technology due to these risks, and stricter compliance requirements increase operational costs. Collectively, these privacy and security concerns slow down UAV deployment across commercial, industrial, and urban sectors.

For more details on this report - Request for Sample

Segmentation Analysis

The global unmanned aerial vehicle market is segmented based on type, range, operational mode, component, end-user, and region.

End-User: Defense and military use drives 53.45% of the UAV market through surveillance and precision strike roles.

Defense and military applications dominate the unmanned aerial vehicle (UAV) market due to their strategic role in modern warfare, providing advanced surveillance, reconnaissance, and precision strike capabilities. Governments worldwide are increasingly investing in UAVs to enhance operational efficiency while reducing risks to human personnel.

In July 2025, India’s Defense Ministry successfully conducted flight trials of the Unmanned Aerial Vehicle Launched Precision Guided Missile (ULPGM)-V3 at Kurnool, Andhra Pradesh. This enhanced version of the ULPGM-V2 features a high-definition dual-channel seeker, day-and-night operational capability, and a two-way data link, enabling precise performance in both plain and high-altitude areas. This boosts India’s ability to produce critical defense technologies, reflecting the increasing integration of UAVs into national defense strategies.

Similarly, in June 2025, US drone-maker Anduril partnered with German defence giant Rheinmetall to develop European variants of the Barracuda and Fury drones. This collaboration aims to strengthen European military capabilities by integrating US technology into Rheinmetall’s production and digital framework, enabling rapid, modular, and NATO-aligned autonomous systems. With the Barracuda designed for quick, low-cost deployment and the Fury for stealthy, long-range combat and surveillance, these developments demonstrate how defense-focused UAVs are driving global market growth and technological innovation.

Geographical Analysis

The North America Unmanned Aerial Vehicle Market was valued at 40.10%market share in 2024

North America dominates the global UAV market, largely driven by the United States’ advanced defense programs and early adoption of unmanned systems. High military spending and government initiatives fuel growth, with drones playing a key role in surveillance and tactical operations. For example, in February 2025, the CIA conducted MQ-9 Reaper drone missions over Mexico to monitor drug cartels, reflecting the strategic reliance on UAVs for intelligence and national security. These operations underscore the US’s technological leadership and its contribution to nearly half of North America’s UAV market share.

In the commercial sector, Canada is rapidly expanding its UAV capabilities. Volatus Aerospace received a Special Flight Operations Certificate (SFOC) from Transport Canada in September 2025, enabling advanced Beyond Visual Line of Sight (BVLOS) operations. Leveraging partnerships with Kongsberg Geospatial and MatrixSpace, Volatus is deploying automated drone-in-a-box networks with scalable detect-and-avoid systems. These developments enhance commercial applications across logistics, industrial monitoring, and infrastructure, positioning Canada as a growing contributor to the regional UAV market.

While Mexico’s UAV market is smaller, it remains strategically significant due to cross-border surveillance and regional security concerns. The CIA’s drone operations over Mexican territory highlight the region’s tactical importance and the use of UAVs for intelligence gathering along the southern US border. Although these missions have raised diplomatic tensions, they reflect the expanding operational footprint of UAVs in North America. Together, the US, Canada, and Mexico’s activities demonstrate a combined technological, commercial, and strategic ecosystem that solidifies North America’s dominant share in the global UAV market.

The Asia-Pacific Unmanned Aerial Vehicle Market was valued at 20.60% market share in 2024

Asia-Pacific’s UAV market is significantly bolstered by India’s growing drone ecosystem, driven by both government support and private initiatives. The Drone Federation India (DFI) represents over 550 drone companies and 5,500 pilots, aiming to make India a global drone hub by 2030. DFI promotes the design, development, manufacturing, adoption, and export of Indian drones and counter-drone technology. It also facilitates ease of doing business and encourages wider adoption of drone technology. Programs like Bharat Drone Mahotsav showcase domestic innovation and attract international collaboration. Rising industrial and defense applications are creating strong demand for drones across the country.

China’s UAV dominance in the region is exemplified by the upcoming deployment of the Jiu Tian, the world’s largest drone mothership. Scheduled for a maiden flight by the end of June 2025, it has a 4,500-mile range, can carry up to 100 loitering munitions or miniature drones, and operate at 15,000 meters. Jiu Tian enables swarming tactics, electronic warfare, ISR, and suppression missions, representing a strategic leap in China’s unmanned warfare capabilities. The UAV’s scale and capabilities underline Beijing’s commitment to extending its aerial operational reach and asymmetric warfare advantage in Asia-Pacific.

Australia’s share in the regional UAV and unmanned systems market is strengthened by strategic defense investments. In September 2025, the government announced a US$1.1 billion investment in "Ghost Shark" autonomous undersea drones, developed with US startup Anduril Industries. These drones are designed for long-range intelligence, surveillance, reconnaissance, and strike missions, significantly enhancing the Australian Navy’s operational capabilities and maritime reach. Such investments highlight Australia’s emphasis on integrating advanced unmanned systems into defense, contributing to Asia-Pacific’s overall UAV market growth.

Competitive Landscape

The major players in the Unmanned Aerial Vehicle Market include Northrop Grumman Corporation, Thales Group, BAE Systems plc, DJI (SZ DJI Technology Co., Ltd.), General Atomics Aeronautical Systems, Inc. (GA-ASI), Israel Aerospace Industries (IAI), Lockheed Martin Corporation, Elbit Systems Ltd., Parrot SA, Insitu, Inc. (Boeing subsidiary) among others.

Northrop Grumman Corporation: Northrop Grumman Corporation is a leading US-based aerospace and defense company specializing in advanced UAV systems. The company designs and manufactures high-performance unmanned aircraft for intelligence, surveillance, reconnaissance (ISR), and combat missions. Its portfolio includes endurance-focused drones such as the RQ-4 Global Hawk and MQ-4C Triton, providing long-range, high-altitude capabilities. Northrop Grumman integrates cutting-edge sensors, autonomous systems, and communications technologies to enhance mission efficiency. The company continues to innovate UAV solutions for military and government customers worldwide, reinforcing its leadership in unmanned aerial systems.

Market Scope

Metrics | Details | |

CAGR | 10.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Mn) | |

Segments Covered | Type | Fixed-Wing UAV, Rotary-Wing UAV, Hybrid/Transitional UAV |

Range | Orotracheal, Nasotracheal | |

Operational Mode | Fully Autonomous, Semi-Autonomous, Remotely-Operated | |

| Component | Hardware, Software, Services |

| End-User | Agriculture, Defense and Military, Aerospace and Aviation, Power & Energy, Media & Entertainment, Healthcare, Mapping and Surveying, Oil & Gas, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global Unmanned Aerial Vehicle Market report delivers a detailed analysis with 78 key tables, more than 76visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more related reports, please click here