Type II Collagen Market Overview

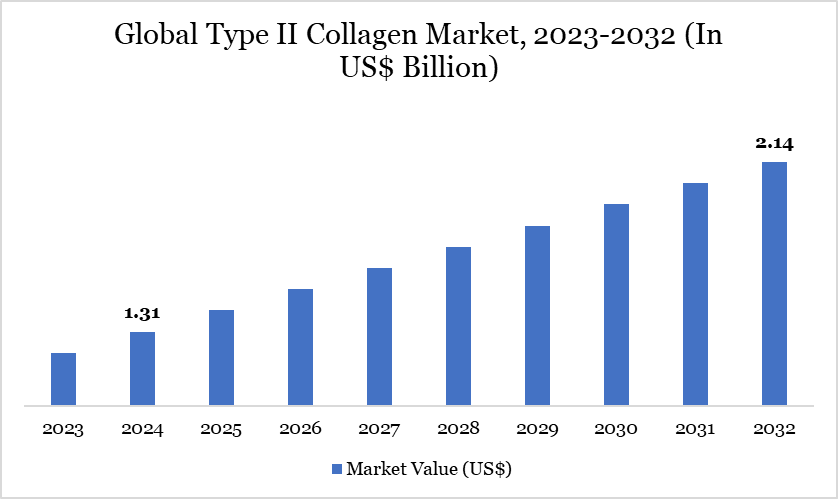

Type II Collagen Market reached US$ 1.31 billion in 2024 and is expected to reach US$ 2.14 billion by 2032, growing at a CAGR of 6.30% during the forecast period 2025-2032.

As the global aging population grows, there is an increasing awareness of joint health and mobility issues. Type II collagen, known for its ability to support cartilage and joint function, is seeing heightened demand. This trend drives global type II collagen market expansion, particularly among elderly consumers and individuals with active lifestyles who prioritize joint health.

According to the World Health Organization, countries face significant challenges in preparing their health and social systems for the rapid demographic shift toward an aging population. By 2050, it is projected that 80% of older adults will reside in low- and middle-income countries and the pace of population aging is accelerating at an unprecedented rate.

Type II Collagen Market Trend

The growing demand for joint health supplements is a major market trend, fueled by rising awareness of collagen’s benefits. An aging global population further drives interest in maintaining mobility and joint function. For instance, in March 2022, ByHealth, China’s leading vitamin and dietary supplements company, launched a new collagen product under its Highflex joint health brand. The product features native (undenatured) type II collagen branded ingredient Collavant n2, from Bioiberica (Barcelona), which has been clinically shown to improve knee discomfort and function.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

By Form | Dry, Liquid |

By Source | Bovine, Porcine, Poultry, Others |

By Application | Food and beverage, Pharmaceuticals, Cosmetics, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Type II Collagen Market Dynamics

Rising Prevalence of Osteoarthritis

As osteoarthritis becomes more common, especially among the aging population, the demand for effective treatments and joint health supplements significantly increases. Type II collagen, known for its role in supporting joint health and reducing inflammation, is increasingly being incorporated into dietary supplements, functional foods and pharmaceuticals to address the growing needs of those affected by this condition.

For instance, according to the Osteoarthritis (OA) Action Alliance, the prevalence of OA varies by age, gender and ethnicity. Age-wise, 43% of individuals with OA are 65 or older and 88% are 45 or older. The highest annual incidence of knee OA occurs between the ages of 55 and 64, although more than half of those with symptomatic knee OA are under 65. Gender differences show that 62% of individuals with OA are women. While OA is more common in men under 45, it becomes more prevalent in women after that age. In terms of ethnicity, 78% of those with OA are non-Hispanic whites.

Growing Interest in Sports Nutrition

The growing interest in sports nutrition is expected to drive the global type II collagen market significantly. As athletes and fitness enthusiasts increasingly focus on joint health, recovery and performance enhancement, type II collagen is gaining attention for its potential benefits in supporting joint integrity, reducing inflammation and promoting cartilage repair, driving the market growth.

The market is witnessing a rise in demand for collagen-based supplements, especially from individuals engaged in high-impact sports. These consumers seek products that can help maintain their joint health and prevent injury, contributing to the expansion of the type II collagen segment within the broader sports nutrition market. This trend is further supported by the growing awareness of collagen's role in improving mobility and flexibility, making it a key ingredient in the market for sports supplements and functional foods.

According to Bulk CEO, the rising popularity of strength training has propelled the direct-to-consumer (DTC) nutrition brand to a record-breaking performance, with revenues surging by 30% to EUR 123.1 million in 2023. Strong customer retention and record-high new customer acquisition were key drivers behind this growth. Bulk added nearly 800,000 new customers last year and sold over nine million products, with clear whey protein emerging as the fastest-growing line and the value essentials range performing well amid the cost of living crisis.

Creatine products remained popular among customers focused on muscle mass building, while collagen and magnesium products saw increased demand as recovery solutions. Bulk’s impressive revenues boosted adjusted EBITDA to EUR 9.3 million, up from EUR 2.6 million in 2022 and pre-tax profits rose to EUR 6 million, compared to just EUR 66k the previous year, despite inflation-driven ingredient cost hikes.

Vegan and Ethical Concerns

As consumer demand shifts towards plant-based and cruelty-free products, a growing segment of the market is becoming increasingly wary of products derived from animal sources, such as type II collagen, which is typically sourced from chicken sternum or other animal tissues. This ethical stance, combined with the rising vegan population globally, may hinder the growth of the type II collagen market, as consumers seek alternative, plant-based solutions for joint health and skin care.

Moreover, the type II collagen market is also likely to face challenges as brands navigate the ethical debates around animal welfare and sustainability. The production methods for animal-derived collagen are often scrutinized for their environmental impact, which can further dampen demand in markets where sustainability and ethical sourcing are high priorities, restraining market growth.

Type II Collagen Market Segment Analysis

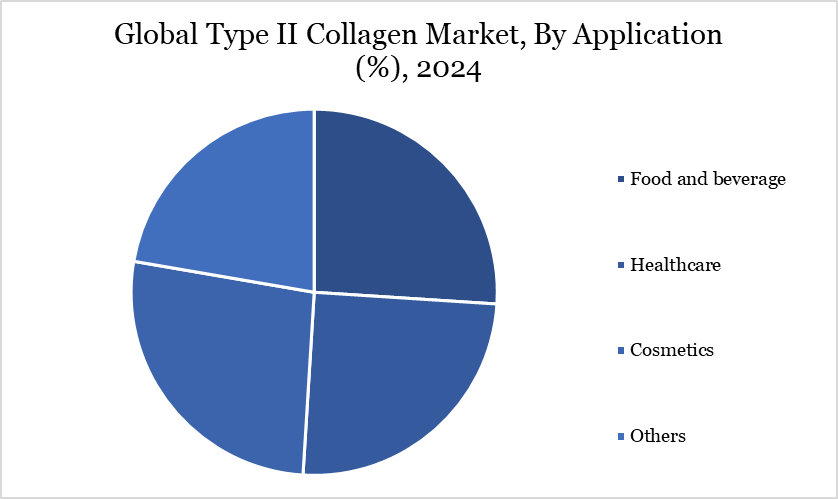

The global type II collagen market is segmented based on form, source, application and region.

Rising Consumer Demand for Type II Collagen Skin Health Products

The cosmetics segment holds a significant share of the global type II collagen market due to a combination of rising consumer demand for skin health products and the increasing awareness of collagen's role in enhancing skin elasticity, hydration and overall appearance. As consumers become more focused on maintaining a youthful appearance, there is a surge in the popularity of anti-aging products, with type II collagen becoming a key ingredient.

The growing demand for anti-aging and skin-rejuvenating solutions is driving the cosmetics market forward with type II collagen’s proven benefits. The cosmetics industry is continually evolving with innovative product formats such as collagen-infused masks, lotions and ingestible beauty supplements. For instance, on January 24, 2023, Geltor expanded into the hair care market with the launch of NuColl, a vegan collagen produced through fermentation.

Type II Collagen Market Geographical Share

Increasing Prevalence of Joint Disorders in North America

North America is expected to dominate the global type II collagen market. The primary driver is the region's rapidly aging population, which is leading to an increasing prevalence of joint disorders such as osteoarthritis. Over 32.5 million Americans, according to data from The Arthritis Foundation, have osteoarthritis, which is continuing to fuel demand for supplements that strengthen joints, such as Type-2 collagen. This is creating significant demand for joint health supplements, where type II collagen is widely used for its potential to support cartilage and improve joint function.

Growing consumer awareness about the benefits of collagen supplements, driven by extensive marketing efforts and strong distribution channels, is contributing to market expansion in North America. The region also benefits from a highly developed healthcare infrastructure and a robust dietary supplement market, allowing for easier access to collagen-based products. These trends, along with a focus on product innovation and new formulations, are helping North America maintain its leading position in the global type II collagen market.

Sustainability Analysis

As environmental and ethical awareness grows among consumers, sustainability is becoming a central focus in the type-II collagen market. Traditional collagen production methods are resource-heavy, but newer extraction techniques have cut water use by up to 40%, reducing environmental impact. Marine collagen and plant-based alternatives are also growing rapidly, at a rate of 15% annually, offering greener options without sacrificing quality. Ethical sourcing is gaining ground, with 72% of consumers preferring cruelty-free and responsibly sourced products. Consequently, more companies are using by-products from the meat and fish industries, with 60% of collagen expected to come from certified ethical sources by 2025.

In efforts to conserve natural resources, the industry is shifting toward lab-grown collagen and sustainable aquaculture, which has lessened pressure on wild fish populations by 30%. Biotech innovations, like fermentation-derived collagen, are expanding by 22% annually and help protect biodiversity. Eco-friendly packaging is another growing priority, with 80% of consumers favoring recyclable or biodegradable materials. As a result, 40% of companies have already adopted sustainable packaging, a number projected to reach 75% by 2026. Economically, sustainability pays off green practices reduce production costs by up to 20%, and 55% of consumers are willing to pay a premium for responsibly sourced collagen, boosting growth in areas like joint health and sports nutrition.

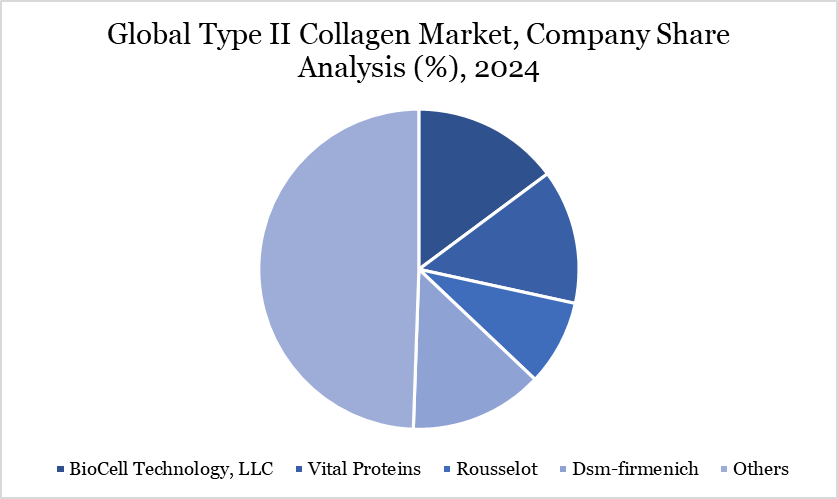

Type II Collagen Market Major Players

The major global players in the market include BioCell Technology, LLC, Vital Proteins, Rousselot, DSM-Firmenich, Chondrex, Inc., Titan Biotech Ltd., Takara Bio Inc., KOKEN CO., LTD., REPROCELL Inc. and Lonza Group.

Key Developments

In November 2024, Centrum launched Centrum Joint & Mobility Capsule, featuring UC-II (Undenatured Type II Collagen) and Vitamin K2 to support cartilage repair and joint flexibility.

On November 4, 2023, Lee Pharma, a Hyderabad-based pharmaceutical company, received marketing authorization to launch its Bio-Cartilage SmoothWalk tablets in the United Arab Emirates.

On March 3, 2022, ByHealth, a leading vitamin and dietary supplements company in China, introduced a new collagen product under its Highflex joint health brand. This product features Collavant n2, a native (undenatured) type II collagen ingredient from Bioiberica (Barcelona), which has been clinically proven to alleviate knee discomfort and improve joint function.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies