Global Dietary Supplements Market Overview

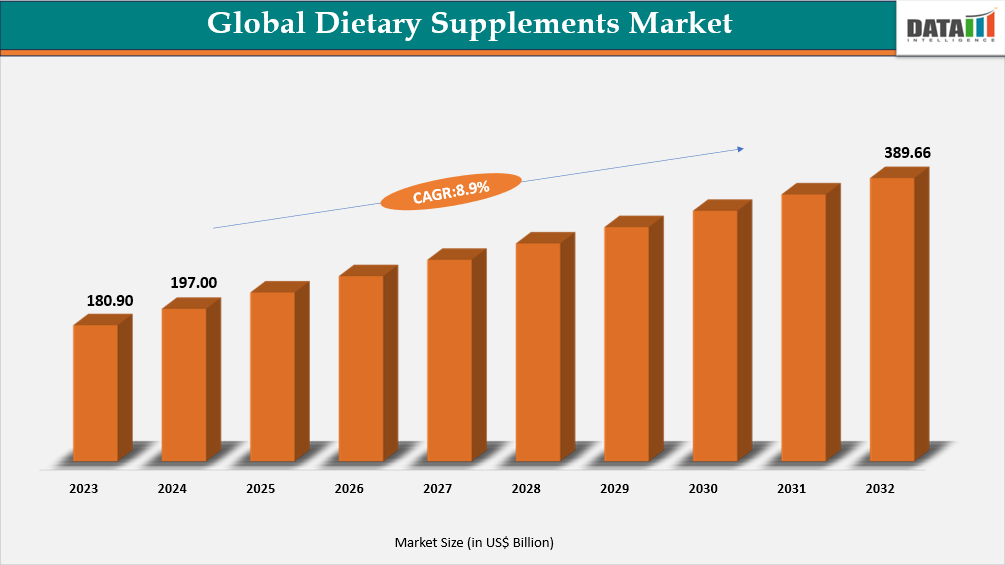

According to DMI analysis, the global dietary supplements market reached US$180.90 billion in 2023, rising to US$197 billion in 2024 and is expected to reach US$389.66 billion by 2032, growing at a strong CAGR of 8.9% during the forecast period from 2025 to 2032.

The global dietary supplements market is undergoing rapid transformation as consumers prioritize preventive health amid rising chronic disease rates. With diabetes cases surging from 200 million in 1990 to 830 million in 2022—and 59% of patients remaining untreated—demand for supplements continues to accelerate. People are increasingly relying on products that support immunity, metabolic balance, cardiovascular wellness, and healthy aging. This shift reflects a broader move toward proactive, long-term health management.

Innovation in the dietary supplements sector is being strongly influenced by sustainability and scientific credibility. Companies such as CarobWay, with its 2025–26 CarobBiome launch, demonstrate growing industry momentum toward upcycled and clean-label ingredients. Brands are emphasizing clinically validated formulations to build trust and efficacy. Overall, the market is transitioning toward environmentally responsible and evidence-backed supplement solutions.

Dietary Supplements Market Industry Trends and Strategic Insights

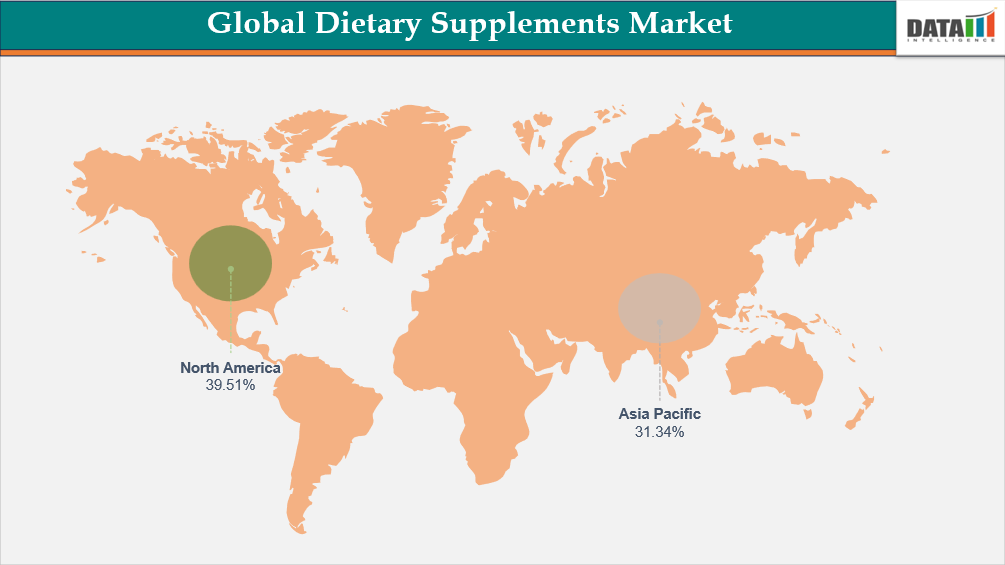

- North America leads the global dietary supplements market, capturing the largest revenue share of 39.51% in 2024.

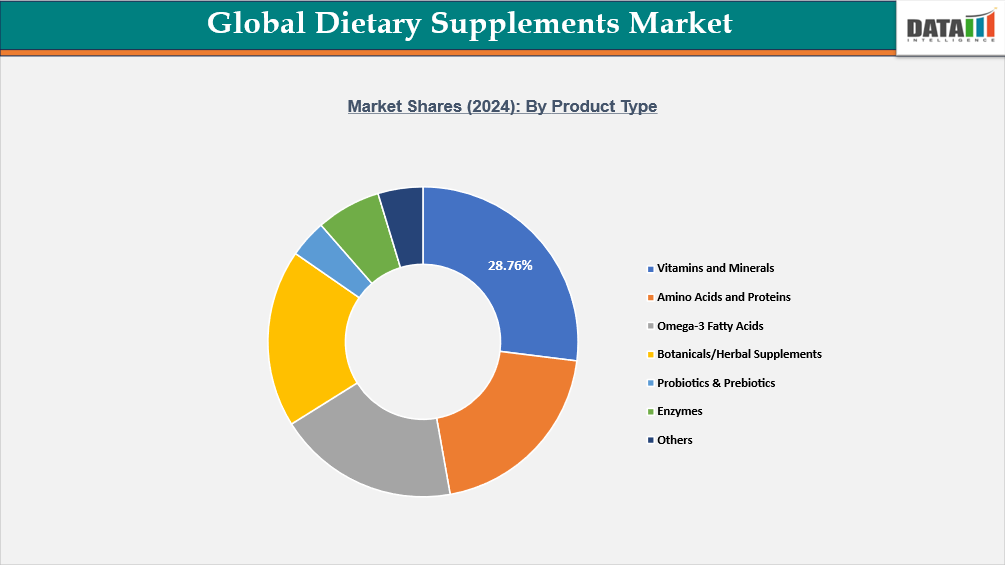

- By product type segment, vitamins & minerals led the global dietary supplements market, capturing the largest revenue share of 28.76% in 2024.

Global Dietary Supplements Market Size and Future Outlook

- 2024 Market Size: US$197.00 billion

- 2032 Projected Market Size: US$389.66 billion

- CAGR (2025–2032): 8.9%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Product Type | Vitamins and Minerals, Amino Acids and Proteins, Omega-3 Fatty Acids, Botanicals/Herbal Supplements, Probiotics & Prebiotics, Enzymes, Others |

| By Form | Capsules and Tablets, Powders, Liquids, Gummies, Softgels, Others |

| By Application | Gastrointestinal Health, Bone & Joint Health, Cardiovascular Health, Energy & Fatigue Reduction, Cognitive / Brain Health, Immune Health, Weight Management, Beauty & Anti-Aging, Pediatric Health, Urinary Tract Health, Oral Health, Women's Health, Others |

| By Age Group | Infants & Toddlers (Ages 0-3 years), Children (Ages 4-12 years), Adolescents & Teenagers (Ages 13-19 years), Young Adults (Ages 20-39 years), Middle-Aged Adults (Ages 40-64 years), Seniors / Elderly (Ages 65+ years) |

| By Distribution Channel | Pharmacies and Drug Stores, Supermarkets & Hypermarkets, Specialty Health & Wellness Stores, Online Retailers, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Preventive-Healthcare Awareness Spurs Supplement Adoption

The escalating global burden of chronic diseases is strengthening the shift toward preventive health, directly increasing demand for dietary supplements. With diabetes cases rising from 200 million in 1990 to 830 million in 2022, and 59% of patients being untreated, consumers are seeking proactive ways to manage metabolic health and immunity. In the US, multimorbidity affects 1 in 4 adults, with cardiac, renal, and metabolic conditions dr iving one-third of all deaths. This growing health strain is accelerating the adoption of vitamins, omega-3s, minerals, and antioxidants to support long-term wellness.

Rising healthcare costs and treatment gaps are reinforcing supplements as a cost-effective preventive solution. CRM conditions account for 90% of the US’s US$4.9 trillion healthcare spend, while heart disease, obesity, cancer, and Alzheimer’s add hundreds of billions in annual economic burden. Limited uptake of advanced therapies is pushing consumers toward more accessible nutritional solutions. As chronic-disease pressures intensify globally, preventive-health awareness is becoming a key catalyst for supplement market growth.

Global Dietary Supplements Market, Segmentation Analysis

The global dietary supplements market is segmented based on product type, form, application, age, distribution channel and region.

Vitamins and Minerals Emerge as the Most Sought-After Supplements as Preventive Health Rises

The vitamins and minerals segment remains the strongest and most consistently demanded category in the dietary supplements market, driven by ongoing micronutrient gaps and rising preventive-health adoption. Core products such as multivitamins, vitamin D, vitamin C, and magnesium continue to lead, supported by growing consumer preference for clean-label, science-backed, and better-absorption formulations.

For instance, in May 2024, Centrum strengthened category awareness with its Your Nutrition Matters initiative, highlighting widespread micronutrient deficiencies and promoting daily multivitamin use. Supported by a JAPI-published expert consensus, the program emphasized the importance of supplementation for individuals with chronic conditions. Survey findings revealed a significant knowledge gap, with only 4% of consumers using supplements daily despite managing multiple health concerns.

Similarly, in September 2025, Wellbeing Nutrition accelerated innovation with its “Slow-Release Supplements” campaign, shifting consumer focus from ingredient quantity to absorption science. Its sustained-release and liposomal magnesium, omega-3, probiotics, and multivitamin products achieved 45% growth, with magnesium leading sales. The campaign reflects rising demand for clinically validated, performance-driven vitamin and mineral solutions.

Daily Gut-Health Demand Makes Probiotics & Prebiotics a Major Share of The Global Supplements Market

Probiotics and prebiotics hold a significant share of the global dietary supplements market, as rising gut health awareness continues to fuel daily consumption habits. According to IFIC, 32% of consumers actively consume probiotics, and among them, 60% take them at least once daily, indicating strong habitual demand that drives repeat purchases. This consistent usage aligns with the broader shift toward microbiome-focused wellness, positioning these products as essential rather than optional supplements. As brands expand functional foods, beverages, and capsules featuring gut-friendly strains and fibres, the category’s momentum strengthens, reinforcing its sizeable share within overall supplement growth.

Global Dietary Supplements Market, Geographical Penetration

Dominating Region: North America Leads the Dietary Supplements Market with 39.51% Through Strong Consumer Awareness, High Healthcare Spending, and the Dominance of Major Nutraceutical Brands

The North American dietary supplements market is strengthening as consumers increasingly demand clean-label, high-protein, and low-sugar formulations that support metabolic and digestive wellness. With 81% of consumers prioritizing clean ingredients, brands are shifting toward recognizable, natural components and gut-friendly fibers. The rising adoption of GLP-1 medications is further driving demand for supplements that aid muscle maintenance and blood-sugar balance. This trend accelerates innovation in prebiotic, probiotic, and metabolic-health–focused ingredients across the region.

US Dietary Supplements Market Outlook

In the US, digestive and metabolic health are becoming top priorities within supplements, supported by strong consumer preference for protein-rich and clean-label solutions. With 55% valuing high protein, the market is expanding toward formulations that complement weight-management and GLP-1–related needs. The 2025 CarobWay–GRA Nutra launch of CarobBiome highlights this shift, introducing an upcycled, vegan, allergen-free prebiotic fiber for supplement applications. Such innovations reflect the US market’s push toward sustainable, natural, and microbiome-supportive ingredients, driving future category growth.

Canada Dietary Supplements Market Trends

Canada’s dietary supplements market is growing steadily as consumers seek clean-label, low-sugar, and high-protein formulations that support digestive and metabolic wellness. Rising interest in natural, transparent ingredients mirrors broader North American trends, with strong demand for gut-friendly prebiotics and functional fibers. The influence of GLP-1 weight-management therapies is also driving the adoption of supplements that aid muscle preservation and blood-sugar balance. Sustainability and plant-based innovation are increasingly shaping product development across the Canadian market.

Fastest Growing Region: Asia-Pacific Becomes the Fastest-Growing Dietary Supplements Market Due to Rising Health Awareness and Expanding Middle-Class Income

The Asia-Pacific region holds a significant share in the Dietary Supplements Market due to rapid digital adoption, high smartphone penetration, and expanding 5G infrastructure. Major markets like China, Japan, South Korea, and India are investing heavily in VR, AR, and XR technologies for marketing campaigns. The growing e-commerce sector and rising consumer demand for interactive and personalized experiences further boost immersive advertising adoption. Additionally, supportive government initiatives and tech innovation hubs in the region accelerate the deployment and integration of immersive technologies in advertising.

India Dietary Supplements Market Insights

India’s dietary supplements landscape is facing growing concerns, as an Assocham survey shows 78% of urban adolescents consume products ranging from energy drinks to protein powders and even steroids. The study found that over 85% of young athletes were encouraged by coaches and trainers to use steroid-like supplements, which remain easily accessible in local markets. Usage was highest in major cities, with heavy consumption of sports drinks (86%), vitamin tablets (75%), and steroids (76%). The report warns that supplement dependence is becoming normalized among youth, raising significant health and regulatory red flags.

China Dietary Supplements Market Industry Growth

China’s dietary supplements market is strengthening as consumers prioritize convenient, science-backed nutrition, especially for daily morning routines. In November 2025, NSF launched the China Morning Nutrition Product Certification, setting a rigorous, standardized system to ensure quality and safety across breakfast-focused supplements. Amway became the first company to be certified, with 16 products meeting strict GMP, ingredient safety, and label-accuracy requirements. This certification reflects rising demand for reliable protein, probiotic, omega, and phytonutrient supplements aligned with the Chinese Nutrition Society guidelines.

Consumer Behavior Analysis

Consumer behavior in the dietary supplements market is increasingly driven by transparency, with buyers seeking clear, trustworthy ingredient labels before making purchase decisions. Corbion’s segmentation highlights that Ingredient-Focused Shoppers (33%), largely Millennials, prefer organic supplements with short, clean-label formulations and closely examine full ingredient lists. Nutrition-Focused Shoppers (43%) prioritize macro profiles—such as high protein, low sugar, or added functional benefits—and focus mainly on the first few ingredients. This shift underscores rising demand for supplements that combine simplicity, purity, and targeted nutritional value.

Meanwhile, Less-Engaged Consumers (24%) remain more price-driven and rely on highlighted claims, peer recommendations, or marketing cues rather than detailed label reading. As a result, brands that emphasize transparent labeling, clear functional benefits, and easy-to-understand ingredient profiles gain stronger traction across all consumer types. The trend reflects growing consumer awareness and scrutiny in the wellness space, pushing supplement companies toward cleaner formulations and more truthful communication. This label-centered behavior is reshaping competitive strategy within the dietary supplements market.

Competitive Landscape

- The dietary supplements market is highly competitive, driven by quality differentiation and formulation innovation.”

- Key players such as Amway Corp., Herbalife International of America, Inc., Nestlé Health Science and Glanbia PLC dominate the market through strong R&D capabilities and diversified application portfolios.

- Companies are prioritizing natural, clean-label, and sustainably sourced ingredients to align with tightening regulatory expectations and rising consumer demand for eco-friendly supplements.

- Strategic partnerships and manufacturing expansions, especially in Asia-Pacific, are reshaping competition as supplement producers secure raw material supply and target fast-growing nutrition and wellness demand.

Key Developments

- In July 2025, Torrent Pharmaceuticals expanded its flagship Shelcal brand with Shelcal Total, an adult nutrition powder designed to address everyday nutritional gaps. The supplement combines high-quality protein, vitamins, minerals, and functional nutrients to support bone, muscle, joint, gut, brain, and skin health. Formulated with vegetarian ingredients and free from added sugar, artificial colors, and flavors, each serving delivers targeted nutrients like calcium, magnesium, vitamin D3 and K2, along with glucosamine and bamboo shoot extract for joint support.

- In November 2025, AxisBiotix launched Skin Clear, a pioneering gut-skin dietary supplement aimed at reducing acne and blemishes from within. The drinkable supplement combines Vitamin C and Probioact Technology to support gut bacterial balance, improving skin clarity and function.

Investment & Funding Landscape

The dietary supplements market is attracting significant investment as global demand for health and wellness products surges. Venture capital and private equity are increasingly funding startups focused on probiotics, plant-based proteins, and personalized nutrition solutions. Strategic partnerships and acquisitions by established players are accelerating innovation and market expansion.

| Company | Investment/Funding | Year | Details | |

| Zooki | Funding of ~US$2.4 million | 2025 | Nutritional supplement maker Zooki secured £1.8 million (~US$2.4 million) in funding from NatWest to support growth and innovation in the wellness market. The funding will bolster R&D for new product lines and flavours, enhance brand visibility, and expand distribution across mainstream retailers. | |

What Sets This Global Dietary Supplements Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by Deployment, source, distribution channel, end-user and application segments (sleep disorders, jet lag, shift-work). Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw-material costs.

- Regulatory Intelligence – Actionable analysis of regulatory frameworks that materially affect Dietary Supplements commercialization, revenue by country, allowable label claims, permitted doses, import/export controls and advertising restrictions.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading pharma and nutraceutical players, contract manufacturers and e-commerce specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, reimbursement dynamics, cultural/consumer behavior and market access considerations. Focus on high-growth or regulatory-uncertain markets.

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw material costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry experts such as clinical sleep specialists, regulatory affairs professionals and key manufacturing companies.