Global Tortilla Market Overview

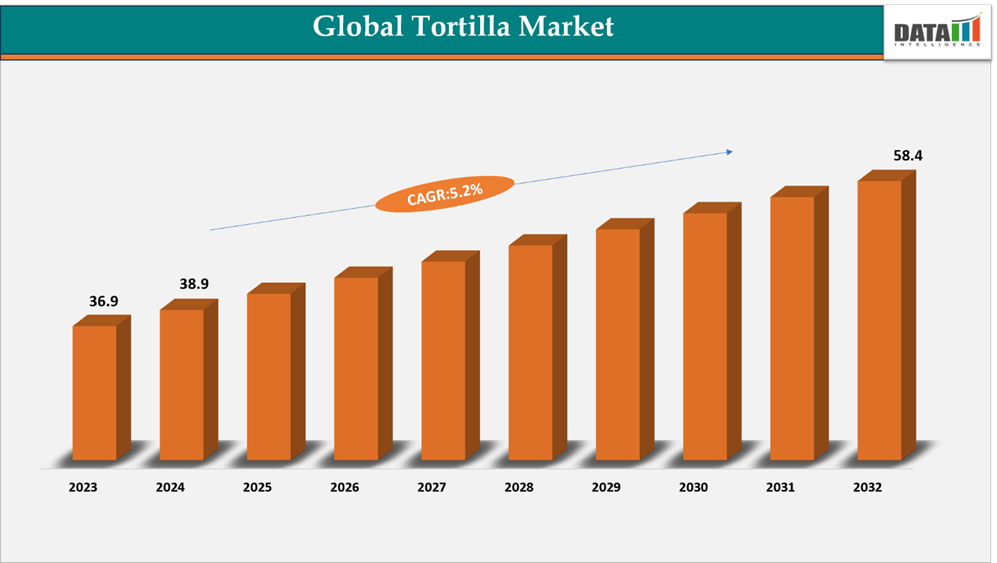

The global tortilla market reached US$36.9 billion in 2023, rising to US$38.9 billion in 2024 and is expected to reach US$58.4 billion by 2032, growing at a CAGR of 5.2% from 2025 to 2032.

The global tortilla market is expanding steadily as consumers show increasing interest in convenient, flavorful, and versatile food options. With busy lifestyles and a growing curiosity for international cuisines, tortillas are becoming a go-to choice over conventional bread products. Their ability to suit a wide range of dishes is helping drive strong market acceptance.

Demand is further supported by the shift toward healthier eating habits and preferences for clean-label, organic, and specialty food items. Producers are responding with innovative tortilla varieties such as whole-wheat, multigrain, gluten-free, and plant-based formats to meet the expectations of health-focused buyers, young consumers, and households seeking customizable meal solutions.

Growth in product development, marketing efforts, and wider retail distribution across supermarkets, quick-service restaurants, online grocery channels, and specialty outlets is increasing the product’s reach. As availability continues to expand across regions, tortillas are becoming a staple in modern diets, strengthening their importance in the global packaged food industry.

Tortilla Market Industry Trends and Strategic Insights

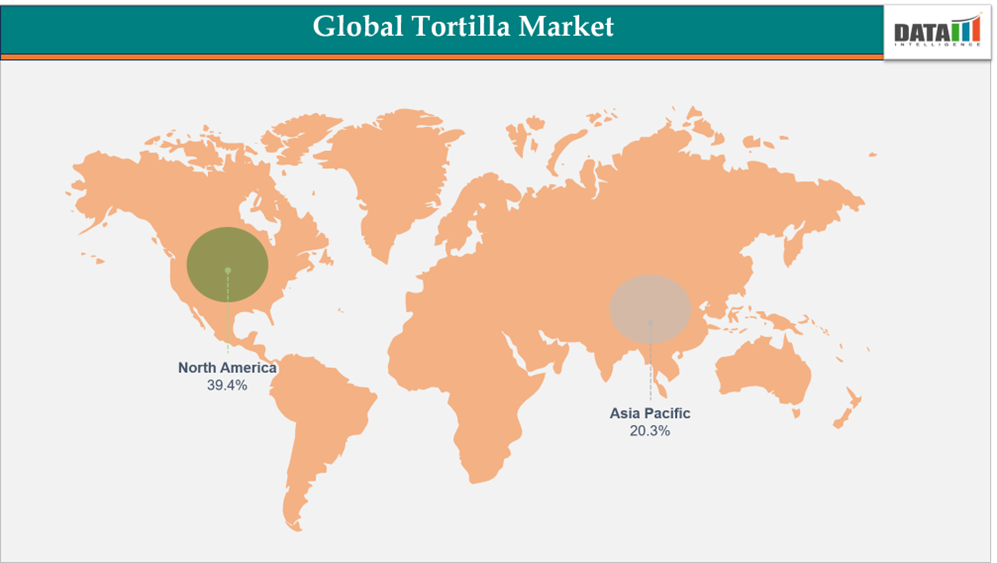

- North America leads the global tortilla market, capturing the largest revenue share of 39.4% in 2024.

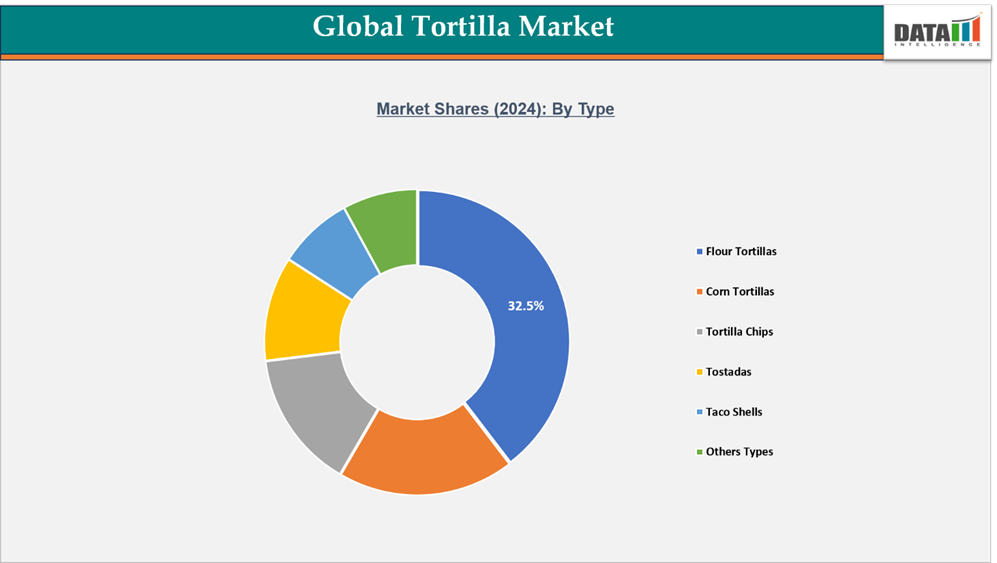

- By type segment, Flour tortilla leads the global tortilla market, capturing the largest revenue share of 32.5% in 2024.

Global Tortilla Market Size and Future Outlook

- 2024 Market Size: US$38.9 billion

- 2032 Projected Market Size: US$58.4 billion

- CAGR (2025–2032): 5.2%

- Dominating Market: North America

- Fastest Growing Market: Asia-Pacific

Market Scope

| Metrics | Details |

| By Type | Flour Tortillas, Corn Tortillas, Tortilla Chips, Tostadas, Taco Shells, Other Types |

| By Source | Corn, Wheat, Others (Cassava) |

| By Processing Type | Fresh, Frozen |

| By Category | Conventional, Organic, Gluten-Free / Functional |

| By Distribution Channel | Supermarkets / Hypermarkets, Convenience Stores, Online Retail / E-commerce, Specialty and Health Food Stores |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

For More Detail Information, Request For Sample

Market Dynamics

Increasing demand for convenience & versatile foods

The growing consumer inclination toward convenient and adaptable food options is one of the major factors driving the growth of the global tortilla market. In today’s fast-paced lifestyle, consumers are increasingly seeking quick, nutritious, and flexible meal solutions and tortillas fit this demand perfectly. Their versatility allows them to be used in a wide range of dishes, from traditional Mexican meals to modern wraps, snacks, and fusion cuisines, making them a preferred choice for both households and the foodservice industry.

A clear reflection of this trend can be seen in PepsiCo’s acquisition of tortilla-chip maker Siete Foods for US$1.2 billion in October 2024. The acquisition highlights PepsiCo’s strategic push to expand its better-for-you snacking portfolio amid growing consumer awareness about healthy eating. Siete Foods, known for its grain-free and gluten-free tortilla products, aligns well with the rising demand for convenient yet nutritious snack options.

Urbanization, higher disposable incomes, and evolving dietary habits further reinforce this demand. Time-pressed consumers, especially working professionals and younger demographics, prefer tortillas for their ease of preparation, portability, and ability to pair with various fillings and flavors. The expanding presence of online food retail and quick-service restaurants offering tortilla-based meals has also made these products more accessible worldwide.

Overall, the rising demand for versatile and ready-to-eat food products continues to accelerate the growth of the tortilla market. Leading manufacturers are responding by innovating healthier, clean-label, and customizable tortilla varieties to cater to changing consumer preferences and sustain market momentum.

Global Tortilla Market, Segmentation Analysis

The global tortilla market is segmented based on type, source, processing type, category, distribution channel and region.

Flour Tortilla Segment Leads Market Expansion

The flour tortilla segment accounts for a substantial portion of the global tortilla market and continues to grow as consumers seek versatile, convenient, and wholesome meal options. Known for their soft texture, neutral flavor, and adaptability, flour tortillas have become a global favorite—used not only in traditional Mexican dishes but also in wraps, burritos, sandwiches, quesadillas, and fusion cuisines. Their ease of use and ability to complement a variety of ingredients make them a staple for both households and foodservice establishments.

As of October 2025, the segment is witnessing strong momentum driven by innovation and a focus on quality. A notable example is Natural Grocers, the nation’s largest family-operated natural and organic grocery retailer, which recently launched Natural Grocers Brand Organic Tortillas. Made in New Mexico using traditional methods, these tortillas deliver a soft, authentic texture that enhances everything from breakfast tacos to enchiladas, even dessert quesadillas. This reflects a growing consumer demand for clean-label, organic, and locally crafted products that balance tradition with modern health-conscious values. The market is also being shaped by a broader shift toward natural, preservative-free, and nutritionally enriched options. Manufacturers are increasingly offering whole wheat, multigrain, and gluten-free flour tortillas to meet the needs of wellness-focused consumers. At the same time, advancements in packaging and production are extending shelf life while maintaining freshness and quality.

Corn Tortilla Segment Maintains Strong Traditional Base

The corn tortilla segment provides a strong foundation for the global tortilla market, supported by consumers who value authentic flavor, clean ingredients, and cultural tradition. Known for their distinct taste, firmer texture, and gluten-free profile, corn tortillas continue to attract buyers who prioritize minimally processed and naturally wholesome food choices. Their widespread use in tacos, tostadas, enchiladas, and street-food-inspired meals ensures steady demand across both home cooking and foodservice applications.

Growth within the corn tortilla category is fueled by heightened interest in heritage grains, non-GMO formulations, and regionally inspired products. Manufacturers are expanding offerings that highlight traditional preparation methods, such as stone-ground masa or nixtamalization, to appeal to authenticity-seeking consumers. At the same time, innovations in flavor, size variations, and ready-to-heat formats are helping the segment adapt to modern convenience needs.

Corn tortillas continue to perform well in retail and foodservice settings due to their affordability, clean-label appeal, and compatibility with diverse culinary styles. As global tastes evolve and more consumers embrace traditional Latin American cuisine, the corn tortilla segment remains essential to market stability delivering consistency, cultural relevance, and reliable revenue opportunities for brands worldwide.

Global Tortilla Market, Geographical Penetration

DOMINATING MARKET:

North America Leads the Global Tortilla Market

The global tortilla market continues to expand at a steady pace, supported by growing consumer interest in convenient, nutritious, and adaptable food products. As tortillas become a regular part of daily meals across various regions, manufacturers are ramping up innovations in clean-label formulations, product quality, and distribution channels. These efforts are helping brands reach broader consumer groups and keep pace with shifting dietary preferences.

US Tortilla Market Outlook

North America remains the largest and most mature tortilla market, strengthened by long-standing cultural relevance, high consumption rates, and deep penetration across retail and foodservice sectors. In the US, tortillas have evolved from a regional food to a widely embraced mainstream staple. Major industry players—including GRUMA, PepsiCo, Grupo Bimbo, and General Mills continue to introduce whole-grain, low-carb, and gluten-free varieties to appeal to health-driven and customization-focused consumers.

Market activity was further highlighted in October 2024, when California Tortilla initiated a post-pandemic expansion and secured a new franchise agreement in Montgomery County, Maryland. This development reflects the rising demand for fresh, customizable tortilla-based meals and the resurgence of quick-service dining across the country.

Canada Tortilla Market Trends

Tortilla consumption in Canada is growing steadily as consumers show increasing interest in global, ethnic, and fusion cuisines. Their versatility, convenience, and alignment with modern eating habits have encouraged retailers and manufacturers to diversify offerings with whole-grain, organic, and minimally processed options suited to evolving health preferences.

The market’s expansion is also supported by targeted investments that aim to boost local production capacity. In 2023, the Ontario government granted Bimbo Canada $1.5 million to establish a tortilla production line at its Trillium bakery on Hamilton Mountain. This investment underscores the rising cultural and economic importance of tortillas in Canada and helps ensure a consistent supply for growing demand.

Alongside traditional retail, the growth of e-commerce, grocery delivery platforms, and foodservice channels is improving accessibility and enhancing category visibility. As tortillas continue to appear in both classic dishes and modern meal formats, they are becoming a staple in Canada’s diverse and convenience-oriented food market.

FASTEST GROWING MARKET:

Asia-Pacific Emerges as the Fastest-Growing Region in the Global Tortilla Market

The global tortilla market is accelerating, supported by rising interest in convenient, versatile, and globally inspired food products. As consumer habits evolve, particularly toward quick meal solutions and healthier eating patterns, tortillas are gaining traction across multiple regions. The expansion of modern retail formats, rapid growth of online grocery platforms, and broader foodservice penetration are helping strengthen tortilla availability throughout Asia-Pacific.

India Tortilla Market Overview

India’s tortilla market is expanding quickly, driven by rising urbanization, increasing exposure to international cuisines, and growing acceptance of convenient meal components. Tortillas are increasingly used as substitutes for traditional breads in wraps, snacks, and fusion dishes, appealing to young consumers and working households seeking easy-to-prepare foods. Manufacturers are introducing whole wheat, multigrain, and flavored tortilla varieties to align with shifting dietary preferences and regional taste profiles. The expansion of hypermarkets, quick-service restaurants, and online grocery channels is further supporting nationwide adoption.

China Tortilla Market Outlook

China is emerging as a promising tortilla market, with growth centered in major cities where consumers are more receptive to global food trends and Western-style meal formats. Rising demand for ready-to-cook and ready-to-eat products, along with increased availability through supermarkets, convenience stores, and e-commerce platforms, is fueling market momentum. Foodservice players and retailers are incorporating tortillas into menus and meal kits, driving awareness and encouraging trial among younger demographics. Innovation in healthier formulations, smaller pack sizes, and localized flavor adaptations is also helping brands strengthen their presence in this fast-evolving market.

Sustainability and ESG Analysis

Sustainability is becoming a key focus in the global tortilla market, shaping product innovation, corporate responsibility, and consumer choices. Brands are increasingly adopting environmentally friendly production processes, sustainable packaging, and responsible sourcing to reduce their ecological footprint and align with ESG standards.

In 2023, Passion Tree, an eco-conscious tortilla brand in Southern California, emerged as a sustainability leader with its award-winning beverages. Through a partnership with Eden Reforestation Projects, the company plants a tree for every case sold, supporting local communities and restoring deforested ecosystems. With more than 50,000 trees planted in Madagascar, Passion Tree sets a benchmark for environmental stewardship, showing how sustainability initiatives can positively impact both communities and the planet while resonating with eco-conscious consumers.

Overall, initiatives such as energy-efficient production, eco-friendly packaging, and reforestation projects enhance environmental accountability, bolster corporate reputation, and position tortilla brands to meet the growing expectations of socially and environmentally conscious consumers and investors worldwide.

Consumer Analysis

The global tortilla market is driven by consumers seeking convenient, versatile, and nutritious food options. According to Kemin, Data shows that around 93.8 million consumers purchase tortilla products weekly, while 122.5 million people in the US consume one to eight or more bags per month, reflecting the product’s strong presence in households and foodservice channels.

Clean-label considerations are increasingly influencing consumer choices, with surveys indicating that a clear and transparent ingredient list is “very important” for buyers. Tortillas are well-positioned in this regard, as they often feature simple, recognizable ingredients that align with health-conscious and label-aware preferences.

Ongoing demand for easy-to-use, customizable, and wellness-friendly foods continues to drive market growth. Consumers are looking for products that fit into busy lifestyles while supporting healthy eating habits. With their combination of convenience, transparency, and versatility, tortillas enjoy high repeat-purchase rates and broad adoption across diverse demographic groups, reinforcing their position as a staple in the global diet.

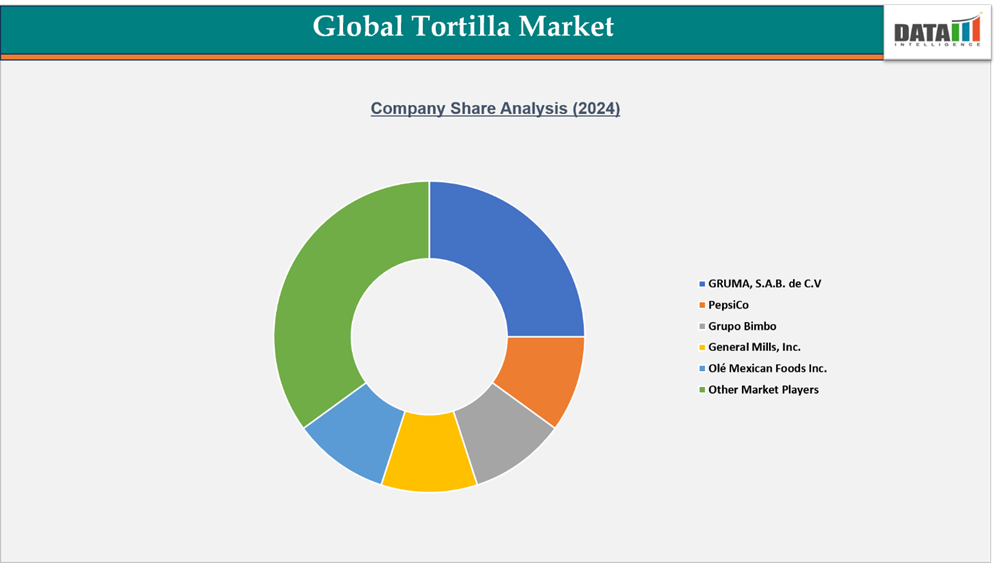

Competitive Landscape

- The global tortilla market is highly competitive, featuring both major multinational food companies and nimble regional players. Leading companies such as GRUMA, S.A.B. de C.V, PepsiCo, Grupo Bimbo, General Mills, La Tortilla Factory, and Olé Mexican Foods retain strong market positions through diversified product lines, continuous innovation, and focused investments in branding and marketing initiatives.

- Many players are expanding into emerging markets through strategic alliances, local collaborations, and acquisitions. These approaches allow companies to scale production, launch new product variants, and enhance distribution across retail, e-commerce, and foodservice channels worldwide.

- Growing consumer demand for convenient, healthy, and versatile food options continues to drive market growth. Innovations in flavors, whole-grain and clean-label products, packaging formats, and sustainable practices, along with strong brand differentiation, remain crucial for companies seeking to maintain competitiveness and achieve sustained growth in the global tortilla market.

Partnership & Acquisition

- In June 2025, C.H. Guenther & Son LLC (CHG), a commercial baking and food manufacturing company with a 170-year history in branded and private-label products, has announced the acquisition of Fresca Mexican Foods, LLC (Fresca), a leading producer of flour tortillas, corn tortillas, and tortilla chips based near Boise, Idaho.

What Sets This Global Tortilla Market Intelligence Report Apart

- Latest Data & Forecasts – Comprehensive, up-to-date insights and projections through 2032. Coverage includes global value by type, source, processing type, category, and distribution channel segments. Scenario forecasts with region-level splits (North America, Europe, Asia-Pacific, South America, Middle East and Africa) and sensitivity to factors such as regulatory reclassification and raw packaging costs.

- Regulatory Intelligence – Comprehensive analysis of regulatory frameworks impacting tortilla production and commercialization, including country-specific labeling and ingredient requirements, food safety standards, import/export regulations, and marketing or advertising guidelines.

- Competitive Benchmarking – Standardized profiling and benchmarking of leading global and regional tortilla companies, craft producers, and distribution specialists active in the market.

- Geographic & Emerging Market Coverage – Region-by-region market sizing, growth drivers, consumer behavior trends, and market access considerations, with a focus on high-growth or regulatory-uncertain markets

- Actionable Strategies – Identify opportunities for launching innovative products, while leveraging strategic partnerships and supply chain integration for maximum ROI.

- Pricing & Cost Analysis – In-depth assessment of price trends, raw Packaging costs and sustainability-driven cost efficiencies across regional markets.

- Expert Analysis – Insights from industry specialists, including beverage innovation experts, regulatory professionals, and leading manufacturers, offering guidance on market dynamics and emerging opportunities.