Smart Hospital Beds Market Size - Industry Trends & Outlook

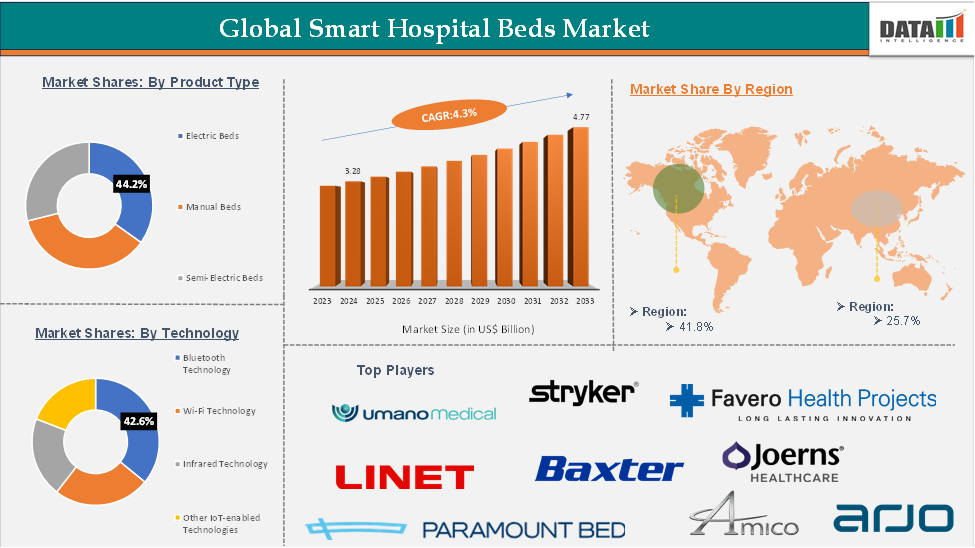

Smart Hospital Beds Market size reached US$ 3.28 Billion in 2024 and is expected to reach US$ 4.77 Billion by 2033, growing at a CAGR of 4.3% during the forecast period 2025-2033.

Smart hospital beds are advanced, technology-driven beds designed to enhance patient care and optimize hospital operations. They feature adjustable positioning, automated monitoring systems, and sensors to track vital signs, movement, and pressure points. These beds provide real-time data to healthcare providers, enabling more accurate interventions. They enhance patient comfort and safety by enabling automatic height adjustment, pressure relief, and fall detection.

The global smart hospital beds market is experiencing steady growth, driven by the rising demand for advanced healthcare infrastructure, increasing technological advancements, the increasing prevalence of chronic illnesses, and the growing elderly population worldwide. Key opportunities lie in the integration of AI, IoT, and remote monitoring technologies, especially as healthcare systems shift toward value-based care and home-based recovery models.

North America is currently the dominant region, owing to its robust healthcare infrastructure, higher adoption of digital health technologies, and supportive reimbursement policies. However, Asia-Pacific is emerging as a high-growth region due to increasing healthcare investments, rising patient awareness, and expanding hospital networks in countries like India and China.

Executive Summary

For more details on this report – Request for Sample

Smart Hospital Beds Market Dynamics: Drivers & Restraints

A rise in technological advancements is expected to drive the smart hospital beds market

The global smart hospital beds market is thriving due to the integration of IoT, AI, and advanced sensors. These technologies enable real-time monitoring of vital signs, movement, and pressure points, enabling healthcare providers to respond quickly to patient needs and improve outcomes. AI-driven analytics predict patient deterioration, while IoT-enabled connectivity enhances workflow efficiency.

Features like automated height adjustment, fall detection, and pressure redistribution improve patient comfort and safety while reducing caregiver burden. Wireless technology advancements like Bluetooth and Wi-Fi enable remote monitoring and telehealth applications. These innovations are transforming hospital beds into intelligent healthcare tools, paving the way for more efficient, patient-centered healthcare systems.

For instance, in June 2023, Baxter International launched its Hillrom Progressa+ bed for the ICU in the US. The bed offers new technology and features that make it easier for nurses to care for patients and support patient recovery. The Progressa+ is designed for critical care environments where patient needs are high and clinical staff are stretched thin. The bed addresses challenges such as reducing strain on nursing resources, reducing pressure injury risk, and simplifying patient positioning. The Hillrom Progressa+ is a "true ICU bed" designed to make care easier for ICU care teams.

The high cost of hospital beds is expected to hinder the smart hospital beds market

Smart hospital beds offer numerous benefits in the healthcare sector, but they are expensive compared to other hospital beds. For example, a Hill-Rom smart bed costs over USD 16,000, while ordinary hospital beds are available for between USD 1000 to USD 8000. This leads to higher adoption of ordinary beds. Emerging economies, such as Asia-Pacific, the Middle East, Africa, and Latin America, have low awareness of smart beds and their advantages.

High maintenance costs, lack of skilled nursing staff, and strict infrastructure budgets discourage hospitals from investing in smart beds. These factors are expected to restrain the healthcare smart bed market growth.

Smart Hospital Beds Market Segment Analysis

The global smart hospital beds market is segmented based on product type, technology, application, end user, and region.

Product Type:

The electric beds segment is expected to hold 44.2% of the global smart hospital beds market

The electric beds segment holds a major portion of the smart hospital beds market share and is expected to continue to hold a significant portion of the smart hospital beds market share during the forecast period.

Electric beds are a key component in the global smart hospital beds market, offering advanced features that improve patient care, safety, and comfort. These beds have motorized controls for height, head, and foot adjustments, making them ideal for critical care units, postoperative care, and patients with mobility limitations. They also integrate smart technologies like IoT and sensors, enabling real-time monitoring of vital signs and patient movement, preventing complications like pressure ulcers and detecting potential falls.

Remote control options and programmable settings streamline care for healthcare providers, allowing them to focus on other critical tasks. As hospitals adopt technology-driven solutions, electric beds are essential in modern medical facilities, driving demand in both developed and emerging markets. For instance, in April 2023, Sleep Number Corporation introduced its next-generation Sleep Number smart beds and Lifestyle Furniture, designed to help sleepers achieve optimal rest and reach their full potential at every life stage, sold separately but most effective when combined.

Smart Hospital Beds Market Geographical Analysis

North America is expected to hold 41.8% of the global smart hospital beds market

North America holds a substantial position in the smart hospital beds market and is expected to hold most of the market share due to its advanced healthcare infrastructure, high adoption of cutting-edge technologies, and growing focus on patient-centered care. The region's significant healthcare spending and government initiatives encourage IoT-enabled smart beds adoption.

The increasing prevalence of chronic diseases, an aging population, and demand for home healthcare solutions contribute to market growth. Leading manufacturers and ongoing research investments fuel innovation, and the integration of smart beds with hospital management systems aligns with the region's push for tech-driven healthcare services.

For instance, in February 2024, Artisight, Inc., a Smart Hospital Platform utilizing artificial intelligence, announced a systemwide expansion of its collaboration with WellSpan Health. The new program will extend remote nursing, observation, and AI services to over 1,000 beds across the WellSpan Health system.

Smart Hospital Beds Market Top Companies

The top companies in the smart hospital beds market include Baxter International, Inc., Stryker, LINET Group SE, Arjo, Amico Group of Companies, Malvestio Spa, Joerns Healthcare, PARAMOUNT BED CO., LTD., Favero Health Projects Spa, Umano Medical Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 4.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Electric Beds, Manual Beds, Semi-Electric Beds |

| Technology | Bluetooth Technology, Wi-Fi Technology, Infrared Technology, Other IoT-Enabled Technologies | |

| Application | Patient Monitoring, Emergency Care, ICU/CCU Care, Postoperative Care, Chronic Care | |

| End User | Hospitals, Nursing Homes, Home Care Settings, Other Healthcare Facilities | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global smart hospital beds market report delivers a detailed analysis with 57 key tables, more than 46 visually impactful figures, and 168 pages of expert insights, providing a complete view of the market landscape.