Small Interfering RNA (siRNA) therapeutics Market Overview

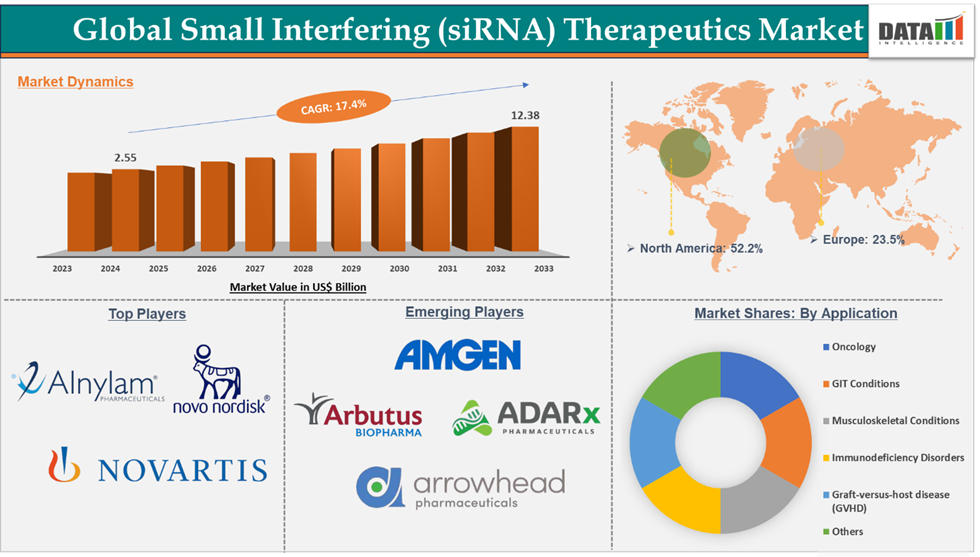

Small Interfering RNA (siRNA) therapeutics Market reached US$ 2.55 billion in 2024 and is expected to reach US$ 12.38 billion by 2033, growing at a CAGR of 17.4% during the forecast period 2025-2033.

The small interfering RNA (siRNA) therapeutics market is experiencing significant growth due to the rising research and development activities for developing novel cell therapies, rising regulatory support and approvals, rising demand for alternatives to traditional drugs for the treatment of life-threatening chronic diseases, and technological advancements and development of novel delivery methods. However, the high cost of cell therapies and efficacy issues can significantly hinder their adoption. The Expanding Applications of siRNA Therapies are a key opportunity for market expansion in the forecast period.

Executive Summary

For more details on this report – Request for Sample

Small Interfering RNA (siRNA) therapeutics Market Dynamics: Drivers & Restraints

The rising R&D activities and product approvals are driving the market growth

The small interfering RNA (siRNA) therapeutics have evolved as the most advanced therapeutic modalities for the treatment of rare and life-threatening diseases with high unmet needs. siRNA drugs work by silencing specific genes at the post-transcriptional level and preventing the expression of proteins encoded by those genes. The discovery of this mechanism has opened new avenues to treat diseases caused by faulty genes.

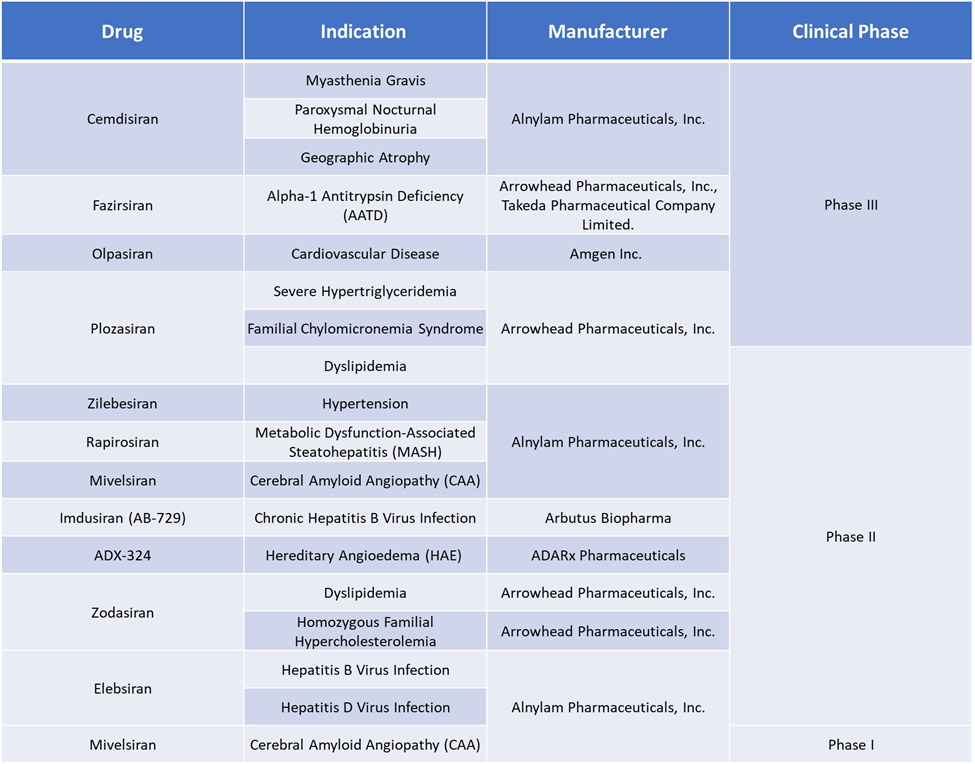

At present, 7 siRNA therapies have been approved for various indications, where gene mutations play a major role in their pathophysiology. The first siRNA therapy, patisiran (Onpattro), was approved in 2018 by the U.S. Food and Drug Administration (FDA). Since then, there have been many research efforts to discover and develop new siRNA therapies that are targeted at various conditions. The most recent approval by the U.S. FDA was in March 2025, when fitusiran (Qfitlia), developed by Alnylam Pharmaceuticals, Inc., received marketing authorization for the treatment of hemophilia A and B. This drug has become the first siRNA therapy in the hemophilia treatment landscape. There are several siRNA therapies in the clinical pipeline, which are expected to make market entry in the forecast period and propel the overall market growth.

High cost of approved siRNA therapies may restrain the market growth

Although siRNA therapies are revolutionizing the rare disease treatment landscape, they are priced very high. For instance, patisiran, sold under the brand name Onpattro, is priced at US$ 10,455 per 5 mL supply of 2mg/ml i.v. Solution. The patient needs one infusion once every 3 weeks, based on the indication. The annual spending of a patient will skyrocket if they are not covered through reimbursement. Patients who are not covered under any insurance plan have to pay out of pocket to afford these therapies.

Moreover, the reimbursement of these drugs may pose a significant financial burden on payers, and they may impose stringent criteria to get access to these drugs. Hence, the adoption of siRNA therapies is expected to be hindered in the forecast period.

Small Interfering RNA (siRNA) therapeutics Market Pipeline Analysis

Small Interfering RNA (siRNA) therapeutics Market Segment Analysis

The global small interfering RNA (siRNA) therapeutics market is segmented based on drug, indication, route of administration, and region.

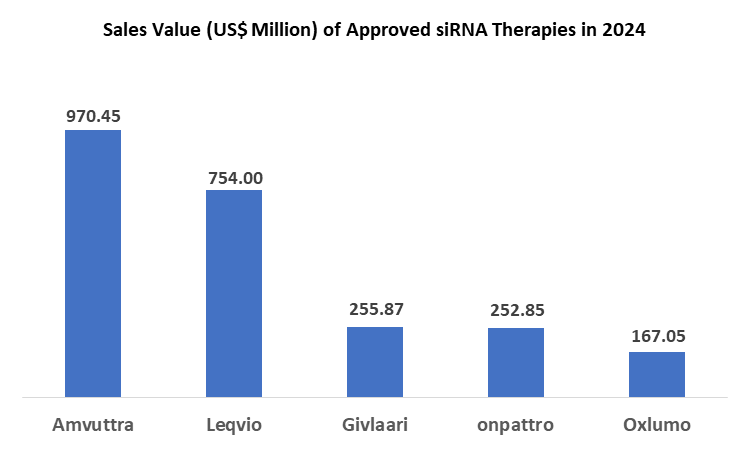

Vutrisiran in the drug segment accounted for 38.05% of the market share in 2024 in the global small interfering RNA (siRNA) therapeutics market.

Vutrisiran, sold under the brand name Amvuttra, is a siRNA therapy developed and marketed by Alnylam Pharmaceuticals, Inc. Vutrisiran is indicated for the treatment of polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults, Cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis in adults to reduce cardiovascular mortality, cardiovascular hospitalizations, and urgent heart failure visits. Vutrisiran received the first approval on June 13, 2022, from the U.S. Food and Drug Administration (FDA). In September 2022, the drug received approval from the European Commission for the treatment of hereditary transthyretin-mediated (hATTR) amyloidosis in adult patients with stage 1 or stage 2 polyneuropathy.

At present Amvuttra is the top selling small interfering RNA therapy which accounted for a total of 38.05% market share with reportedly US$ 970.45 million sales in 2024.

Small Interfering RNA (siRNA) therapeutics Market Geographical Analysis

North America dominated the small interfering RNA (siRNA) therapeutics market with the highest share of 52.2% in 2024

The North America region has become the hub of innovations in the biopharmaceutical industry, and the region, especially the United States, leads in the siRNA therapeutics market. The dominance is mainly attributed to the availability of all approved siRNA therapies in the U.S. market, and the higher proportion of sales each siRNA therapy is generating. For instance, below is the list of top-selling siRNA therapies in terms of sales value and their revenue share from the U.S. market.

siRNA Therapy | Sales (US$ Million) in 2024 | U.S. Sales | U.S. Share |

Amvuttra | 970.45 | 630.61 | 64.98% |

Leqvio | 754.00 | 385.00 | 51.06% |

Givlaari | 255.87 | 165.37 | 64.63% |

Onpattro | 252.85 | 74.78 | 29.57% |

Oxlumo | 167.05 | 62.76 | 37.57% |

This signifies the dominance of the North America region, especially the United States, in the global small-interfering RNA (siRNA) therapeutics market.

Small Interfering RNA (siRNA) Therapeutics Market Major Players

The major players in the small interfering RNA (siRNA) therapeutics market are Alnylam Pharmaceuticals, Inc., Novartis AG, and Novo Nordisk A/S., among others.

Small Interfering RNA (siRNA) Therapeutics Market Emerging Players

The emerging players in the small interfering RNA (siRNA) therapeutics market are Arbutus Biopharma, ADARx Pharmaceuticals, Arrowhead Pharmaceuticals, Inc., and Amgen Inc., among others.

Key Development

In April 2025, Alnylam Pharmaceuticals, Inc. announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) had adopted a positive opinion on recommending approval of vutrisiran for the treatment of wild-type or hereditary transthyretin amyloidosis in adult patients with cardiomyopathy (ATTR-CM).

In March 2025, the U.S. Food and Drug Administration (FDA) approved the 7th siRNA therapy fitusiran (Qfitlia) developed by Alnylam Pharmaceuticals, Inc. for the treatment of Hemophilia A or B. With this approval, fitusiran has become the first siRNA therapy to get approval in the hemophilia landscape, and it works by lowering antithrombin (AT), a protein that inhibits blood clotting.

Market Scope

Metrics | Details | |

CAGR | 17.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Drug | Patisiran, Givosiran, Lumasiran, Inclisiran, Nedosiran, Vutrisiran, and Others |

Indication | Transthyretin Amyloidosis, Acute Hepatic Porphyria, Primary Hyperoxaluria Type 1, Primary Hyperlipidemia, and Others | |

Route of Administration | Intravenous and Subcutaneous | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |