Sleep Aids Market Size and Trends

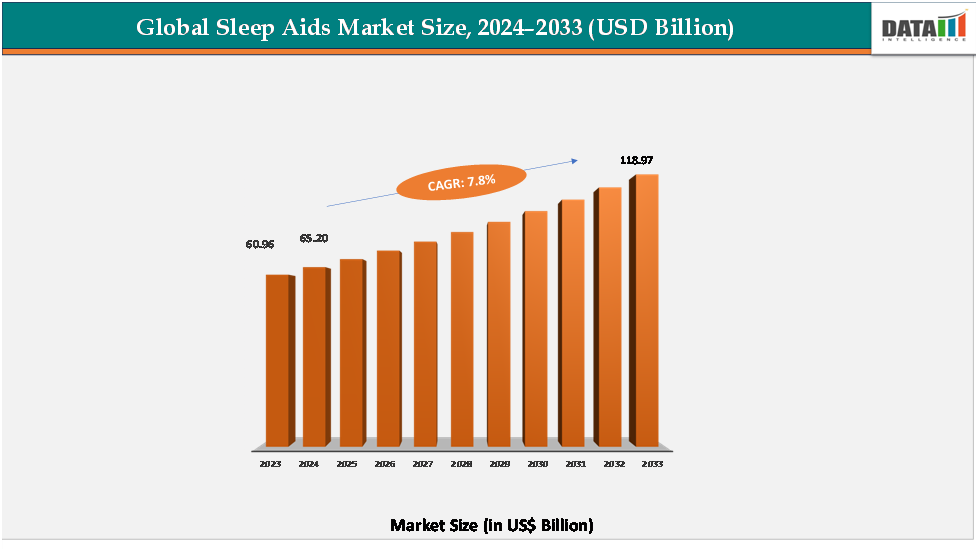

The global sleep aids market reached US$ 60.96billion in 2023, with a rise to US$ 65.20 billion in 2024, and is expected to reach US$ 118.97billion by 2033, growing at a CAGR of 7.8% during the forecast period 2025–2033.

The growing focus on sleep health and overall well-being is reshaping the Sleep Aids market, as modern solutions are enabling safer, more effective, and more sustainable approaches to managing sleep disorders. With their ability to restore healthy sleep patterns, improve cognitive and physical performance, and reduce long-term health risks, these products are empowering individuals to take control of their sleep quality with greater confidence. The rising availability of innovative offerings such as advanced CPAP and BiPAP devices, wearable sleep trackers, smart mattresses, non-invasive therapies, and next-generation medications is meeting the dual demand for clinical effectiveness and lifestyle convenience.

Key Market highlights

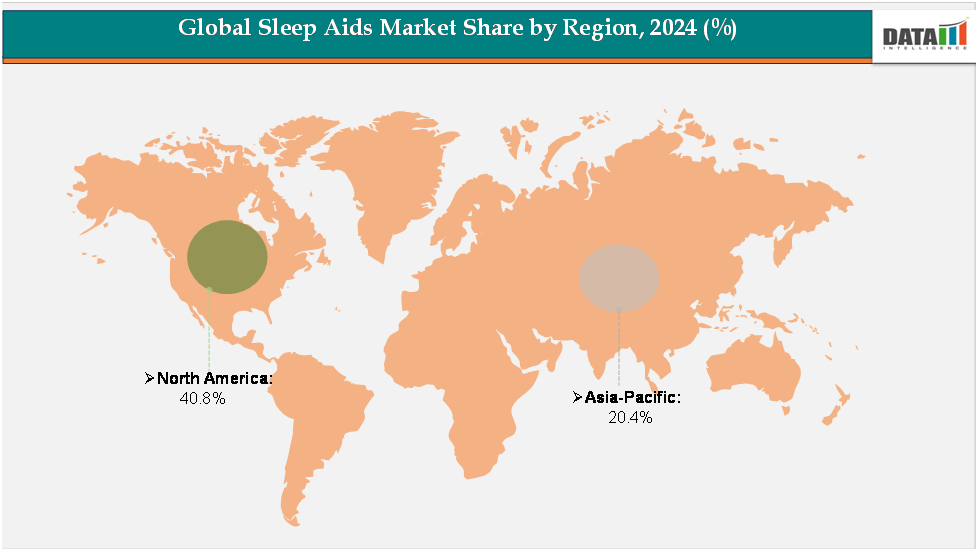

North America dominates the sleep aids market with over 40.8% revenue share, driven by a high prevalence of sleep disorders such as insomnia and sleep apnea, advanced diagnostic capabilities, and widespread adoption of innovative treatment options, including CPAP devices, prescription medications, and digital sleep solutions. Robust reimbursement frameworks, coupled with the presence of leading players and growing consumer awareness about the health impacts of poor sleep, further strengthen the region’s leadership position.

Asia-Pacific is emerging as the fastest-growing region with nearly 20.4% share, fueled by increasing urbanization, rising stress levels, growing disposable incomes, and rapid adoption of sleep aid products in densely populated countries such as China, India, and Japan.

The medications segment leads the sleep aids market, accounting for more than 56.3% of global revenue, owing to their effectiveness in providing rapid relief from insomnia and other sleep-related disorders. Both prescription and over-the-counter drugs remain widely adopted due to their accessibility and immediate impact on sleep regulation.

Market Size & Forecast

2024 Market Size: US$65.20Billion

2033 Projected Market Size: US$118.97Billion

CAGR (2025–2033): 7.8%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Drivers & Restraints

Driver: Rising Prevalence of Sleep Disorders

The rising prevalence of sleep disorders such as insomnia, sleep apnea, restless legs syndrome, and narcolepsy is one of the most significant factors driving the growth of the global sleep aids market. Modern lifestyle changes, including high levels of stress, long working hours, irregular sleep patterns, and increasing dependence on digital devices, have contributed to a steady increase in sleep-related health issues worldwide. At the same time, the aging population is more vulnerable to chronic sleep disturbances due to underlying health conditions, further expanding the affected patient base.

This expanding patient pool is generating strong demand for a broad spectrum of sleep aids, ranging from prescription medications and over-the-counter (OTC) sleep remedies to technologically advanced solutions such as sleep apnea devices, wearable sleep trackers, and behavioral therapies like cognitive behavioral therapy for insomnia (CBT-I). The growing emphasis on preventive healthcare and lifestyle management is also creating opportunities for natural and alternative therapies, including herbal supplements and relaxation-based interventions. Additionally, rising awareness campaigns by healthcare providers and patient advocacy groups about the health risks of untreated sleep disorders are encouraging earlier diagnosis and treatment adoption.

Technological innovation is further fueling market growth, with companies introducing portable, user-friendly CPAP devices, AI-driven sleep monitoring systems, and safer next-generation pharmaceuticals designed to minimize side effects and dependency risks. As the burden of sleep disorders continues to increase and the social and economic costs of poor sleep become more evident, the global sleep aids market is expected to expand rapidly, supported by a combination of rising healthcare expenditure, strong demand for effective solutions, and a growing recognition of sleep health as an essential component of overall well-being.

Restraint: Stringent regulatory requirements

The side effects and dependency risks associated with sleep aids are significant factors that could hinder market growth. Many prescription sleep medications, such as benzodiazepines and non-benzodiazepine hypnotics, are linked to adverse effects, including daytime drowsiness, dizziness, memory impairment, and reduced motor coordination, which raise safety concerns for patients. Moreover, prolonged use of these drugs carries the risk of dependency and tolerance, leading to reduced effectiveness over time and potential withdrawal challenges. Such issues often result in stricter regulatory oversight and caution among healthcare providers when prescribing sleep aids.

For more details on this report - Request for Sample

Segmentation Analysis

The global sleep aids market is segmented by product type, sleep disorder, and region.

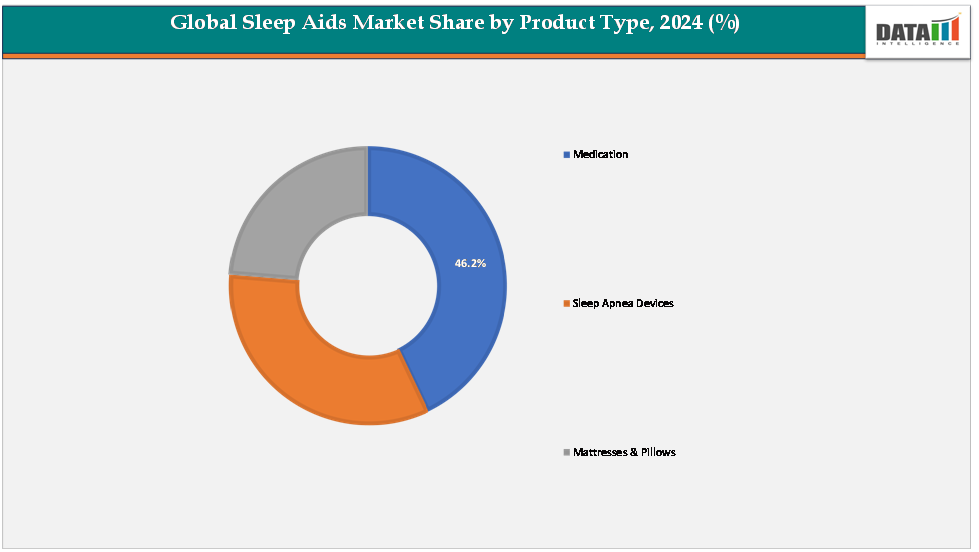

Product Type: The medication segment is estimated to have 46.2% of the sleep aids market share.

Medications currently represent the dominant segment in the sleep aids market, driven by the high prevalence of insomnia and other sleep disorders, along with the quick and effective relief they provide to patients. Prescription drugs such as benzodiazepines, non-benzodiazepine hypnotics, antidepressants, and melatonin receptor agonists remain the most widely used therapeutic option because of their proven efficacy in improving sleep onset and duration. Over-the-counter (OTC) products like antihistamines and melatonin supplements have also gained significant traction due to their accessibility, lower costs, and availability without a prescription. The dominance of medications is further supported by the growing number of individuals self-medicating for occasional sleep problems, increasing awareness of sleep health, and broad physician acceptance of drug-based therapies. The immediate effectiveness of medications continues to secure their leading role in the market, particularly in regions with high rates of stress-induced insomnia and an aging population more prone to sleep disturbances.

The devices segment is estimated to have 34.8% of the sleep aids market share.

The devices segment is expected to be the fastest-growing category in the sleep aids market, fueled by the rising incidence of sleep apnea and other breathing-related sleep disorders, which require long-term and reliable therapeutic solutions. Continuous positive airway pressure (CPAP) machines, mandibular advancement devices, adaptive servo-ventilators, and wearable sleep trackers are gaining strong traction as patients and healthcare providers increasingly shift toward non-pharmacological approaches that minimize the risks of drug dependency and side effects. Advances in technology, such as quieter, more portable CPAP devices, AI-enabled monitoring systems, and improved patient comfort features, are further boosting adoption.

Geographical Analysis

The North America sleep aids market was valued at 40.8%market share in 2024

North America holds the dominant position in the global sleep aids market, largely due to the high prevalence of sleep disorders, advanced healthcare infrastructure, and widespread adoption of both pharmacological and device-based solutions. According to public health agencies, millions of adults in the United States alone suffer from chronic insomnia and sleep apnea, creating a substantial and sustained demand for treatment options. Strong awareness campaigns about the health risks of untreated sleep disorders, combined with easy access to diagnostic facilities and sleep centers, further fuel market dominance.

Moreover, the presence of leading pharmaceutical companies and medical device manufacturers, alongside favorable reimbursement policies, ensures consistent availability and adoption of innovative products such as CPAP devices and advanced therapeutics. For instance, in December 2024, Eli Lilly and Company announced that the U.S. Food and Drug Administration (FDA) had approved Zepbound (tirzepatide) as the first and only prescription treatment for adults with moderate-to-severe obstructive sleep apnea (OSA) who are also living with obesity. Zepbound is intended to help improve sleep disorders in this patient group and is recommended for use alongside a reduced-calorie diet and increased physical activity. These factors collectively secure North America’s leadership role in the global sleep aids market.

The Europe Sleep Aids Market was valued at 22.4% market share in 2024

Europe represents a significant and steadily growing market for sleep aids, characterized by high awareness of sleep health, supportive regulatory frameworks. Countries such as Germany, France, and the United Kingdom are key contributors, with well-established sleep clinics and access to advanced treatment solutions. However, the European market is more cautious compared to North America, as regulatory agencies often emphasize patient safety, leading to stricter guidelines around prescription sleep medications and their potential side effects. This has resulted in a growing preference for non-pharmacological interventions, natural supplements, and innovative devices such as CPAP machines.

Furthermore, the region’s aging population is contributing to a higher incidence of sleep disorders, sustaining demand for therapeutic solutions. While Europe may not grow as rapidly as Asia-Pacific, its focus on safety, quality, and advanced healthcare practices ensures a stable and reliable market position.

The Asia-Pacific Sleep Aids Market was valued at 20.4% market share in 2024

The Asia-Pacific region is emerging as the fastest-growing market for sleep aids, driven by rapid urbanization, increasing stress levels, lifestyle changes, and a rising burden of sleep-related disorders. Countries such as China, India, and Japan are witnessing a surge in cases of insomnia and sleep apnea, fueled by high work-related stress, irregular sleep patterns, and growing obesity rates. Additionally, rising disposable incomes and expanding access to healthcare services are boosting the adoption of both pharmaceutical sleep aids and medical devices. Governments and healthcare organizations are also increasing awareness about sleep health, which is reducing stigma and encouraging diagnosis and treatment. The growing presence of global and regional market players, coupled with technological innovations and affordable solutions tailored for emerging markets, is expected to accelerate growth in Asia-Pacific, making it the most dynamic region in the forecast period.

Competitive Landscape

The major players in the sleep aids market include Merck & Co., Inc., Idorsia Pharmaceuticals Ltd, Pfizer Inc., Lupin Limited, ResMed, Fisher & Paykel Healthcare Limited, SomnoMed, Inspire Medical Systems, Inc., among others.

Key Developments:

- In November 2024, ResMed, a global leader in sleep and digital health solutions, unveiled its next-generation Continuous Positive Airway Pressure (CPAP) device, the AirSense 11, at its Advanced Manufacturing Centre in Tuas, Singapore. The new device is equipped with a suite of advanced features aimed at simplifying the treatment and management of obstructive sleep apnea (OSA), a condition characterized by repeated pauses in breathing during sleep.

Market Scope

Metrics | Details | |

CAGR | 7.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US $Bn) | |

Segments Covered | Product Type | Medication, Sleep Apnea Devices, Mattresses & Pillows |

Sleep Disorder | Insomnia, Sleep Apnea, Restless Legs Syndrome, Narcolepsy, Other Sleep Disorders | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global sleep aids market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report