Obstructive Sleep Apnea (OSA) Market Size

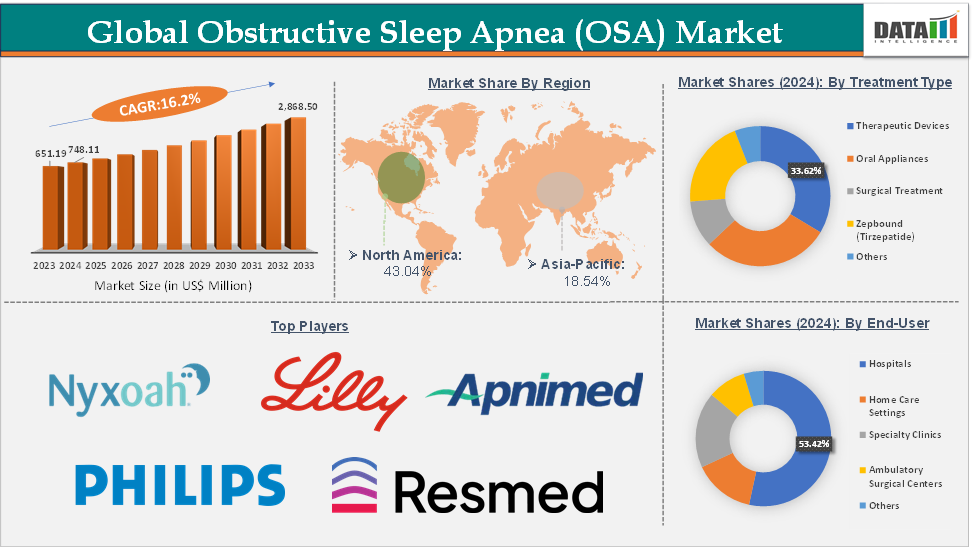

The global obstructive sleep apnea market size reached US$ 748.11 Million in 2024 from US$ 651.19 Million in 2023 and is expected to reach US$ 2,868.50 Million by 2033, growing at a CAGR of 16.2% during the forecast period 2025-2033.

Obstructive Sleep Apnea (OSA) Market Overview

The obstructive sleep apnea (OSA) market is poised for continued growth fueled by technological innovation, expanding patient pools, and increasing integration of digital health solutions. The trend toward personalized medicine and minimally invasive treatment options is expected to open new avenues in OSA management. Additionally, telemedicine and remote patient monitoring are gaining importance, improving treatment adherence and outcomes. The trend toward personalized medicine and minimally invasive treatment options is expected to open new avenues in OSA management. Additionally, telemedicine and remote patient monitoring are gaining importance, improving treatment adherence and outcomes.

Obstructive Sleep Apnea (OSA) Market Executive Summary

Obstructive Sleep Apnea (OSA) Market Dynamics

Drivers:

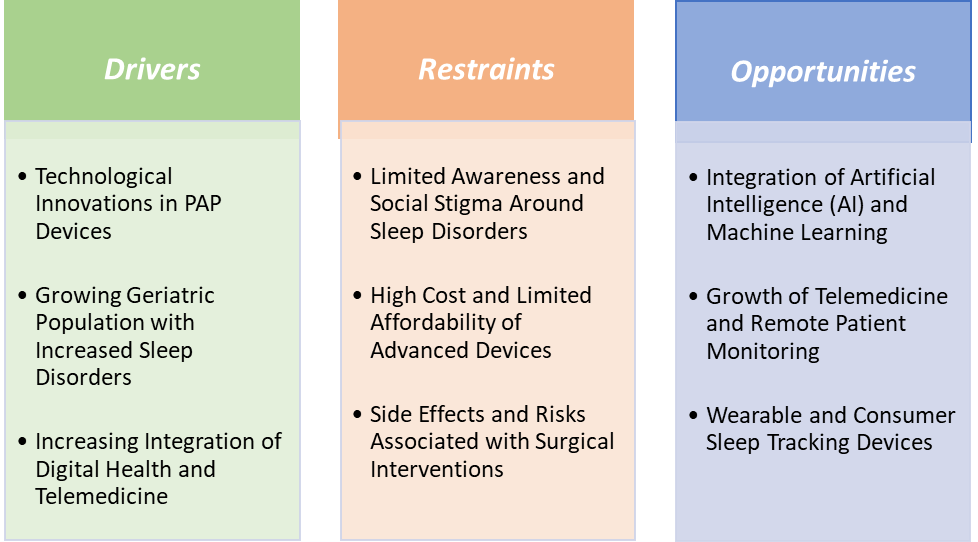

Positive Airway Pressure (PAP) devices, especially Continuous Positive Airway Pressure (CPAP) machines, are the frontline treatment for OSA. Recent technological advances by the major market players in these devices are boosting market growth by improving patient comfort, adherence, diagnostic accuracy, and overall demand.

For instance, in January 2025, ResMed launched AirSense 11 in India. AirSense 11 is the next-generation Continuous Positive Airway Pressure (CPAP) device designed to make it easier for individuals with Obstructive Sleep Apnea (OSA) to start and stay on therapy. AirSense 11, which includes new features like Personal Therapy Assistant and Care Check-In designed to provide tailored guidance to PAP users, helping ease them into therapy and comfortable nightly use. Other features include the availability of remote software updates so users can enjoy the latest version of these tools every night.

A growing geriatric population with increased sleep disorders is also driving the obstructive sleep apnea market growth

The global aging population is expanding rapidly due to increasing life expectancy and declining birth rates. Older adults are more prone to sleep disorders, including Obstructive Sleep Apnea (OSA), due to physiological changes such as decreased muscle tone, changes in airway structure, and higher rates of comorbidities like obesity, cardiovascular disease, and neurological conditions. For instance, every night, more than 54 million Americans with OSA stop breathing, exposing them to serious, long-term health risks.

Studies show that up to 50% of adults over 65 years may suffer from some form of sleep apnea, compared to about 9-38% in the general adult population. The rising geriatric population with OSA symptoms leads to more frequent screenings and diagnoses in hospitals, clinics, and home care settings. Older patients often require tailored therapeutic approaches, increasing demand for specialized PAP devices, oral appliances, and minimally invasive treatments designed for comfort and compliance.

Restraints:

Limited awareness and social stigma around sleep disorders are hampering the growth of the obstructive sleep apnea market

Many individuals remain unaware that symptoms like loud snoring, daytime fatigue, and morning headaches could indicate OSA. According to the American Sleep Apnea Association, up to 80% of moderate to severe OSA cases remain undiagnosed worldwide, primarily due to a lack of awareness. This underdiagnosis limits the number of patients seeking diagnosis and treatment, directly suppressing market growth.

Using devices like CPAP masks during sleep is often perceived as uncomfortable or embarrassing. A survey published in the Journal of Clinical Sleep Medicine found that nearly 40% of patients discontinued CPAP therapy within the first year due to discomfort and social embarrassment. This stigma results in poor adherence and reduced long-term device sales.

Opportunities:

Wearable and consumer sleep tracking devices create a market opportunity for the obstructive sleep apnea market

Wearable devices like smartwatches and dedicated sleep trackers now include sensors that monitor sleep patterns, breathing rates, and oxygen saturation. These devices help users identify potential sleep abnormalities, prompting early consultation and formal OSA diagnosis. The popularity of fitness and health monitoring wearables has increased consumer interest in sleep quality, shifting focus from reactive treatment to proactive prevention. Users detecting irregular sleep or suspected apnea events are more likely to seek professional diagnosis and treatment, expanding the patient pool.

Wearables generate longitudinal sleep data, helping doctors better understand patient sleep patterns outside clinical settings. This data supports improved diagnosis accuracy and personalized treatment plans, enhancing patient outcomes and satisfaction. For instance, Philips’ NightBalance device integrates with consumer sleep data to optimize therapy for positional OSA. This trend is accelerating treatment initiation, thus driving market growth.

For more details on this report – Request for Sample

Obstructive Sleep Apnea (OSA) Market, Segment Analysis

The global obstructive sleep apnea (OSA) market is segmented based on treatment type, severity, end-user, and region.

The therapeutic devices segment from the treatment type is expected to hold 33.62% of the market share in 2024 in the obstructive sleep apnea market

Therapeutic devices, particularly Continuous Positive Airway Pressure (CPAP) machines, are the gold standard and first-line treatment for moderate to severe OSA. CPAP devices keep the airway open during sleep by delivering constant airflow, effectively reducing apnea events and improving patient outcomes. According to the American Sleep Apnea Association, about 80-85% of diagnosed OSA patients are prescribed PAP therapy. The widespread clinical acceptance and proven efficacy drive high demand for these devices globally.

Innovations such as smart connectivity increase comfort and adherence. For instance, in August 2024, Inspire Medical Systems, Inc. announced the FDA approval of the Inspire V therapy system, which includes the next-generation neurostimulator and the associated Bluetooth patient remote and physician programmer.

Because therapeutic devices directly address the root cause of OSA and offer proven clinical benefits, they dominate the market in terms of sales, innovation, and patient adoption. Their combination of effective treatment, ongoing consumable needs, and home-use convenience secures their leading position in the OSA market.

Obstructive Sleep Apnea (OSA) Market, Geographical Analysis

North America is expected to dominate the global obstructive sleep apnea market with a 43.04% share in 2024

North America, especially the United States, has one of the highest reported OSA prevalence rates, with more than 54 million Americans with OSA who stop breathing every night. High awareness among patients and healthcare providers drives increased diagnosis and treatment rates. Additionally, North America is home to leading and emerging market players such as ResMed, Philips Respironics, and Eli Lilly and Company, who innovate and launch new products rapidly.

For instance, in December 2024, Eli Lilly and Company announced the U.S. Food and Drug Administration (FDA) approved Zepbound (tirzepatide) as the first and only prescription medicine for adults with moderate-to-severe obstructive sleep apnea (OSA) and obesity. Zepbound may help adults with moderate-to-severe obstructive sleep apnea and obesity improve their sleep disorder. It should be used with a reduced-calorie diet and increased physical activity.

Asia-Pacific is growing at the fastest pace in the obstructive sleep apnea market, holding 18.54% of the market share

Increasing urbanization, changing lifestyles, and rising obesity rates have contributed to a growing incidence of OSA in APAC countries. Studies estimate that the OSA prevalence in countries like China and India is rising rapidly, with figures reaching 9-20% among adults, but many cases remain undiagnosed. Historically, awareness and diagnosis of sleep disorders in APAC were low, but recent government initiatives and growing healthcare infrastructure are boosting screening and diagnosis.

Obstructive Sleep Apnea (OSA) Market Competitive Landscape

Top companies in the obstructive sleep apnea (OSA) market include Nyxoah SA., Eli Lilly and Company, Koninklijke Philips N.V., Apnimed, Inc., Somnics Health, Inc., ResMed, and Inspire Medical Systems, Inc., among others.

Obstructive Sleep Apnea (OSA) Market, Key Developments

In June 2025, Mosanna Therapeutics secured $80 million in a series A round to develop MOS-118 as a treatment for the nearly 1 billion people globally with obstructive sleep apnea (OSA). The company has completed the formulation work to make the drug into a nasal spray and the initial proof-of-concept animal studies and is now ready to enter clinical trials in patients with OSA.

In June 2025, Mosanna Therapeutics announced the close of $80 million in Series A funding. The company is developing an easy-to-use nighttime nasal spray to treat obstructive sleep apnea that will help restore the body's natural airway control. The financing was led by Pivotal BioVenture Partners and EQT Life Sciences, along with Forbion, Broadview Ventures, and Norwest as co-lead investors. Returning investors included founding investor Forty51 Ventures, as well as Supermoon Capital and High-Tech Gründerfonds (HTGF).

In June 2025, Somnics Health, a pioneer in next-generation sleep apnea solutions, launched iNAP Essentials, a breakthrough program giving patients access to iNAP Sleep Therapy for just $58/month over 24 months. This new initiative removes one of the biggest barriers to treatment—cost—and expands access to comfortable, mask-free therapy for patients with Obstructive Sleep Apnea (OSA).

In May 2025, Apnimed, Inc., a pharmaceutical company building the industry-leading portfolio of first-in-class oral drug candidates that address the root causes of obstructive sleep apnea (OSA) and other sleep-related breathing diseases, announced positive topline results from its pivotal Phase 3 SynAIRgy clinical trial evaluating the efficacy and safety of Apnimed’s lead candidate AD109 (aroxybutynin 2.5mg/atomoxetine 75mg) in adults living with mild, moderate, and severe OSA, and across all weight classes.

Obstructive Sleep Apnea (OSA) Market Scope

Metrics | Details | |

CAGR | 16.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Treatment Type | Therapeutic Devices, Oral Appliances, Surgical Treatment, Zepbound (Tirzepatide), and Others |

Severity | Mild OSA, Moderate OSA, and Severe OSA | |

End-User | Hospitals, Home Care Settings, Specialty Clinics, Ambulatory Surgical Centers, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global obstructive sleep apnea market report delivers a detailed analysis with 53 key tables, more than 53 visually impactful figures, and 135 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here