Global Viral Vector and Plasmid DNA Testing Services Market: Industry Outlook

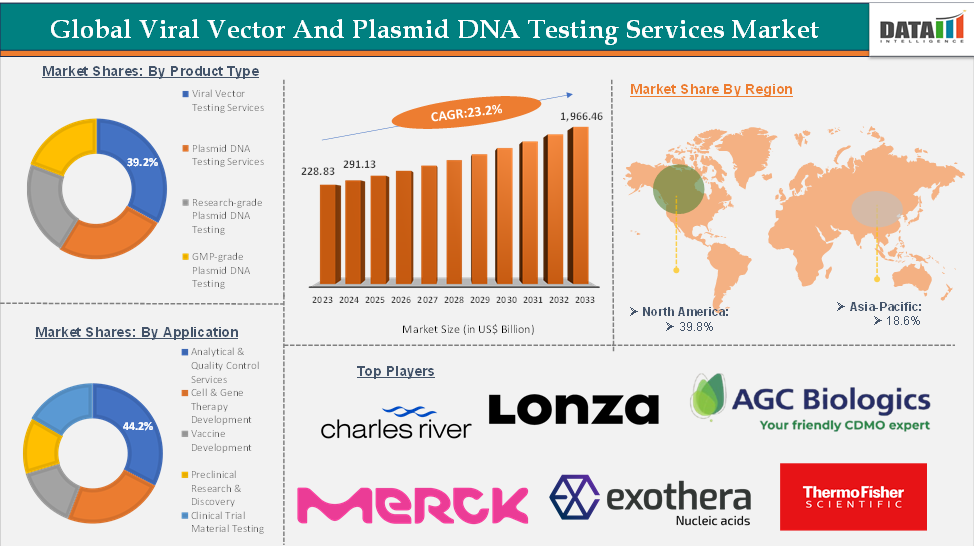

The global viral vector and plasmid DNA testing services market reached US$ 228.83 million in 2023, with a rise of US$ 291.13 million in 2024, and is expected to reach US$ 1,966.46 million by 2033, growing at a CAGR of 23.2% during the forecast period 2025-2033.

The viral vector and plasmid DNA testing services space is advancing rapidly, driven by innovations that are redefining quality control and safety standards in gene and cell therapy manufacturing. Next-generation analytical platforms now offer higher sensitivity, faster turnaround times, and multiplex capabilities, enabling precise detection, characterization, and quantification of viral vectors and plasmid DNA across various therapeutic modalities. Automated workflows integrated with digital data management systems are streamlining compliance with stringent regulatory requirements, while AI-powered analytics are improving assay optimization and process validation. As the biopharmaceutical industry scales up gene and cell therapy pipelines, Viral Vector and Plasmid DNA Testing Services are emerging as a critical, intelligent, and indispensable component of end-to-end therapeutic development.

Executive Summary

Dynamics: Drivers & Restraints

Driver: Rising Demand for Gene And Cell Therapies

The rising demand for gene and cell therapies is poised to significantly drive the Viral Vector and Plasmid DNA Testing Services Market, as these cutting-edge treatments depend on the use of high-quality, precisely characterized viral vectors and plasmid DNA. With an expanding pipeline of therapies targeting rare genetic disorders, cancers, and chronic diseases, the need for rigorous testing to ensure product safety, efficacy, and compliance with stringent regulatory guidelines is greater than ever.

Comprehensive analytical assessments are critical at every stage of development and manufacturing. As biopharmaceutical companies increasingly scale up production and transition from clinical phases to commercial launches, the reliance on specialized testing services is expected to grow rapidly, cementing their role as a vital component in delivering safe and effective gene and cell therapies to patients worldwide.

Restraint: High Cost of Advanced Testing Services

The high cost of advanced testing services could act as a significant restraint on the viral vector and plasmid dna testing services Market, particularly for small and emerging biopharmaceutical companies with limited budgets. Sophisticated assays such as next-generation sequencing (NGS), droplet digital PCR (ddPCR), and comprehensive residual impurity analyses require specialized equipment, highly skilled personnel, and strict adherence to Good Manufacturing Practice (GMP) standards.

For more details on this report, Request for Sample

Segmentation Analysis

The global viral vector and plasmid dna testing services market is segmented based on product type, technology, application, end-user, and region.

Product Type:

The viral vector testing services segment is estimated to have 39.2% of the viral vector and plasmid DNA testing services market share.

The viral vector testing services segment is expected to dominate the viral vector and plasmid DNA testing services market due to the increasing use of viral vectors in the development of gene and cell therapies. These vectors play a critical role in delivering therapeutic genetic material to target cells, making their quality, safety, and regulatory compliance paramount. As a result, demand for specialized testing services continues to rise. With increasing demand, the market players are increasingly providing services and expanding them across the globe. For instance, in June 2024, Charles River Laboratories partnered with the Gates Institute at the University of Colorado Anschutz Medical Campus under a CDMO agreement to develop GMP-grade lentiviral vectors (LVVs). These vectors will support novel CAR T-cell therapies targeting hematological cancers, leveraging Charles River’s expertise in cell and gene therapy manufacturing.

The surge in clinical trials, coupled with the expansion of commercial-scale manufacturing, further amplifies the need for robust viral vector testing to meet stringent FDA, EMA, and other international guidelines. Technological advancements in qPCR, NGS, and digital PCR are also enabling faster, more sensitive, and more accurate testing, solidifying the segment’s leadership in the market.

Geographical Share Analysis

The North America viral vector and plasmid dna testing services market was valued at 40.2% market share in 2024

North America is dominating the viral vector and plasmid dna testing services market, driven by its strong biopharmaceutical ecosystem, advanced research infrastructure, and high concentration of leading gene and cell therapy developers. The region benefits from a robust network of GMP-certified manufacturing facilities, state-of-the-art analytical laboratories, and highly skilled scientific talent, enabling rapid adoption of advanced testing technologies such as next-generation sequencing, digital PCR, and high-resolution chromatography.

Supportive regulatory frameworks from the FDA, coupled with substantial R&D investments and a growing number of clinical trials, further fuel market growth. Additionally, the presence of key industry players and established outsourcing partnerships ensures comprehensive end-to-end testing solutions, positioning North America as the global hub for quality assurance in gene and cell therapy production. For instance, in August 2025, Bionova Scientific, a biologics CDMO and subsidiary of Japan’s Asahi Kasei, inaugurated a 10,000 sq. ft. plasmid DNA (pDNA) development and production facility in The Woodlands, Texas. This expansion enhances Bionova’s existing antibody and protein CDMO capabilities and strengthens its portfolio in mRNA and viral vector-based cell and gene therapies, enabling broader support for biotherapeutic customers.

Major Players

The major players in the viral vector and plasmid dna testing services market include Charles River Laboratories, Thermo Fisher Scientific Inc., Merck KGaA, PathoQuest, Coriolis Pharma, Lonza, AGC Biologics, Exothera, Batavia Biosciences B.V. and ReiThera srl, among others.

Key Developments

Report Scope

Metrics | Details | |

CAGR | 23.2% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Service Type | Viral Vector Testing Services, Plasmid DNA Testing Services, Research-grade Plasmid DNA Testing, GMP-grade Plasmid DNA Testing |

Testing Stage | Upstream Testing, Downstream Testing | |

| Application | Analytical & Quality Control Services, Cell & Gene Therapy Development, Vaccine Development (viral vector–based and DNA vaccines), Preclinical Research & Discovery, Clinical Trial Material Testing |

| End-User | Pharmaceutical & Biopharmaceutical Companies, Contract Development & Manufacturing Organizations (CDMOs), Contract Research Organizations (CROs), Academic & Research Institutes |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global viral vector and plasmid DNA testing services market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here