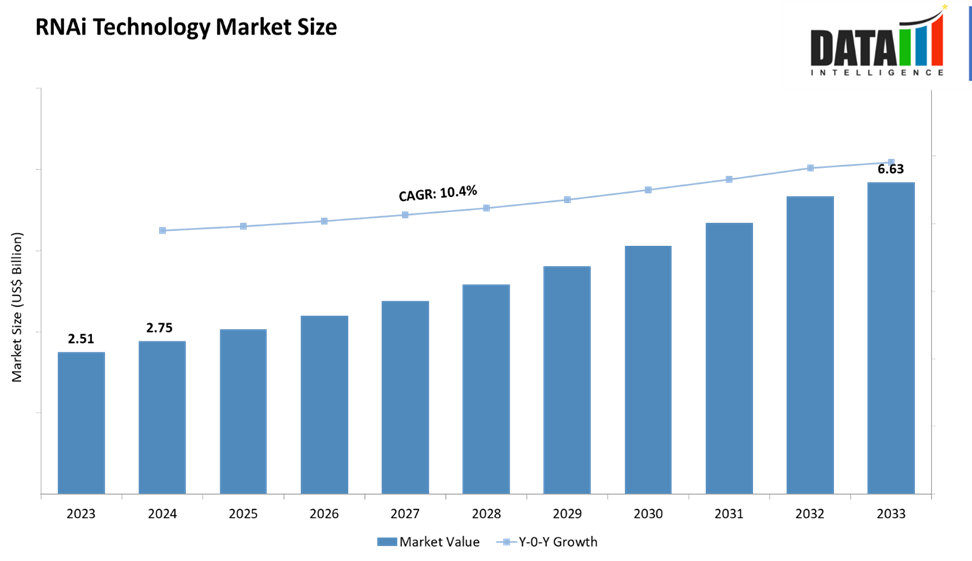

RNAi Technology Market Size and Growth

The global RNAi technology market size reached US$ 2.75 Billion in 2024 from US$ 2.51 Billion in 2023 and is expected to reach US$ 6.63 Billion by 2033, growing at a CAGR of 10.4% during the forecast period 2025-2033. The market is expanding rapidly, driven by the clinical success of approved siRNA drugs, advances in delivery systems like GalNAc conjugates and lipid nanoparticles, and rising investments from pharma and biotech partnerships. North America currently dominates revenues, but Asia-Pacific is poised for the fastest growth due to increasing R&D and manufacturing capacity. The market outlook is strong, particularly in rare diseases, oncology, and metabolic disorders, though challenges in extra-hepatic delivery and high development costs remain key hurdles.

Key Market Trends & Insights

The RNAi market is experiencing robust expansion, underpinned by the successful commercialization of multiple siRNA-based drugs and a growing number of late-stage clinical trials that continue to de-risk the modality. The approval of RNAi therapies for rare genetic and hepatic diseases has significantly increased confidence among regulators, investors, and pharmaceutical companies, creating a positive feedback loop for further R&D funding and partnership activity.

RNAi is increasingly positioned within a crowded therapeutic ecosystem that includes antisense oligonucleotides (ASOs), CRISPR-based gene editing, and mRNA therapeutics. This competitive convergence is pushing RNAi companies to differentiate themselves through improved chemistry, extended durability of effect, and combination approaches. At the same time, intellectual property battles and overlapping innovation spaces underscore the importance of strategic alliances and clear positioning to secure long-term market share.

North America dominates the RNAi technology market with the largest revenue share of 42.73% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 11.7% over the forecast period.

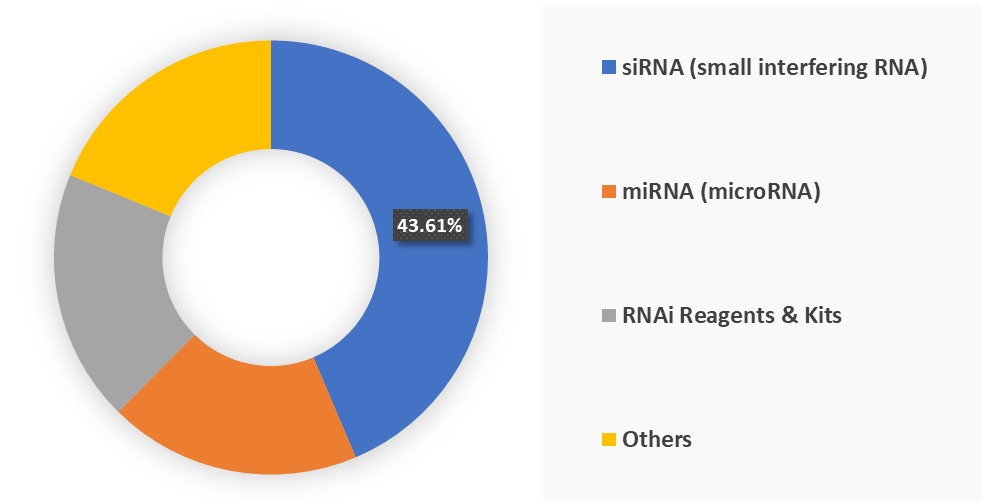

Based on product type, the siRNA (small interfering RNA) segment led the market with the largest revenue share of 43.61% in 2024.

The major market players in the RNAi technology market are Alnylam Pharmaceuticals, Inc., Thermo Fisher Scientific Inc., Merck KGaA, Creative Biolabs, GenScript, Revvity, Promega Corporation, OriGene Technologies, Inc. and Altogen Biosystems, among others

Market Size & Forecast

2024 Market Size: US$ 2.75 Billion

2033 Projected Market Size: US$ 6.63 Billion

CAGR (2025–2033): 10.4%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

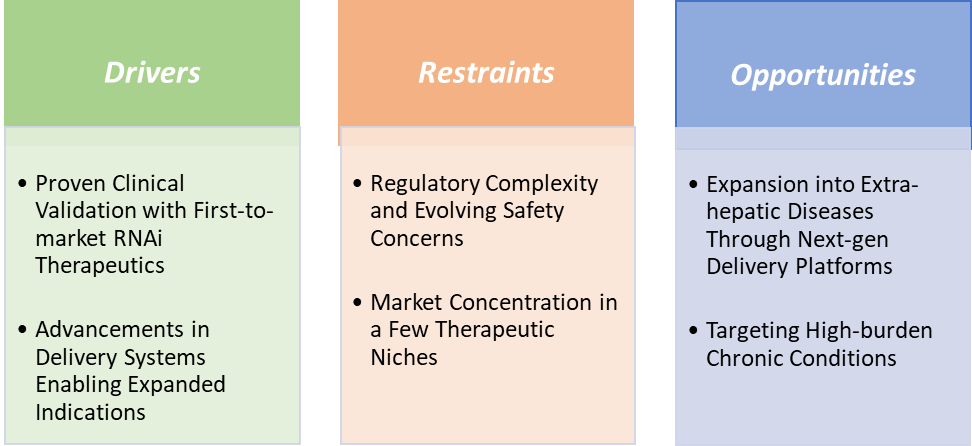

Market Dynamics

Drivers-Proven clinical validation with first-to-market RNAi therapeutics is significantly driving the RNAi technology market growth

The proven clinical validation of first-to-market RNAi therapeutics is one of the most powerful catalysts driving the RNAi technology market’s growth. For years, RNAi was viewed largely as a promising research tool, but skepticism persisted around its clinical viability due to delivery and safety challenges. This changed with the approval of Onpattro (patisiran) in 2018, the first siRNA-based drug approved for treating hereditary transthyretin-mediated amyloidosis. Its success not only validated RNAi’s therapeutic potential but also demonstrated that gene silencing could translate into meaningful patient outcomes.

This milestone was quickly followed by other approvals, such as Givlaari (givosiran) for acute hepatic porphyria, Oxlumo (lumasiran) for primary hyperoxaluria, and Leqvio (inclisiran) for hypercholesterolemia, collectively establishing RNAi as a credible therapeutic modality. Each approval has progressively built trust among regulators, investors, and pharmaceutical companies, reducing uncertainties around safety, durability, and regulatory pathways.

These successes have proven RNAi’s scalability beyond ultra-rare diseases, with inclisiran marking a significant step into the large cardiovascular market. The commercial performance of these drugs, combined with positive Phase III trial results from emerging candidates, has attracted major partnerships and licensing deals between RNAi-focused biotechs like Alnylam and Arrowhead and global pharma leaders. This validation loop successful approvals driving partnerships, funding, and expanded pipelines, is significantly accelerating the overall RNAi market, transforming it from a niche innovation into a mainstream therapeutic platform.

Restraints-Regulatory complexity and evolving safety concerns are hampering the growth of the RNAi technology market

The growth of the RNAi technology market is hampered by ongoing regulatory complexity and evolving safety concerns, which create hurdles for both developers and investors. Despite several successful approvals, regulatory agencies like the FDA and EMA continue to scrutinize RNAi drugs closely due to risks such as off-target gene silencing, immune activation, and hepatotoxicity. Since RNAi therapies often involve repeat dosing for chronic diseases, regulators demand long-term safety data, which prolongs clinical timelines and increases costs. Manufacturing complexities, particularly in ensuring consistent quality of chemically modified oligonucleotides, add another layer of regulatory oversight.

Moreover, uncertainties remain around how RNAi therapies will be evaluated against competing modalities like CRISPR or antisense oligonucleotides, leading to inconsistencies in trial design expectations. These regulatory bottlenecks, combined with the lingering perception of RNAi as a “new” modality, slow down approvals and can dampen investor confidence when unexpected safety issues arise in clinical trials. As a result, while regulatory acceptance of RNAi has improved, the high bar for safety and evolving guidelines remain significant restraints to faster market growth.

For more details on this report – Request for Sample

Market Segment Analysis

The RNAi technology market is segmented based on product type, therapeutic application, end-user, and region.

Product Type-The siRNA (small interfering RNA) segment is dominating the RNAi technology market with a 43.61% share in 2024

The siRNA (small interfering RNA) segment is dominating the RNAi technology market because it has delivered the most successful and clinically validated products to date, establishing itself as the core therapeutic modality in RNAi. siRNAs are synthetic double-stranded oligonucleotides that precisely silence disease-causing genes, and their design flexibility, combined with advances in delivery technologies such as GalNAc conjugates and lipid nanoparticles, has made them commercially viable.

The landmark approval of Onpattro (patisiran) in 2018 for hereditary transthyretin-mediated amyloidosis was the first breakthrough, proving siRNA’s potential in rare genetic diseases. This was followed by other Alnylam products like Givlaari (givosiran) for acute hepatic porphyria, Oxlumo (lumasiran) for primary hyperoxaluria, and Amvuttra (vutrisiran), which further validated siRNA’s role in treating liver-related disorders. Additionally, Leqvio (inclisiran), co-developed by Novartis and Alnylam, marked a major expansion of siRNA into the cardiovascular market, addressing high cholesterol in a much larger patient population. These successes demonstrate siRNA’s scalability beyond ultra-rare diseases, making it the most commercially advanced RNAi segment.

Market Geographical Share

North America is expected to dominate the RNAi technology market with a 44.13% in 2024

North America holds dominance in the RNAi technology market due to its advanced biotech ecosystem, strong funding landscape, and early regulatory approvals of pioneering RNAi drugs. The US, in particular, is home to industry leaders such as Alnylam Pharmaceuticals, which has successfully commercialized multiple siRNA therapies, including Onpattro (patisiran), Givlaari (givosiran), and Oxlumo (lumasiran), setting global benchmarks for RNAi therapeutics. The region also spearheaded the launch of Leqvio (inclisiran) in collaboration with Novartis, marking a major expansion into the high-prevalence cardiovascular disease space.

North America benefits from supportive regulatory frameworks, with the FDA granting designations like orphan drug and breakthrough therapy that have accelerated development timelines for RNAi assets. Additionally, strong academic institutions and research centers in the US and Canada drive innovation in RNAi delivery systems and preclinical research. The presence of established pharmaceutical companies actively partnering with RNAi-focused biotechs further strengthens commercialization pathways. These factors, combined with a high prevalence of genetic and metabolic disorders, robust reimbursement infrastructure, and significant venture capital interest, ensure that North America continues to lead in both revenue share and pipeline advancement in the RNAi technology market.

Market Companies and Competitive Landscape

Top companies in the RNAi technology market include Alnylam Pharmaceuticals, Inc., Thermo Fisher Scientific Inc., Merck KGaA, Creative Biolabs, GenScript, Revvity, Promega Corporation, OriGene Technologies, Inc. and Altogen Biosystems, among others.

Alnylam Pharmaceuticals, Inc.: Alnylam Pharmaceuticals, Inc. is the undisputed leader in the RNAi technology market, having pioneered the first FDA-approved siRNA drug, Onpattro (patisiran), and subsequently expanding its portfolio with Givlaari, Oxlumo, and Amvuttra. The company has established a stronghold in rare genetic and hepatic disorders while also expanding into broader areas like cardiovascular disease through partnerships, such as with Novartis for Leqvio (inclisiran). With a robust pipeline, proprietary delivery platforms, and strategic collaborations, Alnylam continues to set industry benchmarks, driving both innovation and commercialization in RNAi therapeutics.

Recent Developments

In March 2025, Alnylam Pharmaceuticals, Inc., the leading RNAi therapeutics company, highlighted the significance of the US Food and Drug Administration’s (FDA) approval of Qfitlia (fitusiran), the sixth Alnylam-discovered RNAi therapeutic approved in the U.S., and the first and only therapeutic to lower antithrombin (AT), a protein that inhibits blood clotting, to promote thrombin generation to rebalance hemostasis and prevent bleeds. Qfitlia is indicated in the U.S. for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in adult and pediatric patients 12 years of age and older with hemophilia A or B, with or without factor VIII or IX inhibitors (neutralizing antibodies).

In March 2025, Alnylam Pharmaceuticals, Inc. announced the U.S. Food and Drug Administration (FDA) approval of the supplemental New Drug Application (sNDA) for its RNAi therapeutic, AMVUTTRA (vutrisiran), for the treatment of the cardiomyopathy of wild-type or hereditary transthyretin-mediated amyloidosis (ATTR-CM) in adults to reduce cardiovascular mortality, cardiovascular hospitalizations and urgent heart failure visits. The approval expands the indication for AMVUTTRA, which now becomes the first and only therapeutic approved by the FDA for the treatment of ATTR-CM and the polyneuropathy of hereditary transthyretin-mediated amyloidosis (hATTR-PN) in adults.

Market Scope

Metrics | Details | |

CAGR | 10.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | siRNA (small interfering RNA), miRNA (microRNA), RNAi Reagents & Kits, and Others |

Therapeutic Application | Rare Genetic Disorders, Oncology, Cardiovascular & Metabolic Disorders, Neurological or Neurodegenerative Disorders, Infectious Diseases, and Others | |

End-User | Pharmaceutical & Biotech Companies, Academic & Research Institutes, Contract Research Organizations (CROs) & CDMOs and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The RNAi technology market report delivers a detailed analysis with 59 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more biotechnology-related reports, please click here