Respiratory Syncytial Virus (RSV) Market Size & Industry Outlook

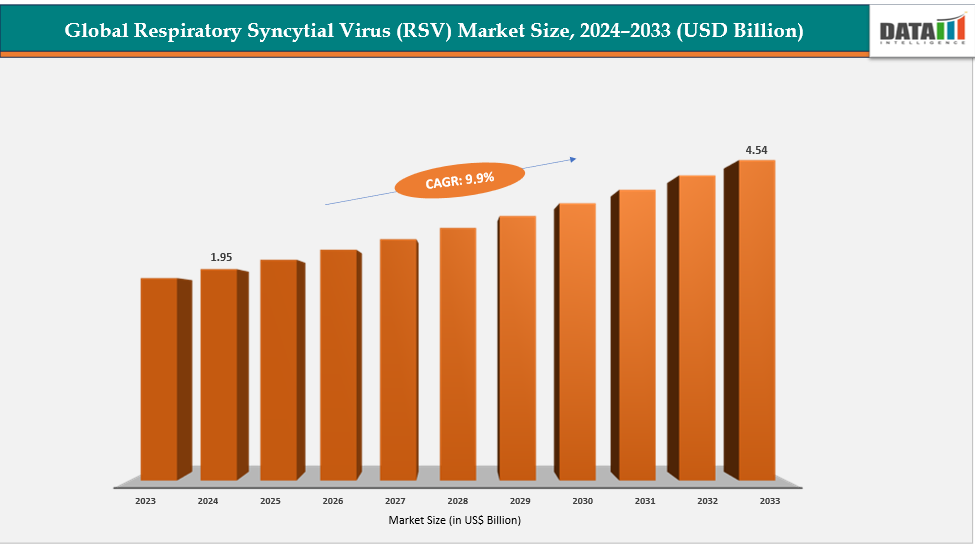

The global respiratory syncytial virus (RSV) market size reached US$ 1.95 billion in 2024 is expected to reach US$ 4.54 billion by 2033, growing at a CAGR of 9.9% during the forecast period 2025-2033. The growing healthcare awareness and expansion of public health initiatives are major drivers of the Respiratory Syncytial Virus (RSV) market in 2025. Governments and health agencies are increasingly emphasizing preventive healthcare and vaccine education following the global resurgence of RSV cases post-COVID-19.

For instance, in 2025, several countries, including the U.S., Japan, and Australia, have intensified public awareness campaigns highlighting the risks of RSV in infants and older adults. The Centers for Disease Control and Prevention (CDC) in the U.S. has expanded its outreach programs to promote maternal RSV vaccination and monoclonal antibody prophylaxis for infants during the 2024–2025 season. Similarly, Japan’s Ministry of Health and various European public health bodies are running awareness drives to improve early diagnosis and vaccination uptake.

These initiatives are increasing patient engagement, improving vaccine acceptance, and driving higher product demand. The combination of government-led immunization programs, healthcare provider education, and media-driven awareness is strengthening the overall market momentum for RSV preventive solutions in 2025.

Key Highlights

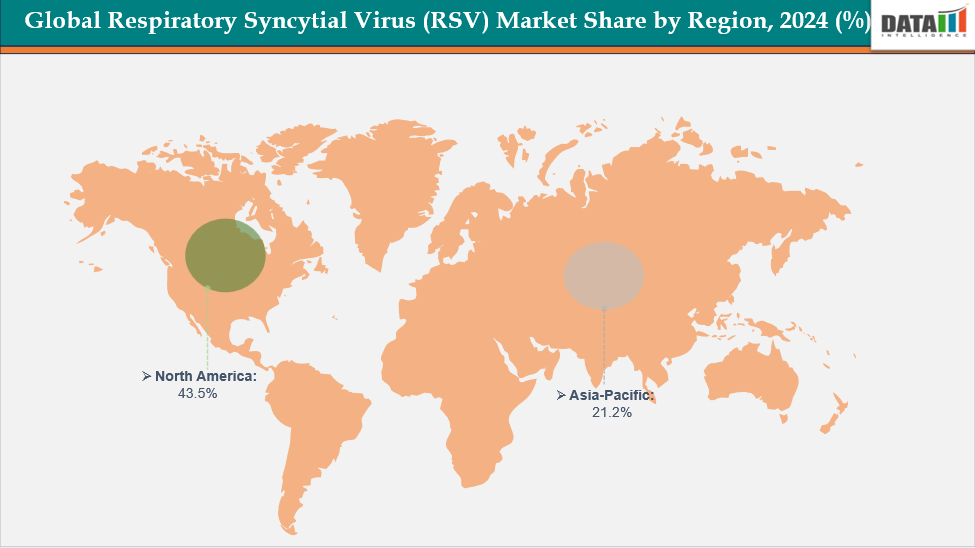

- North America dominates the Respiratory Syncytial Virus (RSV) market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

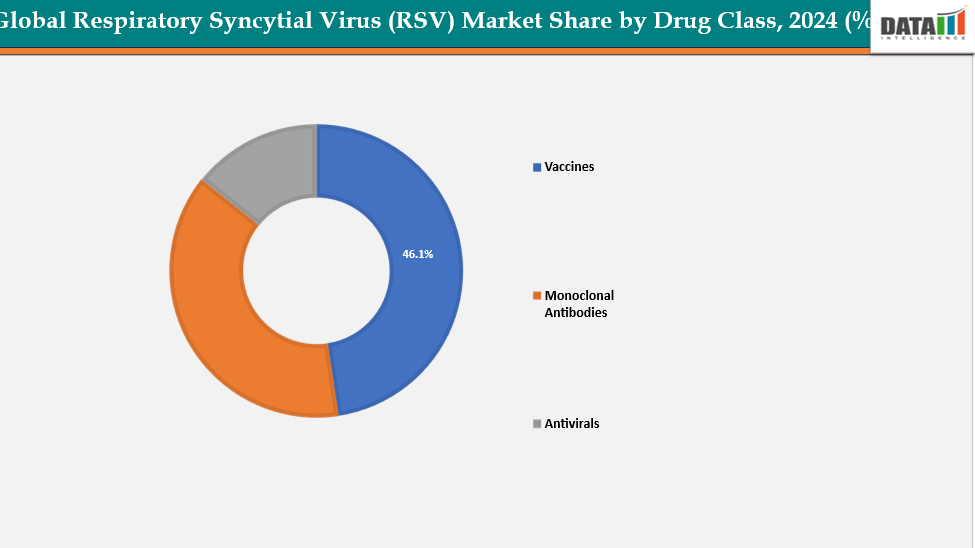

- Based on drug class, vaccines segment led the market with the largest revenue share of 46.1% in 2024.

- The major market players in the Respiratory Syncytial Virus (RSV) market includes Pfizer Inc, GSK, Moderna, Inc, AstraZeneca plc, Sanofi S.A., Merck & Co., Inc. and among others.

Market Dynamics

Drivers: Rising prevalence of RSV infections driving the respiratory syncytial virus (RSV) market growth

The rising prevalence of Respiratory Syncytial Virus (RSV) infections is a key driver accelerating growth in the global RSV market. RSV remains one of the leading causes of acute lower respiratory tract infections, particularly among infants, older adults, and immunocompromised individuals.

According to the Centers for Disease Control and Prevention (CDC), RSV leads to approximately 58,000–80,000 hospitalizations annually among children under 5 years and around 60,000–160,000 hospitalizations in adults aged 65 years and older in the U.S. alone. Similarly, global estimates from the World Health Organization (WHO) suggest that RSV causes more than 30 million lower respiratory tract infections and over 100,000 deaths annually in children under 5 years, mostly in developing countries.

This high and recurring disease burden has created a significant unmet medical need, prompting pharmaceutical companies to invest in vaccine development, monoclonal antibodies, and antiviral therapies. The seasonal resurgence of RSV cases, along with the increasing awareness of its severity, continues to drive demand for effective preventive and treatment solutions in this market.

Restraints: High development, manufacturing and cold-chain costs for vaccines and biologics are hampering the growth of the respiratory syncytial virus (RSV) market

The high development, manufacturing, and cold-chain costs associated with vaccines and biologics present a significant challenge in the Respiratory Syncytial Virus (RSV) market. Developing advanced biologics such as monoclonal antibodies and prefusion F-protein–based vaccines require complex R&D processes, extensive clinical trials, and compliance with stringent regulatory standards—all of which substantially raise overall costs. On average, the R&D investment for a new vaccine can exceed USD 1–2 billion, and the manufacturing cost per dose is much higher compared to conventional small-molecule drugs due to the need for cell-culture systems and purification technologies.

For more details on this report – Request for Sample

Respiratory Syncytial Virus (RSV) Market, Segment Analysis

The global Respiratory Syncytial Virus (RSV) market is segmented based on Drug Class, Age Group, Distribution Channel and region.

Drug Class: The vaccines segment from drug class segment to dominate the respiratory syncytial virus (RSV) market with a 46.1% share in 2024

The Vaccine segment is a major driving force in the Respiratory Syncytial Virus (RSV) market, propelled by recent regulatory approvals and growing public health emphasis on prevention. The introduction of vaccines targeting both older adults and pregnant women (for infant protection through maternal immunization) has significantly expanded the eligible population base. Strong clinical evidence demonstrating substantial reductions in RSV-related hospitalizations and severe respiratory infections is boosting physician confidence and vaccine uptake.

For instance, in October 2024, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) has approved ABRYSVO, the company’s bivalent RSV prefusion F (RSVpreF) vaccine, for the prevention of lower respiratory tract disease (LRTD) caused by RSV in adults aged 18 to 59 years who are at increased risk of developing severe RSV illness. With this approval, ABRYSVO now holds the broadest indication among RSV vaccines for adults, expanding its previous approval beyond individuals aged 60 years and older.

Distribution Channel: The hospital pharmacies segment is estimated to have a 54.1% of the respiratory syncytial virus (RSV) market share in 2024

The Hospital Pharmacies segment plays a crucial role in driving growth within the Respiratory Syncytial Virus (RSV) market. These pharmacies serve as the primary distribution points for RSV vaccines, monoclonal antibodies, and supportive therapeutics used during hospitalizations for severe RSV infections. The increasing rate of infant and elderly admissions due to RSV-related respiratory complications has boosted the demand for prophylactic and therapeutic agents directly dispensed through hospital channels. Hospitals maintain strong purchasing capabilities and are early adopters of new preventive options, particularly for high-risk neonatal and geriatric patients.

Additionally, the growing integration of RSV immunization programs within hospital-based maternal care and neonatal intensive care units (NICUs) further accelerates the uptake of long-acting antibodies and maternal vaccines. The presence of well-established cold-chain systems and in-house vaccination infrastructure enables efficient storage and administration of temperature-sensitive biologics, making hospital pharmacies a preferred point of access for RSV-related products.

Geographical Analysis

North America dominates the global Respiratory Syncytial Virus (RSV) market with a 43.5% in 2024

The RSV market in North America is primarily driven by the growing availability of novel preventive options such as long-acting monoclonal antibodies (nirsevimab/Beyfortus) and adult or maternal vaccines. The strong recommendations from the CDC and ACIP have significantly boosted awareness and adoption among healthcare providers.

In the United States, the market growth is supported by robust public health initiatives and quick integration of RSV prophylaxis into immunization schedules. The large burden of infant and elderly hospitalizations has strengthened the demand for vaccines and antibody-based products. Moreover, real-world effectiveness data demonstrating reduced hospitalization rates are influencing clinicians’ prescribing behavior.

For instance, in June 2025, Merck announced that the FDA has approved ENFLONSIA (clesrovimab-cfor) for preventing respiratory syncytial virus (RSV) lower respiratory tract disease in neonates and infants during their first RSV season. ENFLONSIA is a long-acting monoclonal antibody providing rapid, durable protection for 5 months, with a consistent dosage of 105 mg regardless of the infant's weight. RSV season typically lasts from autumn to spring.

Europe is the second region after North America which is expected to dominate the global Respiratory Syncytial Virus (RSV) market with a 34.5% in 2024

In Europe, the RSV market is expanding due to increasing regulatory approvals from the European Medicines Agency (EMA) and favorable recommendations for both pediatric and adult populations. Several European nations are integrating RSV prevention into their public immunization programs, supported by evidence of significant reductions in hospital admissions among infants.

Germany represents one of the most promising European markets for RSV prophylaxis due to its strong healthcare infrastructure and evidence-based reimbursement system. The high burden of RSV infections among infants and elderly patients has led to increasing clinical demand for preventive measures. National bodies like IQWiG and G-BA evaluate new RSV interventions based on their therapeutic benefit and cost-effectiveness, influencing pricing decisions.

For instance, the demand for GSK's RSV vaccine has significantly risen, driven by increased awareness and campaigns aimed at combating respiratory illnesses. Germany, benefiting from a strong healthcare infrastructure, is actively encouraging immunization efforts to safeguard its citizens against Respiratory Syncytial Virus (RSV), which is associated with serious respiratory complications particularly in vulnerable groups such as infants and the elderly.

The Asia Pacific region is the fastest-growing region in the global Respiratory Syncytial Virus (RSV) market, with a CAGR of 8.1% in 2024

The RSV market across Asia-Pacific is being driven by growing disease awareness, increasing healthcare expenditure, and improved vaccination infrastructure. The region’s diverse economies—from high-income countries like Australia and Japan to developing markets such as India and Indonesia—create varying opportunities for market penetration.

Japan’s RSV market is supported by its aging population, high healthcare standards, and well-organized national immunization system. The government’s proactive stance on respiratory disease prevention and efficient regulatory pathways through the PMDA foster a favorable environment for RSV vaccine approvals.

For instance, in January 2025, Shionogi & Co., Ltd., based in Osaka, Japan and led by CEO Isao Teshirogi, Ph.D., announced that its investigational oral antiviral candidate S-337395 for respiratory syncytial virus (RSV), developed in collaboration with UBE Corporation from Tokyo, successfully met its primary endpoint in a Phase 2 clinical trial.

Competitive Landscape

Top companies in the Respiratory Syncytial Virus (RSV) market Pfizer Inc, GSK, Moderna, Inc., AstraZeneca plc, Sanofi S.A., Merck & Co., Inc. and among others.

Pfizer Inc:- Pfizer plays a leading role in the Respiratory Syncytial Virus (RSV) market with its ABRYSVO vaccine, a bivalent RSV prefusion F (RSVpreF) vaccine approved for use in older adults and high-risk individuals aged 18–59 years, as well as for maternal immunization to protect newborns. The company’s broad product indication and global reach position it as a key player driving RSV vaccination uptake worldwide. Pfizer’s strong clinical data, regulatory approvals, and large-scale manufacturing capacity have enabled rapid market penetration and strengthened its competitive advantage in the expanding RSV prevention landscape.

Market Scope

| Metrics | Details | |

| CAGR | 9.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Drug Class | Vaccines, Monoclonal Antibodies, Antivirals |

| Age Group | Infants and Children, Adults, Geriatric | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Respiratory Syncytial Virus (RSV) market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

For more pharmaceuticals-related reports, please click here

Suggested Reports