Respiratory Disorders Market Size & Industry Outlook

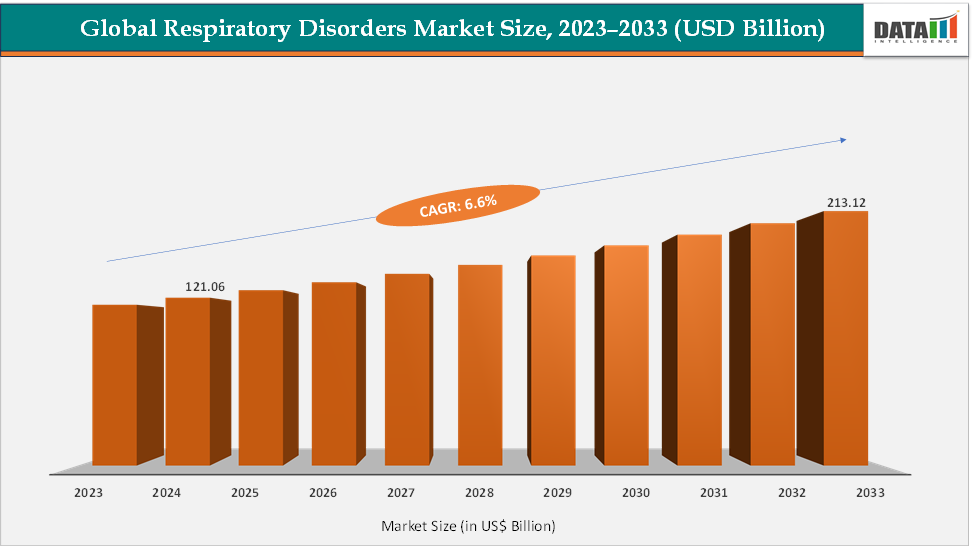

The global respiratory disorders market size reached US$ 121.06 Billion in 2024 from US$ 114.11 Billion in 2023 and is expected to reach US$ 213.12 Billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033. The global respiratory disorders market is experiencing steady growth, driven by rising incidences of asthma, COPD, and infectious respiratory diseases, as well as increased demand for advanced inhalation therapies, biologics, and diagnostic tools. Key growth drivers include an ageing population, urban pollution, smoking prevalence, and the shift toward home-based and digital respiratory care.

Leading products shaping the market include Trelegy Ellipta and Breo Ellipta (GSK), Spiriva Respimat (Boehringer Ingelheim), Symbicort (AstraZeneca), Dupixent (Sanofi/Regeneron), and Ohtuvayre (Merck/Verona Pharma). The device segment continues to expand with innovations such as ResMed’s AirSense 11 CPAP, Philips’ DreamStation 2, and Fisher & Paykel’s Optiflow systems, supporting the surge in home respiratory management. Overall, the market is moving toward precision therapies, connected inhalers, and digital diagnostics, with strong long-term prospects across therapeutics, devices, and diagnostics.

Key Market Highlights

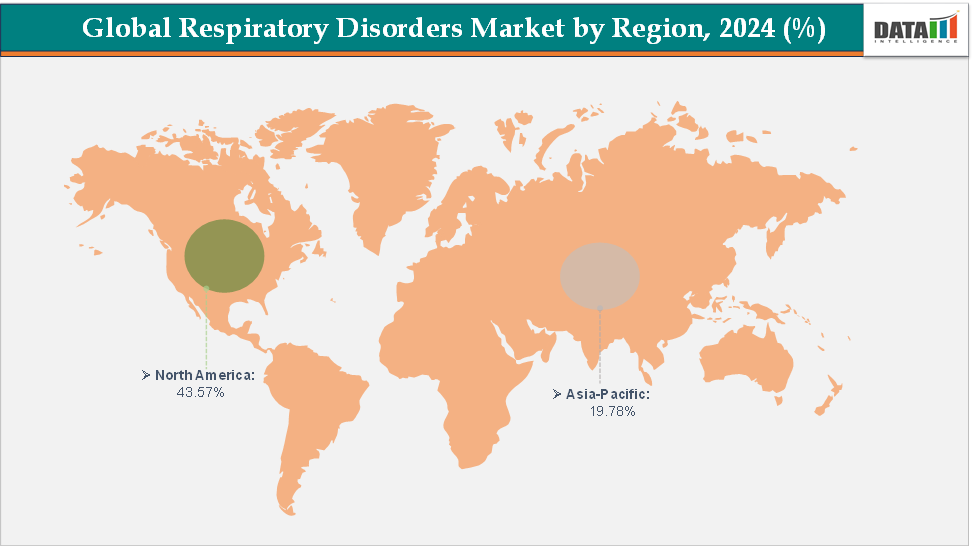

- North America dominates the respiratory disorders market with the largest revenue share of 43.57% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 6.7% over the forecast period.

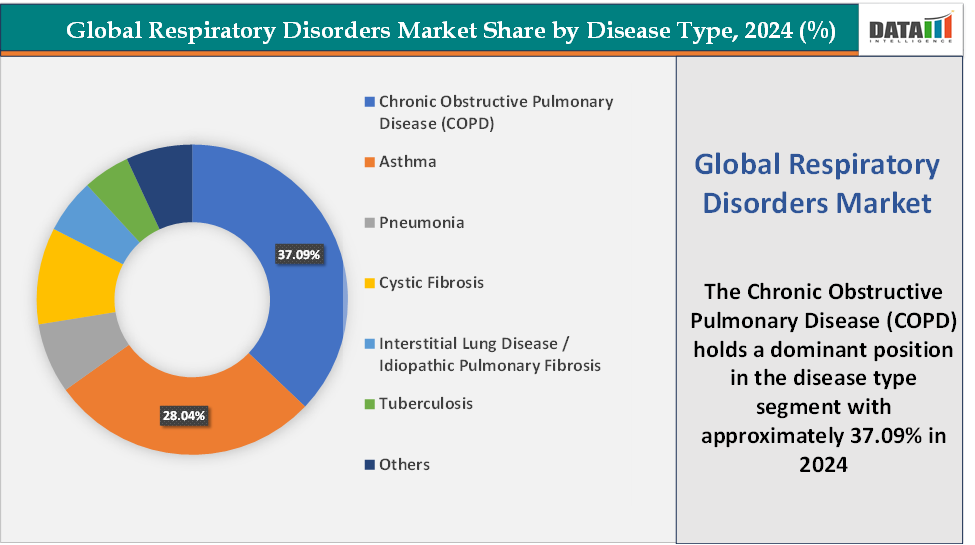

- Based on disease type, the Chronic Obstructive Pulmonary Disease (COPD) segment led the market with the largest revenue share of 37.09% in 2024.

- The major market players in the respiratory disorders market are GSK, AstraZeneca, Boehringer Ingelheim Pharmaceuticals, Inc., Sanofi, Regeneron Pharmaceuticals, Inc., Novartis AG, Merck & Co., Inc., Pfizer Inc., Teva Pharmaceutical Industries Ltd, and F. Hoffmann-La Roche Ltd., among other

Market Dynamics

Drivers: Rising FDA approved therapeutics is significantly driving the respiratory disorders market growth

Rising FDA-approved therapeutics are significantly driving growth in the global respiratory disorders market by bringing new mechanisms of action, broader patient access, and higher-value treatment options into what were previously stagnant disease categories. For instance, in May 2025, GSK plc announced that the US Food and Drug Administration (FDA) approved Nucala (mepolizumab) as an add-on maintenance treatment for adult patients with inadequately controlled COPD and an eosinophilic phenotype.

Similarly, in March 2025, Celltrion announced the U.S. Food and Drug Administration (FDA) approved OMLYCLO (omalizumab-igec) as the first and only biosimilar designated as interchangeable with XOLAIR (omalizumab) for the treatment of moderate to severe persistent asthma, chronic rhinosinusitis with nasal polyps (CRSwNP), Immunoglobulin E (IgE)-mediated food allergy, and chronic spontaneous urticaria (CSU).

Beyond therapeutics, approvals of novel vaccines complement treatment growth, but therapeutic approvals are especially impactful because they raise the average revenue per patient, extend treatment duration, and motivate reimbursement expansion. In short, each new FDA-approved therapeutic redefines standard-of-care, draws investment from payers and providers, and compels older therapy displacement, all of which fuel market expansion and innovation momentum in the respiratory disorders space.

Restraints: Heavy competition and generic pressure are hampering the growth of the market

Heavy competition and generic pressure are increasingly hampering the growth of the global respiratory disorders market by eroding profit margins, intensifying price wars, and reducing incentives for long-term investment in established therapeutic classes. Once high-value inhaled therapies such as Advair (fluticasone/salmeterol) and Flovent (fluticasone) from GSK, which once dominated the asthma and COPD segments, have faced steep revenue declines following patent expiries and the entry of multiple generic versions in the U.S. and Europe. The launch of generic Advair Diskus by Mylan and other manufacturers led to price reductions of over 60%, forcing original producers to shift focus to next-generation combination inhalers such as Trelegy Ellipta to offset losses.

Similarly, Boehringer Ingelheim’s Spiriva Respimat, a long-standing COPD market leader, now faces growing generic threats, and even legal scrutiny over alleged efforts to delay generic entry further highlighting the mounting competitive pressure. Inhalation therapies are particularly vulnerable because their delivery-device patents are complex yet finite, and once those protections lapse, manufacturers of generics and low-cost branded competitors in India and China rapidly capture price-sensitive markets.

Generic competition also extends to biologic therapies, with the approval of biosimilars like Omlyclo (omalizumab-igec) for allergic asthma marking the start of downward pricing trends even in the high-end biologic segment. Together, these dynamics compress profit margins, shorten product lifecycles, and compel companies to invest heavily in innovation or mergers to sustain growth, a trend that, while beneficial for patients through lower prices, acts as a significant restraint on overall market revenue expansion.

For more details on this report – Request for Sample

Respiratory Disorders Market, Segment Analysis

The global respiratory disorders market is segmented based on disease type, treatment type, end-user, and region.

Disease Type: The Chronic Obstructive Pulmonary Disease (COPD) segment is dominating the respiratory disorders market with a 37.09% share in 2024

The Chronic Obstructive Pulmonary Disease (COPD) segment currently dominates the global respiratory disorders market due to its high disease burden, expanding treatment options, and a wave of new FDA approvals that are redefining therapeutic standards. COPD remains one of the leading causes of death globally, for instance, according to the World Health Organization (WHO), chronic obstructive pulmonary disease (COPD) is the fourth leading cause of death worldwide, causing 3.5 million deaths in 2021, approximately 5% of all global deaths. Nearly 90% of COPD deaths in those under 70 years of age occur in low- and middle-income countries (LMIC).

The market has been revitalized by breakthrough innovations such as Dupixent (dupilumab), which received FDA approval in September 2024 as the first-ever biologic for COPD with an eosinophilic phenotype, a milestone that opened a multi-billion-dollar precision medicine opportunity in a disease previously dominated by inhalers. This was followed by GSK’s Nucala (mepolizumab) approval in May 2025 as an add-on biologic therapy for COPD, further expanding biologic access to patients with eosinophilic inflammation.

Established players like GSK, AstraZeneca, and Boehringer Ingelheim continue to maintain dominance with their triple-therapy inhalers such as Trelegy Ellipta and Breztri Aerosphere, which remain the cornerstone for moderate-to-severe COPD management and are now being complemented by biologics for severe, treatment-resistant cases. Beyond the US, regulatory bodies in Europe and Japan are also reviewing expanded COPD indications for existing biologics, signaling global market acceleration. The convergence of these factors such as large patient base, rising biologic adoption, innovative mechanisms, and sustained investment, solidifies COPD as the largest and most dynamic segment in the respiratory disorders market, driving the bulk of its current and forecasted growth over the next decade.

The asthma segment is fastest-growing in the respiratory disorders market with a 28.04% share in 2024

The asthma segment is currently the fastest-growing area within the global respiratory disorders market, driven by an expanding pipeline products, digital innovations, and increasing diagnosis rates worldwide. The segment’s acceleration is largely attributed to the rapid adoption of next-generation biologic therapies that go beyond traditional inhaled corticosteroids and bronchodilators. A major milestone was the FDA approval of Tezspire (tezepelumab), co-developed by Amgen and AstraZeneca, which became the first biologic approved for severe asthma without phenotype or biomarker restrictions, dramatically broadening the eligible patient base.

Rising pipeline products further accelerating the segment growth. For instance, in May 2025, Positive high-level results from the Phase III KALOS and LOGOS trials in patients with uncontrolled asthma showed that AstraZeneca's fixed-dose triple-combination therapy BREZTRI AEROSPHERE (budesonide/glycopyrronium/formoterol fumarate or BGF (320/28.8/9.6μg)) met all primary endpoints, demonstrating a statistically significant and clinically meaningful improvement in lung function compared with dual-combination inhaled corticosteroid/long-acting beta2-agonist (ICS/LABA) medications.

Alongside biologic innovation, asthma care is being revolutionized by smart inhalers, AI-driven adherence platforms, and tele-respiratory monitoring systems, enhancing real-world outcomes and reducing hospitalizations. The prevalence of uncontrolled and severe asthma, particularly in urban and developing regions, combined with strong payer support for biologics and digital solutions, is fueling double-digit annual growth. With these converging trends, the asthma segment is transitioning from a mature inhaler-driven market to a high-value, precision-therapy ecosystem, positioning it as the fastest-expanding frontier within the global respiratory therapeutics landscape.

Respiratory Disorders Market, Geographical Analysis

North America is expected to dominate the global respiratory disorders market with a 43.57% in 2024

North America is expected to continue dominating the global respiratory disorders market due to its high disease prevalence, strong presence of major players, and rapid adoption of novel therapeutics and medical technologies.

US Respiratory Disorders Market Trends

The US in particular leads in regulatory and commercial advancement, with the FDA approval of Dupixent (dupilumab) in September 2024 as the first-ever biologic therapy for COPD, signaling a new era of precision medicine in the respiratory field. This was followed by GSK’s Nucala (mepolizumab) gaining FDA approval in May 2025 for COPD with an eosinophilic phenotype, further strengthening US dominance in high-value biologic therapies

The region’s robust R&D ecosystem, strong payer backing, and regulatory agility make it the first and fastest to adopt new biologics, connected devices, and tele-respiratory solutions. Altogether, these factors such as high disease burden, innovation leadership, premium pricing power, and supportive healthcare infrastructure, ensure the US remains the epicenter of growth and innovation in the global respiratory disorders market.

The Asia Pacific region is the fastest-growing region in the global respiratory disorders market, with a CAGR of 6.7% in 2024

The Asia Pacific region is the fastest-growing market in the global respiratory disorders landscape, fueled by its vast patient pool, rising healthcare investment, and accelerating adoption of advanced therapies and devices. Companies are also expanding their products in APAC, which accelerating the market growth. For instance, in June 2025, Theravance Biopharma, Inc. announced that Viatris Inc. secured regulatory approval from China's National Medical Products Administration (NMPA) for YUPELRI (revefenacin) inhalation solution, the first once–daily nebulized long–acting muscarinic antagonist (LAMA) approved for maintenance treatment of chronic obstructive pulmonary disease (COPD) in China.

Additionally, worsening air pollution, urbanization, and aging populations are intensifying the burden of respiratory diseases, prompting faster adoption of diagnostic and home monitoring devices. Governments across the region are also prioritizing air-quality initiatives and healthcare access, further supporting treatment uptake. Collectively, the combination of new biologic approvals, device innovation, local manufacturing, and a surging patient base positions Asia Pacific as the fastest-expanding and most strategically vital region in the global respiratory disorders market.

Europe Respiratory Disorders Market Trends

The respiratory disorders market in Europe is witnessing strong growth, driven by rapid adoption of advanced biologics, robust regulatory support, and the expansion of digital respiratory care solutions. The region has become a key hub for innovation following the European Medicines Agency (EMA) approval of Dupixent (dupilumab) in July 2024 as the first biologic for Chronic Obstructive Pulmonary Disease (COPD), marking a breakthrough in precision respiratory medicine and expanding treatment options for millions of patients.

Additionally, expanding reimbursement frameworks for biologics, increased adoption of connected respiratory devices, and strong public health initiatives including RSV and pneumococcal vaccination programs are fueling higher diagnosis rates and treatment access. Coupled with an aging population and dense networks of pulmonology specialists, Europe’s ecosystem is accelerating both innovation adoption and revenue growth, positioning the region as one of the most dynamic and strategically important markets in the global respiratory disorders landscape.

Respiratory Disorders Market Competitive Landscape

Top companies in the respiratory disorders market include GSK, AstraZeneca, Boehringer Ingelheim Pharmaceuticals, Inc., Sanofi, Regeneron Pharmaceuticals, Inc., Novartis AG, Merck & Co., Inc., Pfizer Inc., Teva Pharmaceutical Industries Ltd, and F. Hoffmann-La Roche Ltd., among others.

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Disease Type | Chronic Obstructive Pulmonary Disease (COPD), Asthma, Pneumonia, Cystic Fibrosis, Interstitial Lung Disease / Idiopathic Pulmonary Fibrosis, Tuberculosis, and Others |

| Treatment Type | Therapeutics and Devices | |

| End-User | Hospitals, Specialty Clinics, Home Care Settings, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global respiratory disorders market report delivers a detailed analysis with 62 key tables, more than 56 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here