Respiratory Devices Market Size & Industry Outlook

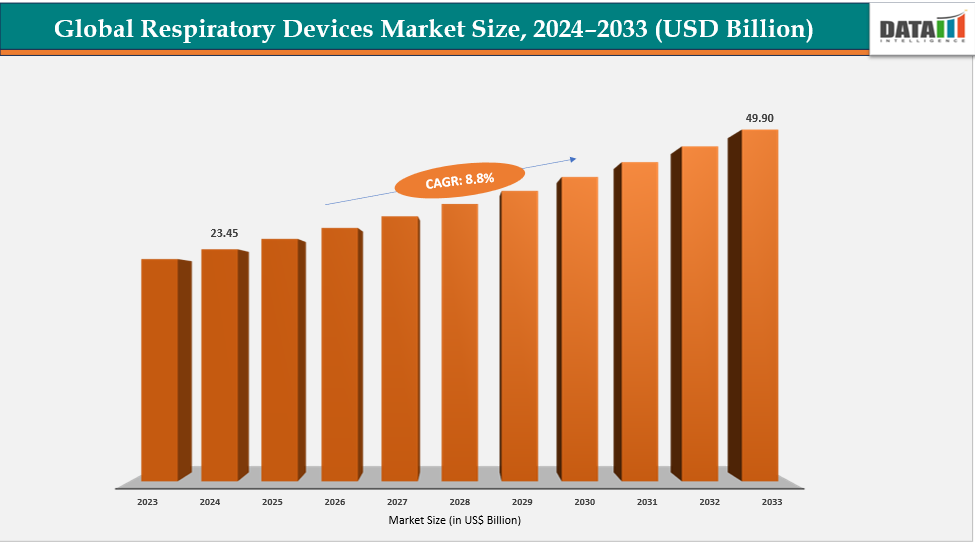

The global respiratory devices market size reached US$ 23.45 Billion in 2024 and is expected to reach US$ 49.90 Billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033.

Respiratory devices are instruments that sustain a patient's lungs normal function or shield the user from airborne dangers. By eliminating carbon dioxide and supplying oxygen, these devices support healthy lung function. For the treatment of a variety of respiratory conditions, respiratory devices are essential. The need for sophisticated, effective, and easily accessible respiratory equipment is only growing as chronic respiratory conditions become more common and healthcare moves toward home-based solutions. Aging demographics, increased awareness, and technology advancements all contribute to this market's continued growth in the years to come. Industry leaders like Fisher & Paykel Healthcare Limited, ResMed, Koninklijke Philips N.V., GE HealthCare, and Medtronic are driving innovation with advanced systems to meet shifting clinical and economic needs.

For instance, in August 2024, the FDA approved the next-generation Inspire V therapy system. Inspire upper airway stimulation is used to treat patients with moderate to severe obstructive sleep apnea (OSA) who cannot tolerate PAP treatments and who do not have a complete concentric collapse at the soft palate level.

Key Highlights

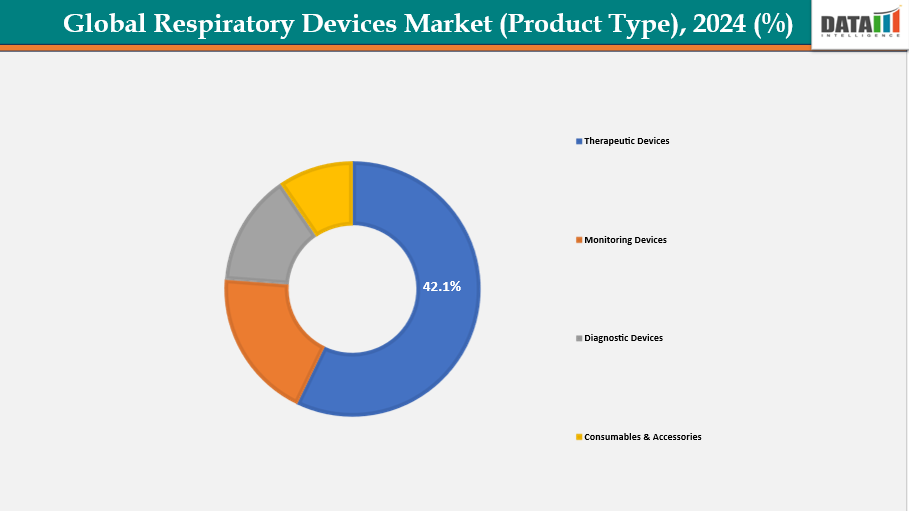

Based on product type, the therapeutic devices segment led the market with the largest revenue share of 42.1% in 2024.

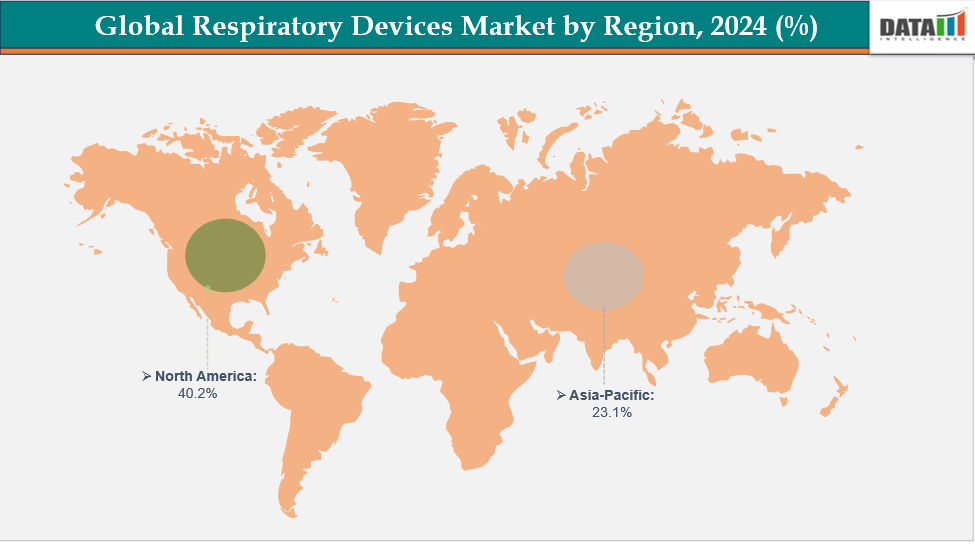

North America is expected to dominate the respiratory devices market with the largest revenue share of 40.2% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 5.5% over the forecast period.

The major market players in the respiratory devices market are Resmed, Koninklijke Philips N.V., Medtronic, Fisher & Paykel Healthcare Limited, Drägerwerk AG & Co. KGaA, Getinge, Masimo, Baxter, Invacare International Holdings Corp., CorVent Medical Inc. and AstraZeneca.

Market Dynamics

Drivers:The rising prevalence of respiratory diseases significantly driving the respiratory devices market growth

The rising prevalence of respiratory diseases is one of the most significant growth drivers for the respiratory devices market, as it directly increases the number of patients with respiratory diseases. Conditions such as COPD, asthma, bronchitis, and pneumonia are becoming more common due to smoking, air pollution, allergies, viral infections, bacterial infections, and environmental changes. According to the World Health Organization (WHO), over 80 million people are affected with respiratory diseases, and many more are undiagnosed worldwide.

Moreover, even though 81.7 million people in the region are living with a chronic respiratory disease (CRD) and 6.8 million are newly diagnosed each year, CRDs have slipped from policy priorities, leaving millions without the care and attention they need. COPD and asthma account for the majority of CRD cases in the regio. Future projections indicate that COPD cases will rise globally by 23% between 2020 and 2050, with the steepest increases among women and in low- and middle-income countries. Hospitalization from asthma also remain high, particularly among young people, despite the availability of effective treatments.

Restraints:The high cost of advanced devices and procedures hampering the growth of the respiratory devices market

The devices are expensive because they are life-sustaining medical technology that needs to be manufactured in relatively small quantities in comparison to consumer electronics and requires advanced engineering, stringent safety regulations, premium materials, and long-term service support. Because of this, acquiring a hospital's fleet of ventilators is a significant choice. One aspect of that decision-making process is the price of purchasing new equipment. Numerous ventilator options are available to meet the needs of different types of patients.

These can cost anywhere from $5,000 to $50,000 USD. Most frequently encountered in hospital intensive care units, premium or high-acuity ventilators usually include a PSOL gas delivery configuration and can currently cost anywhere from $25,000 to $50,000 for mechanical ventilators.

For more details on this report, Request for Sample

Respiratory Devices Market, Segment Analysis

The global respiratory devices market is segmented based on product type, application/indication, portability, end-user, and region.

By Product Type: The therapeutic devices from product type are expected to be dominating the respiratory devices market with a 42.1% share in 2024

The therapeutic devices in the respiratory devices segment are expected to dominate the respiratory devices market owing to the high global prevalence of asthma and Chronic Obstructive Pulmonary Disease (COPD) conditions. Better disease management is made possible by the incorporation of cutting-edge technologies into respiratory equipment, which improves patient outcomes. Additionally, patients are actively looking for therapeutic options that will improve their quality of life as they become more conscious of chronic respiratory difficulties. A wider variety of treatment choices on the market and an expanding healthcare infrastructure both contribute to this tendency.

Owing to this, for the management of critical care in hospitals and the management of respiratory diseases, mechanical ventilators, CPAP/BiPAP machines, nebulizers, and inhalers are widely used. For the management of asthma and COPD, inhalers are widely used. For instance, according to the Global Initiative for Asthma (GINA), asthma is a serious global health problem, affecting approximately 300 million people around the world.

The monitoring devices from product type are expected to be dominating the respiratory devices market with a 35.4% share in 2024

In the respiratory devices market, the monitoring device segment plays a crucial role as it enables real-time assessment of lung function, oxygen levels, and ventilation status, supporting both diagnosis and disease management. Devices such as pulse oximeters, capnographs, and spirometers are increasingly used across hospitals, homecare, and ambulatory settings to track patient conditions, guide treatment decisions, and prevent complications in chronic respiratory diseases like COPD, asthma, and sleep apnea. The rising prevalence of respiratory disorders, coupled with growing demand for home-based monitoring and integration of digital health technologies, is driving strong adoption of this segment, making it an essential component for improving clinical outcomes and reducing healthcare costs.

Geographical Analysis

North America dominates the global respiratory devices market with 40.2% in 2024.

North America has established itself as the dominant region in the global respiratory devices market, largely due to its advanced healthcare ecosystem, high burden of COPD diseases, robust reimbursement ecosystem, strong market presence of leading device manufacturers, and strong reimbursement frameworks. The US, in particular, accounts for the majority of respiratory incidences, fueled by both a high incidence of asthma and COPD and a rapidly aging population prone to respiratory problems.

For instance, recent data published by Asthma Canada states that 4.6 million Canadians are living with asthma, 92% have experienced stress because of their asthma, 26% had an emergency room visit in the past year due to asthma, and 98% say wildfire smoke and poor air quality worsened their symptoms.

Owing to rise in prevalence is one of the key factors that helps the US respiratory devices market to grow during the forecast period. For instance, according to the CDC report published in July 2024, in 2021, 24.9 million people in the US (4.7 million children and 20.3 million adults, 7.7% of the population) had asthma, and about 39.4% of people with current asthma reported having 1 or more asthma attacks in the past 12 months (39.6% among adults and 38.7% among children).

Europe is expected to dominate the global respiratory devices market share with 32.3% in 2025.

The respiratory devices market in Europe is witnessing strong growth, driven by the rising prevalence of asthma, COPD, and sleep apnea, alongside a rapidly aging population. Increasing demand for home-based care, supported by user-friendly CPAP, BiPAP, and oxygen therapy devices, further boosts adoption. Technological advancements, including smart inhalers and portable ventilators, enhance treatment efficiency. Favorable reimbursement policies and government initiatives promoting early diagnosis also support market expansion, making Europe a key growth hub for respiratory device innovation.

Owing to this, in March 2025 the TidalSense received clearance under EU Medical Device Regulations for N-Tidal Diagnose is the first new non-spirometry-based AI COPD diagnostic test. Set to launch in the NHS in the UK from April 2025, this groundbreaking technology offers a game-changing alternative to traditional spirometry - a diagnostic technique

The Asia Pacific region is the fastest-growing region in the global respiratory devices market, with a CAGR of 7.8% in 2024.

Asia-Pacific is emerging as the fastest-growing region in the global respiratory devices market, driven by rapid improvements in healthcare infrastructure, a huge disease burden, high pollution, aging populations, rising income, better healthcare infrastructure, and post-COVID investment in respiratory care.

For instance, in March 2024, Wipro GE Healthcare, a joint venture of India's Wipro Enterprises and a wholly owned entity of U.S.-based GE Healthcare, said it would invest 80 billion rupees ($960 million) in the country in its manufacturing and research and development facilities for medical devices.

Countries such as China is witnessing a sharp rise in the prevalence of respiratory diseases, creating a robust demand for the respiratory device market. Increasing government investments in healthcare modernization, along with the expansion of private hospitals and centers, are enabling wider adoption of therapeutic devices, monitoring devices, diagnostic devices, and consumables & accessories.

For instance, in August 2023, AstraZeneca in China invested an additional US$ 250 million in its asthma inhaler factory in Qingdao, eastern Shandong province, as the British-Swedish drug giant remains upbeat about the country's growth prospects. This extra investment will bring the total in the factory, which will produce its budesonide, glycopyrronium bromide, and formoterol fumarate inhalers for chronic obstructive pulmonary diseases such as asthma, to US$ 700 million.

Competitive Landscape

Top companies in the respiratory devices market include Fisher & Paykel Healthcare Limited, ResMed, Koninklijke Philips N.V., GE HealthCare, Medtronic, Drägerwerk AG & Co. KGaA, Getinge, Masimo, Baxter, Invacare International Holdings Corp., CorVent Medical Inc., and AstraZeneca.

Koninklijke Philips N.V.: Koninklijke Philips N.V. is a global leader in the respiratory devices market with a broad portfolio. It specializes in CPAP/BiPAP machines for sleep apnea, ventilators for COPD and asthma, and related accessories. The company benefits from recurring revenues through its masks and consumables. Its worldwide reach and innovation-driven approach make it a key player in advancing respiratory care.

Market Scope

Metrics | Details | |

CAGR | 8.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Product Type | Therapeutic Devices, Monitoring Devices, Diagnostic Devices, Consumables & Accessories and Others |

Application/Indication | Chronic Obstructive Pulmonary Disease (COPD), Asthma, Sleep Apnea, Pneumonia, Cystic Fibrosis, Bronchitis and others | |

By Portability | Stationary Devices, Portable Devices | |

End-User | Hospitals, Homecare Settings, Ambulatory Surgical Centers (ASCs), Clinics, Emergency Medical Services (EMS)/Transport, and Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global respiratory devices market report delivers a detailed analysis with 62 key tables, more than 61 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here