Prostate Cancer Drugs Market Size & Industry Outlook

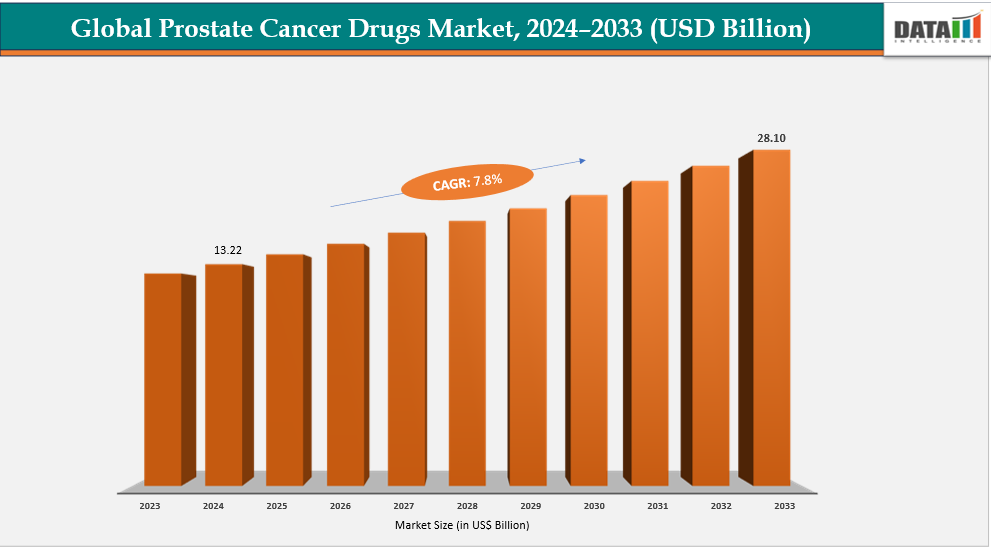

The global prostate cancer drugs market size was US$ 13.22 Billion in 2024 is expected to reach US$ 28.10 Billion by 2033 growing at a CAGR of 8.1% during the forecast period 2025-2033.

The rising global incidence of prostate cancer, driven largely by the rapid growth of the aging male population, is one of the strongest factors accelerating demand in the prostate cancer drugs market. Prostate cancer is predominantly an age-associated disease, with risk increasing sharply after the age of 50 and peaking in men over 70. Improved awareness, rising PSA screening rates, and widespread adoption of advanced diagnostic tools also contribute to higher detection rates, further increasing the number of patients requiring long-term treatment. This expanding patient pool directly boosts the demand for hormonal therapies, AR-targeted agents, PARP inhibitors, radioligand therapies, and chemotherapy, reinforcing the growth trajectory of the global prostate cancer drugs market.

Key Highlights

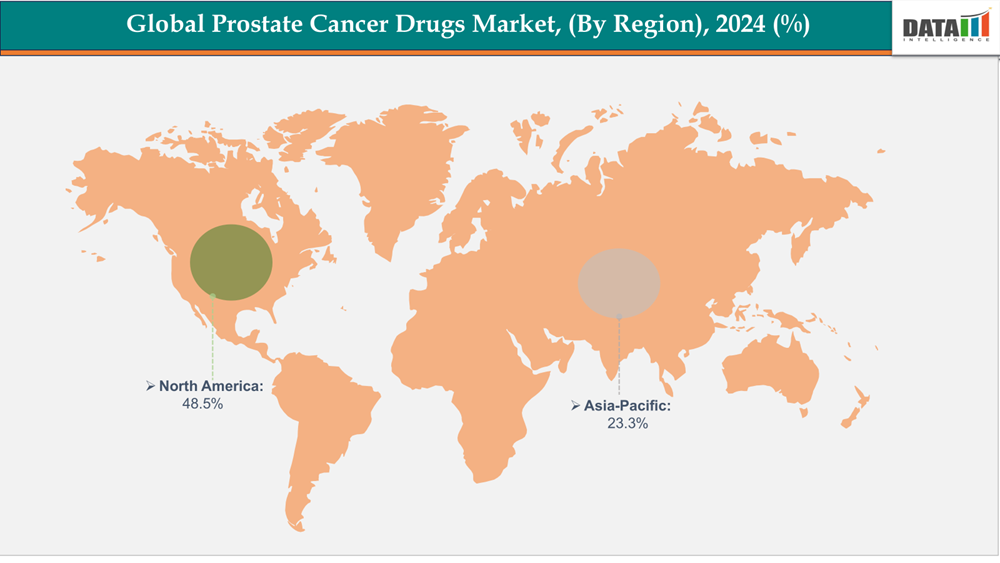

- North America dominates the prostate cancer drugs market with the largest revenue share of 48.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow with a share of 23.3% over the forecast period.

- Based on therapy type, hormonal therapy segment led the market with the largest revenue share of 42.1% in 2024.

- The major market players in the prostate cancer drugs market includes AstellasPharma, Pfizer Inc, Johnson & Johnson (Janssen Biotech, U.S.), Bayer, Novartis, AstraZeneca, Sanofi, Clovis Oncology/PharmaMar, Johnson & Johnson (Janssen Biotech), Merck & Co., Ferring Pharmaceuticals and among others.

Market Dynamics

Drivers: Rising prevalence of prostate cancer are boosting the demand for prostate cancer drugs

The rising global prevalence and incidence of prostate cancer is one of the most powerful demand accelerators for the prostate cancer drugs market. With prostate cancer now ranking as the second most frequently diagnosed cancer in men worldwide, the continuous increase in newly diagnosed and surviving patients is directly expanding the treatment-eligible population, thereby driving steady pharmaceutical sales and long-term therapy utilization. The global prevalence (including survivors) exceeds 4.2 million men, creating a massive cumulative treatment pool for ongoing hormonal, targeted, and radioligand therapies.

Owing to the factors like prevalence, according to the American Cancer Society (ACS 2024), the U.S. alone reported over 299,010 new prostate cancer cases in 2024. The rising prevalence is driven by factors such as aging global male population, lifestyle and environmental changes, genetic and familial predisposition.

Restraints: High cost and access barriers for novel therapies

While innovation in prostate cancer treatment has accelerated introducing androgen receptor inhibitors (ARIs), PARP inhibitors, and radioligand therapies (RLTs) the high cost of these advanced drugs and limited patient access remain major restraints on global market expansion.

For ionstance, PARP inhibitors such as Olaparib (Lynparza) and Rucaparib (Rubraca)—used in BRCA-mutated metastatic prostate cancer remain inaccessible for a large proportion of patients in Asia, Eastern Europe, Latin America, and Middle Eastern markets due to their extremely high cost. In countries such as India and Indonesia, out-of-pocket costs exceed average annual income, limiting uptake almost entirely to private hospitals serving high-income patients.

For more details on this report – Request for Sample

Prostate Cancer Drugs Market, Segmentation Analysis

The global prostate cancer drugs market is segmented based on therapy type, route of administration, distribution channel and region.

Therapy types: The hormonal therapy from therapy types of segments to dominate the prostate cancer drugs market with a 42.1% share in 2024.

The global market for hormonal therapy for prostate cancer is substantial and growing, driven by rising prostate cancer prevalence and the effectiveness of these therapies in extending survival for metastatic and castration-resistant forms of the disease. prostate cancer drugs market, accounting for approximately 42.1% of total market revenue in 2024. This category includes traditional androgen deprivation therapies (ADT)—LHRH agonists, LHRH antagonists, and GnRH inhibitors as well as newer oral hormone-suppressing drugs. ADT continues to maintain strong market presence because it is universally used as a first-line treatment across almost all stages of prostate cancer, from localized disease to metastatic cases.

Furthermore, ongoing research and development enhanced the prominence of this segment. For instance, In April 2024, Novartis and Arvinas partnered to develop and commercialize ARV-766, a protein degrader for prostate cancer. These PROTAC approaches represent a disruptive shift in hormonal therapy: instead of inhibition of AR signaling, they remove the receptor altogether, which may overcome multiple resistance pathways.

Route of Administration: The oral segment is estimated to have a 60% of the prostate cancer drugs market share in 2024

The oral route of administration dominates the global prostate cancer drugs market, accounting for the largest share of total prescriptions and revenue in 2025, primarily due to the widespread adoption of next-generation androgen receptor-targeted therapies (ARIs) and oral hormonal agents. Physicians increasingly prefer oral therapies because they enable long-term, home-based management without the need for frequent hospital visits, a crucial advantage for elderly prostate cancer patients.

For instance, in June 2025, Bayer announced that the U.S. Food and Drug Administration (FDA) has approved its oral androgen receptor inhibitor (ARi) NUBEQA (darolutamide) for the treatment of adult patients with metastatic castration-sensitive prostate cancer (mCSPC), which is also known as metastatic hormone-sensitive prostate cancer (mHSPC). Regulatory approvals and guideline updates by FDA, EMA, and PMDA have expanded oral therapies into earlier disease stages (nmCRPC, mHSPC), further accelerating market uptake. The sustained growth of oral AR-targeted agents positions the oral route as the dominant and fastest-growing administration mode in the prostate cancer drug market through 2033.

Prostate Cancer Drugs Market, Geographical Analysis

North America dominates the global prostate cancer drugs market with a share of 48.5% in 2024

North America dominates the global prostate cancer drugs market, accounting for an estimated 48.5% share in 2024, making it the largest regional market worldwide. This strong market leadership is driven by the region’s high disease prevalence, with the United States alone reporting over 288,000 new prostate cancer cases annually, alongside one of the world’s largest populations of prostate cancer survivors.

The U.S. leads due to its high incidence rate, extensive screening programs, rapid FDA approvals, strong adoption of next-generation AR-targeted therapies, and broad reimbursement coverage through Medicare and private insurers.

For instance, in May 2025, Astellas Pharma Inc. and Pfizer Inc. announced that the companies received an approval by the U.S. Food and Drug Administration (FDA) of a supplemental New Drug Application for XTANDI for the treatment of patients with nonmetastatic castration-sensitive prostate cancer (nmCSPC) with biochemical recurrence at high risk for metastasis (high-risk BCR).

Europe is the second region after North America which is expected to dominate the global prostate cancer drugs market with a share of 7.7% in 2024

The European prostate cancer drug market is experiencing significant growth, driven by a rising incidence of the disease due to an aging population, increased awareness, and advancements in treatments. Hormonal therapy was the largest revenue-generating drug class in 2024, but targeted therapies are projected to grow the fastest, supported by factors like new drug approvals and emerging research.

For instance, in July 2023, Curium announced that the European Commission (EU) has granted marketing authorization for PYLCLARI (Piflufolastat (18F) formerly known as (18F)-DCFPyL) indicated for the detection of prostate-specific membrane antigen (PSMA) positive lesions with positron emission tomography (PET) in adults with prostate cancer.

The Asia Pacific region is the fastest growing region in the global prostate cancer drugs market with a share of 23.3% in 2024

The Asia Pacific prostate cancer drug market is fastest growing region and is holding with a share of 23.3% in 2024. The market is currently dominated by hormonal therapy, which was the largest and fastest-growing drug class in 2024. Key drivers of this growth include an aging population, increasing prevalence of the disease, and growing awareness and funding for research.

For instance, In January 2024, the Japanese Pharmaceuticals and Medical Devices Agency (PMDA) approved talazoparib tosilate for the treatment of certain types of advanced prostate and breast cancer. Specifically, it was approved for BRCA mutation-positive metastatic castration-resistant prostate cancer.

Prostate Cancer Drugs Market Competitive Landscape

Top companies in the prostate cancer drugs market include Astellas Pharma, Pfizer Inc, Johnson & Johnson (Janssen Biotech, U.S.), Bayer, Novartis, AstraZeneca, Sanofi and among others.

Astellas Pharma :- Astellas Pharma's prostate cancer market is dominated by its best-selling drug, Xtandi (enzalutamide), which is a standard of care for multiple prostate cancer stages and drives significant revenue. The company is expanding Xtandi's use into new indications, such as non-metastatic castration-sensitive prostate cancer, to fuel market growth, particularly in regions like Asia Pacific. Astellas is also making significant investments in research and development to maintain its competitive edge in the broader oncology market, including prostate cancer.

Prostate Cancer Drugs Market Scope

| Metrics | Details | |

| CAGR | 7.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Therapy Type | Hormonal Therapy, Chemotherapy, Immunotherapy, Targeted Therapy. |

| Route of Administration | Oral, Intravenous, Others | |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Prostate Cancer drugs market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here