India Prostate Cancer Treatment Market: Industry Outlook

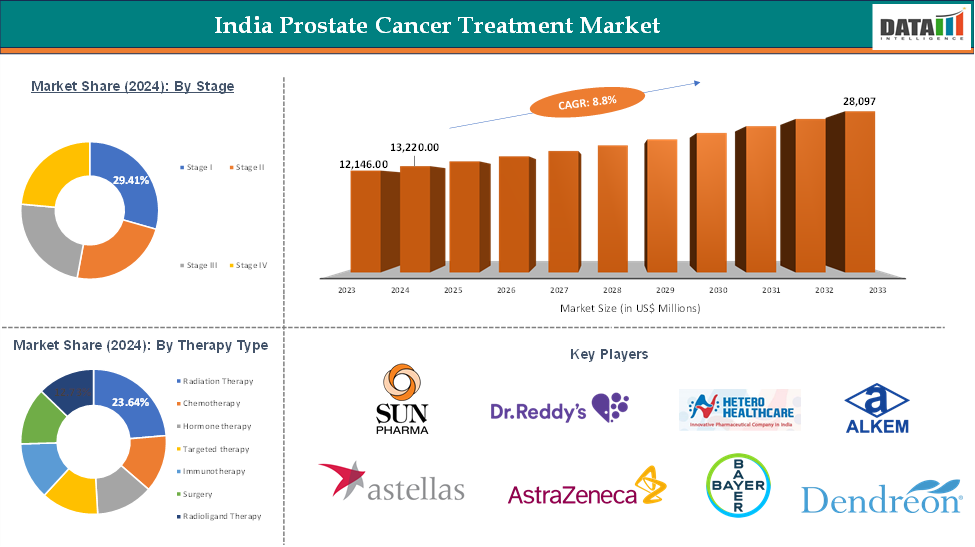

The India Prostate Cancer Treatment market reached US$ 12,146.00 Million in 2023, with a rise of US$ 13,220.00 Million in 2024 and is expected to reach US$ 28,097.00 Million by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033 | According to DataM Intelligence.

The India prostate cancer treatment market is growing due to rising awareness, improved healthcare infrastructure, and the increasing prevalence of prostate cancer among the aging male population. Technological advancements in diagnostics, such as PSA testing and multiparametric MRI, are enabling earlier and more accurate disease identification. The market is also witnessing increased adoption of advanced therapies like minimally invasive robotic surgeries, hormone therapies, and radiation-based modalities.

However, the high cost of these treatments, limited accessibility in rural and semi-urban areas, and lack of insurance penetration and cancer-specific reimbursement support hinder widespread adoption. Government and private sector initiatives aimed at enhancing cancer care infrastructure, spreading awareness, and improving early screening are expected to support market growth. The prostate cancer treatment market holds promising potential as India's healthcare ecosystem evolves.

India Prostate Cancer Treatment Market: Executive Summary

India Prostate Cancer Treatment Market Dynamics: Drivers & Restraints

Driver: Rise in the prevalence of prostate cancer

The rising prevalence of prostate cancer in India is driving the growth of the treatment market. As awareness of prostate health improves and access to diagnostic services expands, more men are being diagnosed, especially in urban and semi-urban areas.

For instance, Prostate cancer, accounting for 5.4% of Indian men's cancers, is increasing, with annual cases potentially doubling by 2040. Metropolitan cities report higher incidence rates, likely due to lifestyle factors and increased awareness, leading to more diagnoses.

Healthcare providers are enhancing their oncology services, while pharmaceutical and biotech companies are intensifying research to introduce personalized and less invasive treatment options. Hospitals are investing in advanced technologies for early detection and precision treatment, boosting the overall market.

The shift towards early diagnosis, driven by improved awareness campaigns and routine screening programs, is increasing the demand for therapeutic interventions. Government bodies and private stakeholders are focusing on strengthening cancer care infrastructure, training specialists, and enhancing access to medications.

Driver: Increasing awareness and early screening initiatives

The India prostate cancer treatment market is experiencing growth due to increased awareness and early screening initiatives. Historically, prostate cancer has been underdiagnosed in India due to a lack of awareness, limited access to healthcare facilities, and cultural hesitation among men. However, recent years have seen a shift towards proactive healthcare behavior among the male population, driven by government health programs, NGO-led awareness campaigns, and private sector health initiatives.

Stakeholders like the Ministry of Health, the Indian Cancer Society, and private hospitals are promoting awareness about prostate cancer symptoms, risk factors, and early detection. The introduction of affordable diagnostic tools like PSA tests has made early screening more accessible, even in semi-urban and rural regions.

This has led to an increase in early-stage diagnoses, with treatment options such as active surveillance, minimally invasive robotic surgeries, and advanced radiation therapies being highly effective. Collaborations between pharmaceutical companies and diagnostic labs are enabling bundled screening packages and mobile diagnostic units, expanding the reach of screening programs to underserved areas.

Restraint: High cost of advanced treatments and diagnostic tools

The India prostate cancer treatment market faces significant challenges due to the high cost of advanced treatments and diagnostic tools. While advanced therapies like robotic-assisted surgeries and IMRT have improved clinical outcomes, affordability remains a major concern for patients, particularly in tier-2 and tier-3 cities. These treatments are primarily available in high-end private hospitals and specialty centers, making them prohibitive for middle- and lower-income groups. Diagnostic advancements like multiparametric MRI, genomic testing, and fusion biopsy are expensive and not widely accessible in public healthcare facilities. The lack of comprehensive insurance coverage further exacerbates the issue, leading to high out-of-pocket expenses and treatment delays. This economic disparity limits early adoption and slows market expansion despite growing disease awareness. Addressing this challenge will require strategic policy interventions, public-private partnerships, and subsidies to improve affordability and ensure equitable access to advanced prostate cancer diagnostics and treatments across all socio-economic groups in India.

Opportunity: Expansion of advanced diagnostic and treatment technologies

The India Prostate Cancer Treatment Market is experiencing significant growth due to the increasing adoption of advanced diagnostic and treatment technologies. Traditional diagnostic methods like digital rectal exams and PSA testing are being replaced by more advanced techniques like MRI fusion-guided biopsies, PET scans, and genomic profiling. These tools offer better accuracy in detecting and staging the disease, enabling clinicians to tailor treatments more effectively.

Technological innovation is also reshaping the treatment landscape, with robotic-assisted surgeries, high-intensity focused ultrasound (HIFU), image-guided radiation therapy (IGRT), and advanced hormonal and immunotherapies gaining traction, especially in tier-1 and tier-2 cities.

These technologies offer improved precision, reduced recovery time, and fewer side effects, making them attractive options for healthcare providers and patients. India's growing pool of skilled oncologists, urologists, and radiologists is well-positioned to support the adoption of these innovations.

For more details on this report, Request for Sample

India Prostate Cancer Treatment Market Segment Analysis

The India prostate cancer treatment market is segmented based on stage, therapy type, end user, and region.

Therapy Type:

The radiation therapy segment in the prostate cancer treatment market was valued at US$ 3,478 Million in 2024 and is estimated to reach US$ 9,054 Million by 2033, growing at a CAGR of 11.2% during the forecast period from 2025-2033.

The India Prostate Cancer Treatment Market is thriving due to the growth of the radiation therapy segment, driven by technological advancements, growing awareness, and the availability of specialized oncology centers.

For instance, in October 2024, Aster DM Healthcare, India's largest integrated healthcare company, became the first facility in the country to implement Intra-Operative Electron Radiation Therapy (IOeRT), marking a significant shift in cancer treatment. The new state-of-the-art medical facility is located at the Aster International Institute of Oncology (AIIO) at Aster Whitefield Hospital, Bengaluru. AIIO, a center of excellence for comprehensive cancer care, specializes in cutting-edge treatments and robotic surgery, including the first SGRT in Karnataka.

Radiation therapy is preferred due to its non-invasive nature and ability to precisely target cancerous tissues, sparing healthy organs. Advanced radiation modalities like Intensity-Modulated Radiation Therapy (IMRT), Image-Guided Radiation Therapy (IGRT), and Stereotactic Body Radiotherapy (SBRT) have improved clinical outcomes, reduced side effects, and enhanced patient quality of life.

The growing demand for organ-preserving treatment options, particularly for the working-age population, is also driving the growth of this segment. Increased government and private sector investment in cancer care infrastructure, including new radiotherapy units, is expanding access to these treatments.

Moreover, reimbursement schemes under public health programs and insurance coverage are also encouraging the adoption of radiation-based therapies. The training and certification of radiation oncologists are improving, addressing the shortage of skilled professionals.

India Prostate Cancer Treatment Market – Major Players

The major players in the India prostate cancer treatment market include Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Hetero Healthcare, Alkem Labs, Astellas Pharma, AstraZeneca, Bayer AG, Dendreon Pharmaceuticals, Ferring B.V., and Johnson & Johnson (Janssen Pharmaceuticals), among others.

India Prostate Cancer Treatment Market – Key Developments

In May 2025, Sarvodaya Hospital in Faridabad, India, became the first theranostics and nuclear medicine center in the country to offer Terbium-161 PSMA therapy for advanced prostate cancer patients, marking a significant breakthrough in the treatment of metastatic castration-resistant or hormone-refractory prostate cancer.

In April 2025, the Tata Memorial Centre in India launched MenCan, a non-profit initiative by the Urologic Oncology Disease Management Group, to address prostate, penile, and testicular cancers, which are increasing in incidence across the country.

India Prostate Cancer Treatment Market: Scope

Metrics | Details | |

CAGR | 8.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Stage | Stage I, Stage II, Stage III, Stage IV |

Therapy Type | Radiation Therapy, Chemotherapy, Hormone therapy, Targeted therapy, Immunotherapy, Surgery, Radioligand Therapy | |

| End User | Hospitals, Oncology Centers, Rehabilitation Centers, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

The India Prostate Cancer Treatment Market is predicted to experience significant growth in the coming years due to the increasing geriatric population, early diagnosis rates, and access to advanced treatment technologies. This growth will be driven by increased awareness, improved screening initiatives, and investment in oncology infrastructure. Technological advancements, particularly robotic-assisted surgeries, will gain traction in urban centers. The government's focus on non-communicable disease management will support long-term expansion.

The India prostate cancer treatment market report delivers a detailed analysis with 50 key tables, more than 61 visually impactful figures, and 205 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here