Disposable Syringes Market Size& Industry Outlook

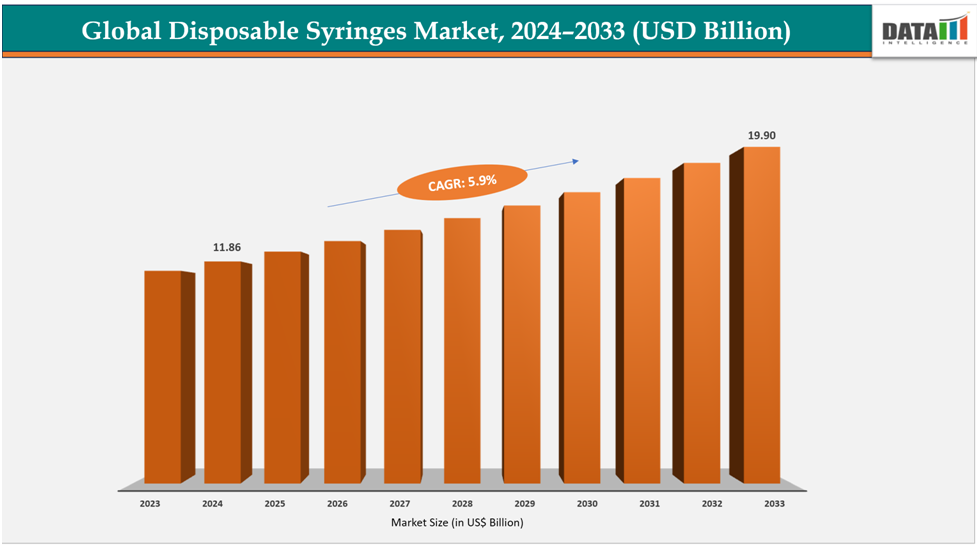

The global disposable syringes market size reached US$ 11.24Billionin 2023 with a rise of US$11.86Billion in 2024 and is expected to reach US$19.90Billion by 2033, growing at a CAGR of 5.9%during the forecast period 2025-2033.

The global disposable syringes market is experiencing robust growth, driven by rising chronic disease prevalence, expanding vaccination programs, and the rise of home healthcare. Large-scale vaccination programs and rising medication self-administration are driving up demand for single-use, safe syringes. North America leads with its sophisticated healthcare infrastructure and stringent safety regulations. Safety-engineered and auto-disable syringes are examples of technological advancements that improve patient safety and efficiency.

Key Highlights

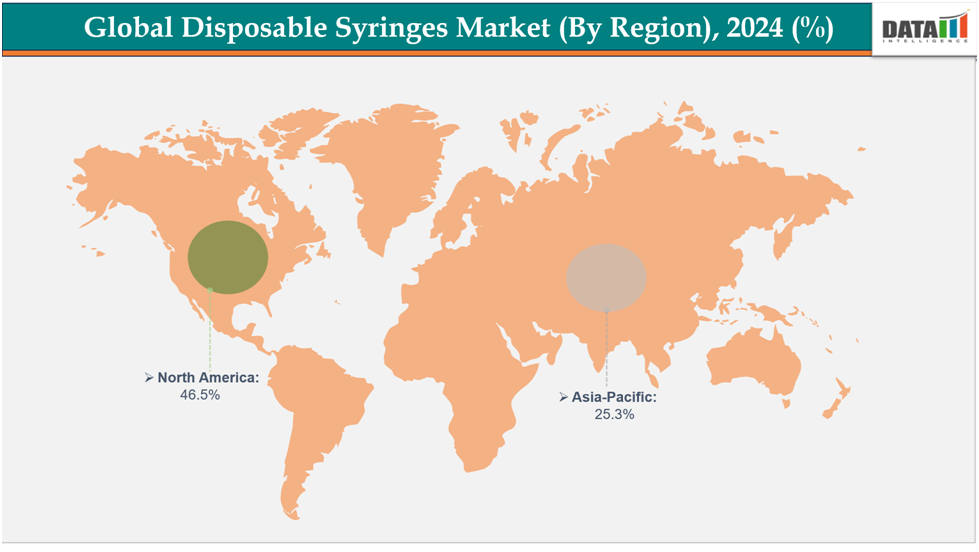

- North America dominates the disposable syringes market with the largest revenue share of 46.5% in 2024

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of7.4% over the forecast period.

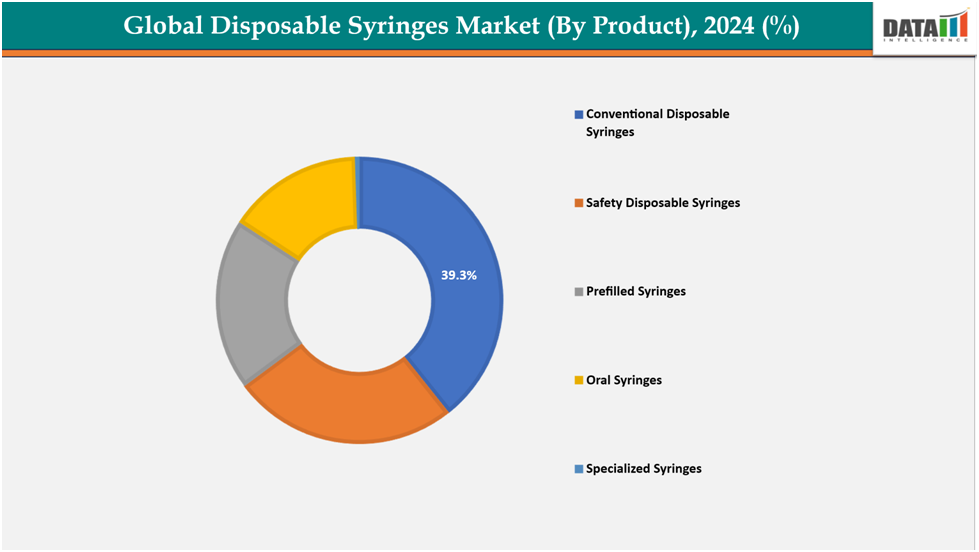

- The conventional disposable syringes segment from product is dominating the disposable syringes market with a 39.3% share in 2024

- The therapeutic injections segment from application is dominating the disposable syringes market with a 61.3% share in 2024

- Top companies in the Disposable Syringes Market include B. Braun SE, BD, Hindustan Syringes & Medical Devices Ltd., dmcmedical, SHANGHAI TEAMSTAND CORPORATION, kohope, Air-Tite Products Co., Inc., ISCON SURGICALS LTD., Gerresheimer AG, The Kare Lab Cardinal Health, and Nipro Corporation, among others.

Market Dynamics

Drivers: Rising prevalence of chronic diseases is significantly driving the disposable syringes market growth

The rising prevalence of chronic diseases, including diabetes, cancer, and autoimmune disorders, is significantly driving the disposable syringes market. There is a constant need for single-use syringes since these illnesses necessitate regular, frequently prolonged injections of insulin, biologics, and chemotherapy. Disposable syringes are essential to hygienic practices, infection control, and safe self-administration in both hospital and home healthcare settings. The growing usage of prefilled syringes and the move toward home healthcare both contribute to the market's expansion.

Owing to factors like the rising prevalence of chronic diseases, including diabetes and cancer, for instance, according to the Cancer Progress Report 2024, an estimated 2,001,140 new cancer cases were diagnosed, and as per the International Diabetes Federation in 2024, vision-related conditions included macular degeneration affecting 8 million, glaucoma 7.7 million, and diabetic retinopathy 3.9 million, while presbyopia emerged as the leading cause of near vision impairment, impacting 826 million people worldwide, and approximately 589 million adults aged 20–79 years were living with diabetes globally.

Restraints: Strict regulations are hampering the growth of the disposable syringes market.

Strict regulations are restraining the growth of the disposable syringes market due to safety, quality, and legal requirements. Regulatory authorities, such as the FDA (Class II) and India’s Drugs and Cosmetics Acts (Class B), classify syringes as moderately risky, necessitating clinical trials and extensive documentation. Meeting strict requirements for performance, usability, and sterility raises production costs and postpones the release of new products. Entry hurdles for smaller manufacturers are higher, which restricts competition and creativity. Global expansion is further complicated by the fact that different countries have different legislation. Despite being necessary for infection control and patient safety, these stringent regulatory frameworks impede quick product introduction and slow market expansion.

For more details on this report, see Request for Sample

Segmentation Analysis

The global disposable syringes market is segmented based on product, application, end user, region

By Product:

The conventional disposable syringes segment from product is dominating the disposable syringes market with a 39.3% share in 2024

The conventional disposable syringes segment dominates the global market in terms of volume and unit sales due to its universal applicability, low cost, and unmatched versatility. These syringes are essential for routine injections, mass immunizations, drug reconstitution, and general clinical procedures, making them widely used across hospitals, clinics, vaccination drives, and home healthcare, particularly in cost-sensitive emerging markets.

For instance, in March 2024, Hindustan Syringes and Medical Devices (HMD) launched Dispojekt single-use syringes with safety needles, aiming to reduce needlestick injuries, lower infection-control costs, and enhance India’s global competitiveness in sharp injury prevention.

Moreover, established manufacturing processes and regulatory compliance ensure easy production and adoption. Combined with rising chronic disease prevalence, increasing vaccinations, and expanding home healthcare, conventional disposable syringes maintain the highest global demand.

By Application: The therapeutic injections segment from application is dominating the disposable syringes market with a 61.3% share in 2024

The therapeutic injections segment dominates the disposable syringes market due to its high-frequency usage and broad patient base. Treatments such as insulin, antibiotics, biologics, and chemotherapy require daily or recurring injections, creating continuous demand. Unlike immunization injections, which are periodic, therapeutic injections serve patients of all ages and conditions, including those with chronic diseases like diabetes, cancer, and autoimmune disorders. Hospitals, clinics, and home healthcare settings rely heavily on single-use syringes to ensure safety, prevent infections, and avoid cross-contamination. This consistent, widespread need makes therapeutic injections the largest application segment in the disposable syringes market.

Geographical Analysis

North America is expected to dominate the global disposable syringes market with a 46.5% in 2024

North America is expected to dominate the global disposable syringes market because the region combines strong healthcare infrastructure and high spending capacity with strict infection control regulations that favor single-use medical devices. For instance, in January 2025, HLB Life Science’s disposable syringe Sofject received FDA 510(k) approval, covering both syringe and needle. The clearance enabled exports to the U.S. via Allison Medical. The product met stringent safety and efficacy standards through performance and equivalence evaluation, marking a major milestone for the company.

The U.S. and Canada have well-established vaccination programs, high surgical volumes, and rising cases of chronic diseases, which continuously drive syringe demand.

Moreover, early adoption of advanced safety syringes, the presence of major manufacturers, and ongoing R&D investments ensure technological leadership. Supportive government initiatives and growing awareness about the prevention of hospital-acquired infections further strengthen North America’s position as the leading market.

Europe is the second region after North America which is expected to dominate the global disposable syringes market with a 34.5% in 2024

Europe’s disposable syringe market growth is driven by an aging population, rising prevalence of chronic and infectious diseases, and well-established healthcare infrastructure. Supportive government regulations promoting patient safety, infection control, and vaccination programs are boosting demand. Additionally, strong manufacturing capabilities and cross-border collaborations of companies to adopt advanced, disposable syringe manufacturing and sales. For instance, in January 2025, Arterex completed the acquisition of Phoenix S.r.l., a European medical device developer and manufacturer. Phoenix brought extensive expertise in designing, developing, and producing disposable medical devices, along with ISO 8 clean room assembly and packaging services. The acquisition strengthened Arterex’s global capabilities in medical device contract manufacturing.

Germany’s disposable syringe market is driven by advanced healthcare infrastructure, stringent safety and infection-control regulations, and high adoption of modern medical devices. Hospitals and clinics are increasingly using single-use syringes for vaccinations, chronic disease management, and surgical procedures. Strong public and private investment in healthcare and manufacturing innovation further supports market growth.

The Asia Pacific region is the fastest-growing region in the global disposable syringes market, with a CAGR of 7.4% in 2024

The Asia-Pacific disposable syringe market is growing due to rising healthcare demand, increasing chronic and infectious disease prevalence, and expanding vaccination programs. Rapidly improving healthcare infrastructure, government initiatives promoting patient safety, and the adoption of single-use medical devices in hospitals and clinics are driving the widespread use of disposable syringes across the region.

Japan’s disposable syringe market is expanding due to its rapidly aging population, increasing prevalence of chronic and infectious diseases, and strong government support for healthcare safety and innovation. Hospitals and clinics are adopting single-use syringes for vaccinations, treatments, and surgical procedures. Advanced manufacturing and regulatory compliance further support market growth, positioning Japan as a key player in the Asia-Pacific region.

Competitive Landscape

Top companies in the disposable syringes market include B. Braun SE, BD, Hindustan Syringes & Medical Devices Ltd.,dmcmedical, SHANGHAI TEAMSTAND CORPORATION, kohope, Air-Tite Products Co., Inc., ISCON SURGICALS LTD.,Gerresheimer AG, The Kare LabCardinal Health, and Nipro Corporation, among others.

B. Braun SE:B. Braun Melsungen AG is a global leader in disposable syringe manufacturing, producing over 1.8 billion single-use syringes annually at its ALMO subsidiary in Bad Arolsen, Germany. Their Omnifix and Injekt syringe lines are renowned for precision, safety, and compliance with ISO 7886-1 standards. These syringes are distributed to more than 140 countries, supporting diverse medical applications from general injections to specialized treatments.

Key Developments:

- In March 2024, BD increased U.S. syringe production at its Nebraska and Connecticut facilities to meet rising demand and ensure continuity of patient care. Following the FDA safety communication in November, BD maintained its commitment to product safety and quality. Over its 125-year history, the company manufactured 2 billion additional syringes and needles to support the global COVID-19 response.

- In September 2024, BD expanded its BD Neopak Glass Prefillable Syringe platform, commercially releasing the BD Neopak XtraFlow Glass Prefillable Syringe. Featuring an 8 mm needle and thinner wall cannula, it optimized subcutaneous delivery of high-viscosity biologics, reduced injection force and time, and supported over 24 approved indications, enhancing usability and drug delivery performance.

Market Scope

| Metrics | Details | |

| CAGR | 5.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Product | Conventional Disposable Syringes, Safety Disposable Syringes, Prefilled Syringes, Oral Syringes, Specialized Syringes |

| By Application | Therapeutic Injections, Immunization Injections | |

| By End User | Hospitals, Diagnostic Laboratories, Blood Banks, Pharmaceutical Industry, Vaccination, Veterinary Purposes | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global disposable syringes market report delivers a detailed analysis with 68 key tables, more than 57visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical disposables-related reports, please click here