Pouch Films Market Overview

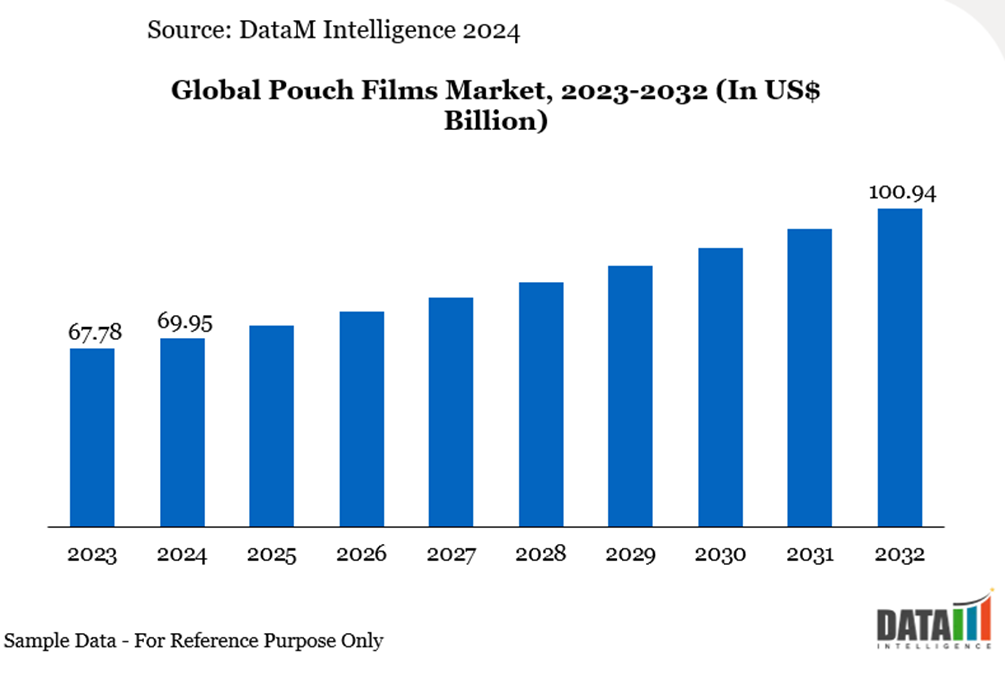

The global pouch films market reached US$69.95 billion in 2024 and is expected to reach US$100.94 billion by 2032, growing at a CAGR of 4.9% during the forecast period 2025-2032. This growth is driven by the increasing demand for efficient and secure packaging solutions across various industries, including cement, chemicals, food, and agriculture. Additionally, the shift toward sustainable and durable packaging materials and the expansion of construction and infrastructure projects worldwide further support market expansion.

Pouch Films Industry Trends and Strategic Insights

The Asia-Pacific region emerged as the dominant market in the market, capturing the largest revenue share of 40.31% in 2024.

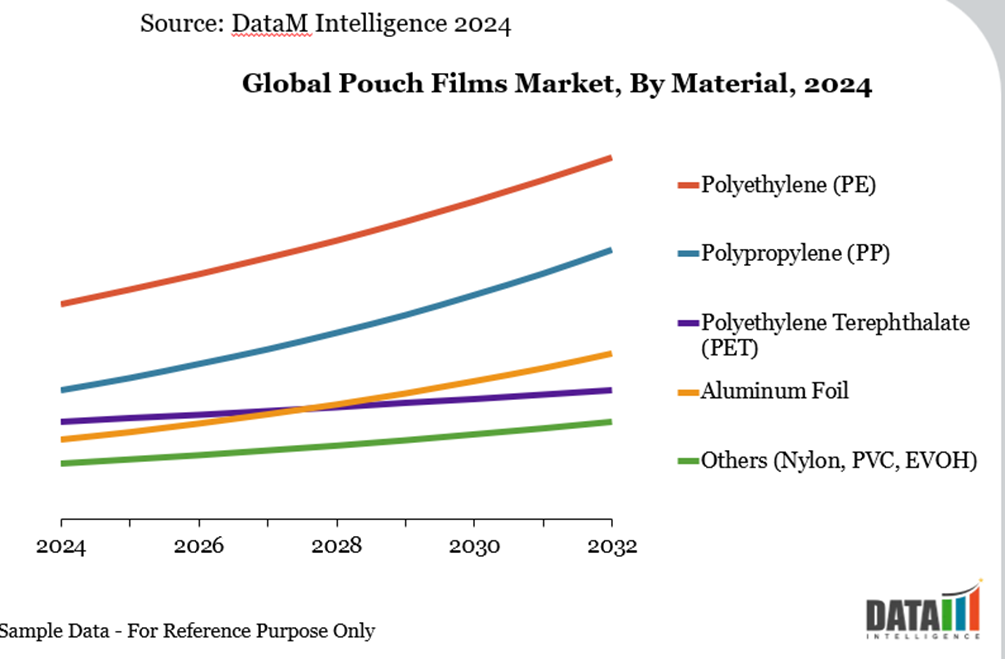

By material, the polyethylene (PE) segment is projected to experience the largest market, registering a significant 40.36% in 2024.

Global Pouch Films Market Size and Future Outlook

2024 Market Size: US$69.95 Billion

2032 Projected Market Size: US$100.94 Billion

CAGR (2025-2032): 4.9%

Largest Market: Asia-Pacific

Fastest Market: Asia-Pacific

Market Scope

Metrics | Details |

By Material | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Aluminum Foil, Others (Nylon, PVC, EVOH) |

By Type | Stand-Up Pouches, Flat Pouches, Spouted Pouches, Retort Pouches, Others (Vacuum Pouches, Specialty Pouches) |

By End-User | Food, Beverages, Pharmaceuticals, Personal Care & Cosmetics, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Expansion of Flexible Packaging in the Food & Beverage Sector

The food and beverage (F&B) industry is the single most important demand driver for pouch films, thanks to their ability to provide prolonged shelf life, lightweight portability and convenience features like resealable zippers and spouts.With changing consumer habits, particularly among urban and millennial generations, there is a strong preference for portion-controlled, on-the-go formats, which pouches well meet. Flexible pouches utilize less material and take up less space than rigid containers, lowering transportation costs and carbon footprints, which are increasingly appreciated by both companies and regulators.

In Asia-Pacific, the rapid expansion of contemporary trade organized retail and online grocery delivery amplify these benefits. Convenience foods, which include snacks, sauces, instant meals and beverages, have grown by double digits in nations such as India, Indonesia and Vietnam. Nestlé India, for example, plans to invest in Maggi sauces and dairy items in 2024, which will directly support increased throughput. Similarly, in Japan, the Asahi Group has converted various ready-to-drink tea items to stand-up pouches, citing increased consumer acceptance and logistics efficiency.

Even in developed areas, innovation in food and beverage packaging drives pouch film demand. In US, businesses such as Campbell Soup have expanded its microwavable retort pouch line, while beverage companies are experimenting with flexible refill packs to eliminate single-use bottles. These trends, taken together, ensure a steady need for high-performance pouch films, particularly those that provide barrier protection for oxygen- and moisture-sensitive items.

Segmentation Analysis

The global pouch films market is segmented based on material, type, end-user and region.

Polyethylene (PE) Dominates Global Pouch Film Market as the Preferred Sustainable and High-Performance Substrate

Polyethylene (PE) is the leading substrate in the global pouch film industry, valued for its superior sealability, flexibility and the growing emphasis on mono-material recyclability. As companies and regulators demand circular packaging solutions, converters are transitioning to all-PE or primarily PE-based laminates. A prime example is Amcor's 2024 introduction of an all-PE spouted bag in conjunction with Stonyfield and Cheer Pack, which is expressly designed to be entirely recyclable, demonstrating both PE's performance and sustainability appeal.

Material manufacturers are increasing PE resin supply for pouch applications. Dow, for example, is extending its high-density and linear low-density PE solutions to fulfill the simultaneous need for increased mechanical toughness and clarity in pouch films, particularly in high-speed packing processes. The new formulations enable thinner constructions while maintaining durability, meeting brand requests for lighter, lower-carbon footprint packaging.

Polyethylene Terephthalate (PET) Leads Fastest Growth in Pouch Films Due to Superior Barrier Properties and Recyclability

Polyethylene terephthalate (PET) is rapidly becoming the fastest-growing material in global pouch film applications due to its exceptional strength, clarity, and superior barrier properties. Its capability to protect products from moisture, oxygen, and contaminants makes it highly suitable for food packaging, beverage packaging, and pharmaceutical applications. The rising demand for premium packaging solutions and extended shelf life is boosting the adoption of PET in flexible packaging and retort pouches. According to Metallurgical and Materials Data, nearly 28 Mt of PET was produced in 2024, with China leading production and holding a 31% global share.

In addition, increasing sustainability initiatives and innovations in PET recycling are accelerating its growth trajectory. The development of recycled PET (rPET) and mono-material PET structures supports circular economy goals, attracting global brands focused on eco-friendly solutions. PET also offers excellent compatibility with high-speed filling lines and enables lightweight packaging designs, ensuring both performance and environmental benefits. This combination of durability, recyclability, and efficiency positions PET as a preferred choice for next-generation flexible packaging solutions.

Geographical Penetration

Asia-Pacific Holds Dominating Share in Global Pouch Films Owing to High Production Capacity and Expanding Packaging Demand

The Asia-Pacific region holds a dominant share in global pouch film applications, driven by strong demand from the food, beverage, and personal care sectors. The region benefits from extensive manufacturing capabilities and rapid adoption of sustainable packaging solutions. On the innovation front, UFlex has strengthened this leadership by introducing a high-barrier transparent BOPET film (F-PSX) in FY24, designed for microwavable and hot-fill foods, outperforming traditional PVDC/EVOH coatings in performance and sustainability. Additionally, its 2023 launch of fully recyclable BOPP/PE spout pouches for brands like Kissan highlights how regional players are leveraging R&D and material innovation to meet consumer and brand expectations.

India Pouch Films Market Outlook

India is witnessing rapid growth in pouch film applications due to rising demand from the food, home-care, and personal-care sectors. In 2023, Amcor plc acquired Phoenix Flexibles in Gujarat to expand its localized manufacturing capabilities and strengthen its presence in the region. This move underscores India’s focus on sustainable, high-quality pouches supported by a strong domestic production infrastructure.

China Pouch Films Market Trends

China remains a key driver of pouch film adoption, supported by large-scale manufacturing and strong sustainability initiatives. In August 2023, Dow Inc. partnered with Mengniu to launch a fully recyclable, all-PE yogurt pouch, reinforcing the shift toward mono-material packaging solutions. This development reflects China’s commitment to circular economy practices and the growing regulatory emphasis on eco-friendly packaging.

North America Holds a Strong Position in Pouch Film Adoption Driven by Advanced Packaging Innovations and Sustainability Initiative

North America holds a dominant position in global pouch film applications, driven by strong demand for sustainable and high-performance flexible packaging solutions. The region benefits from advanced manufacturing technologies, stringent regulations promoting recyclability, and innovation in mono-material and eco-friendly pouches. Continuous developments by key players further reinforce its leadership in flexible packaging adoption.

US Pouch Films Market Insights

US is at the forefront of innovation in flexible packaging, with companies introducing advanced mono-material pouch solutions to improve recyclability and functionality. In February 2024, Cheer Pack North America partnered with Stonyfield and Amcor to introduce CHEERCircle, an all-PE mono-material recycle-ready spouted pouch featuring the advanced Vizi Cap. This innovation delivers improved functionality and recyclability, reflecting industry efforts to create circular packaging systems while meeting high-performance standards for convenience and sustainability.

Canada Pouch Films Industry Growth

Canada is experiencing a strong shift toward sustainable pouch solutions, supported by regulatory frameworks and recycling initiatives. According to the 2024 Canada Plastics Pact progress report, recycling of flexible plastics increased by 13 percentage points by 2022, signaling growing adoption of circular solutions. This progress demonstrates the country’s focus on eco-friendly packaging innovation and its role in reducing environmental impact through improved recyclability.

Sustainability Analysis

Sustainability has become the core focus in pouch film applications, driven by government regulations and brand commitments to reduce environmental impact. The industry is moving from complex multi-material laminates toward mono-material designs like all-PE and all-PP, enabling easier mechanical recycling. Leading brands such as Nestlé have introduced fully recyclable mono-PE pouches, while Amcor expanded its AmLite range with high-barrier mono-PE solutions to support recyclable shelf-stable packaging.

Regulatory measures like the EU’s Single-Use Plastics Directive and PPWR, along with EPR policies in countries such as India and Japan, are accelerating this transition. Resin providers like Dow are innovating with PCR-based resins such as REVOLOOP, integrating up to 70% recycled content. However, achieving recyclability in high-barrier food and pharmaceutical pouches remains challenging due to the need for additional functional layers, which complicates full material recovery.

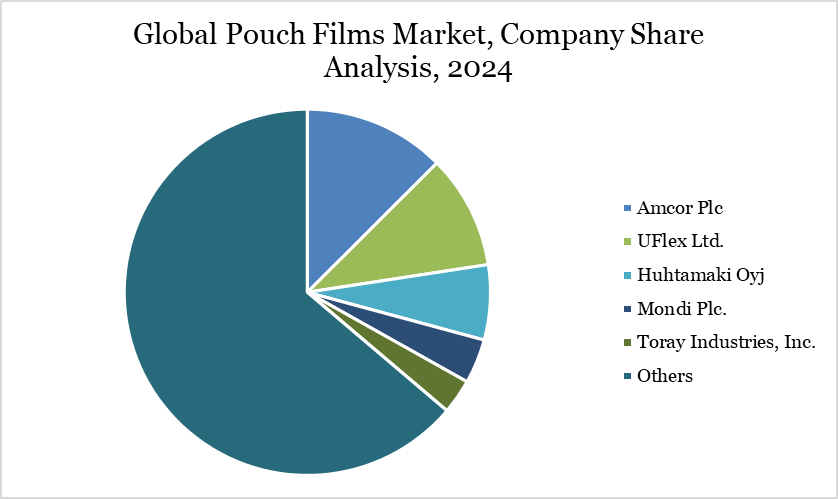

Competitive Landscape

The global pouch films market is highly competitive, driven by a mix of multinational packaging giants, regional converters and material suppliers that cater to diverse end-use sectors.

Key players such as Amcor Plc, UFlex Ltd., Huhtamaki Oyj, Mondi Plc and Toray Industries, Inc. leverage vertically integrated capabilities, spanning resin procurement, film extrusion, lamination, printing and pouch conversion to offer tailored solutions. The companies focus on innovation in high-barrier, recyclable and mono-material films to meet tightening sustainability regulations and growing brand-owner commitments to circular packaging.

Collaborative product development with major FMCG and pharmaceutical brands enables leading firms to secure long-term supply contracts and premium market positioning.

Key Developments

In March 2024, UFlex initiated commercial production of polycondensed polyester chips at its Panipat factory and opened a CPP film line in Russia, strengthening its vertical integration and manufacturing footprint in the region.

In November 2024, Mespack and Amcor have introduced a recycle-ready 2-liter stand-up pouch tailored for home care products such as soaps, detergents, and cleaners. This innovation addresses the challenge of scaling flexible packaging to larger formats while maintaining drop resistance and leak prevention. By combining Mespack’s machinery expertise with Amcor’s advanced film technology, the partners successfully developed a durable, sustainable pouch that meets consumer demand for larger, eco-friendly packaging solutions

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companiestanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report