Portable X-ray Devices Market Size & Industry Outlook

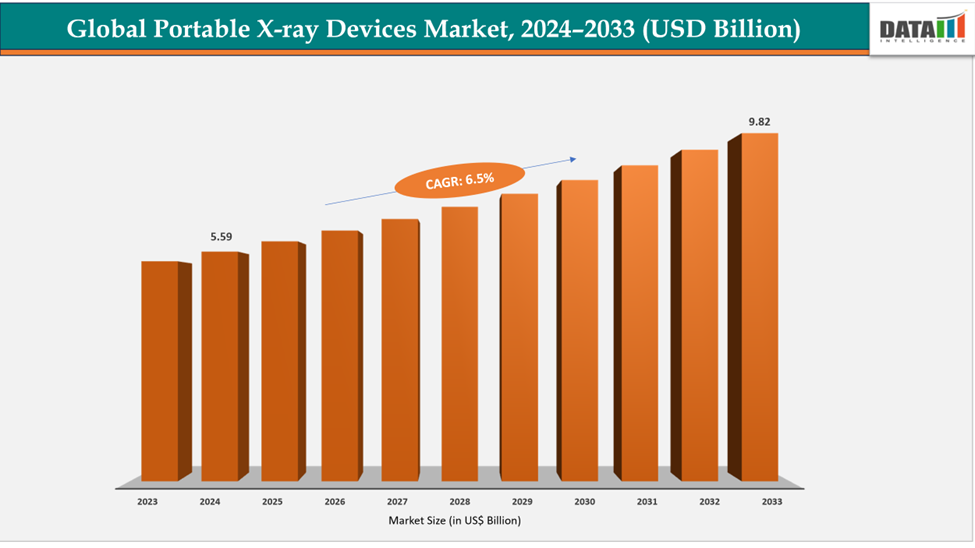

The global portable X-ray devices market size was US$ 5.59 Billion in 2024 and is expected to reach US$ 9.82 Billion by 2033, growing at a CAGR of 6.5% during the forecast period 2025-2033.

The rising number of elderly individuals is creating a greater demand for portable X-ray machines, as older patients often have difficulty moving, which makes in-bed imaging crucial. The prevalence of chronic illnesses, such as respiratory and cardiovascular diseases, heightens the necessity for regular diagnostic testing. Orthopedic issues, including fractures and joint problems, necessitate prompt imaging for effective treatment. Portable X-ray machines facilitate imaging right in hospital wards, rehabilitation facilities, or nursing homes. They minimize the risks associated with patient transport and improve workflow efficiency. An increasing recognition among healthcare professionals regarding the importance of patient safety and comfort is further driving the uptake of these devices.

Key Highlights

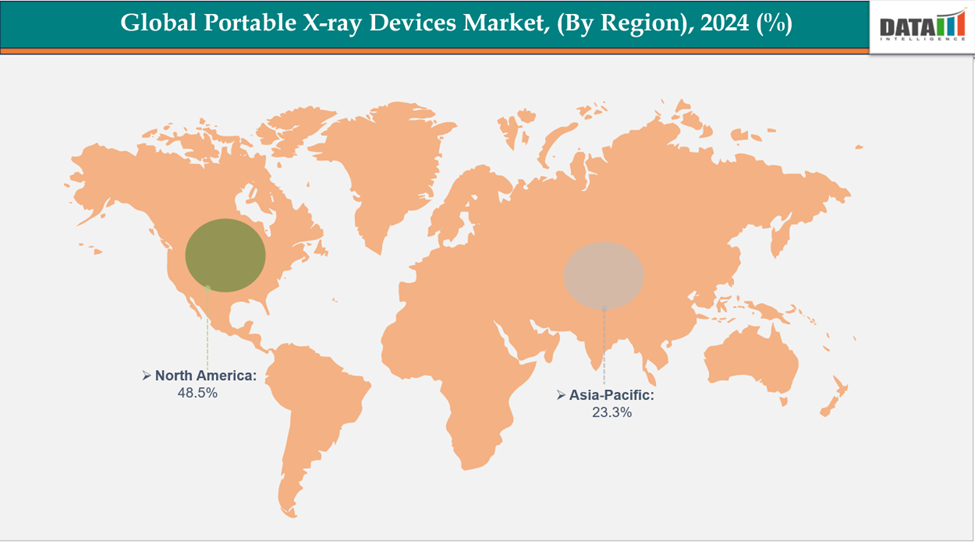

- North America is dominating the global portable X-ray devices market with the largest revenue share of 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global portable X-ray devices market, with a CAGR of 7.7% in 2024

- The digital X‑ray devices segment is dominating the portable X-ray devices market with a 58.3% share in 2024

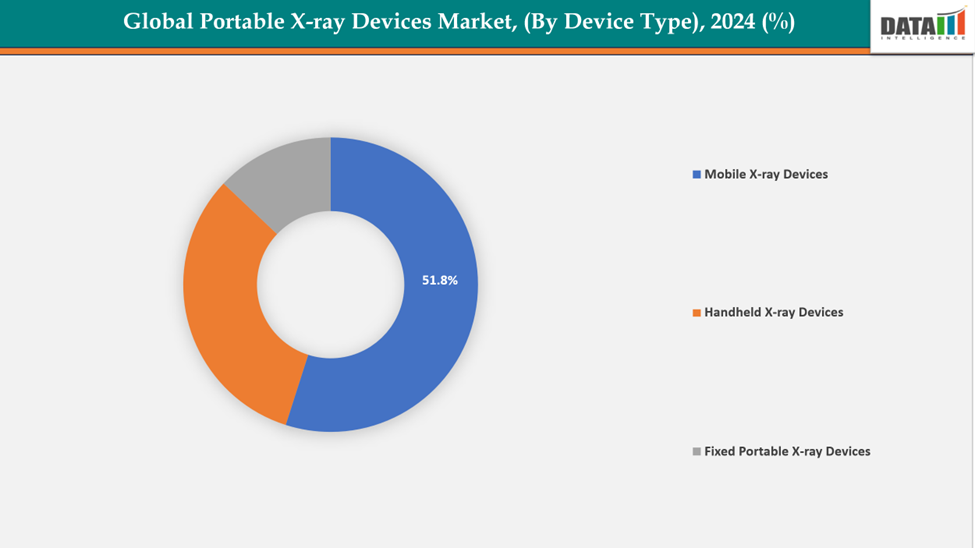

- The mobile x‑ray devices segment is dominating the portable X-ray devices market with a 51.8% share in 2024

- Top companies in the portable X-ray devices market are GE HealthCare, Aspen Imaging Healthcare, Siemens Medical Solutions USA, Inc., Dexcowin, OXOS Medical, Koninklijke Philips N.V., Dental Imaging Technologies Corporation, Carestream Health, and FUJIFILM Corporation, and CANON MEDICAL SYSTEMS CORPORATION, among others.

Market Dynamics

Drivers: Rising demand for point-of-care and bedside imaging is accelerating the growth of the portable X-ray devices market

The increasing need for bedside and point-of-care imaging is greatly driving the expansion of the portable X-ray devices market. These devices enable healthcare providers to conduct diagnostic imaging right at the patient's site, which is essential for patients who are critically ill, have suffered trauma, or are unable to move. By removing the necessity of transporting patients to radiology departments, portable X-ray devices improve workflow efficiency, lower the risk of cross-infection, and enhance patient safety.

Additionally, the growing adoption of home healthcare services, emergency medical units, and FDA approvals for new X-ray technology further boosts demand. For instance, in January 2025, OXOS Medical announced that its MC2 Portable X-ray System received FDA 510(k) clearance, marking a key milestone in advancing safe, smart, and accessible medical imaging technology.

Restraints: High equipment and maintenance costs are hampering the growth of the portable X-ray devices market

The expansion of the worldwide market for portable X-ray devices is restricted by significant costs associated with equipment and maintenance. State-of-the-art digital X-ray machines, particularly those featuring wireless detectors and AI-driven software, necessitate a considerable initial investment. Ongoing maintenance, calibration of detectors, and upgrades for the devices contribute to continuous costs, making it financially burdensome for smaller hospitals and diagnostic centers to own them.

Owing to the factors like cost. For instance, entry-level portable X-ray devices offer cost-effective imaging solutions, typically priced between $40,000 and $45,000, while intermediate models range from $60,000 to $75,000. Refurbished high-end units can reach up to $100,000, depending on features, technology, and performance capabilities.

For more details on this report, see Request for Sample

Portable X-ray Devices Market, Segmentation Analysis

The global portable X-ray devices market is segmented based on device type, technology, application, end‑user, and region

By Device Type: The mobile x‑ray devices segment is dominating the portable X-ray devices market with a 51.8% share in 2024

Mobile X-ray machines represent the largest portion of the global market for portable X-ray devices due to their enhanced mobility, excellent image quality, and widespread acceptance in hospitals. These machines come with digital flat-panel detectors and rechargeable power supplies, allowing for rapid bedside imaging in intensive care units, emergency departments, and operating rooms. Their capacity to produce high-resolution images without the need to move patients significantly improves workflow efficiency and safety, particularly for patients who are critically ill or unable to move.

Moreover, continuous technological upgrades, AI-assisted imaging, and seamless data integration into hospital PACS devices are reinforcing the leading position of mobile X-ray devices. For instance, in August 2025, DRGEM’s PROMO mobile X-ray device received U.S. FDA 510(k) clearance, marking a key regulatory achievement that validated its compliance with U.S. standards and strengthened DRGEM’s global leadership in advanced mobile diagnostic imaging solutions.

By Technology: The digital x‑ray devices segment is dominating the portable X-ray devices market with a 58.3% share in 2024

The digital X-ray devices segment dominates the global portable X-ray devices market due to rapid technological advancements and high clinical efficiency. For instance, in November 2025, Adaptix Limited received FDA 510(k) clearance for its digital X-ray -based Ortho350 system, a compact, mobile, low-dose 3D orthopedic imaging device designed to deliver fast, cost-effective, point-of-care scans of extremities with significantly lower radiation exposure than traditional CT devices.

Furthermore, these devices allow for immediate image capture, minimize radiation exposure, and integrate smoothly with hospital information systems and PACS. Their portable, battery-operated design facilitates bedside and remote imaging, which is perfect for use in emergency situations, ICUs, and home care scenarios. Healthcare professionals favor digital devices due to their improved diagnostic precision, enhanced workflow efficiency, and reduced long-term operating costs when compared to analog devices.

Portable X-ray Devices Market, Geographical Analysis

North America is dominating the global portable X-ray devices market with 48.5% in 2024

The North American region leads the portable X-ray devices market, due to its sophisticated healthcare infrastructure, quick embrace of digital imaging technologies, and increasing numbers of surgical and critical care cases. The presence of favorable reimbursement systems, constant product innovations, highly skilled medical personnel, and stringent regulatory compliance further bolsters the region's dominance in the market.

The portable X-ray devices market in the USA is expanding due to advanced healthcare infrastructure, frequent product launches, innovative imaging technologies, positive FDA approvals, and 510(k) clearances enhancing diagnostic and critical care efficiency. For instance, in April 2025, NANO-X Imaging Ltd. received FDA 510(k) clearance for its Nanox.ARC X, a multi-source digital tomosynthesis X-ray system designed to deliver advanced, low-dose, high-resolution imaging for broad general diagnostic use.

Europe is the second region after North America, which is expected to dominate the global portable X-ray devices market with 34.5% in 2024

The market for portable X-ray devices in Europe is growing due to advancements in healthcare systems, an increasing elderly population, and a rise in the number of surgical procedures. Ongoing product introductions, beneficial reimbursement systems, and a steady stream of EU and CE mark approvals are fostering innovation, improving patient safety, and propelling regional market development throughout healthcare environments.

Owing to factors like continuous EU and CE mark approvals, for instance, in January 2025, Carestream Health received European Union CE Marking approval for its Focus HD Detectors and DRX-Rise Mobile X-ray device, strengthening its digital imaging portfolio and expanding access to advanced portable diagnostic solutions across European healthcare facilities.

Moreover, in April 2024, KA Imaging, a Canadian manufacturer, received CE Mark certification for its Reveal Mobi Lite Portable X-ray device, expanding its product portfolio and enabling sales across Europe to deliver advanced, high-quality mobile imaging solutions.

The Asia Pacific region is the fastest-growing region in the global portable X-ray devices market, with a CAGR of 7.7% in 2024

The market for portable X-ray machines in the Asia-Pacific area, which includes China, India, Japan, and South Korea, is growing swiftly due to increased spending on healthcare, advancements in technology, enhanced hospital infrastructure, favorable government policies, and a higher uptake of point-of-care imaging solutions in both urban and rural medical facilities.

In India, portable X-ray device companies are partnering with hospitals and medical centers, collaborating on mobile screening programs, AI-integrated diagnostics, and point-of-care imaging solutions to expand access and enhance patient care. For instance, in June 2024, FUJIFILM India, in collaboration with NM Medical Mumbai, launched its first Fujifilm Skill Lab to provide advanced training in full-field digital mammography (FFDM) technologies for radiologists and radiographers, with eight participants attending the inaugural session.

Portable X-ray Devices Market Competitive Landscape

Top companies in the portable X-ray devices market are GE HealthCare, Aspen Imaging Healthcare, Siemens Medical Solutions USA, Inc., Dexcowin, OXOS Medical, Koninklijke Philips N.V., Dental Imaging Technologies Corporation, Carestream Health, and FUJIFILM Corporation, and CANON MEDICAL SYSTEMS CORPORATION, among others.

GE HealthCare: GE HealthCare is a global leader in medical imaging, offering advanced portable X-ray devices such as the AMX and Definium series, designed for high-quality, point-of-care imaging. The company focuses on enhancing mobility, workflow efficiency, and image precision through digital technologies, AI integration, and wireless connectivity, strengthening its position in the growing portable X-ray devices market.

Key Developments:

- In November 2025, NANO-X Imaging Ltd. announced a distribution agreement with EXRAY s.r.o., a leading Czech medical imaging distributor, to introduce Nanox’s advanced imaging solutions to healthcare providers across the Czech Republic, expanding its European footprint.

- In July 2025, GE HealthCare announced the commercial launch of its Definium Pace Select ET1, an advanced floor-mounted digital X-ray system designed to deliver high-image quality, improve efficiency in high-throughput environments, and enhance access and affordability.

Portable X-ray Devices Market Scope

| Metrics | Details | |

| CAGR | 6.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Device Type | Mobile X‑ray Devices, Handheld X‑ray Devices, Fixed Portable X‑ray Devices |

| By Technology | Digital X‑ray Devices, Analog X‑ray Devices, Hybrid Devices | |

| By Application | Chest X‑ray, Orthopedic Imaging, Dental Imaging Mammography, Cardiovascular Imaging, and Others | |

| By End‑User | Hospitals, Diagnostic Imaging Centers, Home Healthcare, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global portable X-ray devices market report delivers a detailed analysis with 70 key tables, more than 67 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical imaging-related reports, please click here