Global Electronic Stethoscope Market: Industry Outlook

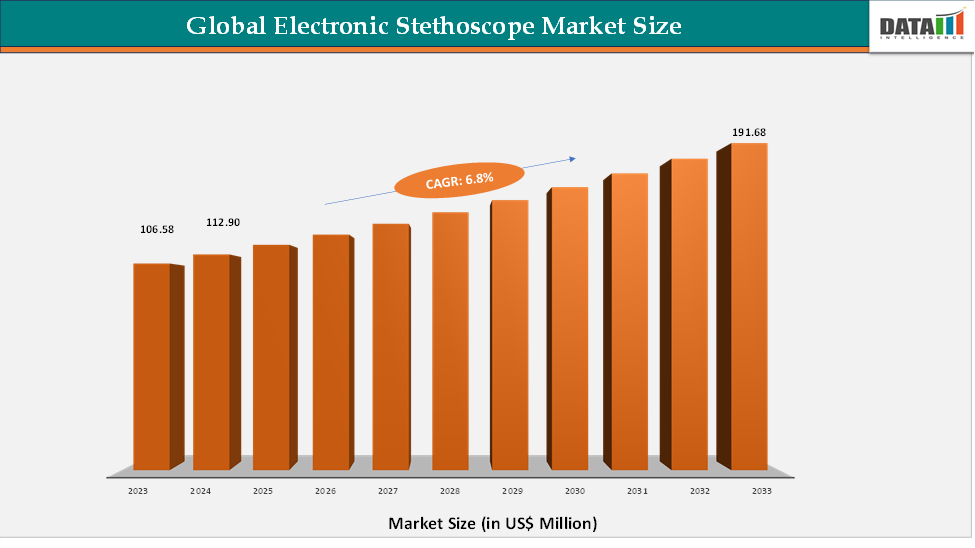

The global electronic stethoscope market reached US$ 106.58 million in 2023, with a rise to US$ 112.90 million in 2024, and is expected to reach US$ 191.68 million by 2033, growing at a CAGR of 6.8% during the forecast period 2025–2033.

The global electronic stethoscopes market has changed rapidly in the past few years. These devices moved from being simple sound amplifiers to becoming smart diagnostic tools powered by AI, ECG integration, and telehealth connectivity. They are now helping doctors and nurses not just listen, but actually detect early signs of heart and lung problems more effectively. Hospitals, primary care clinics, and even home health programs are adopting them because they save time, improve accuracy, and fit seamlessly into the digital healthcare ecosystem.

For more details on this report, Request for Sample

Key Market Trends & Insights

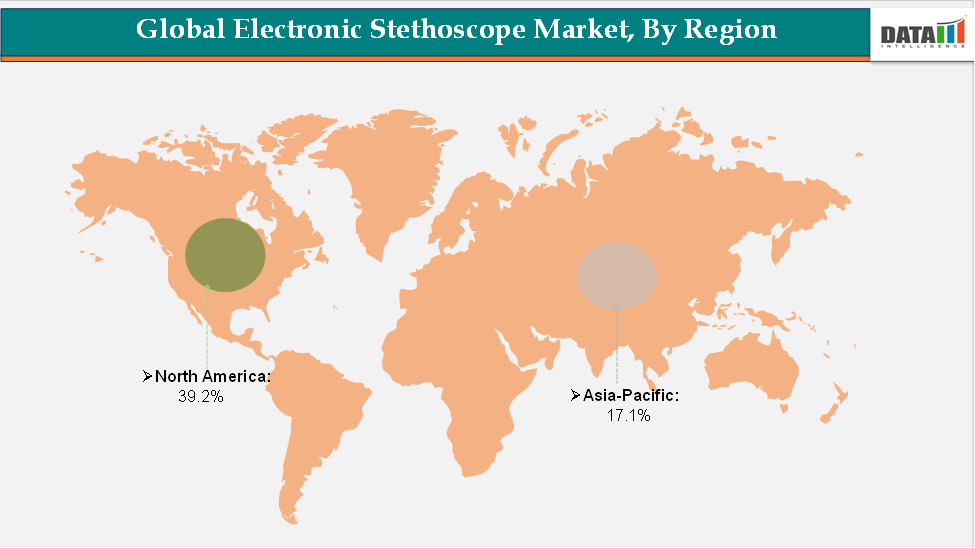

North America accounted for approximately 39.2% of the global electronic stethoscopes market in 2024 and is expected to retain its leading position throughout the forecast period. This dominance is supported by the region’s advanced healthcare infrastructure, strong adoption of AI-enabled diagnostic devices, high prevalence of cardiovascular and respiratory conditions, and a favorable regulatory environment that accelerates FDA approvals for innovative stethoscope technologies.

Asia-Pacific is projected to be the fastest-growing region, driven by rising demand for telehealth solutions, increasing prevalence of cardiopulmonary diseases, and strong government initiatives promoting accessible healthcare. Countries such as China, India, and Japan are at the forefront of this growth, leveraging electronic stethoscopes for both hospital-based diagnostics and home-based monitoring programs.

Market Size & Forecast

2024 Market Size: US$ 112.90 Million

2033 Projected Market Size: US$ 191.68 Million

CAGR (2025–2033): 6.8%

North America: Largest market in 2024

Asia Pacific: Fastest-growing market

Global Electronic Stethoscope Market Dynamics: Drivers & Restraints

Driver: Regulatory Approvals

Regulatory approvals have emerged as a critical enabler of growth in the electronic stethoscopes market. Unlike conventional acoustic stethoscopes, electronic models incorporate advanced functionalities such as AI algorithms, ECG integration, wireless transmission, and cloud connectivity, all of which require stringent regulatory validation to ensure clinical safety and efficacy. Approvals from agencies like the U.S. Food and Drug Administration (FDA) play a pivotal role in shaping adoption patterns, reimbursement eligibility, and overall market confidence.

The industry witnessed several landmark approvals that accelerated commercialization. In 2024, Eko Health secured FDA clearance for its AI algorithm designed to detect low ejection fraction, marking the first time a stethoscope was officially validated as a point-of-care tool for identifying heart failure. This approval positioned electronic stethoscopes as not only listening devices but also frontline diagnostic instruments with measurable clinical impact.

Furthermore, they catalyze investment inflows and strategic collaborations, as demonstrated by Eko Health’s US$41 million Series D funding round in 2024, which followed shortly after its FDA clearance. Collectively, these developments highlight regulatory endorsement as a key driver propelling the electronic stethoscopes market toward broader clinical acceptance and sustained growth.

Restraint: Workflow Integration Challenges

One of the biggest hurdles slowing down the widespread adoption of electronic stethoscopes is the difficulty of integrating them into existing clinical workflows. Traditional acoustic stethoscopes are simple, lightweight, and require no additional setup or digital interface. In contrast, electronic stethoscopes often involve mobile apps, Bluetooth connections, cloud storage, and AI dashboards. For many clinicians, this represents a steep learning curve.

Global Electronic Stethoscope Market Segment Analysis

The global electronic stethoscope market is segmented by type, technology, connectivity, distribution channel, and region.

Technology:

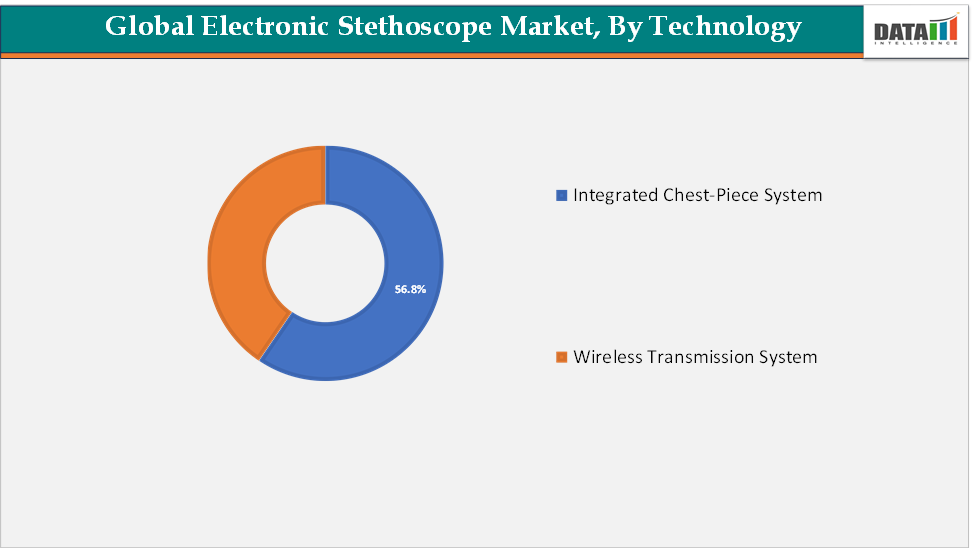

The integrated chest-piece system segment is estimated to have 56.8% of the electronic stethoscope market share.

The integrated chest-piece system segment holds the largest share of the electronic stethoscopes market and continues to dominate because it offers a complete, self-contained design that combines advanced amplification, noise reduction, and digital signal processing directly within the chest piece itself. Unlike attachment-type or modular add-ons, integrated chest-piece models do not require separate external devices, making them more convenient and user-friendly for clinicians in everyday practice.

This design eliminates the variability that can occur with detachable modules and ensures consistent sound quality across different clinical environments, including noisy hospital wards and emergency rooms. Many leading products, such as the 3M Littmann CORE Digital Stethoscope and Eko CORE 500, rely on integrated chest-piece technology to deliver features like up to 40x sound amplification, ECG recording, Bluetooth connectivity, and AI-enabled interpretation.

Clinicians prefer integrated chest-piece systems because they feel and function like a traditional stethoscope, reducing the learning curve and supporting faster adoption. The durability and reliability of this form factor also make it ideal for high-volume use in hospitals and primary care practices. By providing a seamless balance of tradition and technology, the integrated chest-piece system has secured its position as the dominant segment in the electronic stethoscopes market.

The wireless transmission system segment is estimated to have 43.2%% of the Electronic Stethoscope market share

The wireless transmission system segment of electronic stethoscopes includes devices that transmit auscultation sounds via Bluetooth, wi-fi, or proprietary wireless technology to external devices such as smartphones, tablets, computers, or telehealth platforms. These stethoscopes are increasingly valued in remote patient monitoring (RPM), telemedicine consultations, and medical training environments, where the ability to share and store sounds in real time is critical. The Wireless Transmission System segment is still seen as complementary rather than primary. Its adoption is strongest in telehealth, pediatrics, home monitoring, and medical education, whereas the integrated chest-piece system dominates clinical practice and hospital workflows.

Electronic Stethoscope Market - Geographical Analysis

The North America electronic stethoscope market was valued at 39.2% market share in 2024

North America firmly holds the lead in the electronic stethoscopes market, accounting for approximately 39.2% of global revenue. Several factors are contributing to the region’s growth. The region boasts a highly advanced healthcare infrastructure, with top-tier hospitals, clinics, and cardiology networks quick to adopt advanced digital diagnostics. Regulatory support through the U.S. FDA has been pivotal, and the presence of major players such as Eko Health, 3M Littmann, among others, and sizeable investment flows have strengthened the innovation ecosystem and manufacturing capacity.

Recent activity, like 3M Littmann’s 2024 launch of the CORE Digital Stethoscope with Eko integration, and Eko Health’s FDA clearance of its CORE 500 digital stethoscope, continues to broaden adoption and set a high innovation benchmark for the region.

The Asia-Pacific electronic stethoscope market was valued at 17.1% market share in 2024

Asia-Pacific is currently the fastest-growing region in the electronic stethoscopes market, driven by rapid healthcare digitization, growing telemedicine networks, and the rising burden of cardiovascular and respiratory diseases. In 2024, the region has seen accelerating adoption of smart diagnostic devices as governments and private players invest in digital health infrastructure. Countries across the region are strengthening primary care systems and expanding access to connected diagnostic tools, with electronic stethoscopes emerging as an affordable yet advanced solution for early disease detection. This strong momentum reflects the combination of high disease prevalence, supportive policies, and the increasing integration of AI-enabled stethoscopes into telehealth platforms.

India:

Within the Asia-Pacific region, India is emerging as one of the most dominant and fastest-growing countries in the electronic stethoscopes market. Several factors are fueling this growth: the government’s Ayushman Bharat program is expanding healthcare access nationwide, while public–private partnerships are deploying digital diagnostic tools in rural and semi-urban areas. At the same time, India’s thriving medtech startup ecosystem is bringing affordable and innovative electronic stethoscope models to the market, making adoption easier for both clinicians and patients.

Electronic Stethoscope Market – Competitive Landscape

The major players in the Electronic Stethoscope market include Takeda Pharmaceutical Company Limited, Novartis Pharmaceuticals Corporation, Amgen Inc., Lupin, AstraZeneca, AdvaCare Pharma, among others.

Global Electronic Stethoscope Market: Scope

Metrics | Details | |

CAGR | 7.4% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Type | Amplified Electronic Stethoscopes, Digital Electronic Stethoscopes |

Technology | Integrated Chest-Piece System, Wireless Transmission System | |

Connectivity | Wired, Bluetooth, Wi-Fi | |

Distribution Channel | Offline Stores, Online Stores | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global electronic stethoscope market report delivers a detailed analysis with 73 key tables, more than 76 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.