Overview

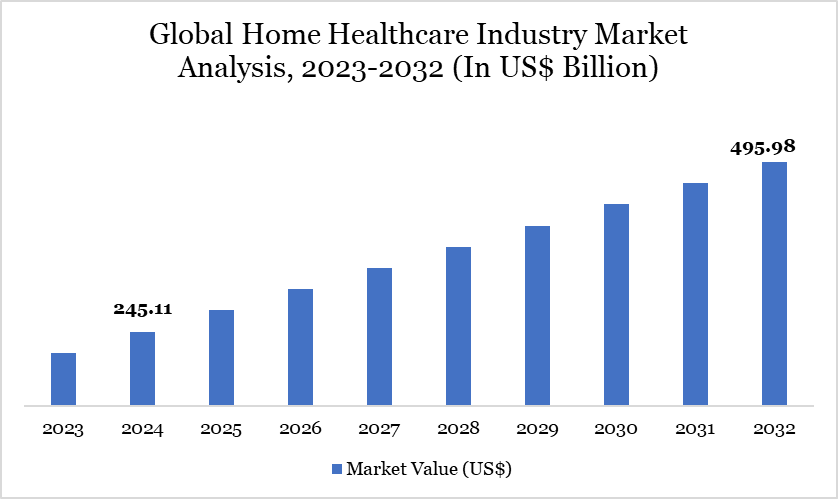

Global home healthcare industry market size reached US$ 245.11 billion in 2024 and is expected to reach US$ 495.98 billion by 2032, growing with a CAGR of 9.21% during the forecast period 2025-2032.

The global home healthcare industry is experiencing significant growth, driven by demographic shifts and increasing demand for cost-effective care solutions. According to the United Nations Department of Economic and Social Affairs, the population aged 65 and over is projected to grow from 771 million in 2022 to 1.6 billion by 2050, substantially increasing the need for home-based healthcare services.

In the US, Medicare spending on home health care services totaled over US$ 29 billion in 2020, reflecting the government's commitment to supporting home healthcare initiatives. Similarly, in Canada, the federal government announced a US$ 6 billion investment in home and community care, along with an additional US$ 1.7 billion over five years to support wage increases for personal support workers, aiming to enhance access and quality of home care services.

Home Healthcare Industry Market Trend

A notable trend in the home healthcare industry is the integration of digital technologies to enhance service delivery. India's National Digital Health Mission promotes electronic medical records to improve home healthcare services. In the US, the adoption of remote patient monitoring and telehealth has been accelerated by Medicare's expanded reimbursement policies, enabling continuous monitoring and personalized care. These technological advancements are reducing hospital visits and making home healthcare a more viable and preferred option for many patients.

Market Scope

| Metrics | Details |

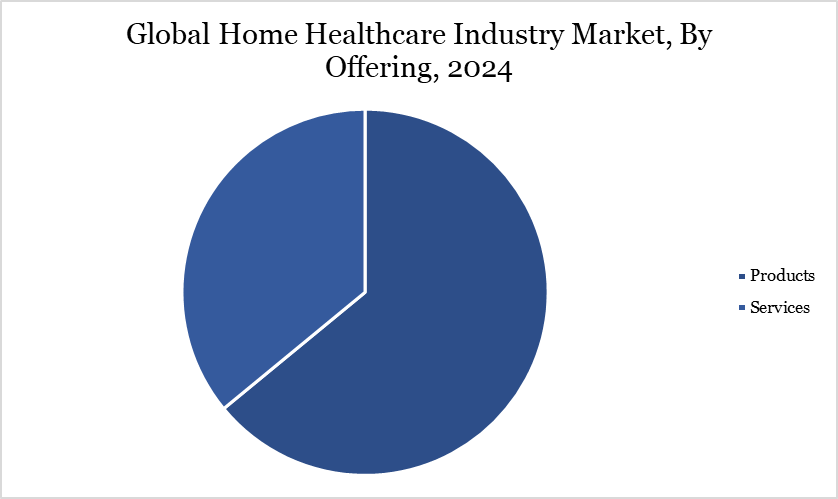

| By Offering | Products, Services |

| By Indication | Cancer, Neurological Disorders, Mobility Disorders, Diabetes, Cardiovascular Disorders, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Dynamics

Rising Healthcare Costs and Government Support

The increasing expense of healthcare is driving patients and healthcare providers to seek economical options, with home healthcare providing substantial cost savings in comparison to hospital treatment. According to the Centers for Medicare & Medicaid Services (CMS), home healthcare is a cost-effective option for managing chronic diseases and recovering from surgeries, as it is notably cheaper than hospital care. With budget limitations, healthcare systems are gaining more government aid in the form of reimbursement policies and tax incentives to promote the use of home healthcare services.

Furthermore, US Bureau of Labor Statistics predicts a 29% increase in job opportunities within the home healthcare industry from 2020 to 2030, surpassing the average growth rate for all professions and highlighting the sector's increasing significance in healthcare services. Additionally, government efforts like these are essential for driving the market forward, as global healthcare expenditures on home healthcare are expected to increase with a notable growth rate each year. This increase is particularly noticeable in nations with elderly populations and overwhelmed hospital systems.

Workforce Shortages and Regulatory Challenges

Workforce shortages and regulatory hurdles are the key factors that hamper the growth of the home healthcare industry. A shortage of qualified home healthcare workers, including nurses and aides, is placing a strain on service delivery, especially in rural areas. WHO projects a shortfall of 18 million health workers to accelerate universal health coverage by 2030, particularly in low- and lower-middle-income countries, exacerbating the issue of home healthcare.

Additionally, regulatory challenges pose a restraint on market growth. Countries with stringent healthcare regulations may face barriers in terms of reimbursement processes, certification requirements for home healthcare providers and privacy concerns surrounding the use of digital health monitoring tools. These regulatory bottlenecks often slow down the adoption of new technologies and services in home healthcare.

Segment Analysis

The global home healthcare industry market is segmented based on offering, indication and region.

Product Offering Segment Driving Home Healthcare Industry Market

The demand for home healthcare market is driven by the adoption of assistive devices and remote monitoring tools. The devices help manage chronic diseases and enable elderly or disabled individuals to live more independently. According to the United Nations, the global population aged 60 years or over is expected to double by 2050, driving increased demand for devices like mobility aids, oxygen delivery systems and home dialysis equipment.

Telehealth and remote patient monitoring are also experiencing significant demand as they enable healthcare providers to monitor patient’s conditions without the need for in-person visits. Furthermore, advancements in communication technologies and the increasing prevalence of chronic conditions such as diabetes and hypertension also drive the home health market growth. Moreover, these tools reduce the burden on healthcare systems by allowing for continuous monitoring and early intervention, which can help prevent hospital readmissions and improve overall patient outcomes.

Geographical Penetration

Demand for Home Healthcare Industry in North America

The demand for home healthcare services in North America is experiencing significant growth, driven by an aging population and a rising prevalence of chronic conditions. In the US, approximately 56 million adults aged 65 and older were recorded in 2020, with projections indicating an increase to 85.7 million by 2050. This demographic shift has led to a surge in home healthcare utilization, with over 12 million Americans receiving such services annually. Notably, home healthcare has been associated with a reduction in hospital readmission rates by up to 25%, underscoring its effectiveness in managing chronic diseases and supporting aging in place.

In Canada, the trend mirrors that of the US, with an increasing number of older adults relying on home care services. In 2023, 4.5% of Canadian adults utilized home care services, up from 4.0% in 2022. However, challenges persist, as 2.0% of adults reported unmet needs for home care, with higher percentages among seniors aged 65 and older (3.8%) and individuals in the lowest income quintile (4.3%). To address these gaps, the Canadian government announced a $6 billion investment in home and community care, along with an additional $1.7 billion over five years to support wage increases for personal support workers, aiming to enhance access and quality of home care services.

Sustainability Analysis

Sustainability is becoming an increasingly important factor in the global home healthcare industry, with a growing emphasis on reducing the environmental impact of medical waste and energy consumption. The adoption of energy-efficient medical equipment and telehealth tools is reducing the healthcare sector's carbon footprint, as digital healthcare technologies are decreasing the reliance on physical infrastructure.

According to the Global Sustainability Council for Healthcare (GSCH), the home healthcare market can contribute significantly to global sustainability goals by reducing the need for hospital infrastructure, thereby decreasing energy consumption and waste generation. Specifically, remote patient monitoring systems and telemedicine help decrease the need for patients to travel and be admitted to the hospital, supporting a more sustainable healthcare system. Furthermore, companies are increasingly focused on designing recyclable and biodegradable medical devices, aligning with global environmental regulations and consumer demand for eco-friendly solutions.

Competitive Landscape

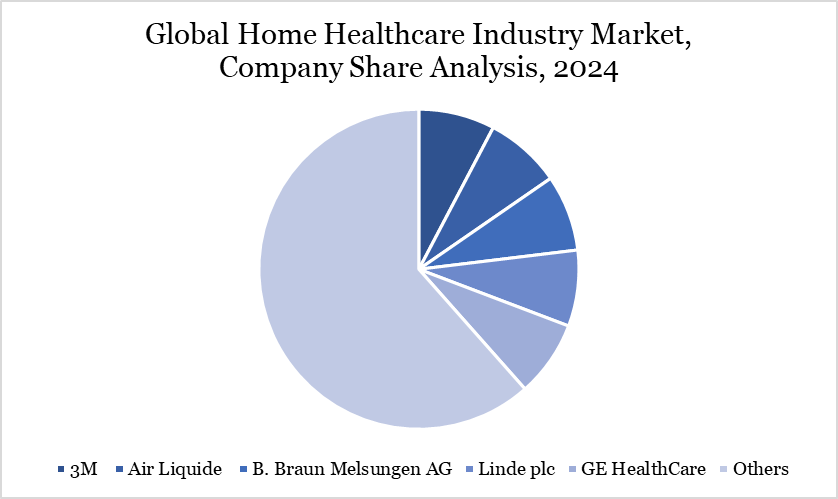

The major global players in the market include Omron Healthcare, Inc., 3M, Air Liquide, B. Braun Melsungen AG, Linde plc, GE HealthCare, Koninklijke Philips N.V., Dickinson and Company, A&D Company Limited and Addus HomeCare Corporation.

Key Developments

In July 2024, Standalone health insurance company Star Health and Allied Insurance Company with an aim to providing healthcare service at doorstep has launched Home Health Care service in 50 cities, a top official said. The city-headquartered company would further expand the service to other cities.

In July 2024, The Accreditation Commission for Health Care Inc launched two new home healthcare-based specialty credentials that will be awarded to ACHC-accredited organizations that have excelled in providing high-quality, patient-centered care.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies