3D Printing Drugs Market Size & Industry Outlook

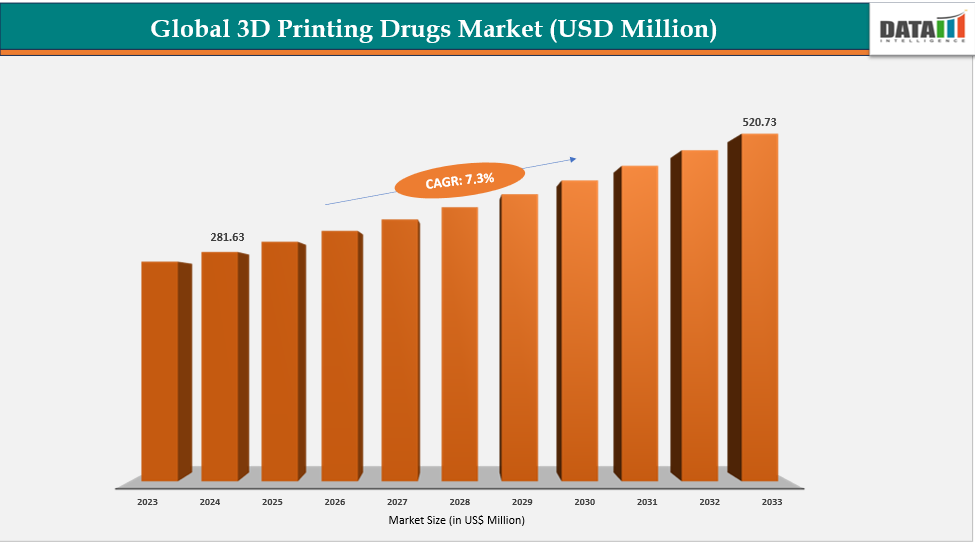

The global 3D printing drugs market size reached US$ 260.32 Million in 2023 with a rise of US$ 281.63 Million in 2024 and is expected to reach US$ 520.73 Million by 2033, growing at a CAGR of 7.3% during the forecast period 2025-2033.

Complex and novel drug forms combined with technological advances are major drivers of the 3D-printed drugs market. Polypills, controlled-release tablets, gastric-retentive forms, microneedles, implants, and other customized treatments that are not possible with standard manufacturing can be made thanks to 3D printing. FDM, SLA, SLS, SSE, and ZipDose are examples of advanced technologies that provide accurate dosing, reproducibility, and scalability, enabling customized drug release profiles for patients with chronic diseases, geriatrics, and children. Innovative materials, automated layering, and rapid prototyping save development times and improve formulation effectiveness.

Key Highlights

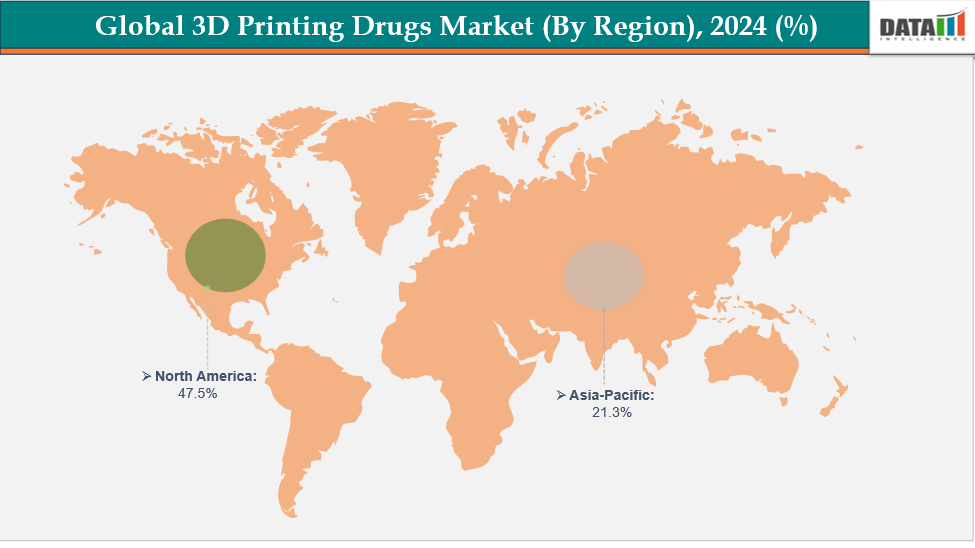

- North America dominates the 3D printing drugs market with the largest revenue share of 47.5% in 2024

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.4% over the forecast period.

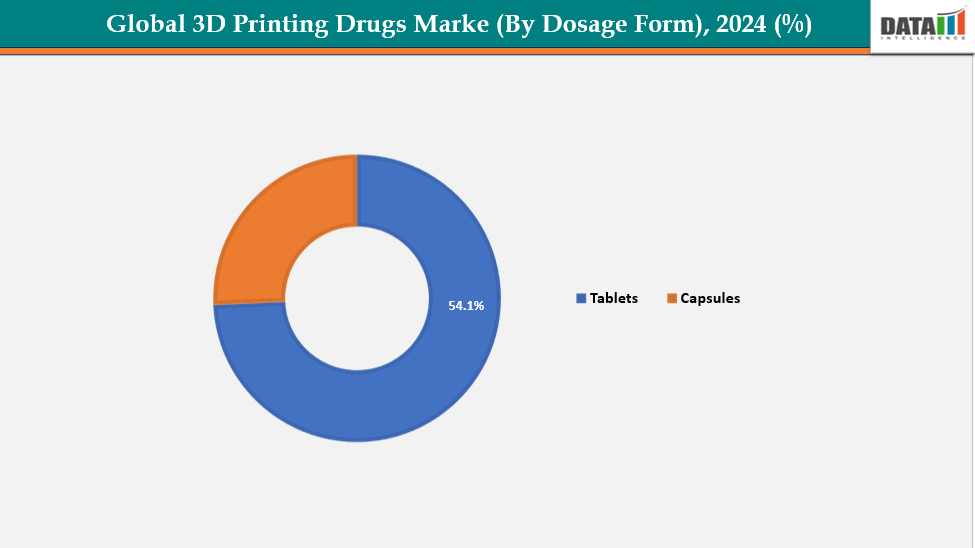

- The tablets segment from dosage form is dominating the 3D printing drugs market with a 54.1% share in 2024

- The Flash dispersing technology segment from technology is dominating the 3D printing drugs market with a 42.3% share in 2024

- Key players in the 3D-printed drugs market include Aprecia Pharmaceuticals, a pioneer in FDA-approved 3D-printed medications, alongside emerging companies such as Triastek, FabRx Ltd, MB Therapeutics, Laxxon Medical, CurifyLabs, Multiply Labs, DOSER, and Merck KGaA, among others.

Market Dynamics

Drivers: Rising demand for personalized medicine is significantly driving the 3D printing drugs market growth

The rising demand for personalized medicine is a major driver of the 3D-printed drugs market, as traditional tablets with fixed doses often fail to meet individual patient needs. For patients with organ impairments, the elderly, and children, 3D printing allows customized dosage that offers advantages not found in commercial products. Customized pills that dissolve quickly are beneficial for patients who have trouble swallowing. For instance, 3D printing allows healthcare providers to customize doses for pediatric patients who require smaller or altered strengths that are not commercially available.

Furthermore, 3D-printed polypills combine several drugs into a single pill with controlled-release characteristics for chronic diseases like epilepsy or cardiovascular disorders, increasing adherence and lowering pill load. Point-of-care printing reduces waste and guarantees accurate dosage by enabling pharmacies and hospitals to make medications as needed.

Restraints: Regulatory uncertainty and approval process are hampering the growth of the 3D printing drugs market

Regulatory uncertainty and the complex approval process are significant barriers to the growth of the 3D-printed drugs market as 3D printing offers new manufacturing techniques that are essentially different from those used in conventional pharmaceutical manufacture. Standardized norms for quality, safety, reproducibility, and stability are still developing, and regulators like the FDA, EMA, and other international bodies have little experience with additive manufacturing for pharmaceuticals. Concerns regarding dose uniformity and bioavailability arise because the internal structure, dosage, and geometry of each printed tablet may differ.

Additionally, point-of-care printing at hospitals or pharmacies adds complexity, as regulators must evaluate decentralized production processes. The lack of harmonized global standards leads to longer approval timelines, increased costs, and hesitation among pharmaceutical companies to invest in large scale production. Until clear regulatory frameworks are established, these uncertainties slow adoption and limit commercialization opportunities.

For more details on this report, see Request for Sample

Segmentation Analysis

The global 3D printing drugs market is segmented based on dosage form, technology, application, end user and region

By Dosage Form:The tablets segment from dosage form is dominating the 3D printing drugs market with a 54.1% share in 2024

The tablets segment dominates the 3D-printed drugs market due to high patient demand, technological feasibility, and regulatory acceptance.3D printing enables precise customization of dose strength, internal geometry, and drug release profiles, supporting personalized therapies for pediatrics, geriatrics, and chronic disease patients. Binder-jetting and similar 3D-printing technologies are mature, reproducible, and scalable, making tablets easier to manufacture and approve compared to newer dosage forms like microneedles, implants, or oral films.

For instance, Spritam, developed by Aprecia Pharmaceuticals, is the world’s first FDA-approved 3D-printed drug and a milestone in pharmaceutical manufacturing. Utilizing Aprecia’s proprietary ZipDose technology, it produces a highly porous, rapidly disintegrating oral tablet specifically designed for epilepsy patients who struggle to swallow conventional pills. Through precise layering, Spritam dissolves quickly with just a small sip of water, combining innovative 3D printing technology with enhanced patient convenience and adherence.

By Technology: The Flash dispersing technology segment from technology is dominating the 3D printing drugs market with a 42.3% share in 2024

The dispersing/dispensing technology segment is being driven by its ability to deliver high-precision, dose-accurate deposition and highly customizable drug geometries features that directly enable personalized dosing and fixed-dose combination tablets. Advances in printable pharmaceutically-compatible inks and excipient formulations, together with improved nozzle reliability and micro-dispensing control, have expanded the range of APIs and release profiles that can be manufactured, increasing clinical and commercial appeal.

Regulatory progress and growing acceptance of digitally controlled small-batch production coupled with cost reductions from automation, rapid prototyping, and reduced waste make on-demand and decentralized manufacturing (e.g., hospital pharmacies and compounding centers) more feasible. Strategic collaborations between device makers, formulation scientists and pharma companies, plus rising demand for pediatric, geriatric and complex therapy regimens, further accelerate adoption of dispersing technologies as a scalable route for bespoke and specialty oral dosage forms.

Geographical Analysis

North America is dominating the global 3D printing drugs market with a 47.5% in 2024

North America is dominating the global 3D-printed drugs market due to a combination of technological, regulatory, and healthcare factors. The region has a highly developed pharmaceutical industry with significant investments in research and innovation, enabling early adoption of advanced manufacturing technologies such as 3D printing. For The FDA’s proactive regulatory framework, including the approval of the first 3D-printed drug, Spritam, provides a clear pathway for commercialization, encouraging pharmaceutical companies to invest in 3D-printed drug development.

The dominance of the U.S. is further reinforced by regulatory and market development. For instance, in January 2024, Triastek’s 3D-printed gastric retention product, T22, received IND clearance from the FDA, becoming the world’s first 3D-printed gastric retention product. At that time, Triastek had four 3D-printed products—T19, T20, T21, and T22—approved for IND clearance, establishing the company as a global leader in pharmaceutical 3D printing clinical development.

Europe is the second region after North America which is expected to dominate the global 3D printing drugs market with a 34.5% in 2024

The 3D-printed drugs market is rapidly expanding in Europe, driven by early adoption of personalized medicine, advanced healthcare infrastructure, and growing chronic disease prevalence. Strong regulatory support from agencies like the EMA, coupled with initiatives promoting precision therapies and patient-centric formulations, further fuels demand, enabling rapid development, approval, and commercialization of innovative 3D-printed drug products.

Germany’s advanced pharmaceutical and healthcare sectors, coupled with high demand for personalized therapies, are driving growth in the 3D-printed drugs market. The adoption of tailored drug formulations is supported by strict regulations emphasizing patient safety and treatment efficacy. Regulatory bodies like the EMA implement initiatives and guidance for innovative drug technologies, reinforcing Germany’s leadership in preventive and personalized 3D-printed drug solutions.

The Asia Pacific region is the fastest-growing region in the global 3D printing drugs market, with a CAGR of 7.4% in 2024.

The 3D-printed drugs market in the Asia-Pacific region, including China, India, Japan, and South Korea, is expanding rapidly. Growth is driven by increasing demand for personalized medicines, rising chronic disease prevalence, and advancements in healthcare infrastructure. In Japan, adoption is supported by government initiatives promoting precision medicine and innovative drug technologies. In China and India, growing awareness of personalized therapy, regulatory support, and improvements in hospital and pharmacy infrastructure are boosting demand for 3D-printed tablets, polypills, and tailored drug delivery systems, enhancing patient outcomes and market growth.

China’s 3D-printed drugs market is growing rapidly, driven by rising demand for personalized therapies, advanced healthcare infrastructure, and regulatory support. Increasing research collaboration and partnerships between companies and institutes are boosting adoption of the 3D-printed drug market. For instance, in July 2024, Triastek, a global leader in 3D-printed pharmaceuticals, entered a research collaboration and platform technology license agreement with BioNTech. The partnership focused on developing oral RNA therapeutics using 3D printing, aiming to deliver innovative, easy-to-administer therapies for cancer and other serious diseases, addressing unmet medical needs.

Competitive Landscape

Key players in the 3D-printed drugs market include Aprecia Pharmaceuticals, a pioneer in FDA-approved 3D-printed medications, alongside emerging companies such as Triastek, FabRx Ltd, MB Therapeutics, Laxxon Medical, CurifyLabs, Multiply Labs, DOSER, and Merck KGaA, among others.

Aprecia Pharmaceutical.: Aprecia Pharmaceuticals, founded in 2003, is a pioneer in 3D-printed drugs, known for its proprietary ZipDose technology. It developed Spritam, the first FDA-approved 3D-printed pill, enabling rapid disintegration and high-dose delivery up to 1,000 mg. Aprecia continues to lead in precision formulation and scalable 3D printing solutions.

Key Developments:

- In September 2025, Adare Pharma Solutions, a global technology-driven CDMO, collaborated with Laxxon Medical to provide cGMP 3D printing capabilities at Adare’s Pessano facility in Milan, Italy. The partnership enabled the formulation of complex pharmaceuticals with customizable release profiles, improved bioavailability, and tailored pharmacokinetics, advancing next-generation 3D-printed oral dosage forms.

Market Scope

| Metrics | Details | |

| CAGR | 7.3% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | By Dosage Form | Tablets, Capsules |

| By Technology | Flash Dispersing Technology, ZipDose Technology, Inkjet Printing, Others. | |

| By Application | Neurology, Cardiology, Oncology, Infectious Diseases, Gastroenterology and Others | |

| By End User | Hospitals, Clinics, Research Laboratories and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global 3D printing drugs market report delivers a detailed analysis with 43 key tables, more than 60 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape