Global Ophthalmology Drugs Market Size & Industry Outlook

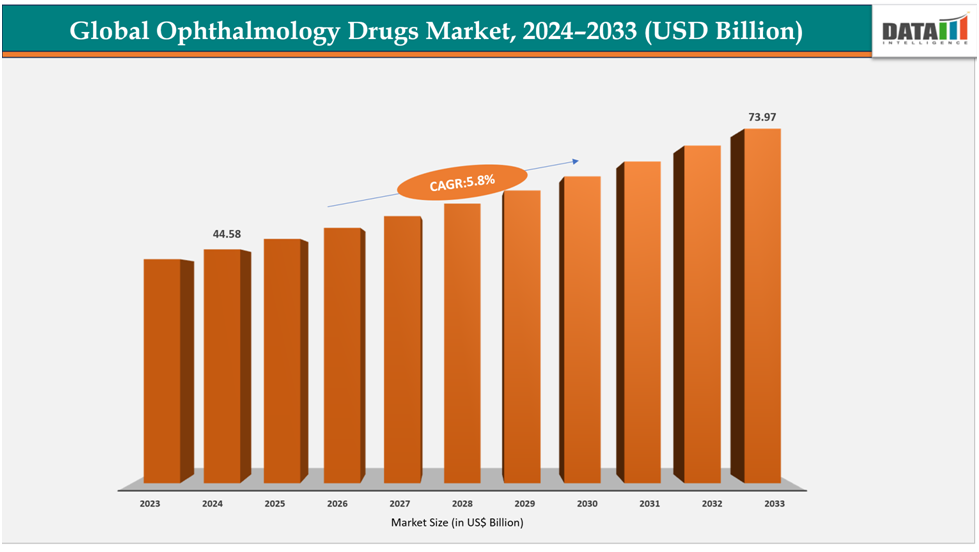

The global ophthalmology drugs market reached US$ 42.30 Billion with a rise of US$ 44.58 Billion in 2024 and is expected to reach US$ 73.97 Billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025-2033.

The global ophthalmology drugs market is growing rapidly, driven by the rising prevalence of eye disorders such as age-related macular degeneration, glaucoma, and diabetic retinopathy, particularly among aging populations. Advances in drug delivery systems, such as sustained-release implants and long-acting injections, are driving the growth of the global ophthalmology drugs market by enhancing treatment efficacy, reducing dosing frequency, and improving patient adherence. These innovations not only provide longer-lasting therapeutic effects but also minimize the treatment burden on patients and healthcare systems, thereby accelerating the adoption of advanced ophthalmic therapies worldwide.

Owing to factors like the rising prevalence of eye disorders, which are significantly driving the demand for ophthalmology treatments; for instance, according to FDA data from 2023, over 2.2 billion people worldwide suffer from near or distance vision impairment, with at least 1 billion cases preventable or untreated. Refractive errors and cataracts are the leading causes, yet only a fraction of affected individuals receive proper treatment. Additionally, diabetic retinopathy, glaucoma, and age-related macular degeneration contribute to an estimated global productivity loss of US$ 411 billion annually.

Key Highlights

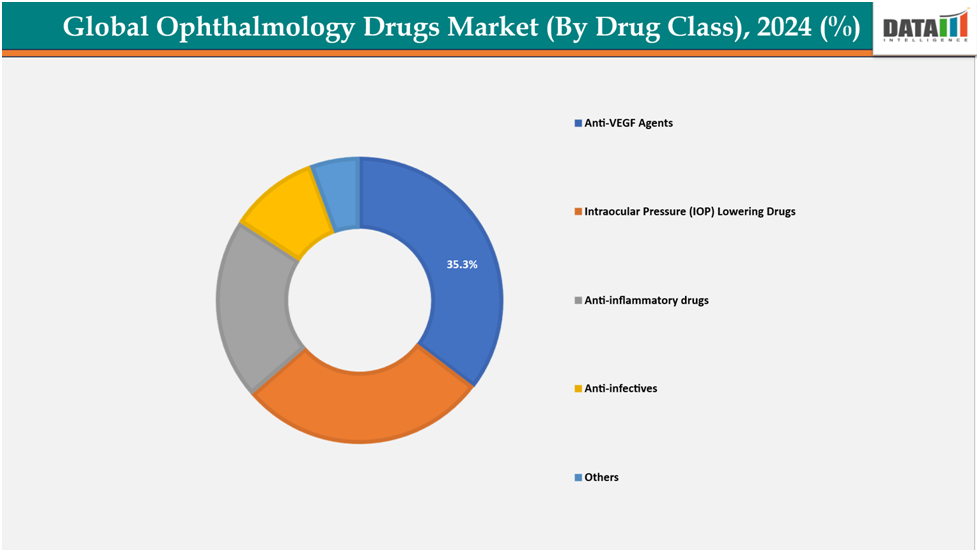

- Based on drug class, anti-VEGF Agents (vascular endothelial growth factor) are leading the market with strong growth potential, with a 35.3% share in 2024

- Based on the retinal disorder segment, it is dominating the ophthalmology drug market with a 33.5% share in 2024

- North America is dominating the ophthalmology drugs market with the largest revenue share of 47.4% in 2024.

- Asia Pacific is the fastest-growing region and is expected to grow over the forecast period with a CAGR of 7.1%during 2024

- Top companies in the ophthalmology Drugs Market are F. Hoffmann-La Roche, Pfizer Inc., Novartis AG, Sun Pharmaceutical Industries Ltd., Alcon Inc., Genentech USA, Inc., Amneal Pharmaceuticals LLC., Astellas Pharma Inc., Cipla, Biocon Biologics Limited., Glenmark Pharmaceuticals Inc., USA, among others.

Market Dynamics

Drivers:

Rising prevalence of eye disorders is significantly driving the ophthalmology drugs market growth

The expansion of the worldwide ophthalmology medicines market is being driven by the increasing frequency of eye ailments such as glaucoma, cataracts, diabetic retinopathy, and age-related macular degeneration. This is because these conditions result in a continually growing pool of patients who need long-term care. Disease incidence is rising as a result of aging populations, increased diabetes rates, and lifestyle choices like screen time. The increased need for efficient treatments, such as eye drops and biologics, is fuelled by this. Better knowledge and quicker diagnosis are also driving more patients into treatment, growing the market, and promoting ongoing innovation in eye medications.

Owing to factors like the rising prevalence of eye disorders, according to the FDA in 2023, globally, at least 2.2 billion people had near or distance vision impairment, with nearly 1 billion cases preventable or unaddressed. Among these, cataracts affected 94 million, refractive errors 88.4 million, age-related macular degeneration 8 million, glaucoma 7.7 million, and diabetic retinopathy 3.9 million. Presbyopia is the leading cause of near vision impairment, impacting 826 million people worldwide.

Restraints:

Safety concerns and side effects associated with long-term treatment are hampering the growth of the ophthalmology drugs market

The growth of the ophthalmology drugs market faces challenges due to safety concerns and potential side effects linked with long-term therapies. Chronic eye conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration often require prolonged treatment, which can lead to adverse effects like eye irritation, dryness, redness, increased intraocular pressure, or even systemic complications. These issues affect patient adherence and reduce compliance over time. Moreover, concerns among patients and healthcare providers about the long-term risks of newer therapies, combined with stringent regulatory requirements to ensure safety, often delay approvals and slow market entry. Together, these factors restrain the overall expansion of ophthalmology medications.

For instance, according to the Glaucoma Research Foundation, beta-blocker eye drops (e.g., timolol) and topical beta-blockers used in glaucoma treatment can be systemically absorbed, leading to side effects such as bradycardia, hypotension, fatigue, and shortness of breath. These systemic effects may deter patients with pre-existing cardiovascular conditions from using these medications.

For more details on this report, see Request for Sample

Segmentation Analysis

The global ophthalmology drugs market is segmented based on drug class, indication, dosage form, route of administration, distribution channel, and region.

By Drug Class:

By drug class, anti-VEGF Agents (vascular endothelial growth factor)are leading the market with strong growth potential, with a35.3% share in 2024

Anti-VEGF medications have become the market leader in ophthalmology due to their ability to effectively treat a number of common retinal conditions, including age-related macular degeneration, diabetic retinopathy, and retinal vein occlusion. These treatments help stabilize or improve vision by preventing aberrant blood vessel formation and vascular leakage, which makes them the gold standard. The absence of substitute medicines that are just as effective strengthens their position in the market. Demand is further sustained by the need for frequent, long-term administration for many retinal diseases.

Constant innovation in formulations, longer-acting medications, and sophisticated delivery systems improves therapeutic results and patient compliance, which supports the anti-VEGF market's robust development potential on a global scale. For instance, in May 2025, the FDA approved Susvimo (ranibizumab injection) 100 mg/mL for diabetic retinopathy. It became the first and only FDA-approved continuous delivery treatment shown to maintain vision in patients with diabetic retinopathy, requiring just one refill every nine months.

By Indication:

The retinal disorder segment is dominating the ophthalmology drug market with a 33.5% share in 2024

The growing prevalence of illnesses like age-related macular degeneration (AMD), diabetic retinopathy, and retinal vein occlusion has caused the retinal disorders category to take the lead in the global market for ophthalmology medications. Many illnesses often require the use of sophisticated, long-term pharmaceuticals, such as anti-VEGF drugs, which are costly, clinically effective, and produce a sizable amount of market revenue. These drugs are necessary for patient care because there are not many other therapy options. Additionally, improvements in drug formulation, sustained-release delivery systems, and biosimilars are expanding accessibility and improving outcomes. The chronic nature of retinal issues ensures ongoing demand and solidifies its superiority over other ophthalmology indications such as glaucoma, dry eye disease, or ocular infections.

Owing to factors likeage-related macular degeneration, nearly 20 million U.S. adults have age-related macular degeneration (AMD), with 18 million in the early stage and 1.49 million at the late stage. Globally, around 200 million people live with AMD, projected to reach 288 million by 2040. Risk increases with age, from 2% at 50–59 to nearly 30% over 75.

Owing to the factors such as the growing prevalence of illnesses like age-related macular degeneration (AMD), the FDA approvedSyfovre (pegcetacoplan) for the treatment of dry AMD; specifically, geographic atrophy demonstrated a 35% reduction in GA progression over the first year of treatment.

Geographical Analysis

North America is dominating the global ophthalmology drugs markets are with 47.4% in 2024.

North America leads the world market for ophthalmology medications due to the high frequency of eye conditions such as glaucoma, dry eye disease, and age-related macular degeneration, particularly in the elderly. Early detection and successful treatment are supported by state-of-the-art testing facilities, trained ophthalmologists, and advanced healthcare infrastructure. Strong reimbursement systems are helping the region quickly adopt cutting-edge treatments like sustained-release formulations, biosimilars, and anti-VEGF medicines. Furthermore, the launch and broad use of innovative ophthalmic medications are made possible by a favorable and expedited regulatory environment for approval, as well as significant healthcare spending, which strengthens North America's market dominance.

Owing to factors like a faster regulatory environment for approval, in September 2025, the FDA granted fast-track designationtoSanofi’s SAR402663 in the US for neovascular age-related macular degeneration. This delivers genetic material encoding soluble FLT01 designed to inhibit vascular endothelial growth factor (VEGF).

Europe is the second-largest region to dominate the global ophthalmology drugs market share with 35.2% in 2024

Europe's market for ophthalmic medications is expanding rapidly, driven by nations like Germany, the UK, and France. Advanced healthcare systems, established networks of hospitals and specialty clinics, and high rates of uptake of novel treatments, including sustained-release formulations, biosimilars, and anti-VEGF medicines, are important factors. The demand for and uptake of ophthalmic treatments in the region is further fueled by regulatory support and guidelines from agencies such as the European Medicines Agency (EMA), which emphasize early diagnosis and efficient management of eye disorders, such as age-related macular degeneration, glaucoma, and diabetic retinopathy.

Germany is one of Europe's biggest markets for medications used in ophthalmology. Modern healthcare infrastructure, which facilitates early detection and efficient treatment of eye conditions, is driving the market. Anti-VEGF agents, biosimilars, and sustained-release formulations are among the innovative therapies that are widely used in hospitals and specialty clinics. These treatments are backed by strong recommendations and treatment guidelines from organizations like the European Medicines Agency (EMA) and healthcare authorities.

For instance, in June 2025, Outlook Therapeutics announced that the Scottish Medicines Consortium (SMC) had accepted LYTENAVA (bevacizumab gamma) for use within NHS Scotland for the treatment of wet age-related macular degeneration (wet AMD). This made it the first and only licensed ophthalmic formulation of bevacizumab for treating wet AMD in adults in the United Kingdom and Germany.

The Asia Pacific region is the fastest-growing region in the global ophthalmology drugs market, with a CAGR of 7.1% during2024.

The Asia-Pacific region, including countries like Japan, China, India, and South Korea, is witnessing significant growth in the ophthalmology drugs market due to the rising prevalence of eye disorders and expanding urban populations with improved access to healthcare. The main forces behind early detection and treatment of retinal disorders in Japan are government campaigns and awareness campaigns that encourage routine eye exams. Diabetes, cataracts, and glaucoma are on the rise in China and India, which are also seeing an increase in the use of advanced treatments, including sustained-release formulations and anti-VEGF drugs, as well as an expansion of their healthcare systems.

Japan has a rapidly aging population, resulting in a high prevalence of age-related macular degeneration (AMD) and glaucoma. Japan has recently seen significant drug approvals in ophthalmology, addressing prevalent eye disorders like age-related macular degeneration (AMD) and glaucoma.

Advanced regulatory processes by the Ministry of Health, Labour and Welfare (MHLW) enable the timely evaluation and approval of innovative therapies. For instance, in August 2025, Santen Pharmaceutical Co., Ltd. obtained manufacturing and marketing approval in Japan for SETANEO 0.002% Ophthalmic Solution, a bicyclic prostaglandin derivative that acts on FP and EP3 receptors, for the treatment of glaucoma and ocular hypertension.

Competitive Landscape

Top companies in the ophthalmology drugs market are F. Hoffmann-La Roche, Pfizer Inc., Novartis AG, Sun Pharmaceutical Industries Ltd., Alcon Inc., Genentech USA, Inc., Amneal Pharmaceuticals LLC., Astellas Pharma Inc., Cipla, Biocon Biologics Limited., Glenmark Pharmaceuticals Inc., USA, among others.

F. Hoffmann-La Roche: F. Hoffmann‑La Roche, based in Switzerland, is a global leader in ophthalmology, offering products like Vabysmo, Lucentis, and Susvimo. With a focus on long-acting implants, bispecific antibodies, and gene/cell therapies, Roche’s strong R&D pipeline and global approvals target major retinal diseases, supporting patient adherence and reinforcing its market leadership.

Market Scope

| Metrics | Details | |

| CAGR | 5.83% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Drug Class | Anti-VEGF Agents, Intraocular Pressure (IOP) Lowering Drugs, Anti-inflammatory drugs, Anti-infectives, and Others |

| By Indication | Retinal Disorders, Glaucoma & Ocular Hypertension, Dry Eye Disease, Eye Infections, Allergic Conjunctivitis and Others | |

| By Dosage Form | Liquids, Ointments, Solid and Others | |

| By Route of Administration | Topical, Injectable, Oral and Others | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global ophthalmology drugs market report delivers a detailed analysis with 81 key tables, more than 80visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Reports

For more pharmaceutical-related reports, please click here