Overview

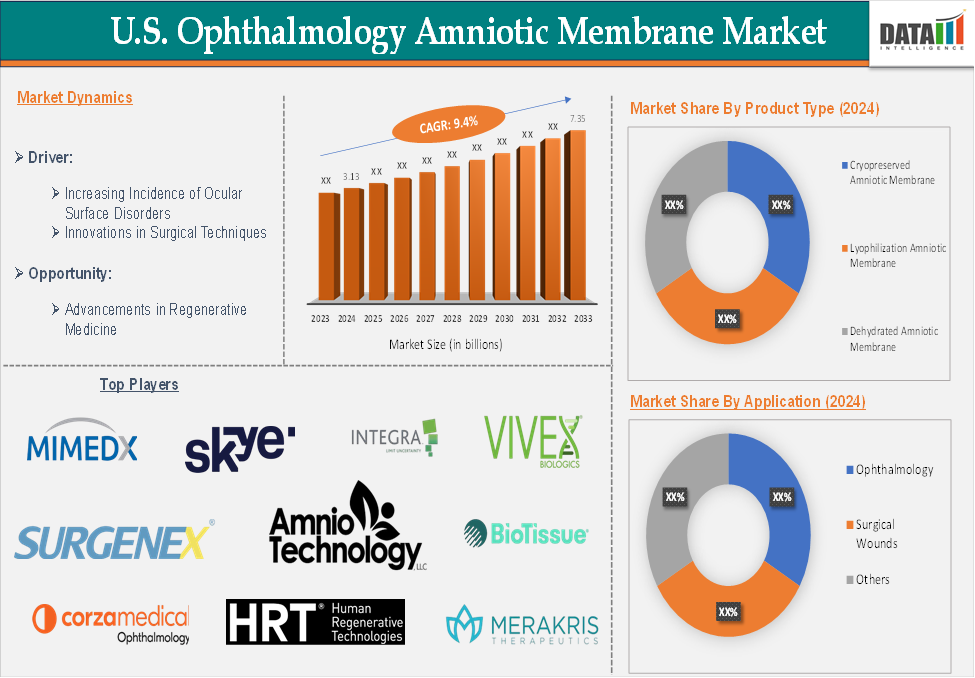

The US ophthalmology amniotic membrane market reached US$ 3.13 billion in 2024 and is expected to reach US$ 7.35 billion by 2033, growing at a CAGR of 9.4% during the forecast period 2025-2033.

The amniotic membrane, or amnion, is the innermost layer of the placenta, which consists of a thick basement membrane and an avascular stromal matrix. Amniotic membrane transplantation (AMT) has been used as a graft or as a dressing in different surgical subspecialties. In ophthalmology, it is used broadly to reconstruct the ocular surface after various procedures, as a graft for ocular surface melts, and as a bandage to promote healing in cases of persistent epithelial defects or ocular surface inflammation. All of these indications use the amniotic membrane's ability to promote healing.

Executive Summary

Market Dynamics: Drivers & Restraints

Increasing Incidence of Ocular Surface Disorders

The prevalence of ocular surface conditions, such as chemical burns, corneal ulcers, and dry eye syndrome, is rising. The effectiveness of amniotic membrane grafts in treating these disorders has increased the demand for these treatments. According to the American Academy of Ophthalmology (2024, the prevalence of dry eye syndrome increases with age. An estimated 3.2 million women age 50 and over and 1.68 million men age 50 and over are affected by dry eye syndrome.

A multifactorial chronic illness of the ocular surface known as dry eye disease (DED) causes sensations of discomfort and anguish. DED is characterized by increased tear evaporation, decreased tear output, and poor tear quality. The most common symptoms of those who are affected include photophobia, weariness, itching, and burning sensations in their eyes. A major public health issue is DED. It is among the most prevalent eye conditions seen in an ophthalmology office. The prevalence of DED ranges from 7.4% to 33.7% worldwide.

According to the Journal of BMC Ophthalmology, in 2023, global surveys indicate that the prevalence of DED ranges from 5 to 50%, with Asia having a higher frequency than Europe and the United States. Geographical location, population, and various diagnostic criteria are the key determinants of the diversity in DED prevalence. Numerous epidemiological studies have revealed that characteristics that increase the likelihood of developing dry eyes include female sex, advanced age, dry and harsh climates, and elderly age.

High Cost of Amniotic Membrane

The high cost of amniotic membranes is a significant restraint in the US ophthalmology market, limiting widespread adoption despite their proven therapeutic benefits. These costs originate at multiple points in the supply chain. First, the procurement of amniotic membranes is inherently expensive due to strict donor screening protocols, ethical sourcing limitations, and the requirement that membranes be harvested exclusively from placentas during elective cesarean sections.

Processing adds further financial strain, especially in the case of cryopreserved membranes, which must be stored and transported at ultra-low temperatures, significantly increasing logistical costs. Even dehydrated membranes, which offer more stability, involve advanced drying and sterilization processes that drive up prices.

On average, the cost of a single amniotic membrane graft ranges from $200 to $1,000, depending on its type and size. These material costs are compounded by the clinical and surgical expenses associated with implantation, including specialized ophthalmic tools and skilled personnel, bringing the total procedure cost to $2,000–$4,000 per case. Furthermore, insurance reimbursement policies are inconsistent, with Medicare and private insurers often reluctant to cover or fully reimburse for such treatments, especially when used in outpatient or non-emergency scenarios.

Segment Analysis

The US ophthalmology amniotic membrane market is segmented based on product type, application, and end-user.

Product Type:

The cryopreserved amniotic membrane segment in the product type is expected to dominate the US ophthalmology amniotic membrane market share

CAM is particularly effective for promoting the healing of corneal and ocular surface wounds due to its anti-inflammatory, anti-scarring, and anti-angiogenic properties. These characteristics are attributed to its composition, which includes heavy-chain hyaluronic acid and pentraxin 3, both of which are preserved during the cryopreservation process. CAM is used to treat conditions such as mechanical dry eye, conjunctival defects, and infectious corneal ulcers. For instance, in cases of severe corneal ulcers, CAM has demonstrated faster epithelialization compared to standard treatments, with significant healing outcomes observed within weeks.

Major players in the country's innovative launches and key developments that would help to drive this segment growth. For instance, in December 2023, Damon Dierker, OD, FAAO, discusses the groundbreaking potential of sutureless cryopreserved amniotic membrane therapy for moderate to severe dry eye.

Also, in March 2021, Bio-Tissue, Inc., announced today that its parent company TissueTech had received clearance from the US Food and Drug Administration (FDA) to proceed with a Phase 2 study using morselized Cryopreserved Amniotic Membrane (CAM) and Cryopreserved Umbilical Cord (CUC) Investigational New Drug (IND) TTBT01. This clearance represents another milestone as the company works to achieve FDA approval for its graft and morselized human birth tissue products as biologics for important clinical indications.

Competitive Landscape

The major players in the US ophthalmology amniotic membrane market include MiMedx Group, Inc., Corza Ophthalmology (Katena Products, Inc.), Skye Bioscience, Inc., INTEGRA LIFESCIENCES HOLDINGS CORPORATION, Amnio Technology, LLC, Human Regenerative Technologies, LLC, Surgenex, BioTissue, VIVEX Biologics, Inc., and Merakris Therapeutics, Inc., among others.

Key Developments

- In June 2024, BioTissue announced the unveiling of its CAM360 AmnioGraft (CAM360 AG), which is a new, hydrated, shelf-stable cryopreserved amniotic membrane (CAM) solution that has been developed for the treatment of ocular surface disease and disorders. The solution is ideal for patients with mild to moderate dry eye disease (DED) and other ocular surface conditions, working to optimize their comfort.

- In November 2022, Verséa launched several products in the ophthalmic space. The company is rolling out the Biovance 3L ocular tri-layer human amniotic membrane.

Scope

| Metrics | Details | |

| CAGR | 9.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Cryopreserved Amniotic Membrane, Lyophilization Amniotic Membrane, Dehydrated Amniotic Membrane |

| Application | Ophthalmology, Surgical Wounds, Others | |

| End-User | Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Others | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials and Product Type pipelines and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Type Performance & Market Positioning: Analyze Product Type performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into Product Type development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient Product Type delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance Product Type safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The US ophthalmology amniotic membrane market report delivers a detailed analysis with 39 key tables, more than 27 visually impactful figures, and 126 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.