Global Operational Technology (OT) Security Market: Industry Outlook

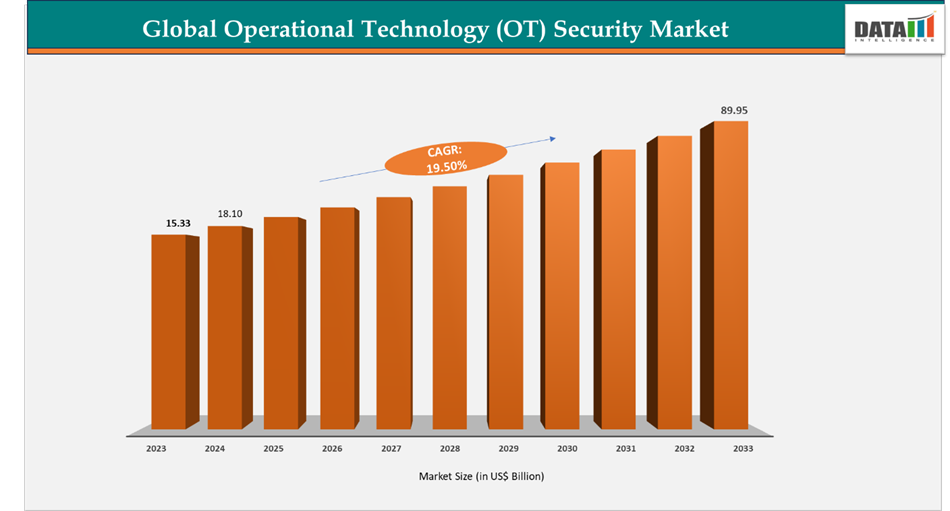

The global operational technology (OT) security market reached US$ 15.33 billion in 2023, with a rise to US$ 18.10 billion in 2024, and is expected to reach US$ 89.95 billion by 2033, growing at a CAGR of 19.50% during the forecast period 2025–2033. The global operational technology (OT) security market is expanding steadily, driven by the increasing convergence of IT and OT systems, the rise of cyber threats targeting critical infrastructure, and the growing adoption of Industry 4.0 practices across manufacturing, energy, utilities, and transportation. As industrial operations become more digitalized, the need for safeguarding connected assets, control systems, and data flows is accelerating investments in OT security solutions. Cloud integration, AI-driven anomaly detection, and zero-trust frameworks are emerging as key pillars of market growth

The U.S. leads the global OT security market with a strong presence of cybersecurity vendors and industrial solution providers. American companies account for a significant share of global revenues, supported by their deep expertise in endpoint protection, intrusion detection, and threat intelligence. The market is reinforced by robust R&D investments, government-backed initiatives such as CISA (Cybersecurity and Infrastructure Security Agency) programs, and rising demand from critical infrastructure sectors, including energy grids, defense, and manufacturing.

For instance, in June 2022, Dragos Inc., a U.S.-based OT cybersecurity leader, expanded its partnership with Emerson to integrate advanced threat detection and response solutions into industrial automation systems. This collaboration highlights how American vendors are aligning with industrial leaders to safeguard critical infrastructure, further strengthening the U.S.’s position as a global hub for OT security innovation.

Japan’s OT security market is gaining momentum on the back of its leadership in factory automation, automotive, and electronics manufacturing. The country’s heavy reliance on precision manufacturing and robotics makes robust OT security indispensable. In December 2023, Mitsubishi Electric Corporation—a global leader in factory automation entered into a collaboration with TXOne Networks, a rapidly growing OT security company. The partnership is designed to bolster OT security in manufacturing sites by combining Mitsubishi Electric’s deep expertise in automation with TXOne’s advanced cybersecurity solutions.

This alliance provides Japanese enterprises with comprehensive OT security strategies, including network segmentation, threat detection, and compliance frameworks tailored for industrial environments. It also underscores Japan’s strategic focus on securing its manufacturing backbone against cyber threats while enabling greater adoption of digital transformation and smart factory initiatives. With continued government emphasis on cybersecurity resilience and strong partnerships between technology and security players, Japan is positioning itself as a key growth hub in the global OT security market.

Key Market Trends & Insights

North America accounted for approximately 42% of the global operational technology (OT) security market in 2024 and is expected to maintain its dominance throughout the forecast period. This leadership is driven by strong demand from critical infrastructure sectors such as energy, defense, and manufacturing, robust investments in R&D, and government-backed initiatives like CISA programs. The region also benefits from the presence of leading OT cybersecurity vendors and strategic collaborations between security providers and industrial automation firms.

Asia-Pacific is projected to be the fastest-growing region in the global operational technology (OT) security market, supported by rapid industrialization, the expansion of smart factories, and increasing adoption of Industry 4.0 technologies. Strong contributions from countries like Japan, China, and South Korea, along with government cybersecurity initiatives and vendor–automation partnerships (such as the Mitsubishi Electric–TXOne Networks collaboration in Japan), are fueling growth. Rising demand in automotive, consumer electronics, and energy sectors further strengthens Asia-Pacific’s role in the OT security landscape.

The Services segment remains a key category in the global aircraft parts market due to its essential role in maintenance, repair, overhaul (MRO), and aftermarket support for commercial and military aircraft. Its widespread adoption across airlines, defense fleets, and third-party MRO providers highlights its importance in ensuring operational safety, extending aircraft lifespan, and supporting technological upgrades. Leading players such as Lufthansa Technik, ST Engineering Aerospace, and AAR Corp dominate this segment, offering comprehensive solutions from component repair to system integration and technical consulting. With growing aircraft fleets and increasing focus on operational efficiency, the Services segment continues to drive innovation and sustain the aerospace ecosystem globally.

Market Size & Forecast

2024 Market Size: US$ 18.10 Billion

2033 Projected Market Size: US$ 89.95 Billion

CAGR (2025–2033): 19.50%

North America: Largest market in 2024

Asia-Pacific: Fastest-growing market

Market Dynamics

Driver: Expansion of Industry 4.0 and Smart Factories

The global operational technology (OT) security market is being propelled by the rapid adoption of Industry 4.0 and smart factory initiatives, which integrate automation, robotics, IoT, and AI into industrial processes. As organizations modernize their production lines and supply chains, the attack surface expands significantly, creating a heightened need for robust OT security solutions to safeguard critical assets, control systems, and real-time data flows. Demand for predictive monitoring, endpoint protection, and anomaly detection tools is rising in tandem with this digital transformation.

For instance, India’s push toward Industry 4.0, supported by initiatives like Digital India, is accelerating OT adoption, with the country’s manufacturing sector projected to reach $1 trillion by 2030 (NITI Aayog). However, a 2024 Gartner report revealed that 70% of Indian industrial firms lack adequate OT security, exposing critical sectors like power and oil to significant risks. Local innovators such as WhizHack Technologies are stepping in with AI-driven solutions like ZeroHack OT to address these vulnerabilities, while real-world incidents like the 2023 ransomware attack on a major Indian oil refinery, which disrupted operations for weeks and caused multiBillion-dollar losses, highlight the urgency of adopting advanced OT cybersecurity frameworks.

Restraint: Legacy OT Systems with Limited Compatibility for Modern Security Tools

Despite the strong growth of the Global OT Security Market, a major challenge arises from the widespread reliance on legacy OT infrastructure across sectors such as energy, manufacturing, and transportation. Many of these systems were designed decades ago with reliability as the primary focus rather than cybersecurity, making them difficult to integrate with modern solutions like zero-trust frameworks, AI-driven monitoring, or encrypted communications.

As a result, organizations face limitations in implementing advanced OT security measures, leaving mission-critical environments vulnerable to sophisticated threats. For instance, report by the U.S. Government Accountability Office (GAO), which revealed that numerous utilities in the energy sector still depend on outdated supervisory control and data acquisition (SCADA) systems lacking essential cybersecurity safeguards. Upgrading or replacing such legacy systems entails high costs and significant operational downtime, thereby slowing OT security adoption and exposing critical infrastructure to evolving cyber risks.

For more details on this report, Request for Sample

Segmentation Analysis

The global operational technology (OT) security market is segmented based on offering, deployment, organization size, end-user, and region.

Offering:The solutions operational technology (OT) security segment is estimated to have 72% of the operational technology (OT) security market share.

The solutions segment holds a significant share of the global aircraft parts market, encompassing airframe components, propulsion systems, avionics, mechanical systems, and interiors. Growth is driven by rising commercial aircraft orders, defense fleet modernization, and technological upgrades. Leading players such as Boeing, Airbus, GE Aviation, and Honeywell Aerospace dominate the design and integration of these solutions. For instance, Boeing awarded contracts to Spirit AeroSystems for fuselage and wing components in 2024, while GE Aviation supplied engine upgrades for the U.S. Air Force’s KC-46 fleet. Avionics demand is rising with digital cockpits and UAVs, and mechanical and interior components are expanding with fleet upgrades. Despite regulatory compliance and certification challenges, investments in advanced materials, digital manufacturing, and OEM–supplier partnerships are expected to sustain strong growth in this segment.

Geographical Analysis

The North America operational technology (OT) security market was valued at 42% market share in 2024

The North America operational technology (OT) security market was valued at 42% market share in 2024.North America stands as a pivotal hub for OT security adoption, driven by rapid digitalization across critical infrastructure, manufacturing, and utilities. The region benefits from strong regulatory frameworks such as NERC CIP in the energy sector and heightened government investments in critical infrastructure resilience. U.S.-based players like Cisco Systems, Fortinet, and Palo Alto Networks dominate with advanced OT cybersecurity offerings, while partnerships with global leaders like Siemens and ABB further expand capabilities. Increasing cyberattacks targeting pipelines, transportation, and utilities have accelerated investments in zero-trust architectures, AI-driven monitoring, and managed OT security services. For instance, the 2021 Colonial Pipeline ransomware attack highlighted vulnerabilities in OT systems, pushing regulators and enterprises toward stronger cybersecurity mandates. Rising adoption of IIoT, smart grids, and 5G-enabled industrial networks continues to fuel demand, though challenges remain with legacy OT system integration and workforce skill gaps.

The Asia-Pacific operational technology (OT) security market was valued at 16.4% market share in 2024

The Asia-Pacific operational technology (OT) security market was valued at 16.4% market share in 2024.In Asia-Pacific global OT security market, anchored by rapid industrialization, large-scale deployment of IIoT devices, and smart factory initiatives across China, Japan, South Korea, and India. China remains at the forefront with government-backed initiatives like “Made in China 2025” accelerating OT security adoption across manufacturing and energy, while Japan and South Korea emphasize automation, robotics, and secure supply chains. India’s push toward Industry 4.0, coupled with initiatives like Digital India, is transforming industrial operations, though a 2024 Gartner report revealed that 70% of Indian firms still lack adequate OT security. Local innovators such as WhizHack Technologies are complementing global leaders by offering AI-driven OT solutions tailored for regional challenges. Cyberattacks on critical infrastructure including a major 2023 ransomware attack on an Indian oil refinery underscore rising risks in the region.

As industrial systems become more digitized and interconnected, a 2025 Fortinet report highlights that OT security is shifting from a technical issue to a board-level priority. The study found that 52% of organizations in Asia-Pacific have placed OT security under the Chief Information Security Officer (CISO), up from 16% in 2022, with 95% of executive leaders now actively involved in OT governance. This trend is particularly visible in manufacturing, logistics, energy, petrochemicals, healthcare, and water utilities, where 80% of firms plan to assign OT security responsibilities to CISOs within the next year.

Competitive Landscape

The major players in the operational technology (OT) security market include Siemens, Palo Alto Networks, Inc., Zscaler, Inc., Cisco Systems, Inc., Fortinet, Inc., SentinelOne, Forcepoint, Broadcom, Qualys, Inc., Kyndryl Inc.

Siemens: Siemens is a global leader in the operational technology (OT) security market, specializing in industrial automation, digitalization, and critical infrastructure protection. Through its Siemens Digital Industries division and the Siemens Energy portfolio, the company delivers integrated OT security solutions that safeguard manufacturing plants, energy grids, transportation systems, and healthcare facilities. Its offerings span secure industrial control systems (ICS), advanced intrusion detection, zero-trust frameworks, and AI-driven monitoring tools. Siemens also plays a pivotal role in advancing Industry 4.0, with its SINEC Security portfolio and partnerships enabling secure deployment of IIoT, smart factories, and edge computing. Backed by decades of expertise, a global presence, and continuous innovation, Siemens reinforces its position as a trusted provider of OT cybersecurity solutions that protect mission-critical environments worldwide.

Market Scope

Metrics | Details | |

CAGR | 19.50% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Offering | Solutions (Network Security, Endpoint Security, Application Security, Identity & Access Management (IAM), Encryption & Data Security, Threat Intelligence & Analytics) Services (Managed Services Professional Services (Consulting & Assessment, Integration & Deployment, Training & Support)) |

| Deployment | On-Premises, Cloud based |

| Organization Size | Large Enterprises, SME's |

| End-User | Manufacturing, Oil & Gas, Transportation & Logistics, Government, Healthcare, Energy & Utilities, Others |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global operational technology (OT) security market report delivers a detailed analysis with 70 key tables, more than 63 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions For Related Reports

For more operational technology (OT) security-related reports, please click here