Cybersecurity Market Size

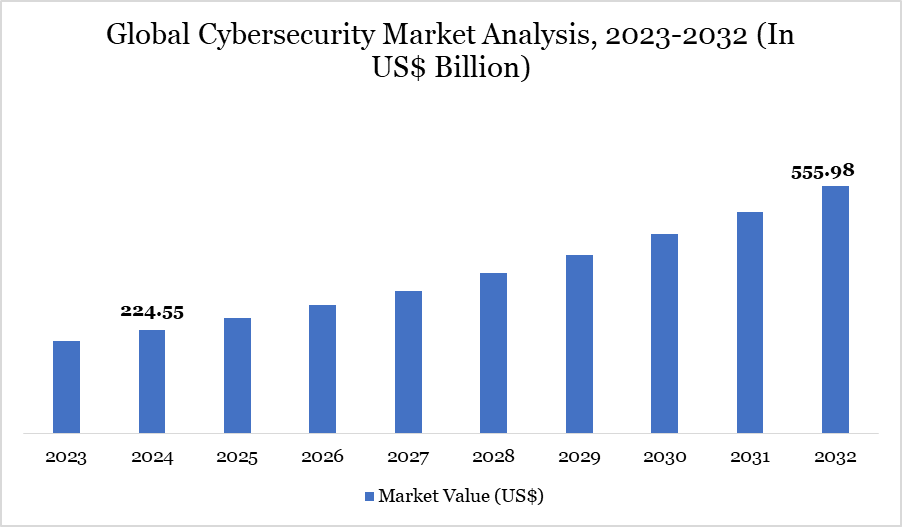

Cybersecurity Market size reached US$ 224.55 billion in 2024 and is expected to reach US$ 555.98 billion by 2032, growing with a CAGR of 12% during the forecast period 2025-2032.

The cybersecurity industry is at the vanguard of global digital defense, anticipated to undergo continuous growth driven by increasingly complex cyber threats, the expansion of linked devices, and heightened regulatory oversight. The incidence of data breaches increased by 41.5 percent in 2022, impacting more than 422 million people. This concerning trend has compelled organizations and governments to invest significantly in cybersecurity measures.

Prominent industry entities, including Palo Alto Networks and CrowdStrike, are using sophisticated technologies such as AI-driven threat detection and real-time monitoring systems. Moreover, swift cloud adoption and the incorporation of AI into security frameworks are transforming cybersecurity methods.

Significant advancements, such as the introduction of the Cyber Trust Mark in January 2025, indicate increasing governmental engagement in consumer cybersecurity. The cybersecurity industry is set to remain an essential component of contemporary company security and national resilience, given its growing applications in industries such as healthcare, telecommunications, and aviation, alongside an increasing reliance on digital infrastructure.

Cybersecurity Market Trend

The cybersecurity market is seeing a significant transformation due to the increasing frequency and complexity of AI-driven attacks. Arkose Labs reports that 56 percent of enterprises indicate that generative AI has markedly augmented the frequency and complexity of cyberattacks. Approximately 91 percent of these attacks commence with phishing emails.

Emotional triggers, including curiosity at 13.7 percent, fear at 13.4 percent, and urgency at 13.2 percent, are persistently manipulated by cybercriminals. In response, organizations are employing machine learning and behavioral analytics techniques to identify and address hazards in real time. In March 2024, Palo Alto Networks introduced Precision AI to enhance corporate defenses against zero-day vulnerabilities and DNS hijacking.

The market is further stimulated by strategic alliances, such Exein's collaboration with MediaTek and Alphabet's acquisition of Wiz, underscoring the necessity and innovation in AI security. These innovations are significantly transforming the competitive and technological landscape of cybersecurity.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Component | Solutions, Services |

| By Deployment | On-premises, Cloud |

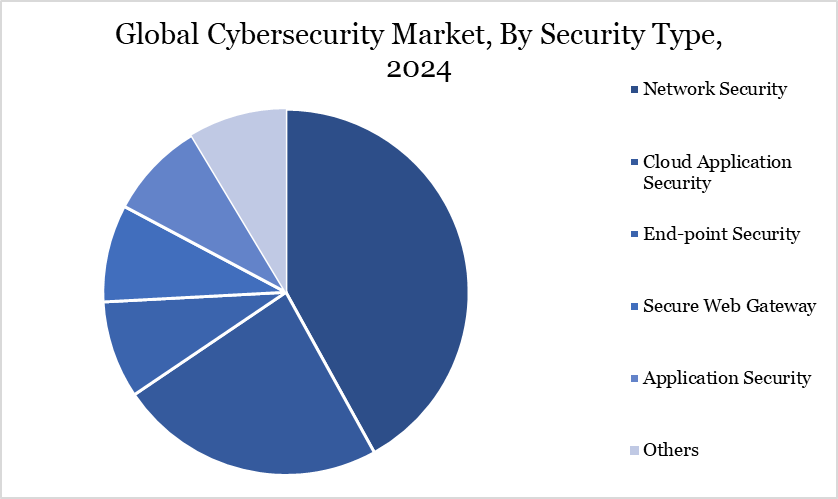

| By Security Type | Network Security, Cloud Application Security, End-point Security, Secure Web Gateway, Application Security, Others |

| By Enterprise Size | Small & Medium Enterprises (SMEs), Large Enterprises |

| By End-user | BFSI, IT and Telecommunications, Healthcare, Government, Manufacturing, Travel and Transportation, Energy and Utilities, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Cybersecurity Market Dynamics

Strategic Response to Escalating Targeted Cyber Assaults

The persistent increase in targeted cyberattacks has become a principal catalyst for the growth of the cybersecurity market. Such attacks frequently result in operational interruptions, substantial financial losses, and the compromise of critical information. In 2022, there was a significant 41.5 percent rise in the number of individuals affected by data breaches, hitting over 422 million people.

Cyber espionage entities such as Dragonfly, Thrip, and Chafer illustrate the significant risks associated with attacking vital sectors such aviation, defense, and telecommunications. In response, multinational corporations are expediting investments in advanced information security systems. This tendency is exacerbated by the escalating necessity to safeguard cloud-based programs, networks, and endpoints from progressively coordinated assaults.

As organizations endeavor to strengthen their digital assets, the demand for robust cybersecurity technologies with real-time protection capabilities is increasing. The current threat landscape has rendered cybersecurity a technology priority and a business continuity necessity, urging organizations to implement advanced, AI-enhanced security frameworks.

Global Shortage of Cyber Talent Threatens Digital Fortification

The cybersecurity sector has a significant impediment owing to a pronounced deficiency of qualified personnel. Notwithstanding a 10 percent augmentation in the workforce in 2022, a shortfall of about 4 million professionals endures, according to ISC2. The deficiency is intensified by the increasing intricacy of contemporary security networks and a surge in cyberattack vectors.

Cloud computing, AI integration, and zero-trust frameworks necessitate specific skills; however, two-thirds of professionals indicate inadequate staffing in critical domains. Geographical discrepancies exacerbate the issue, with regions like Latin America, Nigeria, and the UAE facing the highest layoffs, although the US, Hong Kong, and Saudi Arabia do comparatively better.

The deficiency is especially evident in sectors such as construction, entertainment, and automotive, which have experienced reductions connected to cybersecurity. Organizations are striving to close the gap via training programs and automation; yet, enduring skill deficiencies and insufficient understanding of advanced threats persistently render several enterprises susceptible to highly sophisticated cyberattacks.

Cybersecurity Market Segment Analysis

The global Cybersecurity market is segmented based on component, deployment, security type, enterprise size, end-user and region.

Shielding Software Ecosystems from Evolving Cyber Risks

The application security sector is experiencing the most significant development in the cybersecurity market, driven by heightened application utilization and escalating cyber threats. Applications, especially those associated with cloud services and mobile platforms, exhibit increasing attack surfaces, necessitating specialized security measures.

The transition to agile development and DevOps approaches has integrated security into the initial phases of the development lifecycle, improving vulnerability management. Moreover, more stringent data protection legislation and regulatory compliance mandates have required enhanced measures for application integrity.

Application security is categorized as Web Application Security, Mobile Application Security, and Cloud Application Security. Web Application Security continues to be vital due to the prevalence of web-based business activities, whilst the Mobile and Cloud sectors are rapidly advancing as organizations enhance their digital ecosystems. These customized solutions assist enterprises in mitigating specific vulnerabilities across platforms, ensuring business continuity and compliance while safeguarding user and organizational data from sophisticated and enduring threats.

Cybersecurity Market Geographical Share

North America Shapes Global Cybersecurity Leadership Through Infrastructure and Regulation

North America is the preeminent force in the global cybersecurity market, attributed to its advanced technology infrastructure, swift digital evolution, and increased regulatory scrutiny. The region is enhanced by a sophisticated infrastructure and the presence of cybersecurity leaders like Palo Alto Networks and IBM Corporation.

Government measures are essential, encompassing the introduction of the Cyber Trust Mark in January 2025 and the formation of the FCC's Council on National Security in March 2025. These initiatives signify a deliberate endeavor to enhance digital security, especially for essential infrastructure.

The US, as a digitally advanced economy, confronts increased threats from ransomware, phishing, and cyber espionage, necessitating the swift implementation of stringent security protocols and compliance frameworks such as the Cybersecurity Maturity Model Certification. The expansion of e-commerce platforms and IoT devices in Canada and the US need enterprise-level cybersecurity solutions. These variables collectively establish North America as a leader in global cybersecurity readiness.

Cybersecurity Market Major Players

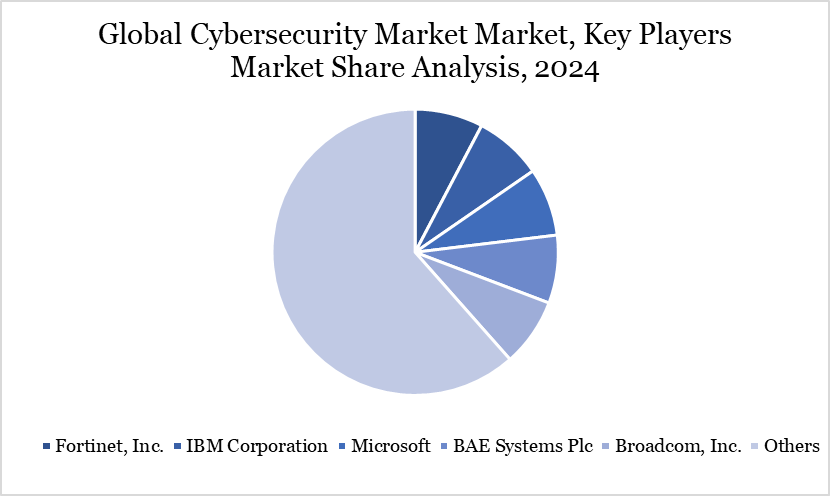

The major global players in the market include Fortinet, Inc., IBM Corporation, Microsoft, BAE Systems Plc, Broadcom, Inc., Centrify Corporation, Check Point Software Technology Ltd., Palo Alto Networks, Inc., Proofpoint, Inc., Sophos Ltd.

Technological Analysis

Cloud Computing Technological innovation is fundamental to the dynamic evolution of cybersecurity, with AI and cloud computing leading the charge. AI-driven threat detection systems now employ machine learning to recognize aberrant patterns and mitigate risks in real time. Palo Alto Networks’ Precision AI, introduced in March 2024, integrates generative AI with machine learning to address threats including DNS hijacking and zero-day attacks.

Simultaneously, cloud-native security solutions are gaining prominence, notably following Google's acquisition of Wiz in March 2025 to enhance its cloud services. The incorporation of security features into hardware platforms, exemplified by the Exein-MediaTek partnership, indicates a wider trend towards integrated device safeguarding.

These innovations facilitate swift threat response and enhanced system visibility. As cybersecurity risks advance through enhanced automation and AI-driven strategies, the market is experiencing a convergence of novel technologies, strategic alliances, and intelligent automation to strengthen digital ecosystems across various sectors.

Key Developments

In January 2025, the US government introduced the US Cyber Trust Mark, a cybersecurity certification for smart consumer goods including as security cameras, televisions, appliances, and fitness trackers. The label assists consumers in recognizing secure, NIST-approved internet-connected products for enhanced home safety.

In October 2024, Atlas Systems introduced ComplyScore, a cybersecurity program aimed at reducing risks for mid-to-large-sized enterprises. The company is first concentrating on the healthcare sector, which offers significant growth potential. ComplyScore assists organizations in identifying, evaluating, and mitigating risks from many perspectives.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies