Oncology Biosimilars Market Size & Industry Outlook

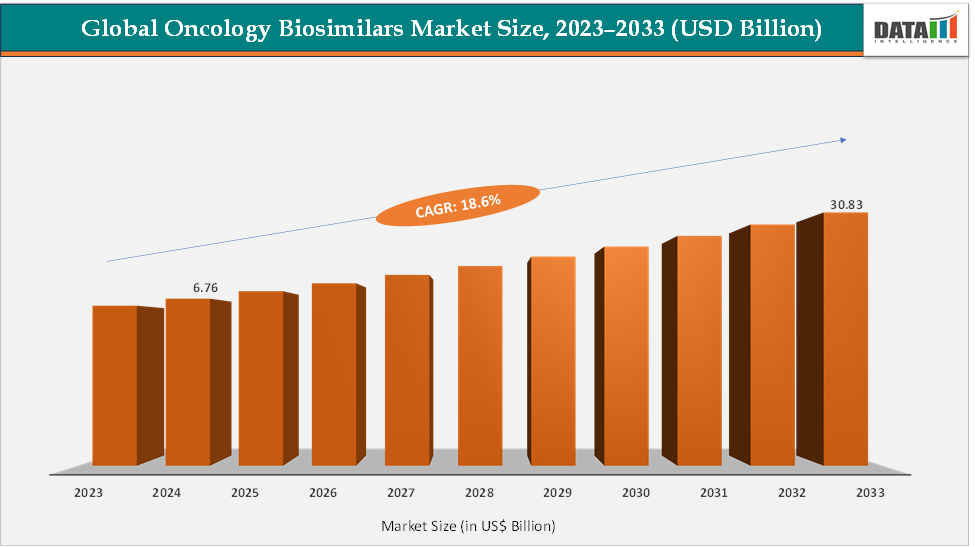

The global oncology biosimilars market size reached US$ 6.76 Billion in 2024 from US$ 5.77 Billion in 2023 and is expected to reach US$ 30.83 Billion by 2033, growing at a CAGR of 18.6% during the forecast period 2025-2033. The market growth is driven by patent expiries of key biologics like trastuzumab, bevacizumab, rituximab, and pegfilgrastim, leading to wider adoption of lower-cost biosimilars. Recent approvals, such as Henlius’s Hercessi (trastuzumab) and Biocon’s bevacizumab biosimilar, highlight increasing competition and regulatory momentum. Major players including Amgen and other major players, are expanding pipelines and partnerships. With strong uptake in Europe and Asia-Pacific and growing U.S. adoption, oncology biosimilars are reshaping cancer-care affordability and accessibility worldwide.

Key Market Highlights

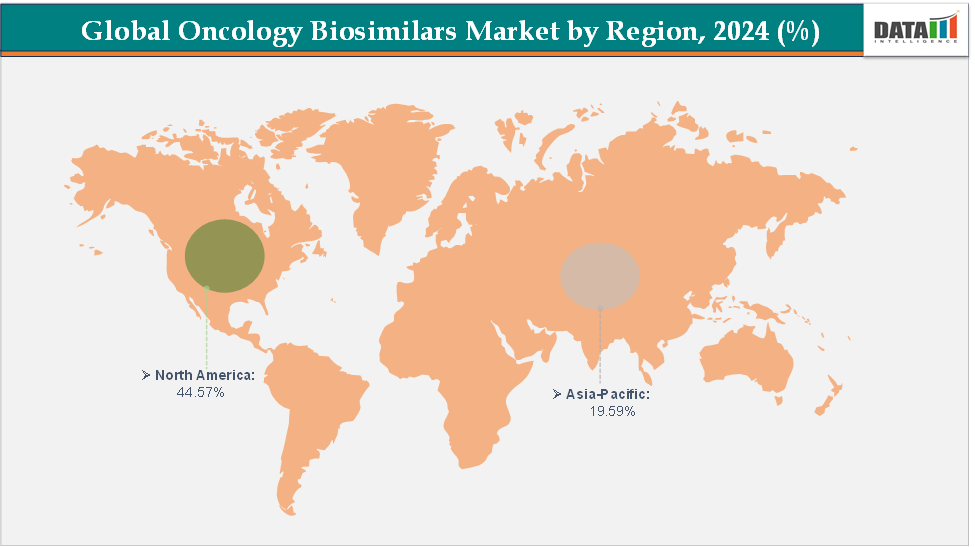

- North America dominates the oncology biosimilars market with the largest revenue share of 44.57% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 18.7% over the forecast period.

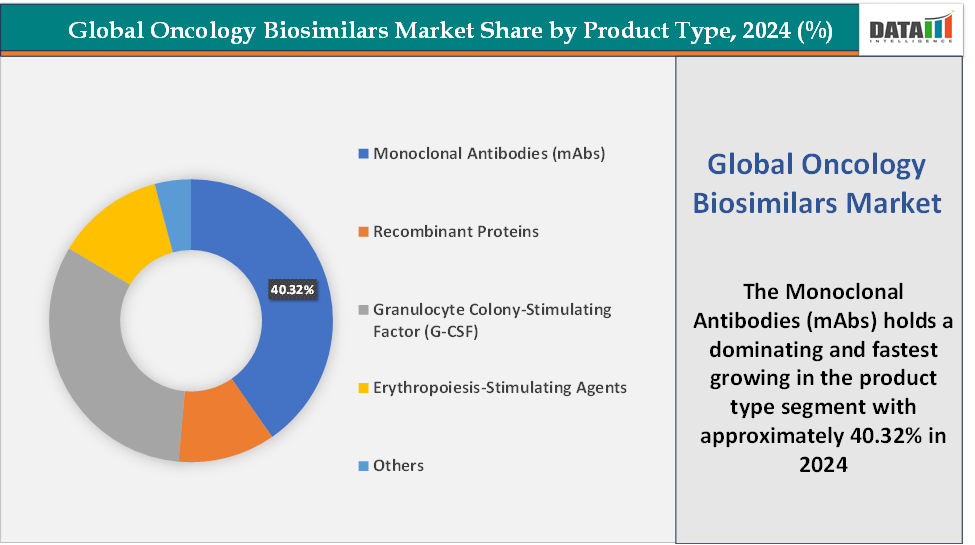

- Based on product type, the monoclonal antibodies (mAbs) segment led the market with the largest revenue share of 40.32% in 2024.

- The major market players in the oncology biosimilars market are Celltrion USA, Inc., Amgen Inc., Pfizer Inc., Biocon Biologics Limited, Teva Pharmaceuticals USA, Inc., Organon group of companies, Accord BioPharma, and Sandoz Inc., among others

Market Dynamics

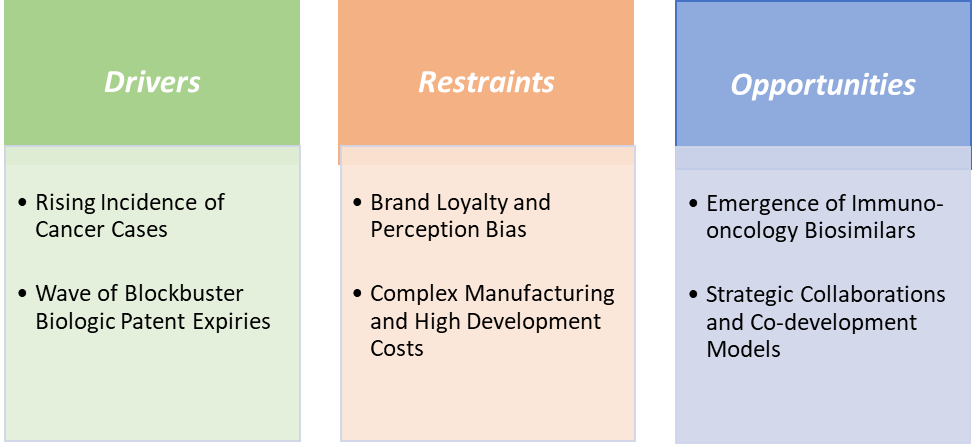

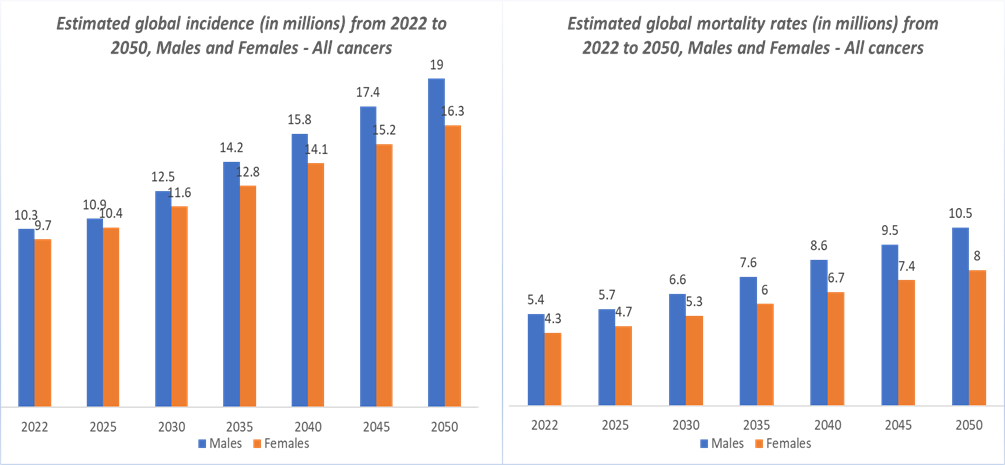

Drivers: Rising incidence of cancer cases is significantly driving the oncology biosimilars market growth

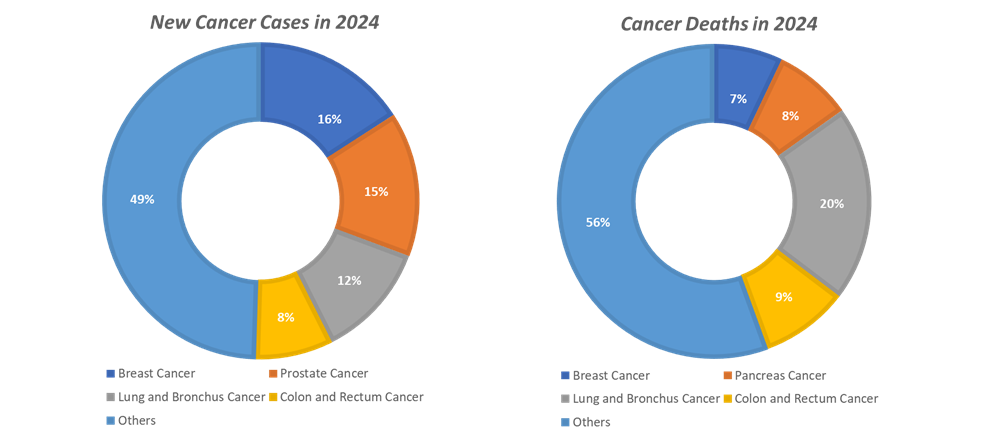

The rising global incidence of cancer is one of the strongest catalysts driving the oncology biosimilars market. According to the National Institute of Health, cancer is among the leading causes of death worldwide. In 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. By 2040, the number of new cancer cases per year is expected to rise to 29.9 million and the number of cancer-related deaths to 15.3 million. According to the International Agency for Research on Cancer, in 2025, cancer incidence cases are projected to reach 21.3 million, and in 2030, the cases are estimated to reach 24.1 million.

This escalation is fueled by population growth, aging demographics, and lifestyle-related risk factors such as smoking, obesity, and poor diet. As cancer prevalence climbs, the demand for biologic therapies, key treatments for breast, lung, colorectal, and hematologic cancers continues to rise, intensifying healthcare costs worldwide. Oncology biosimilars provide a vital solution by offering clinically equivalent yet cost-effective alternatives to high-priced biologics like trastuzumab, bevacizumab, and rituximab. With national health systems and payers under pressure to expand treatment access, biosimilars are being rapidly adopted to meet growing patient volumes without compromising care quality. Consequently, the increasing global cancer burden directly expands the addressable market for oncology biosimilars, fueling both volume growth and policy-driven adoption across developed and emerging economies.

List of biosimilars approved by US Food and Drug Administration for cancer treatment:

| Biologic Medicine | Biosimilars |

| bevacizumab (Avastin) | Mvasi Zirabev Alymsys Vegzelma Avzivi |

| rituximab (Rituxan) | Truxima Ruxience Riabni |

| trastuzumab (Herceptin) | Ogivri Herzuma Ontruzant Trazimera Kanjinti Hercessi |

| filgrastim (Neupogen) | Zarxio Nivestym Releuko Nypozi |

| pegfilgrastim (Neulasta) | Fulphila Udenyca Ziextenzo Nyvepria Fylnetra Stimufend |

| epoetin alfa (Epogen or Procrit) | Retacrit |

| denosumab (Xgeva) | Wyost Osenvelt |

Restraints: Brand loyalty and perception bias are hampering the growth of the market

Brand loyalty and perception bias remain major barriers to the growth of the oncology biosimilars market. Many oncologists and patients continue to trust well-established originator biologics such as Herceptin (trastuzumab), Avastin (bevacizumab), and Rituxan (rituximab) due to their long clinical track records and proven efficacy. Despite regulatory confirmation of equivalence, biosimilars often face skepticism regarding potential differences in safety, immunogenicity, or long-term outcomes.

Originator companies reinforce this loyalty through strong marketing, physician-education programs, and patient-assistance schemes that discourage switching. In markets with limited awareness or weak substitution policies, this perception bias delays adoption even after biosimilar approval. As a result, brand inertia and physician hesitancy continue to limit market penetration and slow the realization of biosimilars’ full cost-saving and accessibility potential in oncology.

For more details on this report – Request for Sample

Oncology Biosimilars Market, Segment Analysis

The global oncology biosimilars market is segmented based on product type, indication, route of administration, and region.

Product Type: The monoclonal antibodies (mAbs) segment is dominating and fastest-growing in the oncology biosimilars market with a 40.32% share in 2024

The monoclonal antibodies (mAbs) segment is both the dominant and fastest-growing category in the oncology biosimilars market. This leadership stems from the pivotal role mAbs play in treating major cancers such as breast, lung, colorectal, and lymphoma, where biologics like trastuzumab (Herceptin), bevacizumab (Avastin), and rituximab (Rituxan) are cornerstone therapies. The expiry of patents for these drugs has created multi-billion-dollar opportunities for biosimilars, leading to a surge of approvals and launches worldwide.

Products include Ogivri (trastuzumab-dkst), Kanjinti (trastuzumab-anns), Mvasi (bevacizumab-awwb), and Truxima (rituximab-abbs), each driving adoption across major markets. Recent developments further highlight the segment’s momentum. For instance, in April 2025, Biocon Biologics Ltd (BBL), a subsidiary of Biocon Ltd announced that the U.S. Food and Drug Administration (U.S. FDA) has approved Jobevne (bevacizumab-nwgd), a biosimilar Bevacizumab for intravenous use. JOBEVNE, a recombinant humanized monoclonal antibody used to treat several different types of cancer, is a biosimilar to the reference product Avastin (bevacizumab). JOBEVNE is a vascular endothelial growth factor (VEGF) inhibitor that binds with VEGF and blocks the interaction with its receptors to prevent angiogenesis combating cancer by restricting blood supply to the tumor.

Oncology Biosimilars Market, Geographical Analysis

North America is expected to dominate the global oncology biosimilars market with a 44.57% in 2024

North America is expected to dominate the global oncology biosimilars market owing to its advanced regulatory framework, high biologic drug usage, and strong presence of leading pharmaceutical companies.

US Oncology Biosimilars Market Trends

The U.S. Food and Drug Administration (FDA) has approved over 63 biosimilars as of late 2024, establishing one of the world’s most mature and transparent biosimilar pathways under the Biologics Price Competition and Innovation Act (BPCIA). The region accounts for largest share of global oncology biosimilars revenue, supported by high cancer prevalence, substantial healthcare spending, and payer-driven efforts to reduce oncology treatment costs.

Major FDA approvals such as Hercessi (trastuzumab-strf) in 2024 and Jobevne (bevacizumab-nwgd) in 2025 underscore the region’s accelerating product pipeline and commercial uptake. The US also benefits from a robust network of oncology clinics and infusion centers that enable rapid adoption once pricing and formulary access are secured. With top players like Amgen, Pfizer, Viatris, and Sandoz headquartered in the region and continuously expanding their biosimilar portfolios, North America is positioned to remain the largest and fastest-evolving market for oncology biosimilars, driven by both policy incentives and growing demand for affordable cancer therapies.

The Asia Pacific region is the fastest-growing region in the global oncology biosimilars market, with a CAGR of 18.7% in 2024

The Asia-Pacific region is the fastest-growing market for oncology biosimilars, propelled by its massive cancer burden, improving healthcare infrastructure, and strong government support for affordable biologics. According to the WHO and GLOBOCAN, Asia-Pacific accounts for nearly 50% of global new cancer cases and over 60% of cancer-related deaths, with countries like China, India, and Japan witnessing sharp increases in breast, lung, and colorectal cancers. This rising prevalence, coupled with the high cost of biologic therapies, has accelerated demand for cost-effective biosimilars.

Leading regional players such as Biocon Biologics (India), Alkem, and Celltrion (South Korea) are spearheading biosimilar innovation and launches, further boosting the growth of the market in the region. For instance, in September 2025, Alkem Laboratories launched a biosimilar product in India for the treatment of breast cancer. The company has introduced Pertuza injection 420mg/14mL, a pertuzumab biosimilar, for the treatment of HER2-positive breast cancer. Alkem's Pertuza is an affordable, indigenously-developed and manufactured biosimilar of pertuzumab.

Europe Oncology Biosimilars Market Trends

The oncology biosimilars market in Europe is witnessing robust growth, driven by the region’s high cancer prevalence, supportive regulatory landscape, and growing emphasis on cost-effective care. With rising new cancer cases, the demand for affordable biologic therapies continues to surge. The European Medicines Agency (EMA) has established one of the most advanced biosimilar approval frameworks globally, enabling faster market entry and broader access.

Countries like Germany, France, Italy, and the U.K. have adopted substitution and tender-based procurement systems that significantly boost biosimilar uptake. Major product launches such as multiple trastuzumab, bevacizumab, and rituximab biosimilars, and the first denosumab biosimilar approved by the European Commission in 2024 are expanding therapeutic options and reducing treatment costs. Backed by high biologic utilization, payer-driven cost containment, and a mature regulatory framework, Europe stands as a global leader and growth engine for oncology biosimilars in the coming decade.

Oncology Biosimilars Market Competitive Landscape

Top companies in the oncology biosimilars market include Celltrion USA, Inc., Amgen Inc., Pfizer Inc., Biocon Biologics Limited, Teva Pharmaceuticals USA, Inc., Organon group of companies, Accord BioPharma, and Sandoz Inc., among others.

Market Scope

| Metrics | Details | |

| CAGR | 18.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Monoclonal Antibodies (mAbs), Recombinant Proteins, Granulocyte Colony-Stimulating Factor (G-CSF), Erythropoiesis-Stimulating Agents, and Others |

| Indication | Breast Cancer, Lung Cancer, Colorectal Cancer, Cervical Cancer, Blood Cancer, and Others | |

| Route of Administration | Oral and Injectable | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global oncology biosimilars market report delivers a detailed analysis with 56 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here