Oil and Gas Cloud Application Market Overview

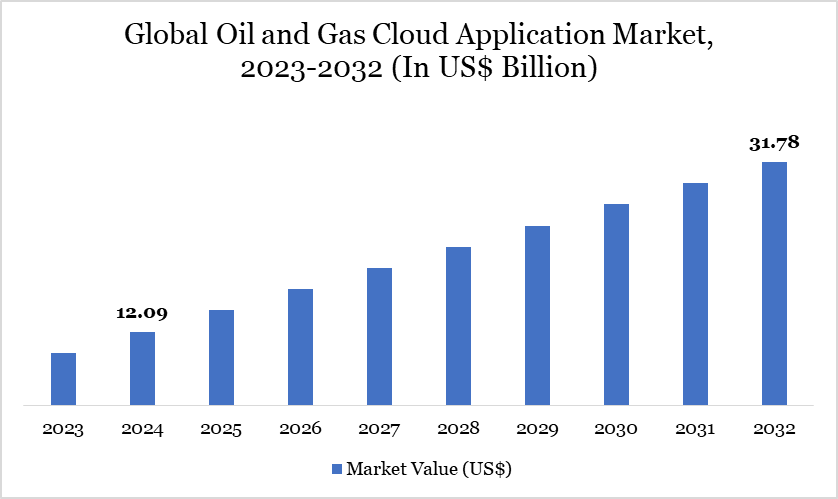

Oil and Gas Cloud Application Market reached US$12.09 billion in 2024 and is expected to reach US$31.78 billion by 2032, growing with a CAGR of 12.84% during the forecast period 2025-2032, according to DataM Intelligence report.

The global oil and gas cloud applications market is experiencing robust growth, driven by the industry's pursuit of digital transformation, operational efficiency, and enhanced data management. The market's growth is also supported by the increasing use of private clouds for data encryption, enhancing cybersecurity measures within the industry.

Moreover, the adoption of cloud applications facilitates better compliance with regulatory standards, disaster recovery, and the modernization of legacy systems. By enabling remote asset management and real-time data processing, cloud technologies are proving essential in navigating the complexities of the oil and gas industry.

Oil and Gas Cloud Application Market Trend

Oil and gas companies are increasingly integrating artificial intelligence (AI) and machine learning (ML) into their cloud platforms to optimize operations and reduce downtime. These technologies enable predictive maintenance by analyzing equipment data to detect anomalies and forecast potential failures.

For instance, BP uses cloud-based AI systems to predict maintenance needs in its upstream operations, significantly lowering operational costs and improving safety. Real-time data processing through cloud applications is becoming essential for decision-making in the oil and gas industry. Companies are using cloud platforms to collect and analyze data from remote sensors and field equipment, allowing faster and more informed responses.

For more details on this report – Request for Sample

Market Scope

Metrics | Details |

By Component | Solutions, Services |

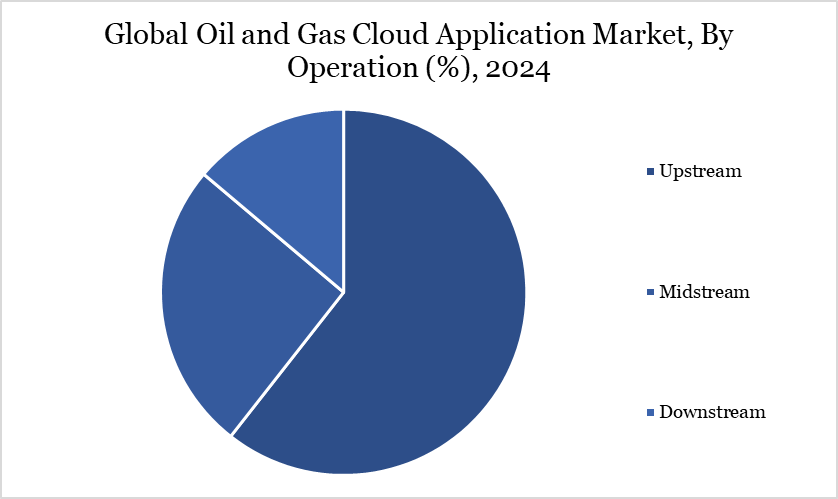

By Operation | Upstream, Midstream, Downstream |

By Deployment | Private Cloud, Public Cloud, Hybrid |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Oil and Gas Cloud Application Market Dynamics

Rising Scalability and Innovation

Cloud solutions for oil and gas are essential for enterprises as they provide scalable resources, cost efficiency and increased flexibility. It enables organizations to store, manage, and analyze data remotely, resulting in decreased hardware expenses and enhanced cooperation. Moreover, cloud computing facilitates accelerated innovation, allowing organizations to swiftly implement new apps and services without substantial initial expenditure.

Cloud computing is utilized in the oil and gas sector to optimize operations, augment decision-making, and refine data management. It facilitates real-time data processing, enhancing asset management and predictive maintenance. Cloud solutions enhance collaboration among multinational teams, optimize supply chain processes and offer the scalability required to manage substantial volumes of seismic and geological data. This results in enhanced efficiency in exploration, production, and distribution operations within the industry.

Operational Efficiency and Innovation

Oil and gas enterprises implementing cloud computing have substantial obstacles concerning data security. The shift to cloud-based solutions presents vulnerabilities that may expose important operational data to cyber-attacks, resulting in potential breaches and illegal access. Integrating cloud computing with pre-existing on-premises systems and other technologies can be intricate.

Oil and gas industries frequently utilize legacy systems and achieving seamless connectivity with the cloud may pose technological difficulties. The oil and gas sector frequently functions in isolated and inhospitable locations where communication is restricted. Cloud computing needs dependable internet connections for real-time data processing, which can be challenging to attain in these areas.

Oil and Gas Cloud Application Market Segment Analysis

The global oil and gas cloud application market is segmented based on component, operation, deployment and region.

Techniques, Technology, and Resource Assessment in the Upstream Sector

Oil and gas exploration constitutes a crucial component of the upstream sector. Petroleum exploration necessitates very advanced techniques, and the technology utilized in this field is evolving swiftly. Exploration typically commences in regions with significant resource potential, often attributable to the local geology and established adjacent petroleum resources.

In a high-potential region, additional investigation is conducted to define a resource. The geophysical and geochemical analysis is conducted with techniques such as induced polarization (IP) surveys, drilling and assaying and electrical currents, among others. The objective during the exploration phase is to identify and assess the potential of a resource.

Exploratory wells are drilled in areas that exhibit potential for resource hosting to assess the resource. In the oil and gas industry, test drilling is a crucial element of the exploration phase. Should the exploratory well prove successful, the subsequent action is to develop wells and extract the resource. Upstream companies also manage the wells that extract crude oil or natural gas from the subsurface.

Oil and Gas Cloud Application Market Geographical Share

Digital Transformation, Data Privacy and Sustainability Initiatives in Europe

Europe possesses the biggest market share owing to the increasing demand for oil and gas cloud applications and the escalating necessity for digital transformation among both large and small enterprises. The UK, because to its early adoption of cloud technology, dominates the European market, trailed by Denmark, Italy and Spain.

The region anticipates utilizing cloud computing technology to decrease expenses and improve operational efficiency. The area possesses enormous oil and gas deposits, especially in the Norwegian belt and the North Sea. Equinor, a Norwegian global energy firm, exemplifies a European oil and gas company that has implemented cloud technologies. Cloud-based data analytics and machine learning were employed to enhance drilling operations in the North Sea.

Equinor improved drilling precision, minimized downtime, and achieved cost savings by employing cloud technology to analyze real-time drilling data from distant sites. Moreover, Europe enforces stringent data privacy regulations, including the General Data Protection Regulation (GDPR). Oil and gas companies operating in Europe were required to ensure that their cloud solutions adhered to these regulations, leading to the extensive implementation of secure and compliant cloud services. European oil and gas corporations were also apprehensive about environmental sustainability.

Technological Analysis

The oil and gas cloud application market are being reshaped by the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), big data analytics, and edge computing. These technologies are enabling oil and gas companies to shift from reactive to predictive operations.

AI and ML, for instance, are used extensively for predictive maintenance and exploration analytics—helping identify equipment failures before they occur and reducing non-productive time. IoT sensors embedded in drilling equipment, pipelines, and storage tanks generate massive volumes of real-time operational data, which is then processed through cloud platforms to enhance asset visibility and efficiency.

Oil and Gas Cloud Application Market Major Players

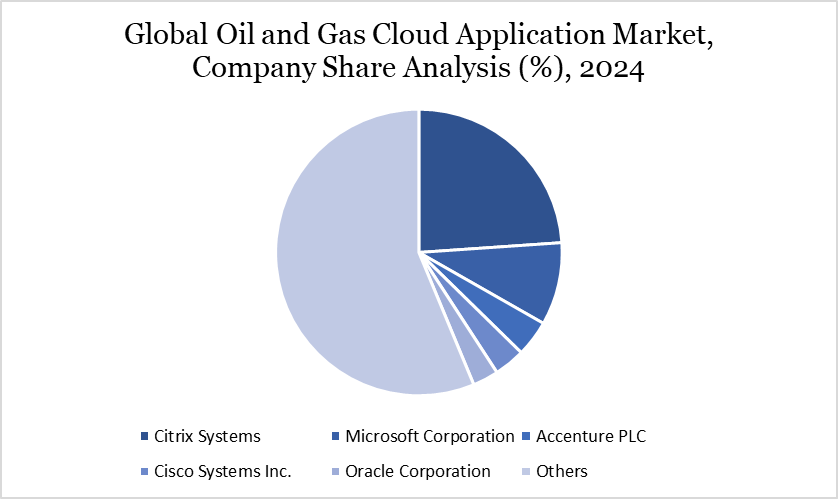

The major global players in the market include Citrix Systems, Microsoft Corporation, Accenture PLC, Cisco Systems Inc, Oracle Corporation, SAP SE, Capgemini S.A., Hewlett-Packard Company, IBM Corporation, Yokogawa Company and among others.

Key Developments

In 2023, Microsoft and Oracle enhanced their partnership to offer Oracle Database Services on Oracle Cloud Infrastructure within Microsoft Azure.

In 2023, Cisco announced the launch of Cisco Secure Application (formerly known as Security Insights for Cloud Native Application Observability) on the Cisco Full-Stack Observability Platform, enabling organizations to integrate application and security teams for the secure development and deployment of modern applications.

In 2023, KBC, a Yokogawa Company, introduced the KBC Acuity Industrial Cloud Suite, a novel cloud distribution platform for its software and solutions. This product aims to consolidate KBC's diverse portfolio of technology and services to tackle difficulties including energy transition, process optimization, value chain optimization and asset management. It concentrates on process industries including oil and gas, petrochemicals and refining.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies