North America Electrical Digital Twin Market Size

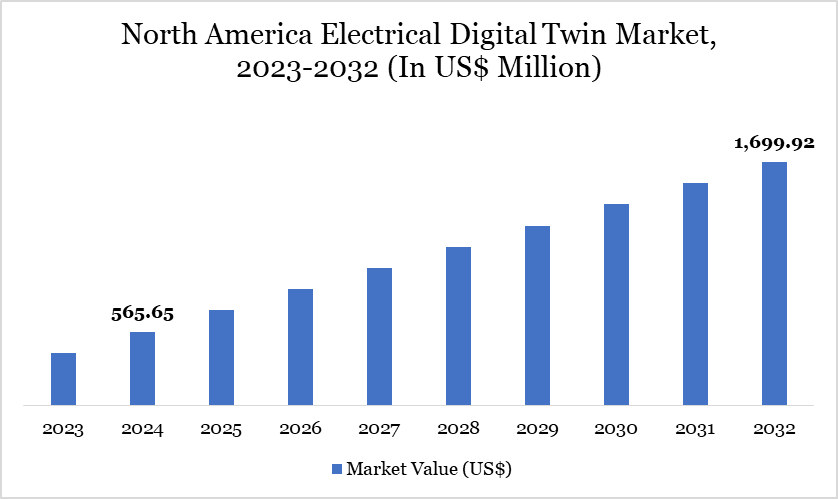

North America Electrical Digital Twin Market Size reached US$ 565.65 million in 2024 and is expected to reach US$ 1,699.92 million by 2032, growing with a CAGR of 14.9% during the forecast period 2025-2032.

The North American electrical digital twin market is experiencing significant growth, driven by the integration of advanced technologies such as artificial intelligence (AI), machine learning and cloud computing. These technologies enable utilities to create virtual replicas of physical assets, allowing for real-time monitoring, predictive maintenance and optimization of power systems.

Government initiatives, such as the US Department of Energy's Grid Resilience and Innovation Partnerships (GRIP) Program, which allocates US$ 10.5 billion over five years to enhance grid flexibility and resilience, further bolster this growth. Additionally, partnerships between technology companies, like Nvidia and Schneider Electric, aim to create digital twins of data centers to improve energy efficiency, highlighting the market's dynamic evolution.

Electrical Digital Twin Market Trend

A key trend in the North American electrical digital twin market is the growing use of AI and machine learning to accelerate grid interconnection processes, as seen in the US Department of Energy’s AI4IX program. Utilities are increasingly adopting cloud-based digital twin platforms for real-time grid monitoring and predictive analytics. Another emerging trend is the integration of digital twins in renewable energy projects, supporting decarbonization and grid decentralization efforts. Collaborations between major tech firms and utilities are also driving innovation in simulation and energy optimization.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Twin Type | Digital Gas & Stream-Power Plant, Digital Wind Farm, Digital Grid, Digital Hydropower Plant, Others. | |

| By Usage Type | Product Digital Twin, Process Digital Twin, System Digital Twin. | |

| By Deployment Mode | Cloud, On-premises. | |

| By Application | Asset Performance Management, Business & Operations Optimization, Fault Detection & Predictive Maintenance, Performance Optimization, Others. | |

| By End-User | Utilities, Grid Infrastructure Operators, Others. | |

| By Country | US, Canada, Mexico | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

North America Electrical Digital Twin Market Dynamics

Growth of Distributed Energy Resources (DERs) and Need for Real-Time Grid Orchestration

The rapid expansion of Distributed Energy Resources (DERs) including rooftop solar, battery storage, electric vehicles (EVs) and smart appliances is significantly driving the adoption of digital twin technologies in North America's electrical grid. As DERs proliferate, utilities face the complex challenge of managing a decentralized and dynamic energy landscape. Digital twins offer a solution by providing real-time simulations and analytics, enabling utilities to optimize grid operations, forecast demand and integrate diverse energy sources effectively.

According to Wood Mackenzie, the US is projected to add 217 gigawatts (GW) of DER capacity by 2028, with flexible EV charging and building automation systems accounting for half of this growth. This surge underscores the need for advanced grid orchestration tools. Digital twins can model and predict the behavior of these distributed assets, facilitating better demand response and grid stability.

The US Department of Energy (DOE) has recognized the potential of virtual power plants (VPPs), which aggregate DERs to provide grid services. The DOE estimates that VPP capacity could reach 30 to 60 GW, offsetting 10% to 20% of peak electricity demand by 2030. Digital twins play a crucial role in managing VPPs by simulating various scenarios and optimizing the dispatch of aggregated resources.

Integration Challenges with Legacy Utility Systems

Integration challenges with legacy utility systems are a significant barrier to the widespread adoption of digital twin technologies in North America's electrical grid. Many utilities operate with infrastructure and software systems that were developed decades ago, which are often incompatible with modern digital solutions. These outdated systems lack the flexibility required to integrate with contemporary tools such as cloud computing, artificial intelligence (AI) and Internet of Things (IoT) devices, which are essential components of effective digital twin implementations.

One of the primary issues is the inefficiency of legacy systems. They are costly to maintain and require specialized expertise that is becoming increasingly scarce as technology evolves. Every dollar spent on maintaining these systems is a dollar not invested in innovation. Moreover, these systems often create data silos, trapping information within individual departments and preventing seamless communication across the organization. This fragmentation hinders decision-making and leaves utilities with an incomplete view of their operations, which is detrimental in today's fast-evolving energy landscape.

North America Electrical Digital Twin Market Segment Analysis

The North America electrical digital twin market is segmented based on twin type, usage type, deployment mode, application, end-user and country.

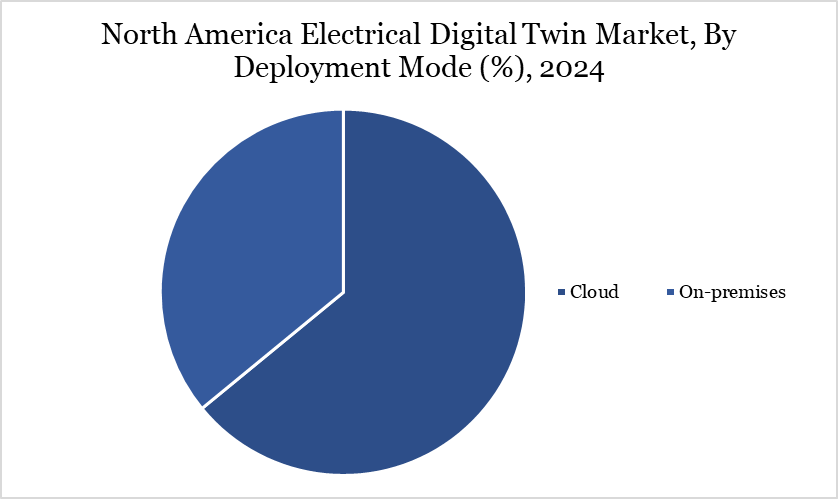

Advancements in Cloud-Based Twin are Expected to Drive the Segment Growth

Cloud deployment offers unparalleled scalability, allowing organizations to adjust resources based on demand without the need for substantial upfront investments in physical infrastructure. This flexibility is particularly beneficial for utilities managing complex and dynamic electrical networks. By leveraging cloud platforms organizations can deploy digital twin solutions that scale with their operational needs, ensuring optimal performance even during peak load conditions.

In March 2025, Schneider Electric, the leader in the digital transformation of energy management and automation and ETAP, the industry and technology leader in power system design and operation, unveiled a cutting-edge digital twin that can accurately design and simulate the power needs of AI Factories. Leveraging the NVIDIA Omniverse Blueprint for AI factory digital twins, Schneider Electric and ETAP enable the development of digital twins that bring together multiple inputs for mechanical, thermal, networking and electrical systems to simulate how an AI Factory operates.

North America Electrical Digital Twin Market Geographical Share

Government Initiatives and Investment in Smart Grid Systems Drive the Market

The strong investments in smart grid projects, renewable energy integration and infrastructure modernization, North America has created a conducive environment for digital twin technology. Government initiatives promoting energy efficiency, grid reliability and adoption of Industry 4.0 technologies further support market growth. The US, in particular, is a pioneer in digitalization across the energy sector, with utilities increasingly using digital twins for predictive maintenance, asset management and performance optimization.

In October 2023, the Biden-Harris Administration, under the Investing in America agenda, announced US$1.3 billion in funding to build three major electric transmission lines across six states: Nevada, Utah, Arizona, New Mexico, New Hampshire and Vermont. The move supports US grid modernization, resilience and the nation’s 2050 net-zero emissions goal. As these large-scale transmission projects are designed to expand grid capacity, enhance resilience and integrate renewable energy, operators must adopt highly precise, real-time virtual models digital twins to monitor, simulate and optimize the performance of the expanded and increasingly complex electric networks.

Technological Analysis

The North American electrical digital twin market is experiencing significant technological advancements, driven by the integration of artificial intelligence (AI), cloud computing and the Internet of Things (IoT). These technologies are enhancing the capabilities of digital twins, enabling utilities to simulate, predict and optimize grid operations more effectively.

A notable development is the US Department of Energy's (DOE) launch of the Artificial Intelligence for Interconnection (AI4IX) program. With an allocation of US$ 30 million, this initiative aims to expedite the connection of renewable energy projects, such as solar and wind farms, to the power grid using AI. The current interconnection process can take up to seven years, creating a backlog of 2,600 gigawatts worth of new energy projects awaiting connection.

North America Electrical Digital Twin Market Major Players

The major players in the market include General Electric, Microsoft Corporation, Bentley Systems, Incorporated, Emerson Electric Co., Ansys and others.

Key Developments

- In September 2023, Ansys introduced a major enhancement to its digital twin capabilities called fusion modeling. This new feature strengthens hybrid analytics, which blends physics-based simulation with data-driven machine learning to create even more accurate and intelligent digital twins.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth countrys.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies