Next-Generation Multiple Myeloma Therapies Market Size & Industry Outlook

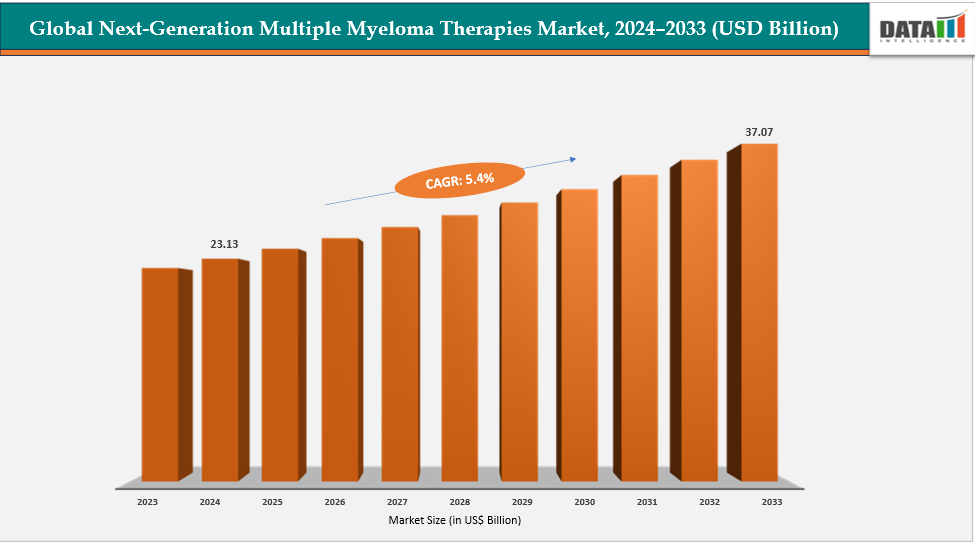

The global next-generation multiple myeloma therapies market size reached US$ 22.03 Billion in 2023 with a rise of US$ 23.13 Billion in 2024 and is expected to reach US$ 37.07 Billion by 2033, growing at a CAGR of 5.4% during the forecast period 2025-2033.

The rare and severe disease known as multiple myeloma starts in the bone marrow's plasma cells and causes unchecked cell development, bone loss, renal dysfunction, and compromised immunity. The market for multiple myeloma treatments is expanding quickly on a global scale as a result of new treatments, increased incidence, and growing disease awareness. By enabling accurate and long-lasting immune responses, next-generation therapies that target new antigens including BCMA, GPRC5D, and FcRH5 are propelling market expansion.

Efficiency and survival results are being improved by developments in antibody-drug conjugates, CAR-T cell treatments, and bispecific antibodies. The landscape of treating multiple myeloma is changing as a result of ongoing trial achievements, regulatory approvals, and a better understanding of the biology of the illness. These factors are driving the development of customized, combination-based therapy.

Key Highlights

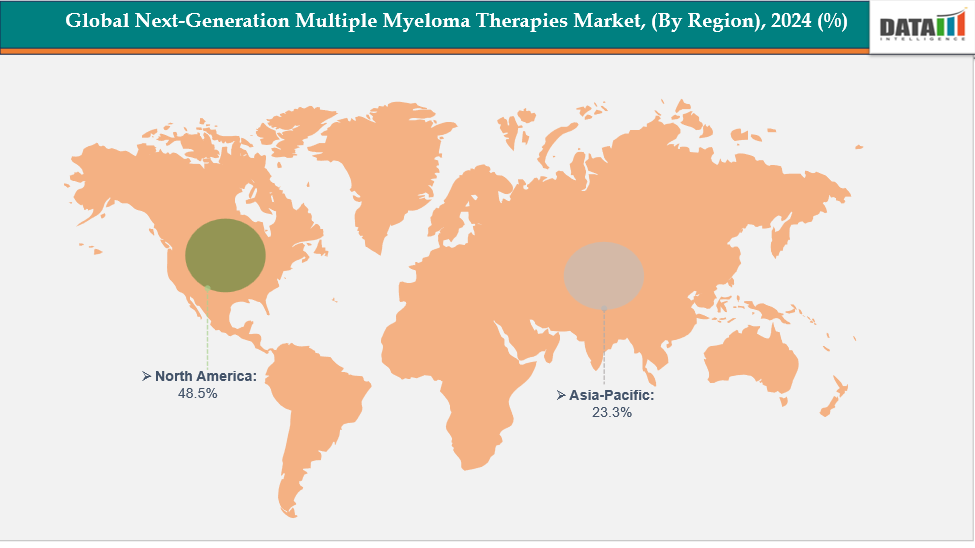

- North America is dominating the global next-generation multiple myeloma therapies market with the largest revenue share of a 48.5% in 2024

- The Asia Pacific region is the fastest-growing region in the global next-generation multiple myeloma therapies market, with a CAGR of 7.7% in 2024

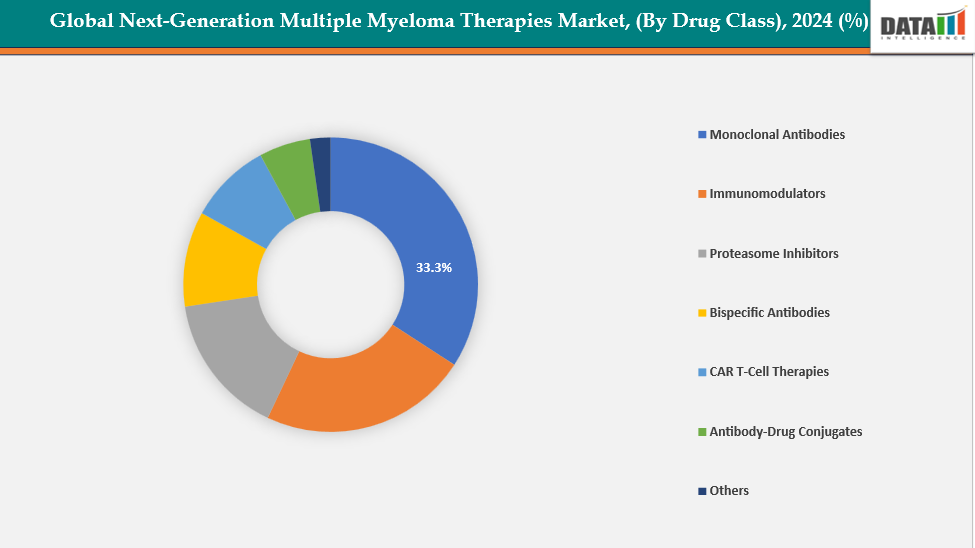

- The monoclonal antibodies segment from drug class is dominating the next-generation multiple myeloma therapies market with a 33.3% share in 2024

- The intravenous segment from route of administration is dominating the next-generation multiple myeloma therapies market with a 45.3% share in 2024

- Top companies in the next-generation multiple myeloma therapies market include Takeda Pharmaceuticals, Inc.; Amgen Inc.; Bristol-Myers Squibb Company; Johnson & Johnson; Sanofi; Karyopharm Therapeutics Inc.; GSK plc. , Legend Biotech; Novartis Pharmaceuticals Corporation; and Regeneron Pharmaceuticals, Inc., among others.

Market Dynamics

Drivers: Rapid launches and adoption of next-gen modalities are accelerating the growth of the next-generation multiple myeloma therapies market

The market for multiple myeloma treatments is expanding rapidly due to the introduction and uptake of next-generation modalities such CAR-T cell therapies, bispecific antibodies, and antibody-drug conjugates. When compared to traditional choices, these cutting-edge treatments offer greater results, longer remission durations, and higher response rates. Their use is accelerating in key regions due to increased research collaborations, quicker clinical development, and more physician trust. Improved production scalability, supporting reimbursement regulations, and increased patient awareness all contribute to increased market penetration.

Owing to factors like next-generation modalities such as CAR-T cell therapies. For instance, in April 2024, Legend Biotech’s CARVYKTI (ciltacabtagene autoleucel) became the first and only BCMA-targeted CAR-T cell therapy approved by the FDA for second-line treatment of multiple myeloma. This milestone marked a major advancement, expanding access to next-generation cell therapy for patients with relapsed or refractory disease.

Restraints: High cost and reimbursement barriers of treatment is hampering the growth of the next-generation multiple myeloma therapies market

The development of next-generation multiple myeloma treatments is being hindered by a number of problems, including the high expense and difficulties with funding. Because they cost hundreds of thousands of dollars per patient, treatments like CAR-T cells, bispecific antibodies, and antibody-drug conjugates are out of reach for many.

Additionally, limited reimbursement coverage and delayed payer approvals restrict patient access, especially in emerging markets. Many healthcare systems struggle to justify such costs despite clinical benefits. Consequently, treatment uptake remains confined to wealthy regions and specialized centers, slowing overall market expansion.

For more details on this report, see Request for Sample

Next-Generation Multiple Myeloma Therapies Market, Segment Analysis

The global next-generation multiple myeloma therapies market is segmented based on drug class, route of administration, distribution channel and region

By Drug Class: The monoclonal antibodies segment from drug class is dominating the next-generation multiple myeloma therapies market with a 33.3% share in 2024

The market for next-generation multiple myeloma medicines is dominated by monoclonal antibodies (mAbs) because of their shown safety, effectiveness, and wider accessibility when compared to cell-based therapies. Agents like Elotuzumab (Empliciti), Isatuximab (Sarclisa), and Daratumumab (Darzalex) have proven indispensable for both newly diagnosed and relapsed/refractory patients, leading to their widespread use. Their commercial dominance is supported by their capacity to target certain antigens, such as CD38 and SLAMF7, as well as their convenient delivery methods (including subcutaneous formulations) and significant combination potential with IMiDs and proteasome inhibitors.

Moreover, continuous research and development, approvals, and new product launches make this segment dominant. For instance, in July 2024, Johnson & Johnson announced that the U.S. FDA approved DARZALEX FASPRO (daratumumab and hyaluronidase-fihj), a monoclonal antibody therapy, in combination with bortezomib, lenalidomide, and dexamethasone (D-VRd) for newly diagnosed multiple myeloma patients eligible for autologous stem cell transplant, marking a major advancement in front-line myeloma treatment.

By Route of Administration: The intravenous segment from route of administration is dominating the next-generation multiple myeloma therapies market with a 45.3% share in 2024

As most sophisticated treatments, including CAR-T cell therapies, bispecific antibodies, monoclonal antibodies, and antibody-drug conjugates, require regulated infusion for safety and efficacy, the intravenous (IV) route dominates the market for next-generation multiple myeloma therapeutics. IV administration guarantees accurate dosage, quick systemic delivery, and careful patient monitoring—all of which are essential for controlling possible side effects including cytokine release syndrome. The predilection for IV methods is reinforced by the fact that hospitals and infusion centers are well-equipped to handle these intricate regimens.

Additionally, this market is dominated by ongoing R&D, approvals, and the introduction of new products. For example, the FDA granted Regeneron Pharmaceuticals expedited clearance in July 2025 for Lynozyfic (linvoseltamab-gcpt), an intravenous bispecific antibody therapy for people with multiple myeloma who have had four previous therapies and have relapsed or are resistant. The LINKER-MM1 clinical trial's robust response rate and response durability served as the foundation for the approval.

Geographical Analysis

North America is dominating the global next-generation multiple myeloma therapies market with a 48.5% in 2024

The market for next-generation multiple myeloma medicines was dominated by North America because of its robust use of cutting-edge immunotherapies, substantial R&D expenditures, and established healthcare system. Key biotech companies, favorable regulatory and reimbursement systems, and early approvals of CAR-T and bispecific antibody medicines are the reasons for the region's leadership.

In the USA, the next-generation multiple myeloma therapies market grew rapidly due to strong R&D investments, increasing FDA approvals, robust biotech funding, and government support for innovative cancer immunotherapies. For instance, in April 2024, the FDA approved CARVYKTI (ciltacabtagene autoleucel) and ABECMA (idecabtagene vicleucel) for the earlier treatment of adults with relapsed or refractory multiple myeloma. These approvals marked a major milestone, expanding access to advanced CAR-T cell therapies and offering new hope to patients with limited treatment options.

Europe is the second region after North America which is expected to dominate the global next-generation multiple myeloma therapies market with a 34.5% in 2024

In Europe, the market for next-generation multiple myeloma therapies expanded rapidely as a result of strong R&D expenditures, growing biotech infrastructure, and supportive regulations. Innovation, clinical adoption, and commercial expansion throughout the area were expedited by the growing use of CAR-T and bispecific antibody therapy as well as strategic partnerships between pharmaceutical companies and research institutions.

Moreover, European Union government approvals for new products further boost market growth. For instance, in March 2024, the European Commission approved Abecma (idecabtagene vicleucel) by Bristol Myers Squibb for adults with relapsed or refractory multiple myeloma after at least two prior therapies. This milestone made Abecma the first CAR-T cell therapy in the European Union approved for earlier-line treatment of triple-class exposed patients.

The Asia Pacific region is the fastest-growing region in the global next-generation multiple myeloma therapies market, with a CAGR of 7.7% in 2024

The market for next-generation multiple myeloma medicines in Asia-Pacific growing rapidely as a result of growing R&D expenditures, substantial biotechnology breakthroughs, and growing demand for targeted therapies. Additional factors driving market expansion were the expanding use of CAR-T cell and bispecific antibody treatments in nations including China, Japan, India, and South Korea, as well as encouraging government programs.

Japan’s market for next-generation multiple myeloma medicines expanded quickly thanks to robust R&D, a rise in clinical trials, and partnerships between academia and business. Aside from government support for oncology innovation, rapid clinical acceptance, and market growth across the country, PMDA and the Ministry of Health, Labour and Welfare (MHLW) approved monoclonal antibody (mAb), advanced CAR-T, and bispecific antibody therapy. Owing to factors like PMDA approvals, for instance, in February 2025, Japan’s Ministry of Health, Labour and Welfare (MHLW) approved Sarclisa (isatuximab) in combination with bortezomib, lenalidomide, and dexamethasone (VRd) for adults with newly diagnosed multiple myeloma, based on positive results from the IMROZ Phase 3 trial.

Competitive Landscape

Top companies in the next-generation multiple myeloma therapies market include Takeda Pharmaceuticals, Inc., Amgen Inc., Bristol-Myers Squibb Company, Johnson & Johnson, Sanofi, Karyopharm Therapeutics Inc., GSK plc. , Legend Biotech, Novartis Pharmaceuticals Corporation, and Regeneron Pharmaceuticals, Inc., among others.

Takeda Pharmaceuticals, Inc.: Takeda Pharmaceuticals, Inc. is a global biopharmaceutical leader focused on advancing innovative therapies for oncology, including next-generation multiple myeloma treatments. The company is actively developing and commercializing advanced modalities such as proteasome inhibitors, antibody–drug conjugates, and cell therapies. Takeda’s strong R&D pipeline, global partnerships, and patient-centric approach reinforce its leadership in transforming multiple myeloma care.

Key Developments:

- In July 2025, Sanofi received European Commission approval for Sarclisa in combination with bortezomib, lenalidomide, and dexamethasone (VRd) for the induction treatment of adults with newly diagnosed multiple myeloma eligible for autologous stem cell transplant, following a positive opinion from the European Medicines Agency’s Committee for Medicinal Products for Human Use.

- In January 2025, China’s National Medical Products Administration (NMPA) approved Sanofi’s Sarclisa, in combination with bortezomib, lenalidomide, and dexamethasone (VRd), for treating adults with newly diagnosed multiple myeloma ineligible for autologous stem cell transplant, based on IMROZ Phase 3 study data, marking it as China’s first approved anti-CD38 therapy with standard VRd for this patient group.

- In August 2024, Takeda launched NINLARO Capsules 0.5 mg (ixazomib citrate) in Japan, expanding its existing dosage lineup (2.3 mg, 3 mg, and 4 mg). The new formulation offers multiple myeloma patients a lower-dose option for maintenance therapy, enabling a 1.5 mg dose using three 0.5 mg capsules for improved treatment flexibility.

- In August 2023, the U.S. FDA granted accelerated approval to Janssen’s TALVEY (talquetamab-tgvs), a first-in-class bispecific antibody, for adults with relapsed or refractory multiple myeloma who had received at least four prior therapies. The approval was based on response rate and durability, with continued approval contingent on confirmatory trial results.

Market Scope

| Metrics | Details | |

| CAGR | 5.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | By Drug Class | Monoclonal Antibodies, Immunomodulators, Proteasome Inhibitors, Bispecific Antibodies, CAR T-Cell Therapies, Antibody-Drug Conjugates and Others |

| By Route of Administration | Intravenous, Subcutaneous, Oral | |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global next-generation multiple myeloma therapies market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here