MHealth Market Overview

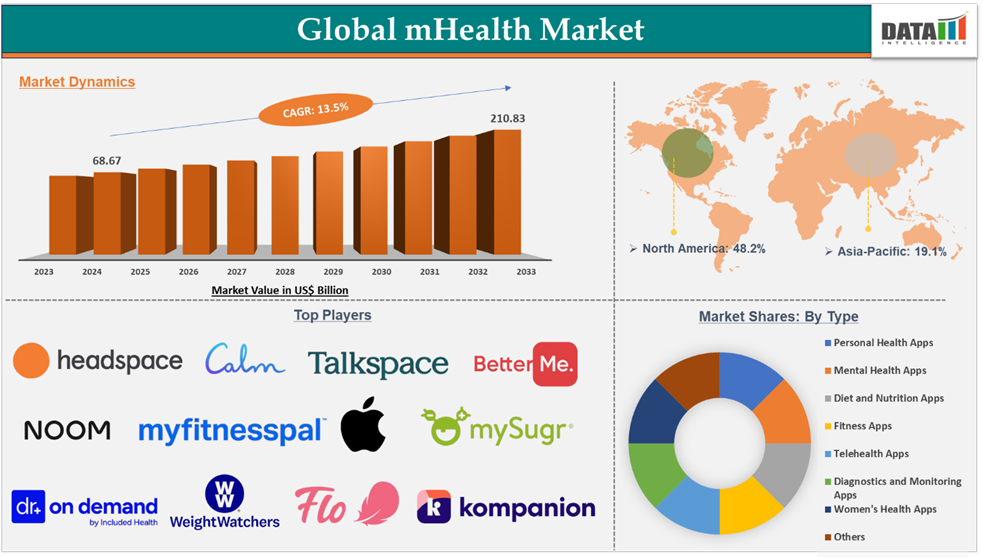

mHealth market reached US$68.67 billion in 2024 and is expected to reach US$210.83 billion by 2033, growing at a CAGR of 13.5% during the forecast period 2025-2033, according to DataM Intelligence report.

The mHealth market is experiencing robust growth driven by factors such as rising utilization of digital health, rapid penetration of smartphones and internet connectivity, launch of apps with advanced features such as artificial intelligence and advanced data analytics, and rising demand for home healthcare, which is bolstered by the rising awareness of personal well-being. Moreover, supportive government initiatives and increasing investment in digital health infrastructure are driving the adoption of mHealth apps. However, data and privacy concerns, limited regulatory support, and technological ambiguity among certain population groups can slow the market growth.

Executive Summary

For more details on this report – Request for Sample

MHealth Market Dynamics: Drivers & Restraints

The rising utilization of digital health and smartphone usage is driving the market growth

mHealth is a crucial domain of digital health, which is boosting access to healthcare within the hands of the public. This digital health solution facilitates remote consultations and continuous health monitoring, thereby enhancing both accessibility and efficiency in healthcare delivery. Furthermore, innovations in wearable technology, including smartwatches and fitness trackers, are expanding the functionality of mHealth applications by enabling real-time tracking of essential health metrics.

The market for mHealth is significantly bolstered by the rising usage of mobile phones and rapid increase in internet accessibility. For instance, according to International Telecommunication Union (ITU), in 2024, approximately 80% of the world’s population owns a mobile phone, and approximately 5.5 billion people have access to the internet, which is 68% of the total global population.

With the rising awareness of one’s health, the public is investing in digital tools that support health management, preventive care, and wellness tracking. This growing interest among the public in personal well-being is leading to higher adoption of mHealth apps.

Data privacy and security concerns may restrain the market growth

The mHealth market's growth is significantly hindered by data privacy and security concerns arising from vulnerabilities in app design, insufficient protections for user data, developer knowledge gaps, regulatory compliance challenges, and user behavior. Addressing these issues is essential for fostering trust among consumers and promoting broader adoption of mHealth solutions. Without enhanced security measures and greater transparency regarding data handling practices, the potential advantages of mHealth technologies may go unrealized. Thus, the above factors could hinder the market growth by reducing the adoption of mHealth solutions.

MHealth Market Segment Analysis

The global mHealth market is segmented based on type, subscription model, and region.

Mental health apps in the type segment accounted for 20.5% of the market share in 2024 in the global mHealth market

Mental health refers to the state of a person’s well-being and emotional and psychological status. Mental health has become a high priority these days due to rising stress levels due to social, economic, and societal factors; increasing awareness of mental health and well-being; and growing recognition of mental health’s role in overall health. Issues like depression, anxiety, and stress are increasingly becoming common worldwide, which are significantly impacting productivity and overall quality of life. For instance, a study published in the BMC Public Health journal in December 2024 stated that among 77 evaluated countries, approximately 30 to 50% of the population reported experiencing psychological stress. Among these countries, 85% have reported a worsening of the psychological stress levels over the past decade. This indicates that a significant portion of the global population is struggling with some form of mental health issue.

As a result, several interventions have come into enforcement to improve the overall mental health of the public. One such intervention is mental health apps. These apps aid a person suffering from mental health issues in multiple ways. Mental health apps are often featured with guided meditation, exercises, mood tracking, cognitive behavioral therapy, access to licensed therapies, AI models to communicate, etc. The popular mental health apps in the current market are Calm, Headspace, BetterHelp, etc.

Governments across the world are prioritizing the mental health of their population; hence, they are actively involved in developing policies, funding mental health programs, and incorporating mental health services in primary healthcare practices. As a result, the mental health apps are gaining huge popularity, as they work in line with the government initiatives. For instance, the Ministry of Health and Family Welfare of India has launched the Tele MANAS Mobile Application on October 10, 2024. This app is designed to provide mental health assistance to people from general mental well-being to severe mental disorders.

Moreover, established market players and new startups are investing heavily in developing mental health apps for the benefit of the public. For instance, in June 2024, Talkspace formed a strategic partnership with FitOn to provide mental health and fitness solutions together to employers.

MHealth Market Geographical Analysis

North America dominated the mHealth market with the highest share of 48.2% in 2024

The North America region is well known for the rapid digitalization of the healthcare industry. The region’s aging population, high prevalence of chronic diseases, increasing demand for home healthcare, rising awareness among the public on personal well-being, high penetration of mobile phones, and high-speed internet connectivity are the key factors contributing to the region’s dominance. The region, especially the U.S., is highly concentrated with key market players and startups, who are constantly involved in innovations and launching advanced mHealth apps.

For instance, in March 2025, Royal Philips in collaboration with Ingeborg Initiatives, has planned to provide Philips Avent Pregnancy+ app to preganent women in Arkansas state of the United States. This app offers customized information and tools to improve health literacy and adopt healthier habits. The app, which has over 80 million lifetime downloads, provides information on Arkansas-based social services, infant health topics, mental health resources, early childhood programs, and additional support services.

Moreover, in May 2024, Allina Health launched Cancer Connection, a new mobile app designed for breast cancer patients to provide insights on their diagnosis and understand their treatment journey. The apps is made available to download from Apple App Store and Google Play.

These initiatives reflect the region’s involvement in advancing the healthcare industry by leveraging mHealth technologies and driving their adoption.

MHealth Market Major Players

The major players in the MHealth market are Headspace Inc., Calm., eMed, Talkspace, Doctor On Demand, Ovia Health, BetterHelp, mySugr, Apple Inc., MyFitnessPal, Inc., Fitbit (Google LLC), Kompanion, Noom, Inc., BetterMe., WW International, Inc., and Flo Health Inc., among others.

Key Development

- In January 2025, Samsung announced that it had introduced a personal health records feature on the Samsung Health App in the Indian market. This feature aligns with the Indian government’s Ayushman Bharat Digital Mission (ABDM), allowing users to manage their health data securely and efficiently. With this feature, the users can now upload their health records without any need for physical paperwork.

- In July 2024, Flo Health, one of the most widely used women’s health apps, announced that it has raised 200 million in a Series C investment from General Atlantic, a leading global growth investor. This huge investment helps Flo to expand its business to new user segments such as perimenopause and menopause.

Market Scope

| Metrics | Details | |

| CAGR | 13.5% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Type | Personal Health Apps, Mental Health Apps, Diet and Nutrition Apps, Fitness Apps, Telehealth Apps, Diagnostics and Monitoring Apps, Women's Health Apps, and Others |

| Subscription Model | Free Apps, Freemium Apps, and Subscription-Based Apps | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |