Medical Packaging Film Market Size and Trends

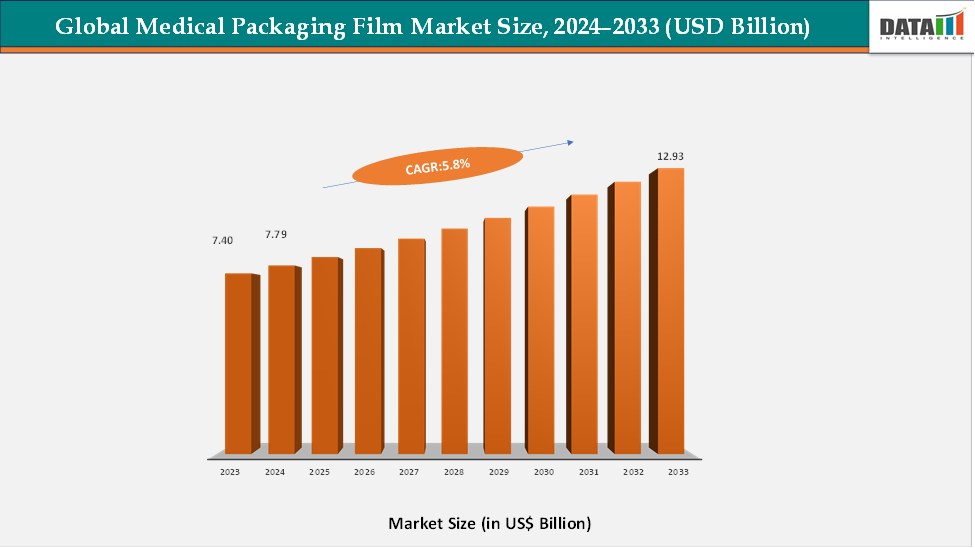

The global medical packaging film market reached US$ US$ 7.40 billion in 2023, with a rise to US$ 7.79 billion in 2024, and is expected to reach US$ 12.93 billion by 2033, growing at a CAGR of 5.8% during the forecast period 2025–2033. The global medical packaging film market is experiencing steady growth, driven by the increasing demand for secure, sterile, and durable packaging solutions across the healthcare and pharmaceutical industries. This growth is supported by the need to ensure product integrity and safety for medical devices, diagnostic kits, and pharmaceutical formulations. Continuous advancements in material science, such as the development of high-barrier, multi-layer, and sustainable polymer films, are improving packaging performance, moisture resistance, and sterilization compatibility.

In addition, the growing focus on eco-friendly and recyclable packaging is prompting manufacturers to adopt biodegradable and recyclable film solutions, aligning with global sustainability initiatives. The rapid expansion of pharmaceutical manufacturing and medical device production, particularly in emerging economies, is further driving market demand. Supportive regulatory frameworks, increasing healthcare investments, and greater emphasis on infection control and patient safety are also contributing to this momentum. With continuous innovation and sustainability shaping the industry landscape, the global medical packaging film market continues to strengthen its position as a vital component of the healthcare supply chain.

Key Market highlights

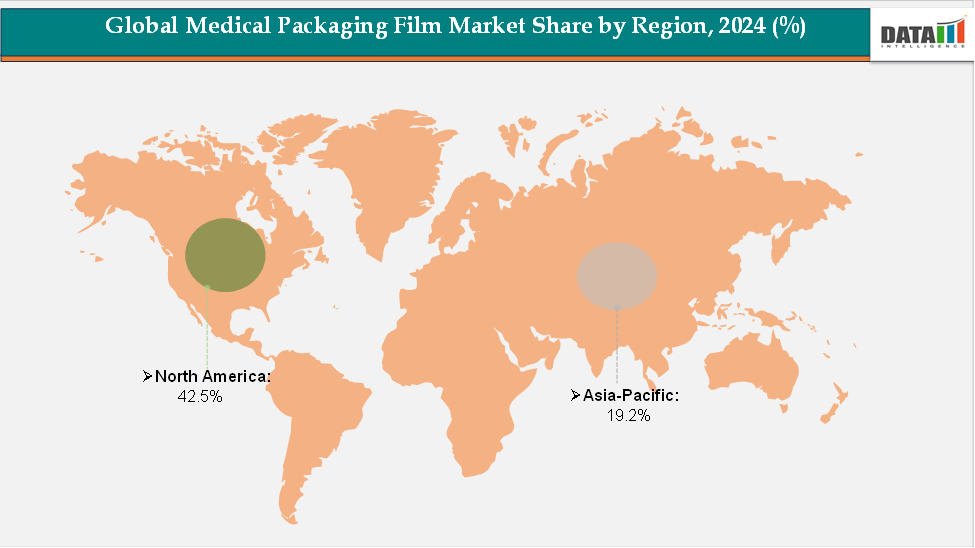

- North America accounted for approximately 42.5% of the global medical packaging film market in 2024 and is expected to maintain its dominant position throughout the forecast period. The region’s leadership is driven by the strong presence of major pharmaceutical and medical device manufacturers, stringent regulatory standards for packaging quality, and a high focus on product safety and sterility.

- The Asia-Pacific region accounted for around 19.2% of the global market in 2024 and is projected to be the fastest-growing region during the forecast period. The region’s rapid growth is fueled by the expanding pharmaceutical manufacturing base in countries such as China and India, rising healthcare expenditures, and increasing adoption of sterile and eco-friendly packaging solutions

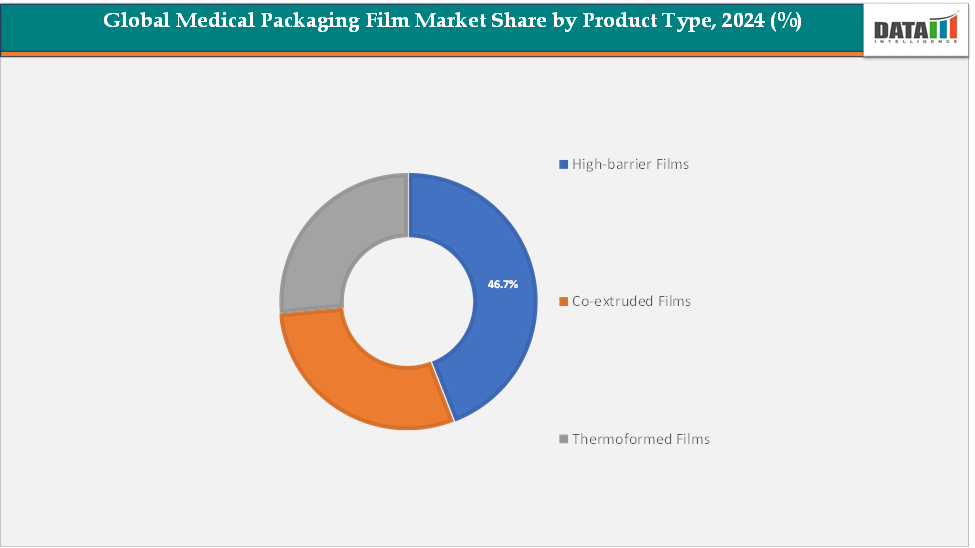

- By product type, high-barrier films dominated the global medical packaging film market, accounting for approximately 46.7% of total revenue in 2024. This dominance is attributed to their exceptional protective properties against moisture, oxygen, and microbial contamination.

Market Size & Forecast

- 2024 Market Size: US$7.79 billion

- 2033 Projected Market Size: US$12.93 billion

- CAGR (2025–2033): 5.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Market Dynamics:

Driver: Rising Demand for Personalized and Small-Batch Pharmaceutical Packaging

Rising demand for personalized and small-batch pharmaceutical packaging is significantly driving the growth of the medical packaging film market. As the pharmaceutical industry shifts toward personalized medicine, cell and gene therapies, and targeted biologics, packaging needs have become more specialized and variable. These treatments are produced in smaller, patient-specific batches that require flexible, high-barrier, and sterilizable films designed for short production runs and rapid changeovers. Medical packaging films offer the ideal combination of barrier protection, printability for serialization and traceability, and compatibility with sterilization and cold-chain storage.

Moreover, the rise of contract manufacturing organizations (CMOs) and contract packagers catering to multiple pharmaceutical clients has boosted demand for versatile film solutions that can handle frequent packaging design changes and smaller order quantities. Additionally, stringent regulatory standards for labeling, tamper evidence, and patient safety are driving the adoption of advanced multi-layer and medical-grade polymer films.

Restraint: Volatility in Polymer Prices and Supply Chain Instability

Volatility in polymer prices and supply chain instability are major restraints for the medical packaging film market. Since films rely heavily on polymers like PE, PP, and PET, fluctuations in crude oil and resin costs directly raise production expenses and squeeze profit margins. Disruptions in global logistics, geopolitical tensions, and raw material shortages often delay deliveries and increase lead times, particularly as pharma-grade films cannot easily switch suppliers due to regulatory constraints.

For more details on this report, Request for Sample

Global Medical Packaging Film Market Segment Analysis

The global medical packaging film market is segmented by product type, material type, application, end user, and region.

Product Type: The high-barrier films segment is estimated to have 46.7% of the medical packaging film market share.

The high-barrier films segment holds the dominant share of the medical packaging film market due to its critical role in preserving product integrity, extending shelf life, and ensuring sterility. These films provide superior protection against oxygen, moisture, UV light, and contaminants, making them indispensable for packaging sensitive products such as sterile medical devices, diagnostic reagents, and biologics. Their ability to maintain drug efficacy and prevent microbial contamination is vital in compliance with stringent healthcare regulations. Multi-layered structures made from polymers such as EVOH, PVDC, and aluminum laminates offer customizable barrier properties tailored to specific product needs.

The dominance is also due to the increasing introduction of advanced, sustainable, and high-performance barrier materials designed to enhance product protection and extend shelf life. These films are essential for preserving the integrity of sensitive pharmaceutical and medical products by providing superior resistance to moisture, oxygen, and contaminants. For instance, in September 2025, CelluForce launched CelluShield, a high-performance, bio-sourced barrier coating developed to help packaging manufacturers meet the rising demand for recyclable flexible packaging without compromising shelf life or product safety.

The growing preference for sustainable yet high-performance materials has also led manufacturers to develop recyclable and bio-based high-barrier films without compromising functionality. Furthermore, as global healthcare systems increasingly rely on pre-filled syringes, blister packs, and medical pouches, the demand for high-barrier films continues to rise. Their superior mechanical strength, heat-sealability, and compatibility with sterilization processes have made them the backbone of the medical packaging ecosystem, maintaining their dominance across both developed and emerging healthcare markets.

Global Medical Packaging Film Market - Geographical Analysis

The North America medical packaging film market was valued at 42.5% market share in 2024

North America holds a dominant position in the global medical packaging films market, primarily due to its well-established healthcare infrastructure, high pharmaceutical production capacity, and strong presence of leading medical packaging manufacturers. The United States has a large number of pharmaceutical giants and medical device companies that demand advanced, high-barrier, and regulatory-compliant packaging solutions. Stringent FDA regulations concerning product safety, sterilization standards, and traceability have driven continuous innovation in medical-grade films, including multi-layer barrier films and recyclable polymer materials.

The region also benefits from robust investments in R&D and technological advancements in material science, such as the development of antimicrobial and sustainable film options. Additionally, the strong network of contract manufacturing organizations (CMOs) and packaging converters in North America enhances scalability and flexibility in meeting diverse medical packaging needs. With the rising demand for biologics, injectable drugs, and personalized medicine, North America continues to lead the market, maintaining its dominance through innovation, regulatory leadership, and a mature pharmaceutical ecosystem.

The European Medical Packaging Film market was valued at 21.6% market share in 2024

Europe holds a significant position in the medical packaging films market, supported by its advanced regulatory environment, strong pharmaceutical production base, and focus on sustainability. Countries such as Germany, France, and Switzerland are major contributors, driven by their established pharmaceutical industries and high export volumes of medical and healthcare products. The European Medicines Agency (EMA) enforces stringent safety and packaging standards, encouraging the use of high-performance barrier films that ensure sterility and product stability.

Moreover, the region’s growing emphasis on eco-friendly and recyclable packaging materials has spurred innovation in bio-based and recyclable film solutions, aligning with the European Union’s circular economy goals. European manufacturers are investing in next-generation films that combine recyclability with superior protection for sensitive medical products. Additionally, the expansion of aging populations and the rising prevalence of chronic diseases across the continent continue to sustain steady demand for advanced medical packaging. Collectively, these factors position Europe as a key and technologically progressive market for medical packaging films.

The Asia-Pacific Medical Packaging Film market was valued at 19.2% market share in 2024

Asia-Pacific is emerging as the fastest-growing region in the medical packaging films market, fueled by the rapid expansion of the pharmaceutical and healthcare sectors in countries such as China, India, Japan, and South Korea. The region’s growing population, increasing healthcare expenditure, and expanding access to modern medical facilities are driving strong demand for safe, sterile, and cost-effective packaging solutions. Governments across Asia are strengthening pharmaceutical manufacturing and export capacities, while global medical device and drug producers are increasingly outsourcing packaging operations to the region due to lower production costs and skilled labor availability.

Moreover, the rapid growth of generic drug production and contract packaging services in India and China has further boosted the demand for medical-grade films. Advancements in local polymer production and packaging technology are also reducing dependence on imports, promoting regional self-sufficiency. As regulatory frameworks in the Asia-Pacific align more closely with international standards, demand for high-barrier, sterilizable, and sustainable film solutions is accelerating.

Global Medical Packaging Film Market – Competitive Landscape

The major players in the medical packaging film market include Winpak & Wipak, Amcor, Covestro AG, Toray Plastics (America), Inc., Coveris, WEIGAO GROUP, Ampac Packaging, Solstice Advanced Materials Inc., DuPont, among others.

Market Scope

| Metrics | Details | |

| CAGR | 5.8% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | High-barrier Films, Co-extruded Films, Thermoformed Films |

| Material Type | Polythylene, Polypropylene, Polyvinyl Chloride, Polyamide, Others | |

| Application | Bags & Pouches, Sachets, Lidding, Tubes, Others | |

| End User | Pharmaceutical Companies, Medical Device Companies, CDMOs, CPOs, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global medical packaging film market report delivers a detailed analysis with 70 key tables, more than 66 visually impactful figures, and 195 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more packaging-related reports, please click here