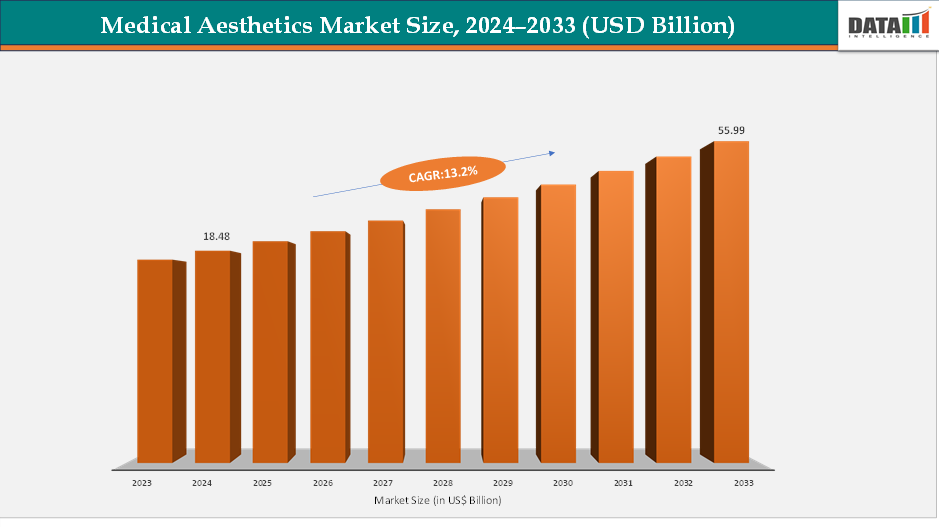

Medical Aesthetics Market Size and Growth

The global medical aesthetics market size is projected to grow from US$ 18.48 billion in 2024 to US$ 55.99 billion by 2033, registering a CAGR of 13.2% during the forecast period. The global medical aesthetics market is experiencing robust growth, fueled by the rising demand for minimally invasive and non-invasive procedures, technological advancements in energy-based devices, and increasing consumer awareness of aesthetic enhancements. Aesthetic solutions such as botulinum toxins, dermal fillers, body contouring devices, and Medical Aesthetics are witnessing strong adoption across diverse age groups, driven by lifestyle changes, growing acceptance of cosmetic procedures, and social media influence.

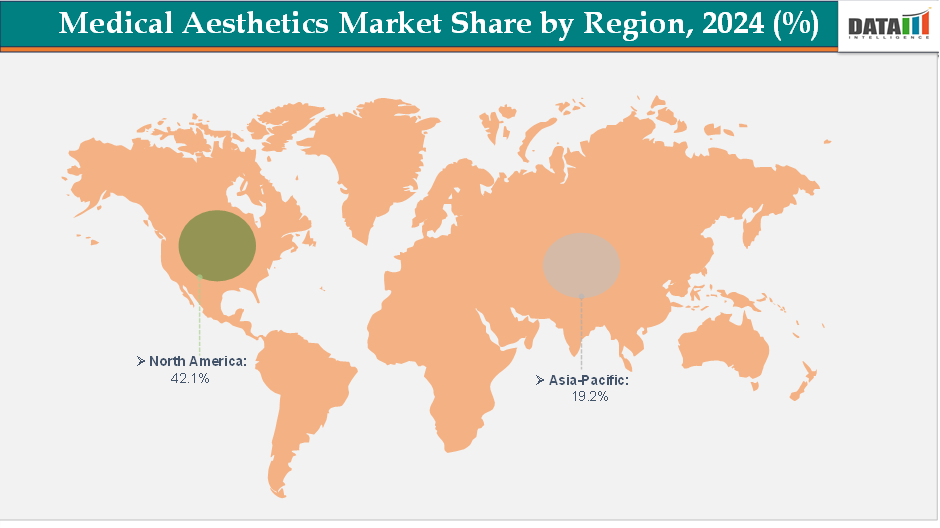

North America dominates the medical aesthetics market due to advanced healthcare infrastructure, leading companies like AbbVie, Revance, Merz, and Galderma, early product adoption, high consumer spending power, skilled practitioners, and favorable regulatory frameworks. This makes it the largest revenue contributor to the global medical aesthetics landscape.

Medical Aesthetics Market Size, 2024–2033 (USD Billion)

Key Highlights from the Report

North America leads the Medical Aesthetics market, holding 42.1% share in 2024, driven by strong healthcare systems, major pharmaceutical players like Allergan Aesthetics (AbbVie Inc.) and Revance Therapeutics, Inc, and active clinical research backed by FDA approvals.

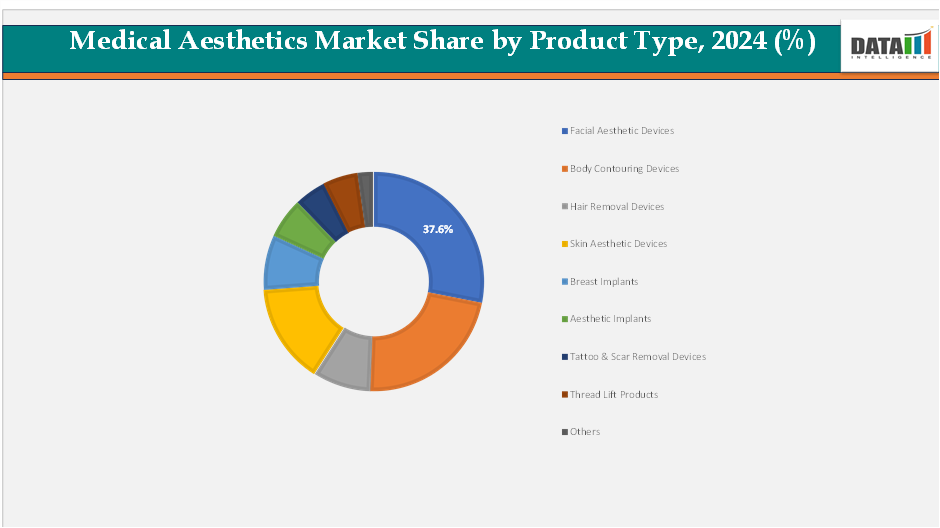

Facial aesthetic devices expected to be the leading product type, capturing 37.6% share in 2024, supported by product launches, collaborations, and partnerships that strengthen its dominance.

Market Dynamics

Drivers - Rising Demand for Minimally Invasive and Non-invasive Procedures

The medical aesthetics market is driven by a growing preference for minimally invasive and non-invasive treatments. Patients are seeking visible results with reduced pain, fewer complications, and minimal downtime compared to traditional surgical procedures. Treatments like botulinum toxin injections, dermal fillers, chemical peels, and energy-based skin rejuvenation are becoming mainstream, offering natural-looking enhancements at a fraction of surgery recovery time.

For instance, the popularity of Allergan Aesthetics’ Botox and Galderma’s Restylane fillers highlights how minimally invasive procedures are reshaping consumer demand. Similarly, energy-based technologies like Ultherapy by Merz Aesthetics and CoolSculpting by AbbVie demonstrate how non-surgical options are gaining traction, as patients increasingly opt for treatments that fit seamlessly into their daily routines without extended recovery periods.

Restraints: High Treatment Costs

The medical aesthetics market faces a significant challenge due to the high cost of treatments, particularly in price-sensitive regions. Popular injectable procedures like Botox and dermal fillers can cost between USD 400-800 per session, while energy-based facial rejuvenation or laser treatments can cost between USD 1,000-2,500 per cycle. In developed markets, more invasive options can cost over USD 6,000-10,000. These high costs, driven by advanced device costs, consumables, and practitioner expertise, make aesthetic procedures unaffordable for a significant portion of the global population, leading to delayed or avoided treatments.

Opportunities: Expansion in Emerging Markets

The medical aesthetics market is experiencing growth due to expansion in emerging markets like Asia-Pacific, Latin America, and the Middle East. Rising disposable incomes, a growing middle-class population, and increased awareness of aesthetic procedures are creating a fertile environment for market growth. Medical tourism hubs like South Korea, Thailand, Brazil, and Turkey attract international patients with affordable yet high-quality treatments.

Moreover, global players are entering these regions through partnerships, distribution agreements, and local manufacturing, ensuring wider access to advanced injectables, implants, and energy-based devices. This expansion broadens the customer base for established brands and fosters innovation in cost-effective products tailored to regional needs.

Market Segmentation Analysis

By Product Type - Facial Aesthetic Devices segment is expected to lead the market

Facial aesthetic devices segment is expected to dominant the Medical Aesthetics market, accounting for nearly 37.6% share in 2024. The demand for facial aesthetic devices is driven by increasing consumer preference for minimally invasive cosmetic solutions like laser skin resurfacing, radiofrequency-based tightening, and ultrasound lifting. Technological advancements, such as combination platforms integrating laser, light, and RF energy, are enhancing treatment efficiency and safety. The availability of dermatologist- and clinic-based devices and home-use aesthetic solutions supports market expansion for facial devices globally.

For instance, in August 2025, Primelaze has partnered with German laser manufacturer Hypertech Laser Systems launched the BiAxis QS (Nano) and BiAxis Pico in India. These advanced Q-Switched Nd:YAG laser systems are designed for performance, precision, and safety, transforming dermatological and aesthetic treatments across India. They effectively treat all skin types, targeting pigmentation, melasma, and multicoloured tattoos for skin rejuvenation.

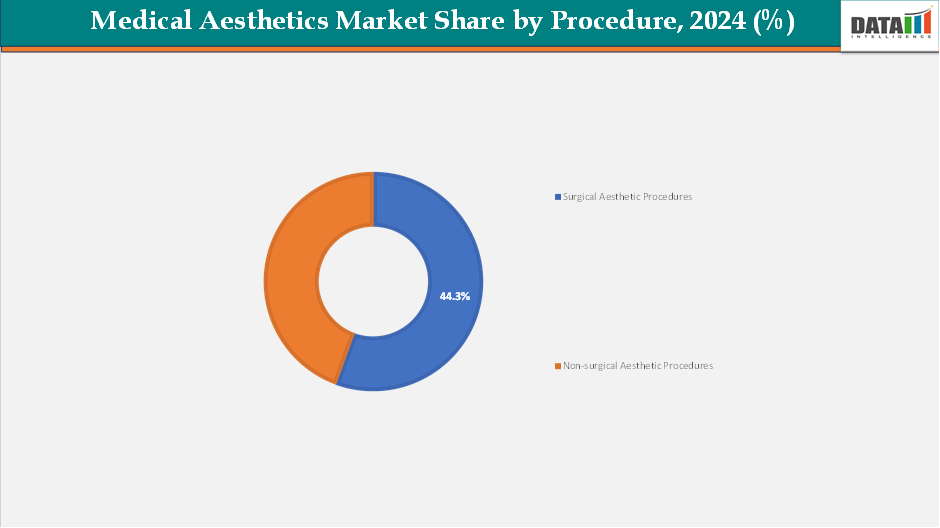

By Procedure – Surgical Aesthetic Procedures is expected to lead the market with strong growth potential

The surgical aesthetic procedures segment is projected to register the fastest growth, with a CAGR of 4.5% from 2024 to 2033. Surgical aesthetic procedures are gaining popularity due to the demand for long-lasting, transformative results. Rising disposable incomes, access to skilled plastic surgeons, and normalization of cosmetic surgery in developed and emerging markets are driving growth. Popular procedures include facelifts, liposuction, breast augmentation, and rhinoplasty, with improved techniques, shorter recovery times, and enhanced safety profiles. Medical tourism in countries like South Korea, Turkey, and Thailand attracts international patients seeking affordable, advanced surgical aesthetic procedures, contributing to overall market growth.

Medical Aesthetics Market Share by Procedure, 2024 (%)

Market Regional Insights

Medical Aesthetics Market Share by Region, 2024 (%)

North America Medical Aesthetics Market Trends

North America dominates the global medical aesthetics market due to advanced healthcare infrastructure, high purchasing power, and industry leaders like Allergan Aesthetics, Revance, and Evolus. The region's widespread awareness of cosmetic procedures and cultural acceptance of aesthetic enhancements have led to a rise in demand for minimally invasive treatments like Botox, dermal fillers, chemical peels, and laser-based skin rejuvenation.

Moreover, product launches, strong R&D investments, early adoption of cutting-edge technologies, and favorable reimbursement coverage further drive market penetration. Media influence, celebrity endorsements, and a focus on personal wellness and anti-aging sustain long-term demand across the region's diverse age spectrum.

For instance, in February 2025, Allergan Aesthetics, an AbbVie company, has announced the opening of three new U.S. training centers by Allergan Medical Institute (AMI), which will provide high-quality, tailored training to licensed aesthetics providers. AMI's unique curriculum and product portfolio will enable providers and business owners to deliver desired patient outcomes.

Moreover, in March 2024, Hugel America, a division of Hugel Inc., has received FDA approval for its neurotoxin Letybo for injection treatment of moderate-to-severe glabellar lines in adults, marking a significant milestone in the medical aesthetics industry.

Asia-Pacific Medical Aesthetics Market Trends

The Asia-Pacific region is the fastest-growing market for medical aesthetics, driven by rising disposable incomes, healthcare access, and beauty standards. The region is a hub for medical tourism, offering high-quality cosmetic and reconstructive procedures at lower costs. South Korea is a leader in aesthetic technology adoption. Governments are investing in healthcare infrastructure and supporting international partnerships, while younger demographics are embracing minimally invasive treatments.

For instance, in July 2025, Uniskin launched a light medical aesthetics clinic in Shanghai 'Uniskin Med,' it claims that men only need 55 RMB/day to improve their appearence, which means 20,000 RMB per year.

Market Competitive Landscape:

The following are the major companies operating in the Medical Aesthetics market. These players hold a significant share and play an important role in shaping market growth and trends.

Allergan Aesthetics (AbbVie Inc.)

Revance Therapeutics, Inc.

Evolus, Inc.

Candela Medical

Merz Aesthetics

Cynosure, LLC

Tiger Aesthetics Medical

Alma Lasers

Sciton

Venus Concept Inc

The medical aesthetics market is dominated by multinational corporations and specialized companies, with leading players like Allergan Aesthetics, Revance Therapeutics, Evolus, Candela Medical, Merz Aesthetics, Cynosure, Tiger Aesthetics Medical, Alma Lasers, Sciton, and Venus Concept Inc. driving growth in surgical and non-surgical segments. Their portfolios include botulinum toxins, dermal fillers, laser systems, body contouring, and skin rejuvenation technologies. Their leadership is reinforced by investments in R&D, regulatory approvals, and strategic collaborations. These players address rising consumer demand for minimally invasive treatments and cater to diverse end-user needs in established and emerging markets.

Key Developments

In May 2025, The Laser Lounge Spa in Sarasota is revolutionizing skincare and aesthetics with non-surgical, medical-grade treatments, combining advanced technology with clinical expertise to help clients look and feel their best.

In March 2025, JeNaCell, an Evonik company, introduced epicite CALM at the Aesthetic & Anti-Aging Medicine World Congress in Monaco, offering a new gold standard in medical aesthetics, focusing on optimal post-treatment recovery following laser, light, and energy-based treatments.

Suggestions for Related Report

For more medical devices-related reports, please click here