Facial Aesthetics Market Size

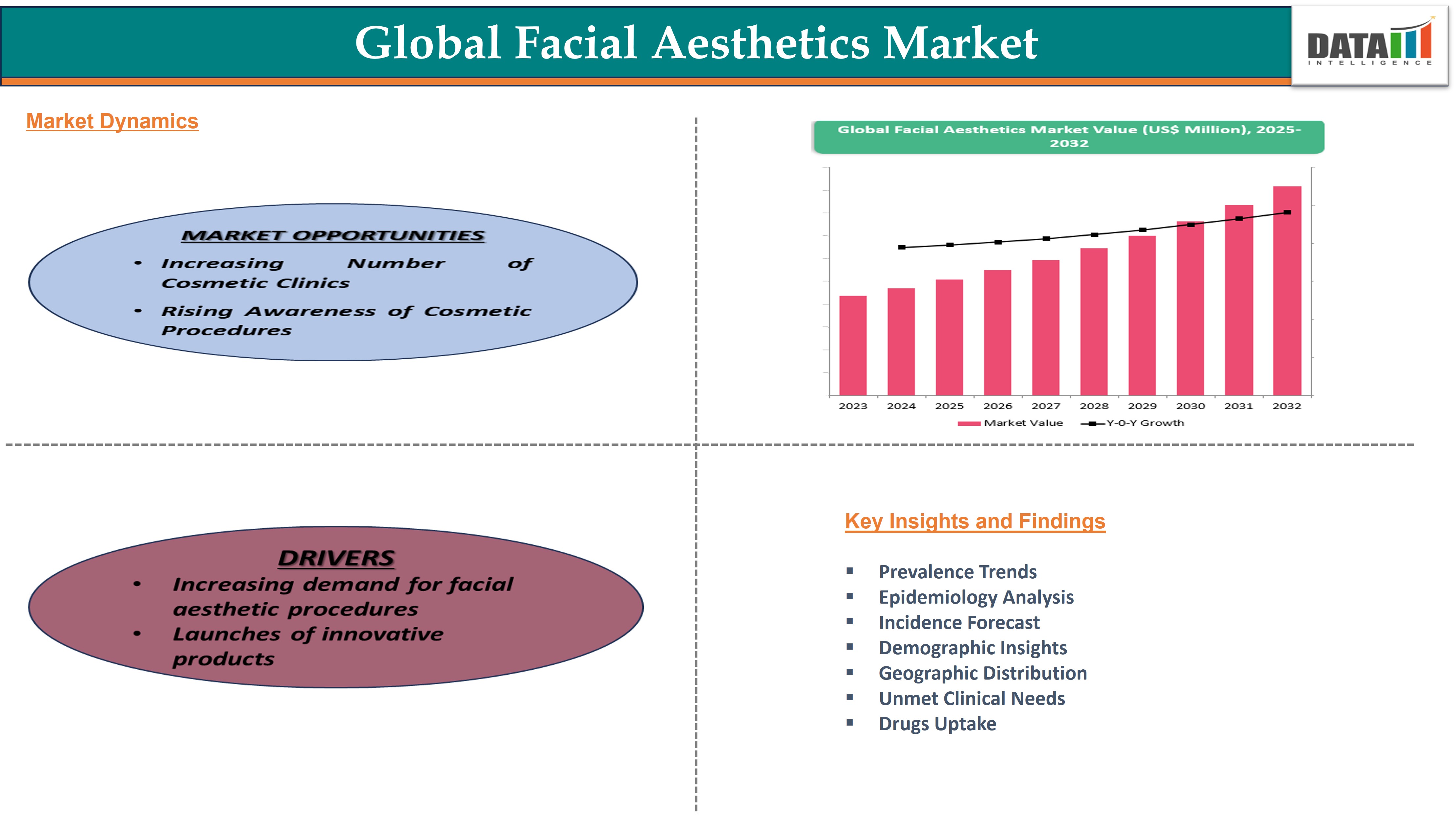

Facial Aesthetics Market reached US$ 14.2 billion in 2024 and is expected to reach US$ 34.25 billion by 2032, growing at a CAGR of 11.6% during the forecast period 2025-2032.

Facial aesthetics encompass a range of non-surgical and minimally invasive procedures designed to enhance one's appearance by temporarily reducing wrinkles, restoring lost facial volume, and refining facial features. These treatments are increasingly popular as individuals seek effective solutions to maintain or regain a more youthful, refreshed, and radiant look without invasive surgery.

Common treatment areas for facial aesthetics include the forehead, cheeks, and lips, key areas where signs of aging such as wrinkles, sagging skin, and volume loss are most apparent. One of the primary goals of facial aesthetics is to soften the appearance of wrinkles and fine lines while restoring facial harmony.

For more details on this report – Request for Sample

Facial Aesthetics Market Dynamics

Increasing demand for facial aesthetic procedures

The growing demand for facial aesthetic procedures, alongside a surge in product innovations and launches, is significantly driving the expansion of the facial aesthetics market. As the global population continues to age, an increasing number of individuals are seeking ways to address common signs of aging, such as wrinkles, fine lines, and sagging skin. This has led to a rise in spending on aesthetic treatments, as more people look for solutions to maintain a youthful and refreshed appearance.

Facial aesthetics are now becoming more accessible, with a broadening consumer base seeking both non-invasive and minimally invasive procedures. Among these, facial filler injections have become particularly popular. According to a 2023 report from the National Institute of Health, facial filler injections are the second most common nonsurgical cosmetic procedure in the United States, with an impressive 3.4 million procedures conducted annually. The increasing popularity of facial fillers can be attributed to their ease of administration, minimal discomfort, and quick recovery time, making them a convenient option for individuals looking for a fast yet effective solution to combat signs of aging.

Facial Aesthetics Market Segment Analysis

The global facial aesthetics market is segmented based on product, application, end-user, and region.

Product:

Derma Fillers segment is expected to dominate the global facial aesthetics market share

The derma fillers segment is expected to hold a significant portion of the facial aesthetics market. Dermal fillers can be utilized for volume restoration, smoothing wrinkles, and lip enhancement, among other things. This adaptability draws in a wide range of customers. More recent products have advanced formulas with improved skin tissue integration and longer-lasting benefits.

Increasing launches of new formulations are expected to drive the segment growth. The increasing approvals of the products are also expected to increase the segment's growth with the expansion of the company's product portfolio expansion.

For instance, on May 15, 2023, Allergan Aesthetics, an AbbVie company, announced the U.S. FDA approval of SKINVIVE by JUVÉDERM to improve skin smoothness of the cheeks in adults over the age of 21. SKINVIVE by JUVÉDERM is the first and only hyaluronic acid (HA) intradermal microdroplet injection for skin smoothness available in the U.S. with results lasting through six months with optimal treatment.

Additionally, on March 5, 2024, Allergan Aesthetics received the Food and Drug Administration (FDA) approval for Juvéderm Voluma XC for supraperiosteal injection to augment the temple region to improve moderate to severe temple hollowing in adults over the age of 21. Thus, the above factors are expected to drive the segment’s growth during the forecast period.

Facial Aesthetics Market Geographical Share

North America is expected to hold a significant position in the global Facial Aesthetics market share

North America region is expected to hold the largest market share over the forecast period owing to the strong presence of major players and increasing novel product launches. North America especially the United States is home to its strong presence of major players such as pharmaceutical companies, cosmetic companies and medical device companies. The presence of major players actively performing research activities to develop more advanced devices to perform non-surgical aesthetic procedures more quickly.

Further, due to the presence of major market players in the region, there are increasing novel product launches which further drive the market in the region. For instance, in September 2024, Perfect Corp. launched its new Skincare Pro Aesthetic Simulator for non-surgical facial treatments. It is designed specifically for dermatologists, aestheticians, and beauty professionals, this advanced solution seamlessly integrates AI image analysis and AI deep learning models to accurately simulate and visualize 27 types of non-surgical facial procedures across six facial zones.

In May 2023, Galderma launched FACE by Galderma, an innovative aesthetic visualization tool powered by augmented reality (AR) that allows aesthetic professionals and patients to visualize injectable treatment results at the planning stage before treatment begins. This innovative solution gives patients a simulated real-time "before and after" visual of what may be possible from an individualized treatment plan and may help alleviate patient concerns about injectable results.

Facial Aesthetics Market Major Players

The major global players in the facial aesthetics market include Galderma Laboratories L.P, Merz North America Inc., Suneva Medical, Allergan Aesthetics, Revance Aesthetics, Bausch & Lomb Incorporated., Cynosure Lutronic, Candela Corporation, MDSS and ADODERM GmbH among others.

| Metrics | Details | |

| CAGR | 11.6% | |

| Market Size Available for Years | 2022-2032 | |

| Estimation Forecast Period | 2025-2032 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | Derma Fillers, Botulinum Toxin, Chemical Peel, Microdermabrasion, Others |

| Application | Facial Line Correction Treatment, Scar Treatment, Lip Treatments, Restoration of Volume/ Fullness, Others | |

| End-User | Hospitals, Specialty Clinics, Dermatology Clinics, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Key Developments

- In September 2024, Allergan Aesthetics, an AbbVie company (NYSE: ABBV), announced that BOTOX Cosmetic (onabotulinumtoxinA) is available for the treatment of masseter muscle prominence (MMP) in China. The masseter is one of the muscles in the lower face involved in chewing, and the prominence of the masseter muscle can result in a wide and square lower face shape.

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Global Facial Aesthetics market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.