Dermal Fillers Market Size & Industry Outlook

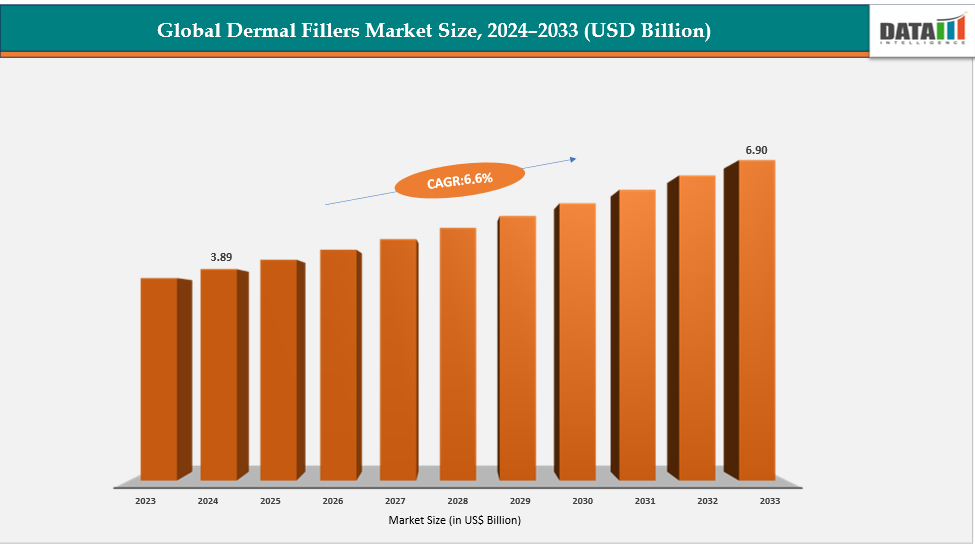

The global dermal fillers market size reached US$ 3.89 billion in 2024 is expected to reach US$ 6.90 billion by 2033, growing at a CAGR of 6.6% during the forecast period 2025-2033. Another significant driver shaping the growth of the dermal fillers market is the rapidly increasing aging population and the global emphasis on age-related aesthetic enhancement. As individuals age, the skin naturally undergoes structural changes, including the breakdown of collagen, reduction in fat layers, and loss of skin elasticity. These changes result in wrinkles, fine lines, and facial volume loss, particularly in areas such as the cheeks, nasolabial folds, and around the lips. Dermal fillers offer a convenient, minimally invasive solution to counter these visible signs of aging by providing immediate volume restoration and contour improvements without the need for surgical procedures.

Additionally, growth in aesthetic clinics, dermatology centers, and medical spas has made these treatments more accessible. Continuous improvements in filler formulations especially hyaluronic acid-based fillers that offer higher biocompatibility, reversible results, and longer-lasting effects have also strengthened patient confidence. Collectively, these factors make the aging population and their aesthetic expectations a major driver propelling sustained growth in the dermal fillers market.

Key Highlights

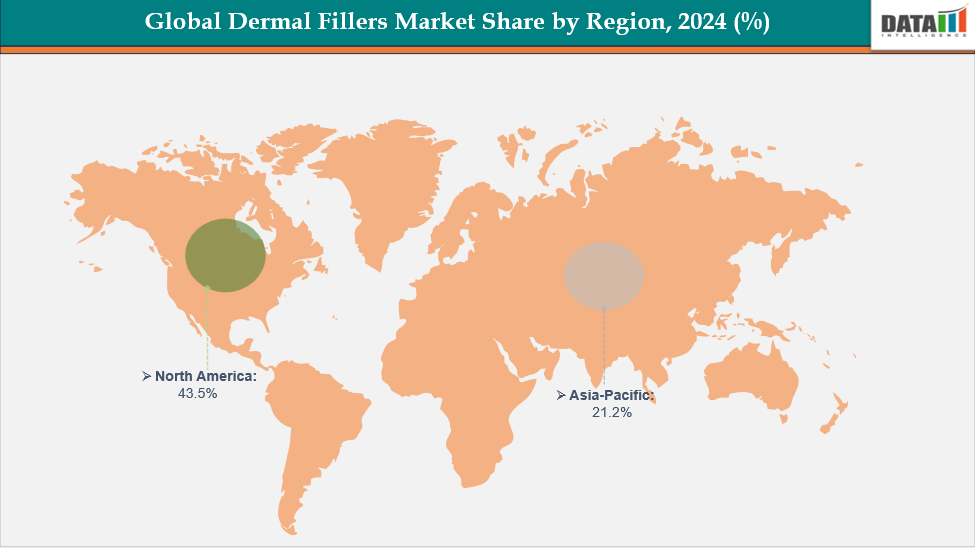

- North America dominates the Dermal Fillers market with the largest revenue share of 43.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 8.1% over the forecast period.

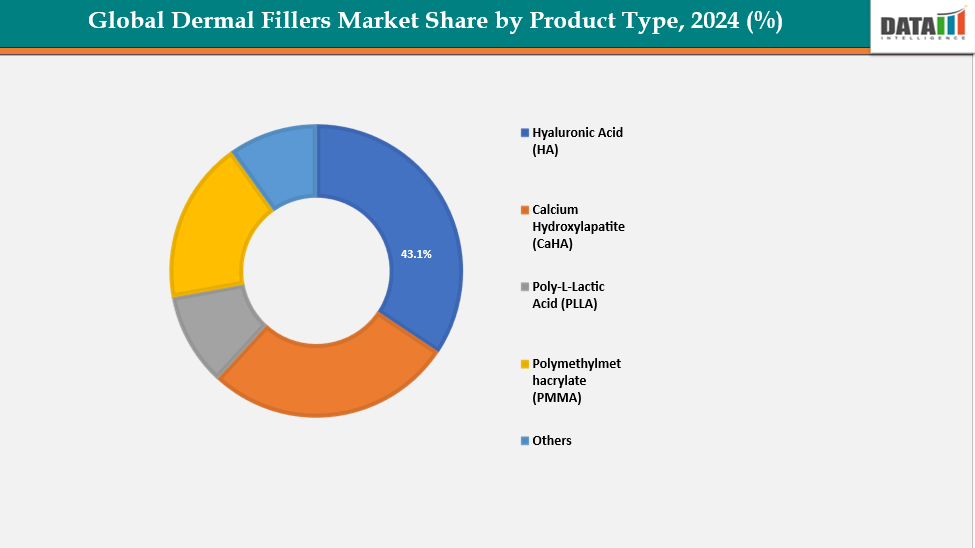

- Based on product type, Hyaluronic Acid (HA) segment led the market with the largest revenue share of 43.1% in 2024.

- The major market players in the Dermal Fillers market includes Abbvie Inc, Galderma, Merz Pharma, Sinclair Pharma plc, Teoxane Laboratories, Dr. Korman Laboratories Ltd, Advanced Aesthetic Technologies, Revance Aesthetics, Tiger Aesthetics Medical, LLC. and among others.

Market Dynamics

Drivers: Growing demand for minimally invasive cosmetic procedures driving the dermal fillers market growth

The growing demand for minimally invasive cosmetic procedures plays a major role in driving the dermal fillers market. Consumers today increasingly prefer aesthetic treatments that offer noticeable improvements without the risks, pain, or recovery time associated with surgical interventions. Dermal fillers fit this need perfectly, as they provide quick, outpatient procedures with immediate results and minimal downtime, allowing individuals to resume daily activities almost instantly. Rising social acceptance of cosmetic enhancements, coupled with the influence of social media and beauty standards, has made these procedures more mainstream across various age groups.

Additionally, continuous advancements in filler formulations and injection techniques have improved safety, comfort, and the natural appearance of outcomes, further boosting patient confidence. This widespread shift toward less invasive and more convenient cosmetic solutions continues to accelerate the adoption of dermal fillers globally.

Restraints: High cost of treatment and limited insurance coverage are hampering the growth of the dermal fillers market

A key restraint in the dermal fillers market is the high cost of treatment combined with limited insurance coverage. Dermal filler procedures can be expensive, particularly when multiple syringes are required to achieve desired results or when patients need periodic maintenance every 6–18 months. Since these treatments are primarily classified as elective aesthetic procedures, they are generally not covered by health insurance plans, meaning patients must bear the full cost out-of-pocket.

This financial burden can limit accessibility, especially in price-sensitive markets or among younger consumers with lower disposable incomes. As a result, while demand for aesthetic enhancements is growing, cost-related concerns continue to restrict wider adoption and may prevent repeat or long-term use among certain patient groups.

For more details on this report – Request for Sample

Dermal Fillers Market, Segmentation Analysis

The global dermal fillers market is segmented based on product type, material, application, gender, end user and region.

Product Type: The hyaluronic acid (ha) from product type segment to dominate the dermal fillers market with a 43.1% share in 2024

The Hyaluronic Acid (HA) segment is a major growth driver in the dermal fillers market due to its strong biocompatibility, safety profile, and natural-looking results. HA is a substance naturally found in the skin, which makes HA-based fillers well-tolerated and less likely to cause allergic reactions. These fillers are widely preferred for their ability to attract and retain moisture, providing immediate volume enhancement, smooth texture, and improved skin hydration.

For instance, in February 2025 Evolus, Inc., a performance beauty company focused on expanding its aesthetic product lineup, announced that the U.S. Food and Drug Administration (FDA) has approved Evolysse Form and Evolysse Smooth injectable hyaluronic acid (HA) gels.

These represent the first products in the Evolysse collection. The approvals mark the company’s entry into the U.S. HA dermal filler market, strengthening its position as a multi-product aesthetics player and increasing its total addressable market by 78% to an estimated $6 billion.

Additionally, HA fillers are reversible; if results are unsatisfactory or complications occur, they can be dissolved using hyaluronidase, which increases patient confidence and clinician preference. The availability of HA fillers in various densities and formulations allows for tailored treatment across multiple facial areas, from fine lines to deeper volume restoration. Continuous innovation by manufacturers to develop longer-lasting and more refined HA products further supports the expansion of this segment in the global dermal fillers market.

Material: The biodegradable segment is estimated to have a 41.1% of the dermal fillers market share in 2024

The biodegradable materials segment plays a vital role in the dermal fillers market, driven by the strong preference for products that are safely absorbed by the body over time. Biodegradable fillers—primarily composed of hyaluronic acid (HA), polylactic acid (PLA), and calcium hydroxylapatite (CaHA)—offer a natural-looking result with lower risk of long-term side effects, as they gradually break down without leaving permanent residues.

This temporary and reversible nature allows practitioners to adjust treatments based on patient needs, offering greater flexibility and personalization in aesthetic outcomes. Growing demand for minimally invasive cosmetic procedures, expanded clinical applications in facial contouring and anti-aging, and continuous advancements in filler formulation and cross-linking technologies are collectively driving adoption of biodegradable fillers, solidifying their position as the dominant segment in the dermal fillers market.

Dermal Fillers Market Geographical Analysis

North America dominates the global dermal fillers market with a 43.5% in 2024

North America is anticipated to capture a significant share of the dermal fillers market, driven by factors such as new product launches, advancements in treatment techniques, improved healthcare infrastructure, and growing awareness of medical aesthetic procedures among consumers.

Over the past decade, there has been a notable increase in the number of these procedures, particularly in developing countries, fueled by rising disposable incomes and dual-income households. Additionally, ongoing innovations in product formulations are expected to further support market growth in the region during the forecast period.

For instance, in August 2025, Revance, a rapidly expanding global aesthetics and skincare company, has introduced a major update to its aesthetic portfolio with the launch of the Teoxane RHA Collection with Mepivacaine. In the U.S. market, mepivacaine now replaces lidocaine as the anesthetic in the Teoxane RHA Collection, marking the first significant anesthetic advancement in hyaluronic acid fillers in nearly 20 years.

Moreover, in October 2024, Allergan Aesthetics, a division of AbbVie, announced that JUVÉDERM VOLUMA XC for temple hollowing is now available nationwide. JUVÉDERM VOLUMA XC is the first and only hyaluronic acid (HA) filler authorized to treat moderate to severe temple hollowing in adults over 21.

Europe is the second region after North America which is expected to dominate the global dermal fillers market with a 34.5% in 2024

In Europe, the dermal fillers market is being driven by growing consumer awareness of aesthetic procedures, increasing demand for minimally invasive treatments, and advancements in product formulations. Additionally, supportive regulatory frameworks and the presence of well-established healthcare infrastructure contribute to the market’s steady growth.

Germany’s market growth is fueled by a high adoption rate of cosmetic procedures, rising disposable income, and increasing popularity of non-surgical facial rejuvenation treatments. Continuous innovations in hyaluronic acid fillers and strong dermatology networks also support market expansion.

For instance, January 2025, Merz Aesthetics has launched Ultherapy PRIME across Europe, the Middle East, and Africa, an advanced version of its non-invasive skin-lifting technology, Ultherapy. The company also showcased six abstracts at the 2025 International Master Course on Aging Science (IMCAS) World Congress, highlighting its product portfolio and emphasizing its contributions to regenerative aesthetics.

The Asia Pacific region is the fastest-growing region in the global dermal fillers market, with a CAGR of 8.1% in 2024

The Asia Pacific region is witnessing rapid market growth due to rising beauty consciousness, growing middle-class population, and increasing affordability of aesthetic procedures. The surge in social media influence and cultural acceptance of cosmetic enhancements further drives demand.

In Japan, key growth factors include an aging population seeking anti-aging solutions, widespread adoption of minimally invasive cosmetic treatments, and high consumer awareness of advanced skincare and aesthetic technologies. Strong healthcare infrastructure and local product innovations also contribute to market growth.

Dermal Fillers Market Competitive Landscape

Top companies in the dermal fillers market include Abbvie Inc, Galderma, Merz Pharma, Sinclair Pharma plc, Teoxane Laboratories, Dr. Korman Laboratories Ltd, Advanced Aesthetic Technologies, Revance Aesthetics, Tiger Aesthetics Medical, LLC. and among others.

Abbvie Inc:- AbbVie Inc. plays a prominent role in the dermal fillers market as a leading innovator in aesthetic medicine. The company leverages its strong R&D capabilities to develop advanced hyaluronic acid-based fillers and neuromodulators that cater to a growing demand for minimally invasive cosmetic procedures. AbbVie’s established global distribution network, extensive clinical expertise, and focus on product safety and efficacy help strengthen its market presence. By continuously expanding its aesthetic portfolio and introducing new formulations, AbbVie contributes significantly to market growth, particularly in regions with high adoption of cosmetic treatments.

Market Scope

| Metrics | Details | |

| CAGR | 6.6% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Hyaluronic Acid (HA), Calcium Hydroxylapatite (CaHA), Poly-L-Lactic Acid (PLLA), Polymethylmethacrylate (PMMA), Others |

| Material | Biodegradable, Non-Biodegradable | |

| Application | Facial Line Correction, Lip Enhancement, Wrinkle Reduction Facial Contouring, Scar Treatment, Others | |

| Gender | Female, Male | |

| End User | Dermatology Clinics, Hospitals, Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Dermal Fillers market report delivers a detailed analysis with 62 key tables, more than 57 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

For more medical devices-related reports, please click here