Machine Direction Oriented MDO Films Market Size

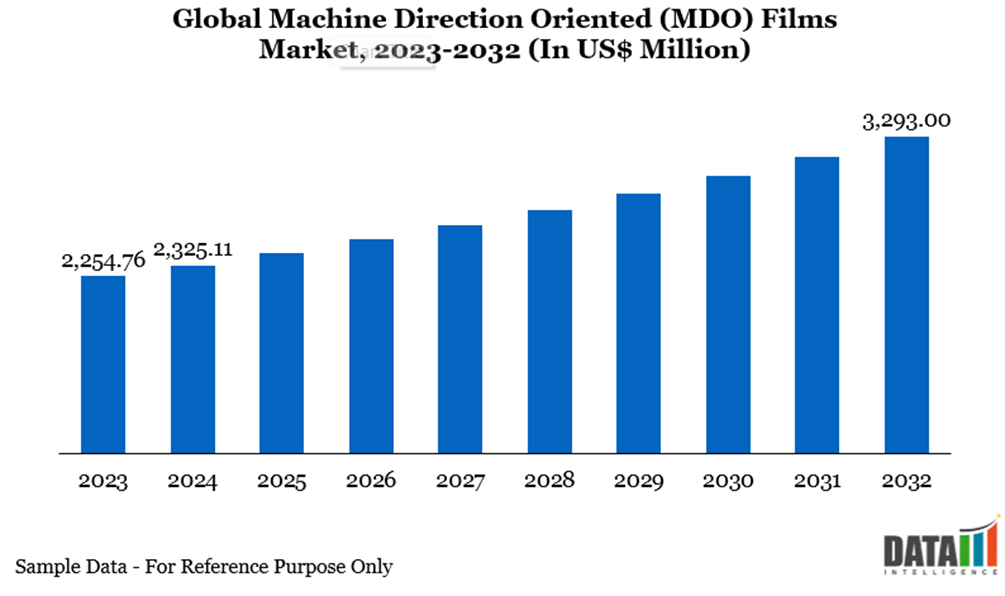

The global machine direction oriented (MDO) films market reached US$2,325.11 million in 2024 and is expected to reach US$3,293.00 million by 2032, growing at a CAGR of 4.6% during the forecast period 2025-2032. This growth is driven by increasing demand for high-performance, cost-effective, and recyclable films across food, pharmaceutical, and packaging industries, alongside innovations in materials like PE and PP that enhance mechanical and optical properties.

Machine Direction Oriented (MDO) Films Industry Trends and Strategic Insights

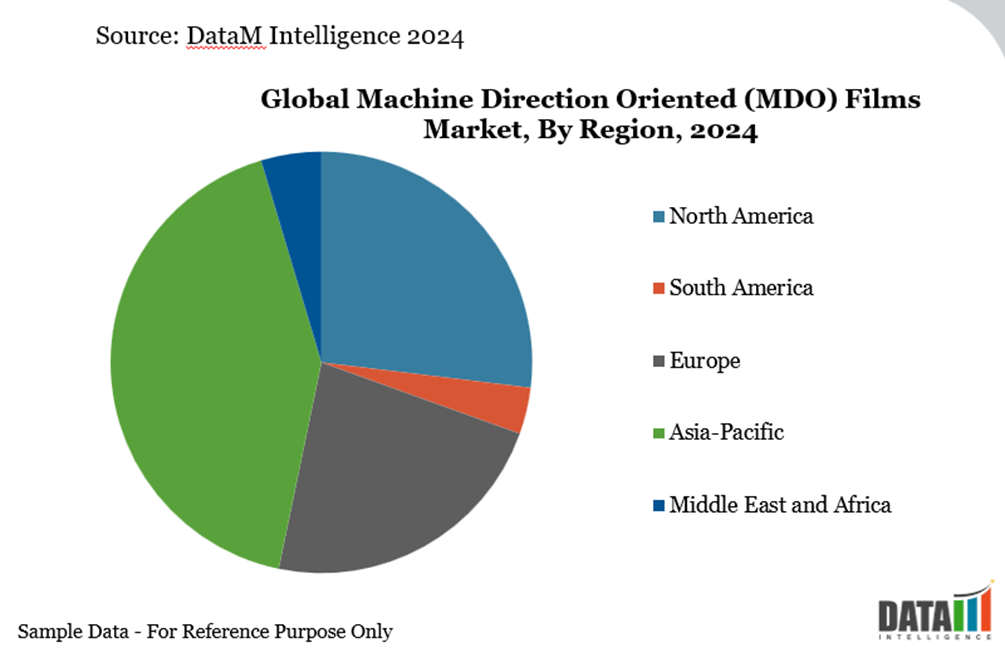

The Asia-Pacific region emerged as the dominant market in the market, capturing the largest revenue share of 42.96% in 2024.

By material, the synthetic paper segment is projected to experience the largest market, registering a significant 58.38% in 2024.

Global Machine Direction Oriented (MDO) Films Market Size and Future Outlook

2024 Market Size: US$2,325.11 Million

2032 Projected Market Size: US$3,293.00 Million

CAGR (2025-2032): 4.6%

Largest Market: Asia-Pacific

Fastest Market: Asia-Pacific

Market Scope

Metrics | Details |

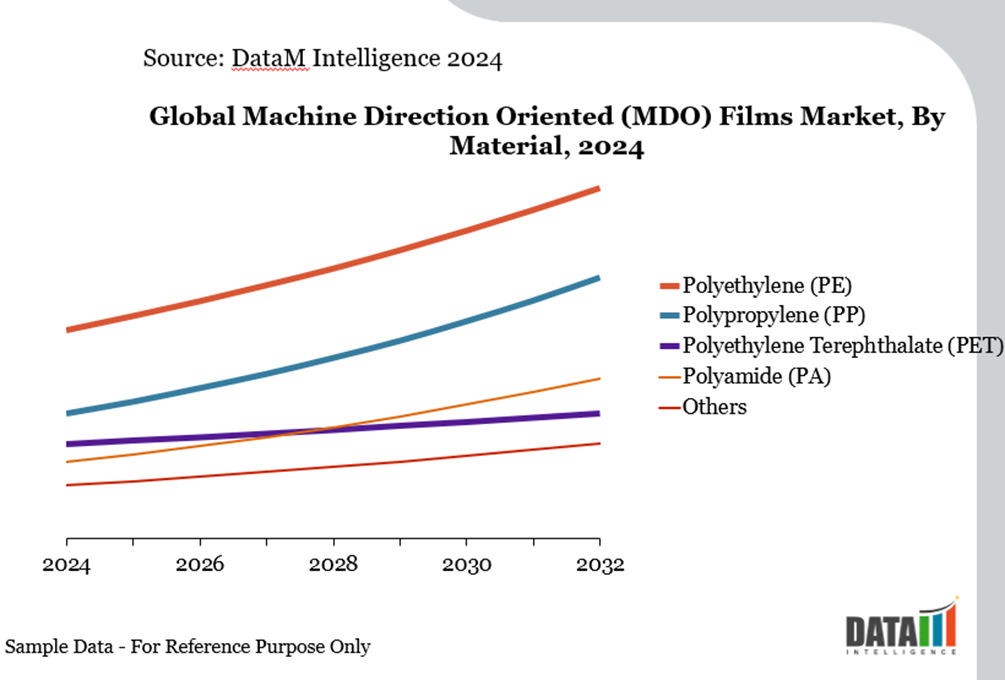

By Material | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyamide (PA), Others |

By Manufacturing Process | Cast Film Extrusion, Blown Film Extrusion |

By Application | Bags & Pouches, Shrink Labels, Shrink Wraps, Agro Textiles, Others |

By End-User | Food & Beverages, Healthcare, Personal Care & Cosmetics, Agriculture, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered

| Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Driver -Strong Growth in Food & Beverage Flexible Packaging

The food and beverage industry has emerged as the most important driver of MDO films, with consumer demand for packaged goods altering the dynamics of flexible packaging. Rising urbanization, e-commerce penetration and hectic lives contribute to the transition to lightweight, resealable and portion-sized package forms, where MDO films provide an ideal blend of performance and cost.

MDO films offer significant technical advantages for food packaging applications. Their high rigidity, outstanding printability and transparency allow for quality branding while reducing total packaging thickness, resulting in decreased raw material use. This "downgauging" impact has become a focus for both converters and FMCG companies, which are under pressure to satisfy sustainability targets while maintaining packaging integrity. To increase recycling and decrease transportation costs, European snack and confectionery businesses are replacing multi-material frameworks with thinner MDO laminates.

Recent developments have emphasized the strength of this driver. Mars Wrigley Europe introduced recyclable candy wrappers made of MDO-PE films in 2024 and Indian dairy firms began using MDO laminates for liquid pouches on a commercial basis. Southeast Asian beverage makers are testing MDO-based shrink sleeves for water bottles as a replacement for bulkier PET-G labels, which will improve recycling rates.

The actions of large-scale brand owners have a multiplier impact, encouraging converters to expand MDO capacity and innovate barrier features, firmly establishing food and beverage growth as the market's biggest structural driver.

Segmentation Analysis

The global machine direction oriented (MDO) films market is segmented based on material, manufacturing process, application, end-user and region.

Polyethylene Leads Global MDO Film Market Due to Cost-Effectiveness and Recyclability

Polyethylene is the leading material in the global machine-direction oriented film segment, valued for its scalability, cost-effectiveness and recyclability. In the MDO-PE category, both industrial champions and niche inventors use the orientation process to improve mechanical and optical attributes like as tensile strength, stiffness, tear resistance and clarity.

A few prominent manufacturers hold significant market shares in 2024, owing to their vertically integrated supply chain and investment in recyclable-grade MDO PE branding, which aligns with consumer and brand desire for mono-material circularity.

Mitsui Chemicals distinguishes itself through material science, such as its "ArmorFlex" high-barrier MDO PE films, which have thin gauges (as low as 40 microns) and improved oxygen and moisture barrier functionality, making them excellent for food and pharmaceutical retort pouch applications. Mitsui collaborated with Ajinomoto to reduce material usage by 30% while preserving durability, hence enhancing appeal in Asian markets.

Polypropylene Holds Strong MDO Film Market Share Due to High Strength, Clarity, and Cost-Effectiveness

Polypropylene (PP) holds a strong position in the MDO film market due to its excellent clarity, chemical resistance, and high heat tolerance, making it ideal for packaging applications requiring durability and visual appeal. Its lightweight nature and ability to form stiff, tear-resistant films also enhance its adoption across food, healthcare, and consumer goods sectors.

Recent innovations have further bolstered PP's position. Profol, for instance, has highlighted the advantages of PP packaging, emphasizing its recyclability and suitability for sustainable packaging solutions. Their CPPeel polypropylene-based peelable lidding helps lower the carbon footprint of packaging materials, showcasing the material's potential in eco-friendly applications.

Geographical Penetration

Asia-Pacific Dominates Global Machine Direction Oriented (MDO) Films Market Due to large Manufacturing Base, High Demand in Packaging, and Cost-Effective Production.

Asia-Pacific MDO films market is being driven primarily by explosive expansion in e-commerce, modern retail and convenience consumption across the region. As supply chains modernize and demand for lightweight, sturdy and visually appealing packaging develops, MDO films, which are known for their high clarity, tensile strength and downgauging capability, are an obvious choice. This trend is visible in areas like as India, where frozen foods and snacks are growing at a double-digit rate, forcing companies such as Chemco Group to launch cutting-edge stretch film lines with over 1,000-ton annual capacity in April 2024, ensuring supply matches rising FMCG packaging demand.

India Machine Direction Oriented (MDO) Films Market Outlook

India holds a significant position in the global machine direction oriented (MDO) films landscape, driven by rising demand for durable and cost-effective packaging solutions across food and dry goods. Innovations like TOPPAN Inc.’s collaboration in India, which launched a customized BOPP-based barrier film (GL-SP) in March 2024, highlight the shift toward application-specific, high-performance formats. These films leverage orientation techniques such as MDO to enhance mechanical and barrier properties while maintaining affordability. The combination of local manufacturing partnerships and growing adoption in Asian markets reinforces India’s influential role in shaping the sector’s growth trajectory.

China Machine Direction Oriented (MDO) Films Market Trends

China holds a significant position in the global MDO segment due to its large-scale production capabilities and strong manufacturing infrastructure. The country benefits from abundant raw material availability and cost-efficient labor, enabling competitive pricing for high-quality films. Rising demand from food, packaging, and pharmaceutical sectors further fuels production and adoption. Additionally, Chinese manufacturers are increasingly investing in recyclable and high-performance films, aligning with sustainability trends and driving growth.

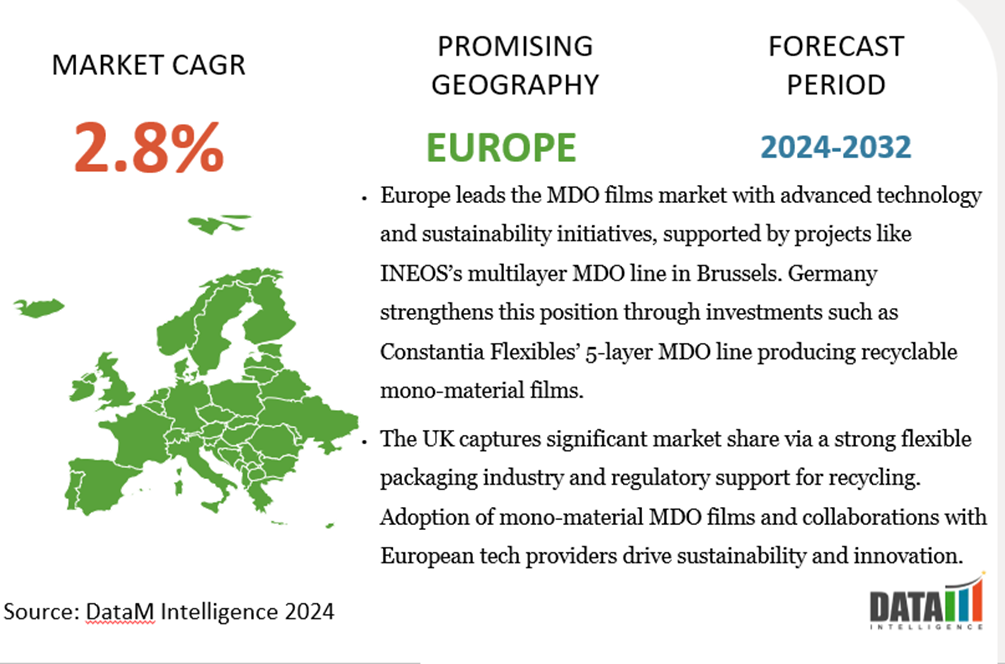

Europe Holds Significant Share in MDO Films Market Due to Advanced Technology and Sustainability Initiatives

Europe holds a strong position in the global MDO films sector, driven by advanced manufacturing capabilities, sustainability initiatives, and technological innovations. In July 2024, INEOS Olefins & Polymers Europe commissioned a new multilayer blown film line with Machine Direction Orientation (MDO) at its R&D centre in Brussels, enabling co-development of fully recyclable flexible packaging films. This investment could prevent around one million tonnes of waste from reaching landfill annually, supporting circular economy goals and compliance with EU packaging regulations.

Germany Machine Direction Oriented (MDO) Films Market Insights

Germany leads Europe’s MDO films segment with robust industrial infrastructure and technological expertise. In July 2025, Constantia Flexibles invested €6.5 million in a state-of-the-art 5-layer blown film line with inline MDO at its Pirk site. The facility produces EcoLamHighplus, a PE-based mono-material film designed for sustainability and recyclability. This move strengthens Germany’s position in eco-friendly packaging and promotes circular economy solutions.

UK Machine Direction Oriented (MDO) Films Industry Growth

The UK holds a significant share due to its strong flexible packaging industry and adoption of sustainable solutions. Local manufacturers are increasingly developing mono-material MDO films to enhance recyclability and reduce environmental impact. Regulatory support for recycling and waste reduction accelerates adoption of high-performance films. Collaborative projects with European technology providers further drive innovation and sustainability in the UK market.

Sustainability Analysis

MDO films are at the heart of the transition to mono-material flexible packaging because orientation increases stiffness, clarity and toughness, allowing for downgauging and the replacement of mixed PET/PE or OPP/PE laminates with all-PE (or all-PP) structures that are compatible with mainstream film recycling streams. RecyClass and the Association of Plastic Recyclers (APR) have now established de facto guidelines for films (e.g., PE-flexible guiding, ink/adhesive compatibility, barrier layers), providing converters with unambiguous targets for resin choice, coatings and tie layers. RecyClass produced an updated, official methodology in 2025, as well as a joint APR-RecyClass collaboration report, to harmonize processes and reduce the possibility that a film certified recyclable in the EU may fail to be recognized in North America.

Policy establishes the direction of travel. The EU's Packaging and Packaging Waste Regulation (PPWR) went into effect on February 11, 2025, with tiered implementation schedules; it establishes standards for recyclability, design-for-recyclability by 2030 and "recycling at scale" by 2035.

For filmmakers, this shifts portfolios toward mono-PE/mono-PP MDO structures capable of demonstrating collection, sorting and high-quality reprocessing on an industrial scale, which is critical for cutting EPR prices and meeting brand obligations. The industry statement outlining PPWR highlights "all packaging must be recyclable" and progressive DfR compliance deadlines, bolstering the business case for MDO solutions that prevent metallization and incompatible layers.

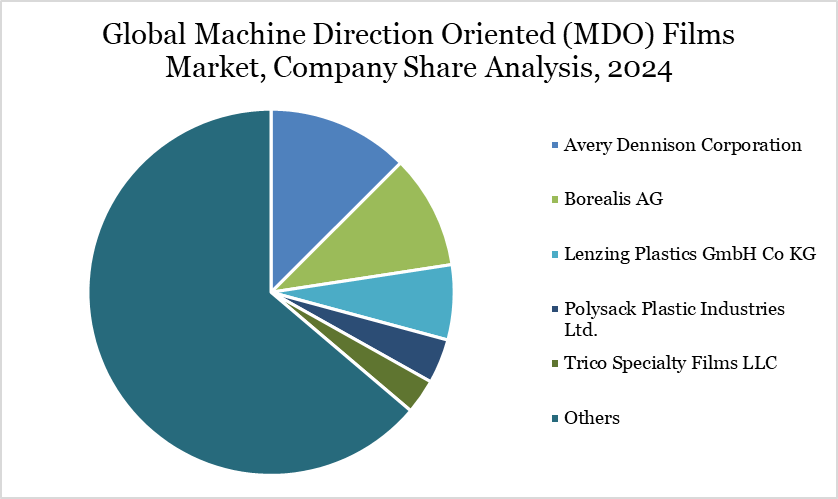

Competitive Landscape

The global MDO films market is moderately consolidated at the top, with a lengthy competitive tail of regional producers.

Avery Dennison Corporation, Borealis AG, Coveris, RKW Group, Trico Specialty Films LLC and others dominate the market.

Cost dynamics and substitution concerns contribute to increased competitive pressure. Large, integrated film manufacturers and converters (e.g., global packaging majors and specialty film producers) compete on resin breadth (PE, PP, PET, PA), multi-layer expertise and the ability to deliver consistent gauge control at high line speeds.

Their advantage originates from scale (global procurement of ethylene/propylene derivatives), established quality systems and extensive client experience with FMCG and healthcare brands.

Key Developments

In June 2025,RKW Group has launched new MDO-PE films with an integrated EVOH barrier as part of its RKW Horizon range. The films are designed to provide a recyclable and sustainable packaging solution, especially when used with RKW’s ProTec sealing films. This innovation highlights the company’s focus on eco-friendly, high-performance film technologies.

In May 2024, Reifenhäuser Blown Film showcased the world’s first 18-micrometre MDO-PE film at drupa 2024. The ultra-thin film reduces material usage by 25% compared to earlier versions and enables fully recyclable, low-carbon mono-material flexible packaging. This development underscores Reifenhäuser’s push for sustainable, high-performance packaging solutions.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies