Overview

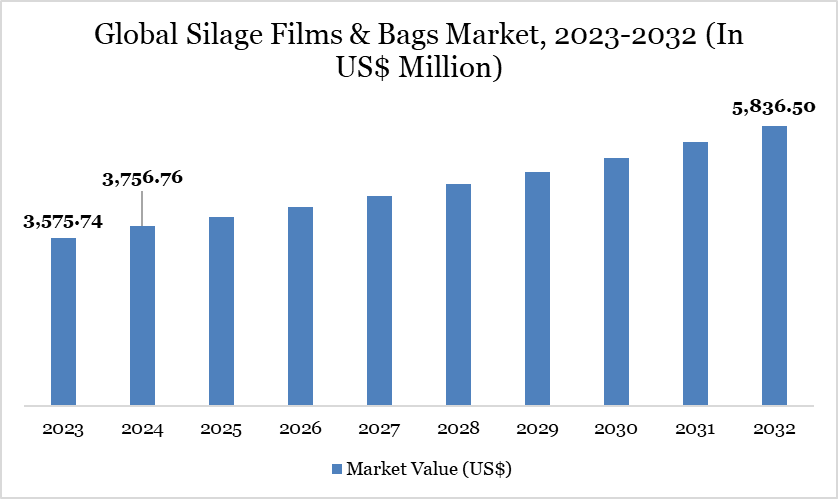

The global silage films & bags market reached US$3,756.76 million in 2024 and is expected to reach US$5,836.50 million by 2032, growing at a CAGR of 5.73% during the forecast period 2025-2032.

The Silage Films & Bags market is witnessing strong growth, driven by rising urbanization, infrastructure expansion, and the increasing demand for lightweight, durable, and energy-efficient materials. Aluminum’s recyclability and corrosion resistance make it a preferred choice for modern buildings, particularly in facades, doors, and roofing systems. According to National Action Plans on Business and Human Rights, the global construction market is expected to grow by US$4.5 trillion to US$15.2 trillion within the next decade, with China, India, the US, and Indonesia accounting for nearly 60% of this growth, creating massive opportunities for aluminum consumption.

This momentum is further supported by sustainable building initiatives, where aluminum plays a crucial role due to its eco-friendly properties and alignment with green certification standards. Rapid infrastructure projects in emerging economies, coupled with smart city developments, are fueling demand for advanced aluminum alloys and solutions. With governments emphasizing sustainable growth and global players investing in innovative construction materials, the Silage Films & Bags market is set to expand at a robust pace in the coming years.

Silage Films & Bags Market Trend

The Silage Films & Bags market trend is shifting toward sustainability, innovation, and energy efficiency. Increasing adoption of aluminum in green buildings, smart city projects, and modern infrastructure is driving demand for lightweight and recyclable materials. Advanced aluminum alloys are gaining popularity for their strength, design flexibility, and corrosion resistance, making them ideal for facades, windows, and roofing. With rapid urbanization in Asia-Pacific and rising government focus on eco-friendly construction, the market is expected to grow steadily, supported by continuous technological advancements and large-scale infrastructure investments worldwide.

Market Scope

Metrics | Details |

By Product Type | Silage Films, Silage Bags |

By Layer Structure | Monolayer, Multilayer (3-layer, 5-layer, 7-layer, etc.) |

By Material | Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), High-Density Polyethylene (HDPE), Ethylene-Vinyl Alcohol (EVOH), Others |

By Application | Corn Silage, Grass Silage, Legume Silage, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Need for Efficient Forage Preservation

The growing need for efficient forage preservation is a key driver of the silage films and bags market. According to the FAO, global livestock production continues to expand, accounting for around 40% of agricultural output making farmers face increasing pressure to maintain high-quality feed for their herds. With the total demand for animal products in developing countries expected to more than double by 2030, preserving forage efficiently is essential to meet year-round feed requirements. Silage films and bags help minimize spoilage by providing superior oxygen and moisture barriers, ensuring that nutrients in stored forage remain intact.

Recent trends in livestock and meat consumption are further boosting market growth. FAO reports show that global meat production has more than tripled over the past 50 years, reaching over 350 million tonnes annually, reflecting rising demand for animal feed. The ability of silage films and bags to maintain feed quality under varying climatic conditions and reduce storage losses makes them increasingly vital. Combined with technological advancements in multilayer films that enhance durability and preservation efficiency, the market for silage films and bags continues to expand globally.

Environmental Concerns

Environmental concerns are significantly restraining the Silage Films & Bags Market because traditional polyethylene-based films are non-biodegradable and accumulate as plastic waste. Improper disposal of these films, especially in regions with weak waste management systems, leads to soil and water pollution. Increasing regulatory pressure on single-use plastics and growing consumer awareness are pushing farmers to seek eco-friendly alternatives. This shift limits demand for conventional silage films, slowing market growth.

Segmentation Analysis

The global Silage Films & Bags market is segmented based on product type, layer of structure, material, end-user and region

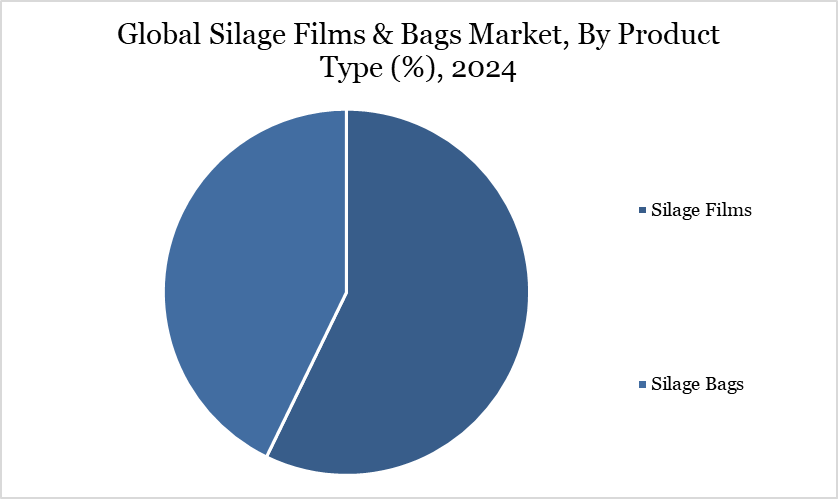

Silage Films Hold Significant Market Share Due to Their High Efficiency in Preserving Forage and Enhancing Silage Quality

Silage films hold a significant share in the Silage Films & Bags Market due to their critical role in preserving livestock feed and enhancing silage quality. These films create an airtight seal around forage, promoting anaerobic fermentation and preventing spoilage, which is essential for maintaining the nutritional value of silage. For instance, Silostop Agri launched Silostop Complete in May 2023, a UV-stable, high-performance High Oxygen Barrier (HOB) film that reduces oxygen permeation, limits mold growth, and minimizes dry matter losses in the top layers of storage bunkers.

Geographical Penetration

Asia-Pacific Leads Silage Films & Bags Market due to Large-Scale Farming and High Livestock Demand

Asia-Pacific holds a prominent share in the silage films and bags market due to its large and growing livestock and poultry sector. According to FAOSTAT (2022), India ranks 2nd in global egg production and 5th in meat production, with egg production rising from 78.48 billion in 2014-15 to 142.77 billion in 2023-24 (CAGR 6.87%) and meat production increasing from 6.69 million tonnes to 10.25 million tonnes (CAGR 4.85%). This rapid growth in poultry and meat production drives higher demand for silage films and bags to preserve fodder and improve livestock feed efficiency.

Additionally, modern farming practices, government support, and rising awareness about feed quality further boost the adoption of silage films and bags in the region. Large-scale agricultural operations in countries like India, China, and Australia, combined with investments in cold storage and feed management infrastructure, strengthen the Asia-Pacific’s dominant position in the global silage films and bags market.

Sustainability Analysis

The silage films & bags market is increasingly influenced by sustainability trends as agricultural stakeholders seek eco-friendly alternatives. Traditional polyethylene-based films contribute to plastic waste, raising environmental concerns and prompting regulations on single-use plastics. Manufacturers are responding by developing biodegradable and recyclable silage films that reduce landfill accumulation and carbon footprint.

Additionally, innovations like multilayer films with improved durability help lower overall material usage while maintaining crop preservation efficiency. Adoption of compostable films and closed-loop recycling initiatives is gradually increasing, especially in Europe and the Asia-Pacific. Sustainable practices not only address environmental impact but also enhance the market’s long-term viability by aligning with global green agriculture goals.

Competitive Landscape

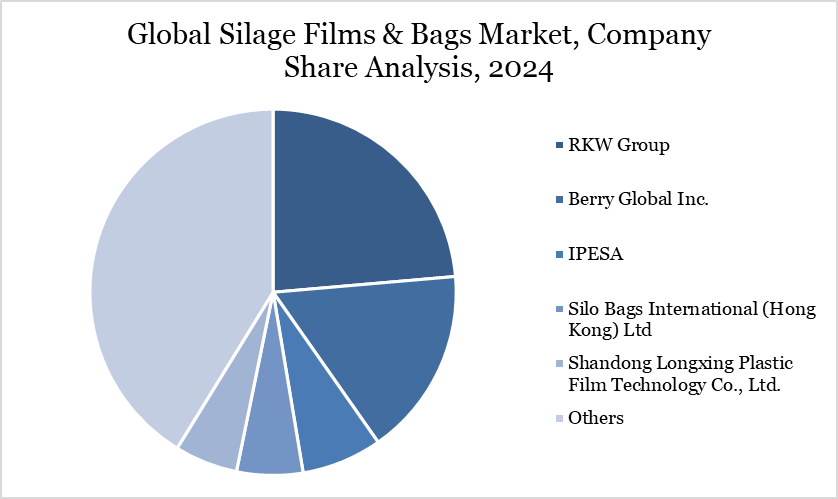

The major global players in the market include RKW Group, Berry Global Inc., IPESA, Silo Bags International (Hong Kong) Ltd, Shandong Longxing Plastic Film Technology Co., Ltd., Rishi FIBC Solutions Pvt. Ltd, Poly-Ag Corp., Pacifil Brasil, Agroflex, Planet Plastic LLC

Key Developments

In March 2024, Armando Alvarez Group (AAG) partnered with ExxonMobil to develop silo bags using performance polyethylene (PE) resin, enhancing recyclability in locations that accept film. The bags are designed with improved filling capacity, tear and puncture resistance, dart impact strength, and high resistance to slumping. Manufactured by AAG’s Spain-based affiliate Sotrafa, these silo bags aim to meet rising demand in the agricultural films market for flexible, reliable, and cost-effective storage solutions. They help extend the preservation of silage and grains while promoting circularity through recyclable materials.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report