Japan Automotive Testing Inspection Certification Market Size

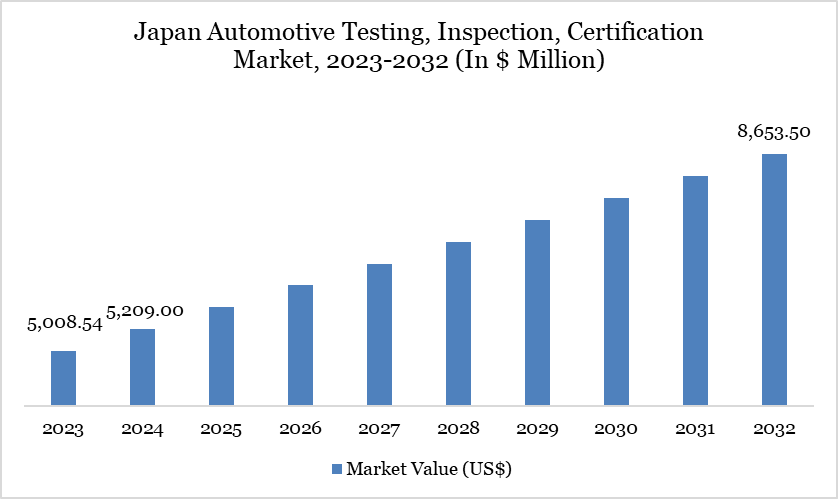

The Japan automotive testing, inspection and certification market reached US$ 5,209.00 million in 2024 and is expected to reach US$ 8,653.30 million by 2032, growing at a CAGR of 6.55% during the forecast period 2025-2032.

Japan’s automotive TIC market plays a vital role in ensuring compliance with the country’s strict safety, emissions, and quality standards overseen by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). In FY2023, MLIT recorded over 3.5 million vehicle recalls, underscoring the scale of mandatory inspections and corrective measures required to maintain safety and reliability.

The push toward full electrification of new passenger vehicles by 2035, as outlined by the Ministry of Economy, Trade and Industry (METI), is accelerating demand for battery, software, and electromagnetic compatibility (EMC) testing. Major automakers, including Toyota and Honda, continue to expand in-house R&D and testing centers, integrating these capabilities into the approval process before final external certification.

Automotive Testing, Inspection and Certification Market Trend

A unique trend in Japan’s automotive TIC market is the rapid integration of advanced robotics and automation in testing facilities, driven by the country’s leadership in industrial robotics. According to the International Federation of Robotics, Japan had over 350,000 operational industrial robots in 2023, the highest globally, with significant deployment in automotive testing for crash, durability, and precision inspections.

Automakers like Toyota leverage robotic systems in their Aichi R&D facilities to improve throughput and reduce error rates in validation processes. This automation aligns with government initiatives under METI’s smart manufacturing agenda, ensuring consistency in safety and emissions verification. The trend not only cuts operational costs but also enhances Japan’s capacity to manage increasing TIC workloads linked to electrification, recalls, and global certification standards.

Market Scope

Metrics | Details |

By Automotive Component/Type | Crash Testing, Engine & Gear Testing, Electrical Systems & Components Testing, Chassis & Suspension Testing, Emission Testing, Others |

By Vehicle Type | Passenger Vehicles, Commercial Vehicles |

By Sourcing Type | In-House, Outsourced |

By Service | Testing, Inspection, Certification |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Expansion of Electrified Vehicle Testing Requirements

Japan’s government mandate that all new passenger cars sold by 2035 be electrified has become a major driver for the expansion of testing, inspection, and certification (TIC) services. This transition demands rigorous validation of high-voltage batteries, charging infrastructure, power electronics, and software to meet Ministry of Land, Infrastructure, Transport and Tourism (MLIT) type-approval standards. The Ministry of Economy, Trade and Industry (METI) has also identified EV infrastructure as a priority under its Green Growth Strategy, pushing manufacturers to strengthen in-house and third-party TIC processes for compliance and export readiness.

To support these requirements, automakers are expanding advanced testing capabilities, including crash safety for battery-integrated vehicles and durability checks for EV components. A recent example is UL Solutions’ planned EMC laboratory in Toyota City, which will focus on mitigating electromagnetic interference in safety-critical EV systems. These developments highlight how electrification is reshaping Japan’s TIC landscape, with growing demand for specialized testing facilities to ensure safety, reliability, and adherence to international standards.

High Cost and Complexity of Compliance with Multi-Layered Regulations

The Japan automotive TIC market faces significant restraints due to the high cost and complexity of meeting overlapping regulatory requirements. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) enforces strict type-approval systems that require exhaustive safety, emissions, and software compliance before vehicles reach the market. In FY2023, MLIT recorded over 3.5 million vehicle recalls, reflecting the heavy burden on manufacturers to continuously update and test products to avoid penalties and reputational risks. These regulatory demands require costly investments in precision testing infrastructure, advanced laboratories, and trained personnel, often straining smaller and mid-sized suppliers who lack the resources of large automakers.

Compliance costs are further heightened by Japan’s alignment with global standards, requiring companies to undergo multiple layers of certification for both domestic and export markets. For example, METI’s Green Growth Strategy sets ambitious benchmarks for electrified vehicles by 2035, necessitating extensive additional testing for high-voltage systems and energy efficiency beyond conventional vehicle standards. This multi-layered framework forces firms to balance national regulations with international certifications such as UNECE standards, leading to duplicated efforts and higher operational expenses. The complexity and expense of navigating these regulatory pathways are slowing down testing cycles and adding structural restraints to the growth of Japan’s TIC market.

Segment Analysis

The Japan automotive testing, inspection and certification market is segmented by service, automotive component/type, vehicle type, sourcing type.

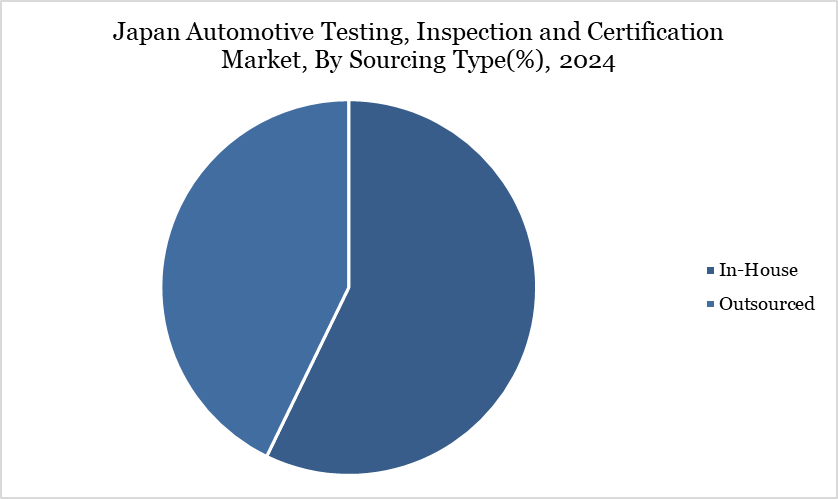

In-House Segment Holds a Significant Share

In-house testing and certification are gaining momentum in Japan as major automakers expand facilities to align with government-led electrification and safety mandates. The Ministry of Economy, Trade and Industry (METI) has outlined that by 2035, all new passenger cars sold must be electrified, a shift that compels OEMs to invest in internal battery, emissions, and software testing labs to shorten development cycles and ensure compliance. Toyota and Honda, for instance, operate dedicated R&D and testing centers in Aichi and Tochigi, equipped with crash test tracks, emissions labs, and EV battery validation units, allowing faster conformity with Ministry of Land, Infrastructure, Transport and Tourism (MLIT) type-approval requirements before formal external audits.

This in-house capability also reduces reliance on third-party TIC services for early-stage validation while addressing stringent recall accountability standards enforced by MLIT, which requires manufacturers to investigate and rectify defects directly. In FY2023 alone, over 3.5 million vehicles were subject to recalls in Japan, underscoring the importance of OEMs maintaining robust in-house inspection systems to prevent regulatory penalties and reputational risks.

Furthermore, as the Japan Automobile Manufacturers Association (JAMA) reports consistent annual R&D spending of over ¥3 (US$ 0.020) trillion by member companies, in-house TIC operations are increasingly integrated into innovation pipelines, particularly for autonomous driving and connected vehicle testing, strengthening Japan’s position as a global hub for compliant, sustainable mobility.

Sustainability Analysis

Japan’s automotive TIC market underpins decarbonization and safety goals by validating compliance with policies that target a sector responsible for ~16% of national CO₂ emissions and a government aim for all new passenger-vehicle sales to be electrified by 2035, driving demand for battery, EMC, and energy-efficiency testing. It supports product integrity and defect mitigation through MLIT’s continuous recall oversight and rectification actions, which require investigations, corrective plans, and type-approval measures—expanding verification workloads for safety, emission, and software/OTA conformity.

Sustainability also spans circularity compliance: Japan’s End-of-Life Vehicle Recycling Law mandates proper treatment and recycling responsibilities across the value chain, reinforcing inspections and documentation that TIC providers audit. On the industry side, capacity growth such as UL Solutions planned advanced automotive EMC laboratory in Japan’s Tokai region elevates local testing for interference risks in increasingly electronics-dense EVs and hybrids, accelerating market access while supporting reliable, lower-emission mobility.

Competitive Landscape

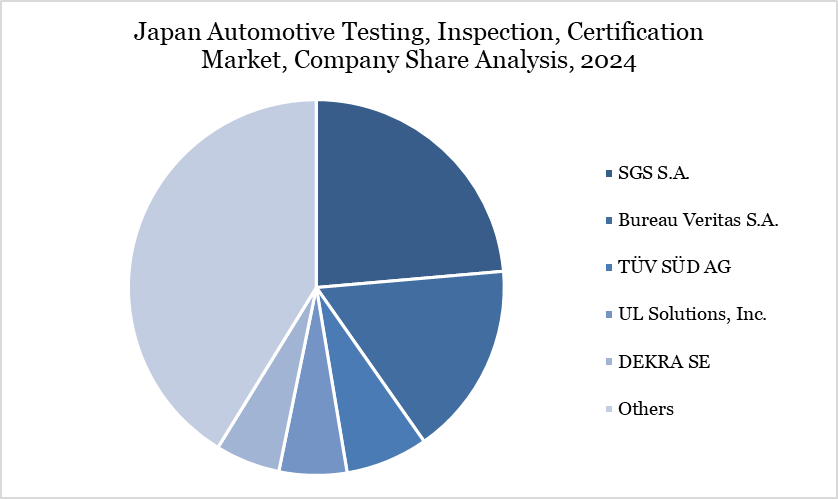

The major players in the market include SGS S.A., Bureau Veritas S.A., TÜV SÜD AG, DEKRA SE, Intertek Group plc, Applus+ Group, Element Materials Technology, UL Solutions, Inc., and DNV GL.

Key Developments

On March 16, 2025, UL Solutions Inc. announced plans to establish an advanced automotive electromagnetic compatibility (EMC) laboratory in Toyota City, Japan. The facility will support manufacturers in mitigating electromagnetic interference risks that could disrupt critical vehicle systems such as braking and engine control. With modern vehicles integrating increasingly complex electronics, EMC testing is essential to ensure performance, reliability, and compliance with global standards. Japan, as a leading automotive hub, represents a key growth market for expanding EMC testing services.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies